1. Introduction

- This document is Annex D of the 2025/26 NHS Payment Scheme (NHSPS).

- The NHSPS contains rules for four different payment mechanisms. To support these payment mechanisms, the NHSPS includes prices which are categorised as either unit prices or guide prices.

- The following table illustrates how each of these categories are expected to be used for each payment mechanism:

|

|

Aligned payment and incentive |

Low volume activity |

Activity-based payment |

Local payment arrangement |

|

Unit prices |

Use as part of variable element |

Not applicable |

Use for all relevant activity |

Not applicable |

|

Guide prices |

Can be benchmarks to support fixed payment |

Not applicable |

Not applicable |

Can be used to support local payment |

- This document describes the:

- method used to calculate 2025/26 prices (Section 2)

- method used to set 2025/26 cost uplift and efficiency factors (Section 3).

2. Calculating 2025/26 prices

- This section describes the method used for calculating 2025/26 prices. Appendix 1 gives a more detailed step-by-step description of the method and the model used. The model is built using the software package SAS. The code is available on request – please contact pricingenquiries@nhs.net.

- Some guide prices are calculated in a different way (for example, where there is not appropriate cost data available). All guide prices are published in Annex A, with details of how they have been calculated.

2.1 The method for setting prices

2.1.1 Modelling prices for 2025/26

- The calculation of NHSPS prices is a complex, multi-step process. The calculation method closely follows that previously used by the then Department of Health Payment by Results (PbR) team, up to 2013/14, and for the National Tariff.

- Our modelling approach for 2025/26 uses largely the same calculation method and currencies as the 2023/25 NHSPS. Rather than calculate new price relativities, the initial price relativities for the 2025/26 NHSPS are the 2024/25 pay award NHSPS prices (ie the prices published in September 2024 to reflect agreed pay awards).

- This means that the modelling approach for 2025/26 prices involves the following steps.

- Take the 2024/25 NHSPS pay award prices and use them as price relativities for 2025/26. This is described in more detail in Appendix 1.

- Use adjustment factors to increase or decrease the total amounts allocated to specific areas (clinical sub-chapters and/or points of delivery), where appropriate, in line with agreed policy decisions or clinical advice and applied using a cash in/cash out approach (see Appendix 2).

- Apply cash in/cash out adjustments to account for changes in high cost drugs and devices lists, and to manage year-on-year volatility of prices (see Appendix 2).

- Apply cash in/cash out adjustments to increase the cost base for accident and emergency, maternity and non-elective prices (see Appendix 2).

- Adjust prices to 2025/26 levels to reflect cost uplifts (4.15% – see Section 3.1) and an estimate of the minimum level of efficiency that we expect providers to be able to achieve in 2025/26 (2.0% – see Section 3.2).

2.2 Managing model inputs

2.2.1 Overall approach

- The two main data inputs used to generate prices for the 2025/26 are:

- costs – 2018/19 national cost collection patient-level cost data (PLICS)

- activity – 2018/19 Hospital Episode Statistics (HES) and 2018/19 PLICS.

- These same inputs have been used for prices since the 2022/23 National Tariff.

- The PLICS costs dataset contains cost and activity data for many, but not all, healthcare service providers. The data is collected from all NHS trusts and foundation trusts and therefore covers most healthcare costs. We do not currently collect cost data from the independent sector.

- The HES activity dataset contains the number of admitted patient care (APC) spells, outpatient appointments and A&E attendances in England from all providers of secondary care services to the NHS. It is mainly needed for the APC tariff calculation because the APC currencies are paid on a spell basis, while the activity data contained in the PLICS cost dataset are based on finished consultant episodes (FCEs).

- In our modelling of the 2025/26 prices, we used 2018/19 HES data, grouped by NHS England using the 2018/19 (HRG4+) groupers and the 2024/25 local payment grouper.

Cost data cleaning

- One of our main objectives in setting prices is to reduce unexplained price volatility.

- We consider that using cleaned data (ie raw PLICS cost data with some implausible records removed) will, over time, reduce the number of illogical cost inputs (for example, fewer very low-cost recordings for a particular service and fewer illogical relativities). This, in turn, should reduce the number of modelled prices that require manual adjustment and therefore increase the reliability of the prices. We believe this benefit outweighs the disadvantage of losing some data points as a result of the data cleaning process.

- The data cleaning rules exclude:

- outliers from the raw reference cost dataset, detected using a statistical outlier test known as the Grubbs test (also known as the ‘maximum normed residual test’)

- providers that submitted costs more than 50% below the national average for more than 25% of HRGs as well as 50% higher than the national average for more than 25% of HRGs submitted.

