Issue 7: Preparedness letter for primary dental care

Contents

- Contract arrangements from 1 January to 31 March 2021 (Q4)

- PPE access via portal

- New NHS dentistry and oral health bulletin

- Weekly primary care bulletin

- Look after yourself too

- Annex: Contractual arrangements up to 31 March 2021

Classification: Official

Publication approval reference: 001559

22 December 2020

Dear Dental Colleagues,

Re: Contract arrangements from 1 January to 31 March 2021 (Q4)

Since dental services reopened in June there have been steady improvements in access, as changes in infection prevention and control guidance, provision of personal protective equipment (PPE) and processes and procedures become more familiar to dental teams and patients. But it is not yet business as usual. Updates to contractual arrangements set out below for Quarter 4 reflect improved understanding of COVID-19’s impact on practice operations and increased access to care to meet patient needs and address backlogs of care. This marks the next step in the restoration of dental services.

We have worked closely with government to determine a safe and reasonable contractual arrangement from 1 January to 31 March 2021 for NHS dentistry. Practices delivering 45% of contracted units of dental activity during this period will be deemed to have delivered the full contracted volume. In addition, COVID-19 related PPE will be provided free to practices (see below).This recognises constraints on practices seeking to deliver services safely and in line with current contractual guidance. It also recognises the need to best use NHS capacity for NHS patients. Detailed arrangements are set out in the annex.

We recognise there may be exceptional circumstances when this activity target may not be deliverable. Commissioners have discretion to make exceptions – for example, where practice staff are required to self-isolate or are affected by the reinstatement of shielding in tier 4 areas. This should be in accordance with the approach set out in section 6 of the supporting guidance published here. A dedicated helpdesk to support queries and questions can be contacted via the following email address: yearend@pcc-cic.org.uk.

PPE access via portal

The Department of Health and Social Care has published its strategy for supplying PPE over the next phase of the pandemic. COVID-19-related PPE will be provided free to all primary care providers.

Please ensure you are registered with the PPE portal, so we can make sure supplies of PPE can be distributed to your practice or service.

From Jan – Mar 2021 an adjustment will be made to the contract value to reflect variable costs not incurred by contractors for activity that is not delivered. Contractors will access PPE via the PPE portal and in line with the government’s strategy. This will replace current arrangements, in which the increased PPE costs were largely covered by the practices retaining the payment for variable costs for activity which was not delivered. For contractors eligible for reimbursement of PPE costs since the start of the pandemic, the guidance is available here.

Further information on the portal supply can be found on the DHSC guidance page. If providers have any queries, or have not received an email invitation, please contact the DHSC PPE portal customer services on 0800 876 6802.

New NHS dentistry and oral health bulletin

In October we launched the NHS dentistry and oral health update, rounding up all the latest professional news and important resources for anyone working in NHS dental services. News will continue to be shared in the primary care bulletin too. Although this bulletin is for NHS dental teams, private practices are welcome to sign up as they may find this information of interest. Please click here to subscribe.

Weekly primary care bulletin

Please subscribe to the weekly primary care bulletin as this is the quickest and most effective way to access the latest information you will need. Previous issues are on our website here.

Look after yourself too

Please remember to keep yourself safe and seek help if you think you need any. Staff can access free wellbeing support, free coaching and access volunteer support who can deliver groceries, medication and essential items, by calling 0808 196 3646.

Kind regards,

Gabi Darby | Interim Director of Primary Care Commissioning Transformation

Sara Hurley | Chief Dental Officer

Annex: Contractual arrangements up to 31 March 2021

This annex sets out the agreed arrangements for this period. It is associated with delivery of services against the current standard operating procedure (SOP). Contractual arrangements will, by default, revert to normal in April 2021. However, we (NHS and the government) will keep the situation under review to explore how best to support contractors in delivering prevention, improving access and addressing health inequalities.

From 1 January 2021, arrangements will be based on the usual contractual metrics: units of dental activity (UDAs), units of orthodontic activity (UOAs), and courses of treatment (COTs). We will waive certain clawback rights for practices that meet the conditions below. The adjusted NHS target for contracts is 45% of the NHS contract target, measured in UDAs, and 70% of the NHS contract target, measured in UOAs only, to be delivered between 1 January and 31 March 2021.

Table 1: General contracts

| April 2020 – December 2020 | January 2021 – March 2021 |

|---|---|

| Deemed to have delivered 100% of 9/12ths of annual contracted UDA activity if conditions in preparatory letters have been met | Required to deliver 45% of 3/12ths of annual contracted UDA activity |

Table 2: Orthodontic contracts

| April 2020 – December 2020 | January 2021 – March 2021 |

|---|---|

| Deemed to have delivered 100% of 9/12ths of annual contracted UOA activity if conditions in preparatory letters have been met | Required to deliver 70% of 3/12ths of annual contracted UOA activity |

Guidance and principles for commissioners to follow in relation to Community Dental Services (CDS) and Any Qualified Providers (AQPs), operating under local Personal Dental Services (PDS) agreements across regions, will be clearly set out within supporting guidance.

DHSC will issue arrangements for General Dental Services (GDS) contracts and PDS agreement holders operating under prototype contract arrangements.

Commissioners should consider contractor exceptional circumstances as detailed in the supporting guidance here, recognising the current context.

Practices are asked to meet, and declare that they have met, a set of conditions to be eligible for clawback rights to be waived. Breach of these conditions will result in the application of the usual contractual arrangements and clawback, instead of any waiver of clawback rights.

We ask practices to make the following commitments:

- Maximise safe throughput to meet as many prioritised needs as possible.

- Remain open and prioritise care for patients who are considered at highest risk of oral disease, in line with the prevailing dental SOP and guidance.

- Use NHS funding to the full for the provision of NHS services. Ensure full compliance to Clause 59 of GDS/PDS contract agreements – that practices will not advise that NHS services are unavailable with a view to gaining their agreement to undergoing the treatment privately

- Continue preventative work (such as confirmation via the FP17 data that best practice prevention advice has been given to patients) and target efforts in a way that will reduce health inequalities (eg by agreeing to see irregular attenders as well as usual patients). This will be auditable by local teams with an expectation that practices will be able to provide evidence of their efforts.

- Prioritise all known and unknown patients to the practice who require urgent dental care if contacted directly or via 111 services, as capacity allows.

- Keep contractual premises open unless otherwise agreed via the regional commissioner.

- Complete and keep under review all staff risk assessments.

- Do not seek any duplicate or superfluous funding from the NHS or other government sources – including furlough or additional sick or parental leave pay that was not used to pay for cover.

Urgent dental care centres (UDCs)

Our regional teams will continue to put in place arrangements as required for urgent dental care through UDCs.

Where – exceptionally – practices are also acting as UDCs and:

- they cannot deliver sufficient activity to meet the adjusted target corresponding to delivery of 100% of contractual activity

- the actual level of activity delivered was lower than it would have been were they not acting as a UDC

- they can demonstrate this to their commissioner

commissioners will make allowance for this in reconciling contract values at the end of the year. The commissioner can choose to treat the contractor’s delivery as if it were higher than the actual delivered level – up to the amount that the contractor can demonstrate they would have delivered during that period were they not a UDC. This adjusted activity level will then be used for the purposes of contract reconciliation rather than the actual activity level for the periods when the contractor was operating as a UDC. When using the adjusted activity level to calculate the deemed activity level, the deemed activity level will not be set higher than 104% of usual activity during the period that the contractor was a UDC. Adjustments to contracts for variable costs not incurred will continue to be made based on actual activity delivered; not the adjusted figure, nor the deemed delivered figure.