- We merged data where prices would have been based on very small activity numbers (fewer than 50) unless we were advised otherwise by the National Casemix Office clinical Expert Working Groups (EWGs). This was done to maintain stability of prices over time. A review of orthopaedic services found that most trusts have small numbers of cases with anomalous costs for the HRG to which they are allocated, and that these costs are often produced by data errors. Small activity numbers increase the likelihood that prices can be distorted by such errors.

- We also merged data where illogical relativities were found – for example, where a more complex HRG had a lower cost than a less complex HRG.

2.3 Clinical Negligence Scheme for Trusts (CNST)

- The CNST is an indemnity scheme for clinical negligence claims. Providers contribute to the scheme to cover the legal and compensatory costs of clinical negligence. ICBs and NHS England are also members of the CNST scheme. NHS Resolution administers the scheme and sets the contribution that each provider must make to ensure the scheme is fully funded each year.

- The NHSPS cost uplift factor includes an estimate of CNST contributions that are not allocated to specific HRG subchapters (see Section 1.1). CNST is also applied to price calculations.

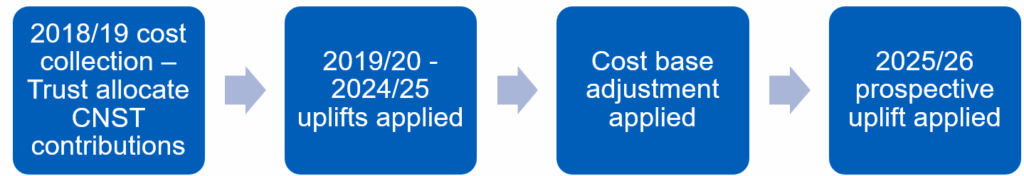

- Figure 1 summarises our approach to including CNST in the NHSPS prices.

Figure 1: Including CNST in the NHSPS prices

- A provider’s CNST contributions are included in the costs it submits as part of the national cost collection. For 2025/26 NHSPS prices, these are 2018/19 PLICS. The cost uplift (including unallocated CNST) and efficiency factors for 2019/20 – 2024/25 are then applied, as part of the process of bringing prices up to the cost base for the current year (ie the level of the year in which the prices are set). Cost base adjustments are then made to scale prices to the agreed payment levels before applying the prospective CNST adjustment, the other cost uplifts, adjustments and the efficiency factor. The prospective adjustment is the difference between the total amount of CNST included in 2024/25 NHSPS pay award prices and the total amount of CNST included in 2025/26 NHSPS prices.

- We have allocated the change in CNST costs to core HRG subchapters in line with the average cost increases that will be paid by providers (see Table 1 below). This approach is different to other cost adjustments to prices, which are estimated and applied across all prices. Each relevant HRG is adjusted based on the change in CNST cost across specialties mapped to HRG subchapters. This means that our cost adjustments reflect, on average, each provider’s relative exposure to CNST cost changes, given their individual mix of services and procedures.

- For example, maternity services have been a major driver of CNST costs in recent years. For this reason, a provider delivering maternity services as a large proportion of its overall service mix would probably find that its CNST contributions (set by NHS Resolution) have increased more quickly than the contributions of other providers. The cost uplift reflects this, with the CNST uplift higher for maternity services (see Table 1).

- These CNST adjustments are applied to NHSPS prices as part of the price calculation process. For API agreements, the fixed element must be uplifted to reflect the CNST HRG subchapter adjustments. Special attention should be given to maternity services to ensure the maternity CNST uplift (1.80%) is applied.

- Table 1 lists the percentage changes that we have applied to each HRG subchapter to reflect the change in CNST costs.

- Most of the changes in CNST costs are allocated at HRG subchapter level, maternity or A&E (as shown in Table 1), but a small residual amount is unallocated at a specific HRG level. This unallocated figure is redistributed as a general adjustment across all prices. The amount of unallocated CNST increased by about £8.7 million between 2024/25 and 2025/26. We have therefore calculated the adjustment due to this pressure as 0.31% in 2025/26 (see Section 1.1).