Contract reconciliation

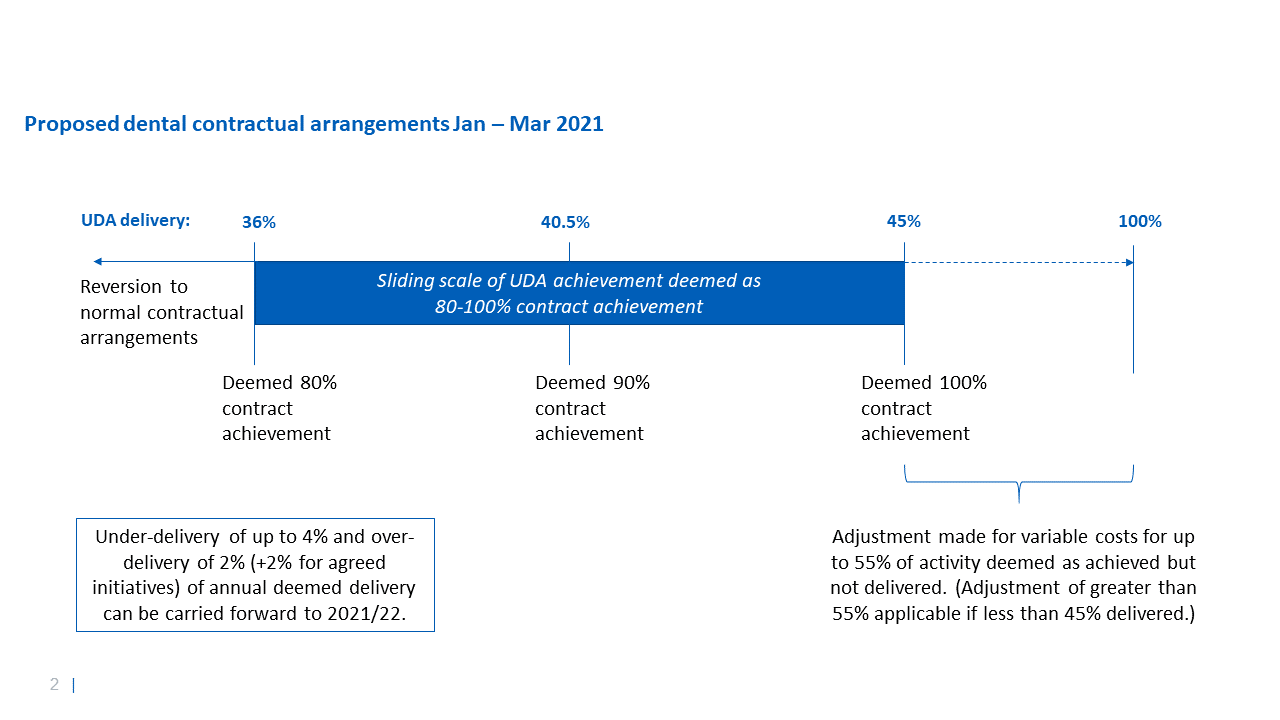

As part of the annual reconciliation process, contractors will be deemed to have delivered 100% of activity in the months January to March 2021 if NHS FP17s/FP17Os completed/delivered between 1 January 2020 and 31 March 2021 are 45% and 70% of usual NHS contracted activity for Quarter 4, for UDAs and UOAs respectively. The arrangements are illustrated in Figure 1:

Figure 1: UDA threshold applicable from January to March 2021

Where contractors deliver at least 80% of this 45% cumulative activity in January to March (ie at least 36% of contracted activity for this period), we will waive some clawback rights. If a practice delivers X% of activity, where X falls between 36% and 45%, delivery will be deemed to be (X/45)%. For example, if 40.5% of contracted activity in this period is delivered, this will be deemed to be 90% of contracted activity in this period; or, if 43% of usual activity is delivered in this period, 43% / 45% = 95.55% will be deemed to have been delivered.

Where contractors deliver less than 80% of this 45% cumulative activity in January to March (ie less than 36% of contracted activity for this period), contractors will be deemed to have delivered only the actual activity delivered in the months January to March.

The deemed activity for the final quarter will be added to any deemed activity for the months April to December at 1/12th (8.33%) of their contracted activity per month where conditions in place at that time were met. For example, if 35% of contracted activity is delivered in January to March and all requirements are met in the months April to December, then deemed activity would be:

8.33%* x 9 months plus 35% of 8.33%, x 3 months (8.75%)

that is: (0.833 x 9) + (0.35 x (0.0833 x 3) ) = 0.8372 = 83.72%

* 100%/12 months to give 8.33% a month

Usual contractual rules would apply to this annually deemed 83.72% – ie this would be treated as 16.28% under-delivery against the contract.

For the purposes of calculating activity deemed to be delivered, where the conditions in place in those months have been met, no actual activity for the months April to December inclusive will be taken into account in the annual contract reconciliation. Instead the deemed activity levels will be used.

For any period during April to December where the conditions detailed within our letters of the 25 March 2020, 28 May 2020 and 13 July 2020 were not met, the normal contractual arrangements will apply and only actual activity will be counted in any month where those conditions were not met.

Usual contractual rules are applied to activity deemed to have been delivered in the year as calculated. For example, if 95% of activity is deemed to have been delivered in the year, 5% of activity will be clawed back.