Table 1: CNST tariff impact by HRG subchapter

|

HRG sub chapter |

2025/26 uplift (%) |

HRG sub chapter |

2025/26 uplift (%) |

HRG sub chapter |

2025/26 uplift (%) |

|

AA |

0.22% |

JA |

0.09% |

PP |

0.58% |

|

AB |

0.09% |

JC |

0.13% |

PQ |

0.22% |

|

BZ |

0.07% |

JD |

0.11% |

PR |

0.49% |

|

CA |

0.21% |

KA |

0.20% |

PV |

0.52% |

|

CB |

0.15% |

KB |

0.07% |

PW |

0.66% |

|

CD |

0.06% |

KC |

0.07% |

PX |

0.49% |

|

DZ |

0.08% |

LA |

0.09% |

SA |

0.11% |

|

EB |

0.08% |

LB |

0.13% |

VA |

0.15% |

|

EC |

0.05% |

MA |

0.31% |

WH |

0.14% |

|

ED |

0.07% |

MB |

0.23% |

WJ |

0.11% |

|

EY |

0.11% |

PB |

0.33% |

YA |

0.33% |

|

FD |

0.15% |

PC |

0.60% |

YD |

0.06% |

|

FE |

0.14% |

PD |

0.59% |

YF |

0.16% |

|

FF |

0.20% |

PE |

0.28% |

YG |

0.13% |

|

GA |

0.21% |

PF |

0.46% |

YH |

0.28% |

|

GB |

0.15% |

PG |

0.28% |

YJ |

0.02% |

|

GC |

0.13% |

PH |

0.44% |

YL |

0.06% |

|

HC |

0.28% |

PJ |

0.55% |

YQ |

0.20% |

|

HD |

0.11% |

PK |

0.43% |

YR |

0.20% |

|

HE |

0.22% |

PL |

0.33% |

|

|

|

HN |

0.19% |

PM |

0.11% |

VB |

0.50% |

|

HT |

0.18% |

PN |

0.26% |

Maternity |

1.80% |

2.4 Making post-modelling adjustments to prices

- The method for setting prices involves making some manual adjustments to the modelled prices. This is done to minimise the risk of setting implausible prices (eg prices that have illogical relativities) based on cost data of variable quality.

- The 2025/26 prices are based on those from 2024/25. These were themselves based on 2023/24 prices, which were based on 2022/23 prices. Manual adjustments to price relativities made for previous years continue to be reflected in the 2025/26 prices. In addition, for we have made the following manual adjustments to price relativities for 2025/26:

- Uplifting A&E, maternity and non-elective prices to return these services to their pre-pandemic cost base. This is an uplift of £2.9bn, implemented differentially so A&E prices are uplifted by 18%; maternity prices by 11% and non-elective prices by 12%.

- Applying a 15% uplift to prices for some gynaecology and ear, nose and throat (ENT) services:

- Gynaecology: MA10Z, MA31Z, MA32Z, MA33Z, MA34Z

- ENT: CA11A, CA28Z, CA32A, CA35A, CA61Z.

- Adjusting the price for HRG FF05Z (Intermediate Upper Gastrointestinal Tract Procedures, 19 years and over) to ensure it supports usage of capsule sponge tests.

- Adjusting prices for Automated Red Cell activity to reflect the cost of the blood component.

- Calculating prices for TFC 352 (Tropical Medicine Service) by setting them as the same as the current respective prices for TFC 350 (Infectious Diseases Service)

- See the cash in/cash out table in Appendix 2 for details of these adjustments.

- We have also adjusted modelled prices to set prices for the new Right Procedure Right Place (RPRP) best practice tariff (BPT) – see Annex C.

- The RPRP BPT prices have been set with reference to British Association of Day Surgery (BADS) target ratios for outpatients and day cases. We have used these rates to calculate an equalised price for day case, elective and outpatient settings. For example, if the BADS target is for a procedure to be performed as outpatient 80% of the time and as day case/elective 20% of the time, the price is 80% of the outpatient price and 20% of the day case/elective price for the procedure.

- To reduce the risk of instability from making this change, we are using a two-step transition path to move to the new prices. For most of the procedures, this means that the price for 2025/26 is halfway between the current activity ratio and the BADS target ratio.

- For the procedure in HRG HN45A (carpal tunnel release, OCPS A651) we are taking a different approach that sees the 2025/26 price based on 20% of the outpatient price and 80% of the day case/elective price (compared to a BADS target ratio of 80% outpatient/20% day case/elective). This is in recognition of concerns that moving immediately to BADS pricing could destabilise this activity due to the large price differential and a relatively low proportion of outpatient activity for this procedure.

2.5 Adjusting prices to reflect patient complexity

- NHSPS prices are calculated on the basis of average costs. This means they do not take account of cost differences between providers because some providers serve patients with more complex needs. As such, top-up payments for some specialised services are made to recognise these cost differences and to improve the extent to which provider reimbursement reflect the actual costs of providing healthcare when this is not sufficiently differentiated in the HRG design.

- Top-up payments are made as an adjustment to prices, with eligible providers (contained within the prescribed specialised services (PSS) operational tool) receiving an increased payment for specialised activity.

- Top-ups are funded through an adjustment (a top-slice) to remove money from the total amount allocated to unit prices, which is then reallocated to providers of specialised services. Each eligible provider will receive a specialist top-up payment from NHS England as part of the API fixed element. The payment of top-ups remains the responsibility of NHS England, even if the specialised activity has been delegated to ICBs. See Annex A for details of the specialist top-up amounts.

- In 2024/25, there was a PSS guaranteed minimum floor value, calculated using 2019/20 HES datasets grouped with 2024/25 local payment grouper and 2024/25 PSS operational tool. We have adjusted the 2024/25 published total PSS values with the net cost uplift factor for 2025/26.

- The 2025/26 published prices were applied to the HRGs generated by the grouper above. The 2025/26 top up rates for eligible PSS flags were applied to the PSS top up flags as generated by the PSS tool above.

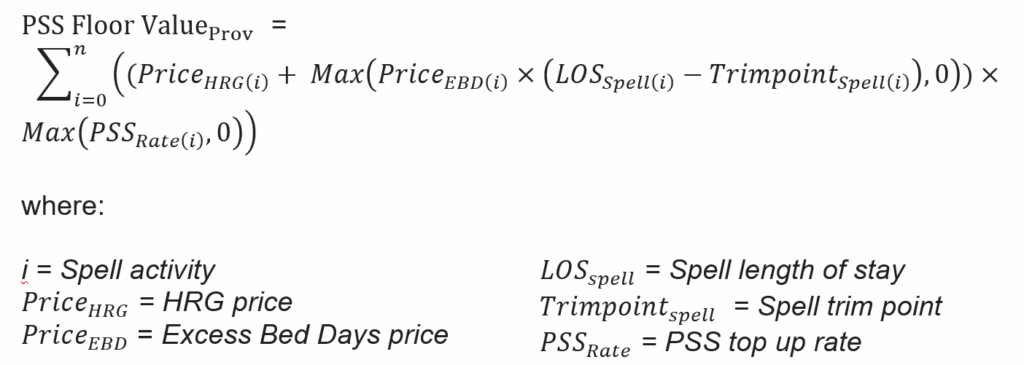

- The floor value for each provider was then calculated using the following formula:

- Providers and commissioners should consider how to take account of eligible provider PSS values when agreeing their API fixed element.

- A list of the services eligible for top-ups, the adjustments and their flags can be found in Annex A, tab 13. See also Section 8.3 of the NHSPS.

2.6 Prices cost base

- The prices cost base is the level of cost that the NHSPS would allow providers to recover (were prices used for all activity), before adjustments are made for cost uplifts and the efficiency factor is applied.

- For 2025/26, we have used largely the same method for setting the prices cost base as used for the 2023/25 NHSPS. This equalises the cost base to that which was set in the previous year, adjusted for activity and scope changes. We have then increased the cost base by £3bn to uplift the prices for accident and emergency, maternity and non-elective services.

- We used 2024/25 prices and revenue as our starting point for calculating the initial prices cost base (before the £3bn uplift).

- After setting the starting point, we considered new information and several factors to form a view on whether an adjustment to the cost base is warranted.

- Information and factors that we considered include:

- historical efficiency and cost uplift assumptions

- latest cost data

- additional funding outside the NHSPS

- changes to the scope of the NHSPS

- any other additional revenue that providers use to pay for NHSPS services

- our pricing principles and the factors that legislation requires us to consider, including matters such as the importance of setting cost-reflective prices and the need to consider the duties of commissioners in the context of the budget available for the NHS.

- In judging where to set the cost base, we consider the effect of setting the cost base too high or too low:

- If we set the cost base too low (ie we set too high an expectation that providers will be able to catch up to past undelivered efficiency), providers would be at greater risk of deficit, service quality could decrease below the level that would otherwise apply (eg increased emergency waiting times), and some providers might cease providing certain services.

- However, if we set the cost base too high, commissioners, who have an obligation to stay within their budgets, are likely to restrict the volumes of commissioned services and could cease commissioning certain services entirely. This would reduce access to healthcare services.

- For 2025/26, it is our judgement that it is appropriate to keep the initial cost base equal to the revenue that would be received under 2024/25 prices, adjusted for activity and scope changes. We have then increased the cost base by £3bn to uplift accident and emergency, maternity and non-elective prices as the reported costs of these services have increased more rapidly than others.

- Since 2021/22, CQUIN funding has been integrated into the tariff. As such, the cost base has been increased by around 1.25% to reflect the equivalent amount reallocated from CQUIN. For 2025/26, this increase is reflected in the NHSPS prices. As such, no separate CQUIN adjustment is needed for payment arrangements based on 2025/26 prices.