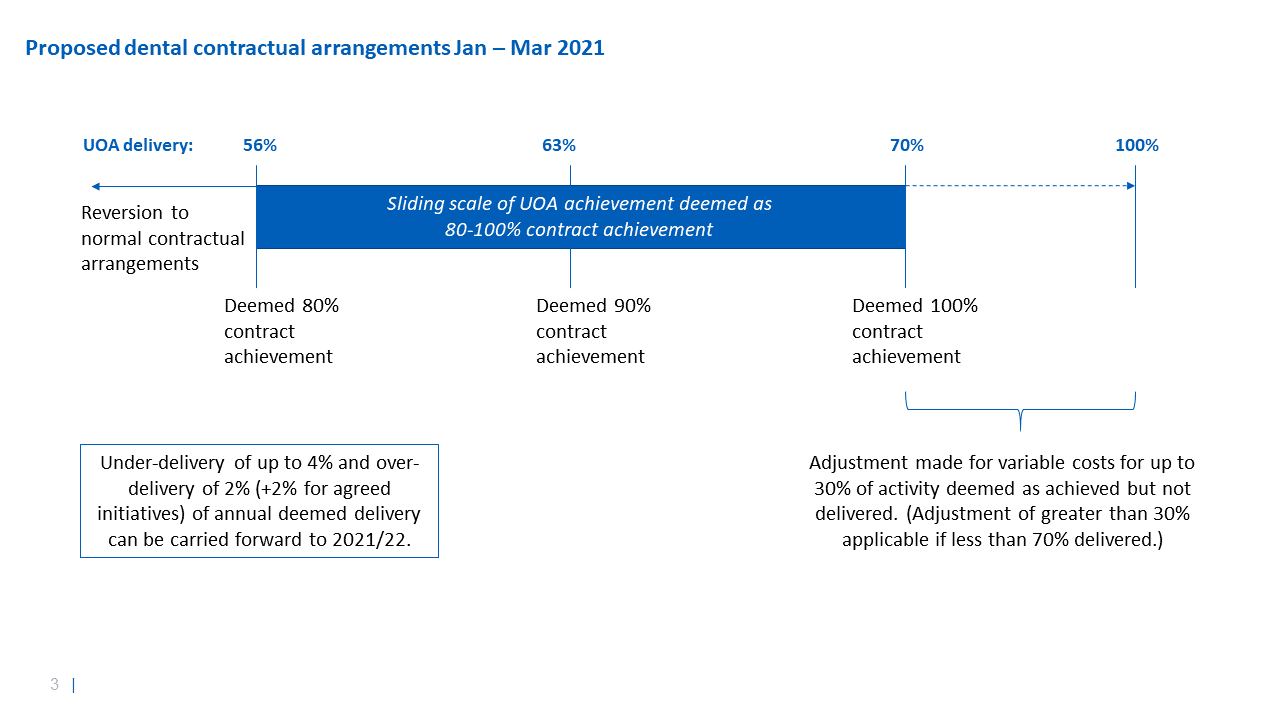

The arrangements for UOAs will apply as described above but the thresholds are different, reflecting differences in the nature of these courses of treatment and current activity levels. These are shown in Figure 2.

Figure 2: UOA threshold applicable from January to March 2021

Adjustments for variable costs and PPE

Abatements for variable costs in April to June communicated in our letter of 13 July 2020 remain in place for those months, reflecting the costs not incurred while practices were closed.

When practices reopened, as required by the 13 July 2020 letter, they received the full value of the contract, with no adjustment for variable costs, in recognition of the increased costs of PPE they would incur.

PPE is now available to practices via the government PPE portal. As a result, from January to March 2021 there will again be an adjustment to contract value for variable costs not incurred, at the same rate of 16.75%.

For a practice that has delivered 45% of contracted activity, the 16.75% adjustment will be applied to the 55% which is deemed as delivered, but which has not actually been delivered. If a practice delivers 60% of activity, the adjustment only applies to the 40% which is deemed delivered but not actually delivered. This adjustment will be dealt with as part of the end of year reconciliation.

Where clawback or carryover applies, there will not also be an additional adjustment for variable costs for any activity that is clawed back in full or required to be carried over in full.

Example 1: Practice 1 delivers 35% of usual activity from January to March and met all conditions from April to December. Its deemed annual activity is 83.72%, as in the example above, and 16.28% of contractual value will be clawed back; variable costs will already have been deducted as part of this and so not deducted again.

Example 2: Practice 2 delivers 36% in January to March and so is deemed to have delivered 80% of activity in that period, and it met all other conditions in April to December – it will be deemed to have delivered 9*8.33%+3*80%*8.33% = 94.96% of the annual contract, and so have 5.04% of the contract clawed back. Practice 2 would ordinarily have a clawback for January to March based on (100%-36%) *3*8.33% = 16% of its annual activity not actually delivered – because there has instead been a clawback for 5.04%, the adjustment for variable costs will be applied to the remaining 10.96% under delivery which is not being clawed back (16%-5.04%=10.96%). The adjustment for Practice 2 is 10.96%*16.75% = 1.83% of the annual contract value.

Annual declaration

In addition to the activity expectations, contractors will be asked to complete a declaration at year end to include:

- completion of workforce risk assessments

- completion of the monthly workforce return and retention of the workforce

- declaration that payments during the 2020/21 contract year have been made to the practice workforce from April – December

- declaration of proportion of NHS and private turnover

- declaration of surgery opening hours and availability of NHS services

- practice has an NHS nhs.net email address that is active

- practice has not received any duplicate or superfluous funding from the NHS or other government sources – including furlough or additional sick or parental leave pay that was not used to pay for cover

- practice has ensured that face-to-face urgent dental care is available for regular and non-regular attenders via direct contact or referral via 111

- practice has reviewed any interrupted patient care pathways and restarted these where appropriate to do so

- practice has ensured that patients who normally attend the practice are prioritised for care in terms of their risk.

Further detailed guidance published here and helpdesk support the above contractual arrangements yearend@pcc-cic.org.uk.