2.7 2025/26 guide prices

- In the NHSPS, guide prices are intended to be used as benchmarks or a starting point for local payment arrangements, where there are no available unit prices.

- All prices for non-elective services are considered to be guide prices (other than termination of pregnancy services which will be unit prices, paid using variable payment). The uplifted prices for accident and emergency, maternity and non-elective services continue to be guide prices and should inform setting of fixed payments.

- For 2025/26, we have set new guide prices for:

- haematopoietic stem cell transplantation (HSCT)

- diabetic eye screening and optical coherence tomography.

- We have also revised the guide price for cardiothoracic transplantation.

- All guide prices are published in Annex A, with details of how they have been calculated.

2.8 Short stay emergency adjustment

- The short stay emergency adjustment (SSEM) is applicable to guide prices for emergency care. It is a mechanism for ensuring appropriate payment for lengths of stay shorter than two days, where the average HRG length of stay (LoS) is longer. It applies whether the patient is admitted under a medical or a surgical specialty providing all the following criteria are met:

- The patient’s adjusted LoS is either zero or one day.

- The patient is not a child, defined as aged under 19 years on the date of admission.

- The admission method code is 21-25, 2A, 2B, 2C or 2D (or 28 if the provider has not implemented Commissioning Data Set CDS version 6.2)

- The average length of non-elective stay for the HRG is two or more days.

- The assignment of the HRG can be based on a diagnosis code, rather than on a procedure code alone, irrespective of whether a diagnosis or procedure is dominant in the HRG derivation.

- The adjustment percentages applied are:

|

HRG average length of stay |

2025/26 short stay percentages |

|

< 2 days |

100% |

|

2 days |

65% |

|

3 or 4 days |

45% |

|

≥5 days |

20% |

- Annex A lists the HRGs SSEM is applicable to.

- For BPTs, SSEM is not universally applicable as:

- it only applies to diagnostic-driven HRGs

- it does not apply, for example, when the purpose of the BPT is to reduce length of stay.

- Annex A gives details of which BPTs the SSEM applies to.

- Providers and commissioners should take the application of SSEM into account when agreeing local data flows and reconciliation processes. Where applicable, any local adjustment should be adjusted at the same rate as the core spell (as defined in Annex A).

3. Setting 2025/26 cost uplift and efficiency factors

3.1 Cost uplift factor

- Every year, the efficient cost of providing healthcare changes because of changes in wages, prices and other inputs that providers have limited control over. The NHSPS therefore includes a forward-looking adjustment to reflect expected cost pressures in future years (the cost uplift factor).

- The cost uplift factor is applied to the prices and LVA payment values published as part of the NHSPS. It should also be considered in API and local payment arrangements.

- The cost uplift factor for 2025/26 is 4.15%. This section explains how we have calculated this.

3.1.1 Inflation

- In determining the inflation cost uplift, we considered six categories of cost pressures. These are:

- pay costs

- drugs costs

- revenue consequences of capital costs (ie changes in costs associated with depreciation and private finance initiative payments)

- changes in the cost associated with CNST payments that are not allocated to HRG subchapter, maternity or A&E (see Section 2.3)

- other operating costs

- costs arising from new requirements in the Mandate to NHS England. We call these changes ‘service development’ costs. There are no adjustments from the mandate for service development in 2025/26.

- We gathered initial estimates across these cost categories and then reviewed them to set an appropriate figure for the NHSPS in 2025/26, which in some instances requires an adjustment to the initial figure. The adjustments are included in a total cost uplift factor.

- Table 2 outlines the cost categories and the source for initial estimates.

Table 2: Costs included in the 2025/26 cost uplift factor

|

Cost category |

Description |

Source for initial estimates |

|

Pay |

Assumed pay settlement, pay drift and other labour costs |

Internal data Department of Health and Social Care |

|

Drugs |

Expected changes in drug costs included in the NHSPS. |

Internal data Office for Budgetary Responsibility |

|

Capital |

Expected changes in the revenue consequences of capital. |

Office for Budgetary Responsibility |

|

Unallocated CNST |

Expected changes in CNST contributions that have not gone through the HRG level CNST uplifts. |

NHS Resolution |

|

Other |

General inflation for other operating expenses. |

Internal data Office for Budgetary Responsibility |

- In setting the general cost uplift factor, each cost category is assigned a weight reflecting the proportion of total expenditure. These weights are based on aggregate provider expenditure from published 2022/23 financial accounts. Table 3 shows the weights applied to each cost category.

- For the cost weights, we used previous National Tariff and NHSPS cost uplifts to adjust the 2022/23 consolidated accounts data to produce a projected set of 2025/26 cost weights. Prior to 2025/26, the cost uplift factor was presented to one decimal place – it is now presented to two decimal places to avoid potential confusion.

Table 3: Elements of inflation in the cost uplift factor

|

Cost |

Estimate |

Cost weight |

Weighted estimate |

|

Pay |

4.72% |

70.45% |

3.33% |

|

Drugs |

0.83% |

2.34% |

0.01% |

|

Capital |

2.39% |

7.35% |

0.18% |

|

Unallocated CNST |

0.31% |

2.09% |

0.01% |

|

Other |

3.51% |

17.76% |

0.62% |

|

Total |

4.15% | ||

|

Note: calculations are done unrounded – only two decimal places displayed. | |||

- The following costs are excluded from the calculation of cost weights:

- Purchase of healthcare from other bodies, which includes a combination of costs and cannot be discretely applied to one specific category.

- Education and training costs, which are not included in the NHSPS.

- High cost drugs, which are not reimbursed through NHSPS prices.

- Below, we describe our method for estimating the level of each inflation-related cost uplift component and the unallocated CNST adjustment.

Pay

- Pay costs are a major component of providers’ aggregate input costs. Therefore, it is important that we reflect changes in these costs as accurately as possible when setting national prices.

- Pay-related inflation has three elements:

- Pay settlements – the increase in the unit cost of labour reflected in pay awards for the NHS.

- Pay drift – the tendency for staff to move to a higher increment or to be upgraded; this also includes the impact of overtime.

- Extra overhead labour costs.

- As Table 3 shows, total indicative pay cost change is estimated at 4.72% for 2025/26. This reflects a nominal 2.8% for pay currently included in 2025/26 allocations, plus 0.1% for pay drift. The pay figure also includes other pay-related cost pressures on NHS services. As presented here, the pay cost estimate explicitly does not reflect final pay arrangements for 2025/26, which have not yet been agreed.

Drugs costs

- The drugs cost uplift is intended to reflect increases in drugs expenditure per unit of activity.

- To estimate price growth in generic drugs included in the NHSPS, we used the Office for Budget Responsibility’s October 2024 forecast GDP deflator rate for 2025/26 (2.39%). We also assumed that price growth for branded medicines will remain flat for NHSPS purposes.

- This results in assumed drugs cost inflation of 0.83% for 2025/26.

Capital costs (changes in depreciation and private finance initiative payments)

- Providers’ costs typically include depreciation charges and private finance initiative (PFI) payments. As with increases in operating costs, providers should have an opportunity to recover an increase in these capital costs.

- As with drugs costs, we used the October 2024 GDP deflator rate for 2025/26 (2.39%) to calculate assumed capital cost inflation.

Unallocated CNST

- Section 2.3 describes how CNST costs have been allocated at HRG subchapter level, maternity or A&E. However, a small residual amount is unallocated at a specific HRG level. Total change in unallocated CNST, which is included in the NHSPS but cannot be allocated to HRG subchapters, is estimated at 0.31% for 2025/26. This is based on the change in contribution rates for unallocated CNST as a proportion of the total CNST collection from NHS providers for 2024/25.

Other operating costs

- Other operating costs include general costs such as medical, surgical and laboratory equipment and fuel.

- To set this element, we used a figure of 3% inflation (not including pay or drugs), provided by DHSC, and an uplift of 0.5% to account for the National Living Wage increases that was set out in the Autumn 2024 Budget.

- This results in an ‘other costs’ inflation uplift of 3.51% for 2025/26.

Service development

- The service development uplifts reflect expected extra unit costs to providers of major initiatives that are included in the Government’s Mandate to NHS England, setting out the objectives for the NHS. However, there are no major initiatives anticipated in the Mandate to be funded through the NHSPS in 2025/26, and no uplift is applied.

3.2 Efficiency factor

- The cost uplift factor reflects our estimate of inflation. The efficiency factor reflects our estimate of the average efficiency providers can be expected to achieve year-on-year. This approach is consistent with other sectors where prices are regulated centrally.

- The efficiency factor is applied to the prices and LVA payment values published as part of the NHSPS. It should also be considered in API and local payment arrangements.

- Setting the efficiency factor inappropriately can have adverse impacts on providers, commissioners and patients because:

- setting an efficiency factor too high may challenge the financial position and sustainability of providers. Providers may not be adequately reimbursed for the services they provide, which could affect patients’ quality of care.

- setting an efficiency factor too low may reduce the incentive for providers to achieve cost savings and reduce the volume of services that commissioners can purchase with given budgets, affecting patients’ access to services.

- The efficiency factor for 2025/26 is 2.0%. Our judgement is that this is challenging but achievable, given evidence around catch-up potential and trends in efficiency and financial pressure. This is also consistent with the Government’s 2% productivity, efficiency and savings target for all departments, which applies to DHSC (including the NHS).

- We are planning to undertake a fuller review of the efficiency factor from 2026/27 onwards when prices are recalculated using more up to date costs.

- We are also working to support NHS organisations’ productivity and efficiency. A newly launched Efficiency and Productivity landing page on Model Health System allows organisations to benchmark themselves across a range of productivity and efficiency indicators and identify potential sources of improvement. The FutureNHS Productivity and Efficiency Improvement Hub also contains a range of resources and information including a workforce productivity tool.

- The NHS’s overall efficiency requirement for 2025/26 will be higher than the 2.0% NHSPS efficiency factor. This will be achieved through measures outside of the NHSPS and allocative efficiency/productivity gains.

Appendix 1: Step-by-step price calculation process

- Creating NHSPS prices involves three main stages:

- data grouping and combining

- data cleaning

- price calculation.

- Each of these stages involves multiple steps. This Appendix provides details about what happens at each step.

- For 2025/26, prices have been set by rolling over 2024/25 NHSPS pay award price relativities, rather than calculating price relativities using new cost and activity data. However, this Appendix sets out the full calculation process if new price relativities were being calculated.

- The following sections give details of the steps the model uses to apply the price calculation method.

Data grouping and combining

- For 2054/26, the two main data inputs to generate individual prices are:

- costs – 2018/19 National Cost Collection data (both patient-level cost (PLICS) and aggregated National Cost data)

- activity – 2018/19 hospital episodes statistics (HES) and 2018/19 PLICS.

- The purpose of data grouping is to:

- group the HES admitted patient care (APC), outpatient (OP) and Accident and Emergency (AE) data sets for the National Cost data year (ie 2018/19) with that year’s Costing Grouper to group activity into HRGs

- determine trimpoints and excess bed days for HES admitted patient care (APC) spell activity

- The purpose of combining data sources is to:

- link the HES APC, OP and AE core activity data to the respective PLICS data

- identify outpatient attendance treatment functions, derive department and service codes as appropriate

- get any data not in PLICS plus the unbundled (non-core) APC and OP costs from the aggregated National Costs data

- combine the PLICS and aggregated National Costs data to be ready to be put through the model to calculate prices

Group the activity data (HES)

- The raw activity input data for payment modelling are HES APC, outpatient (OP) and accident and emergency (AE) activity. The cost input for the model is national cost collection data.

- The HES data sets are grouped using the relevant HRG4+ cost Grouper. Length of stay (LoS) trimpoints are calculated for each APC spell HRG using the following formula and rounding the result to the nearest whole number:

- Spell HRG trimpoint = Max{5, Q3 + 1.5 x (Q3 – Q1)}

Where:- The adjusted length of stay (aLoS) for an APC spell is defined as the number of days from admission to discharge (technically: the number of changes of calendar day), after deduction of any days spent in critical care, rehabilitation, specialist palliative care and delayed transfers of care

- Q1 is the aLoS at which 75% of admissions grouping to the HRG have a higher aLoS (first quartile)

- Q3 is the aLoS at which 25% of admissions grouping to the HRG have a higher aLoS (third quartile)

- Once the trimpoints have been calculated for each APC spell HRG, the number of excess bed days are determined as Max{0, aLoS – trimpoint} for each spell.

Link the HES APC, OP and AE core activity data to the PLICS data

- As the PLICS data is at record level and can be linked to the grouped HES data, the actual APC spell activity counts and costs are created using PLICS data. Note that this removes the complex estimation steps that had been needed in previous years to convert episodes to spells in the method. It also results in aggregated costs and counts which may be different at HRG level to those in the published National Costs.

- The OP and AE core activity counts and costs are similarly created by linking the PLICS data to the grouped HES data.

Derive department and service codes (APC, OPROC, OPATT and A&E)

- The published National Costs contain department codes and service codes, as well as currency codes. Department codes generally correspond to points of delivery, for example the APC points of delivery are day case, elective and non-elective. In the NHSPS, prices and scope (and trimpoints beyond which APC excess bed day payments are made) may be differentiated by points of delivery.

- The APC points of delivery (which appear as department codes in the published National Costs and for which unit prices are calculated) are derived from the admission method and the patient classification fields in the APC HES data set.

- Treatment function codes (TFCs) are recorded in the HES data sets and HRGs are assigned by the Grouper that groups the HES data. However, the department and service codes are derived from other fields in the HES data sets.

Get other data from the aggregated National Costs data

- The PLICS part of the National Costs data collection is comprised of APC, OP and AE data. The costs are allocated to activities and resources, rather than to core episode/attendance activity, and to unbundled activity. Rather than derive episode/attendance level costs for unbundled APC and OP, aggregated National Costs data is used.

- Data for other points of delivery/care settings are still collected at an aggregated level from providers.

- Note that due to data privacy regulations, there is small number suppression in the published National Costs data, whereas all numbers (ie with no suppression) are used for price modelling.

Combine the data

- The data is then combined to be prepared for the price calculation model.

Data cleaning

- The purpose of these stages is to ensure that the data is cleansed of outliers and ready to be put through the model to calculate prices.

- Data cleaning rules are applied to the cost data, removing the following records:

- Outlier trusts, detected using a statistical outlier test known as the Grubbs test (also known as the ‘maximum normed residual test’). Data from outlier trusts are excluded from price calculation.

- Providers that submitted costs more than 50% below the national average for more than 25% of HRGs/TFCs as well as 50% higher than the national average for more than 25% of HRGs /TFCs submitted.

Initial data and ‘unit cost’

- The input for the model is combined PLICS (linked to HES) and aggregated National Costs data.

- The spell/attendance level data is then subject to the following data cleaning stages.

Remove MFF

- The market forces factor (MFF) is an estimate of the unavoidable cost differences between healthcare providers.

- The unit costs providers report include costs that are particular to their geographical location(s). We need to remove these for the analysis as we wish to calculate an average price for the country as a whole. These location-specific costs are removed by dividing providers’ national costs by their particular MFF value.

Apply the Grubbs test

- Outliers are removed from the raw reference cost dataset based on the Grubbs method, also known as the ‘maximum normed residual test’.

- The Grubbs test is defined as:

- H0: the sample doesn’t have outliers

- H1: the sample has at least one outlier

- The Grubbs score is calculated using the following formula:

- G = max|Xi-μ|/σ

Where:- G is the Grubbs score

- Xi is the unit cost after the Market Forces Factor (MFF) is removed in a specific sample (see next section for more detail on MFF)

- μ is the sample mean

- σ is the standard deviation.

- The outliers are then identified (and subsequently removed) by comparing the Grubbs score for each observation in the sample with the Grubbs critical value for the sample.

- The test detects one outlier at a time. This outlier is temporarily deleted from the dataset and the test is repeated until no outliers are detected. This test is undertaken across the natural logarithm of the unit cost after the MFF is removed from each cost value in the dataset.

- Please note: The Grubbs test only removes single results, whereas the 25/50 cleaning rule (applied in the next step) removes all of a provider’s data.

Apply the 25/50 rule

- Cost data from a provider are removed if they submit national costs that are:

- more than 50% lower than the national average for more than 25% of the HRGs submitted, and

- more than 50% higher than the national average for more than 25% of the HRGs submitted for each HRG and department.

- Once the data inputs have been cleaned and prepared, they are ready to be used to calculate prices.

Price calculation

- The price calculation stages use the cleaned cost and activity data and apply calculations and adjustments to produce a tariff price.

- In the pricing model, some of these steps only apply to data for certain services. Where this is the case, it is indicated in brackets at the end of the step name (APC = admitted patient care; OPATT = outpatient attendances). All other steps apply in the same way for all services.

Remove the costs of specialised services (APC)

- Additional payments for specialised activity are made outside of tariff prices, in the form of top-ups. As the costs of specialised services are contained in the national costs, the average prices would be set too high if we did not remove these costs. We estimate the costs to commissioners for this and adjust the cost quantum accordingly.

- This is done by top-slicing – adjusting the price of all (or a subset of all) currencies to compensate for costs that cannot be targeted at specific currencies.

Adjust for A&E admission costs (A&E, APC)

- A&E attendances where patients are admitted generate both an A&E and non-elective payment. The costs solely associated with admitting the patient are removed from the A&E costs and added to the non-elective (NE) tariff. We do this to get a full and accurate NE cost base and to have the A&E cost base reflect only the costs of patient care in the A&E setting.

- The input figure for the A&E attendance leading to NE admission is obtained from the A&E tariff calculation model.

Adjust excess bed day prices for adults and paediatrics (APC)

- Separate long stay funding is provided for excess bed days, so excess bed day costs are removed from the spell cost used to calculate price. The clinical requirements of adults and children can vary, including the expected length of stay and cost so separate calculations are made.

- Therefore, this step calculates the excess bed day prices (also known as long stay payments) as the weighted average of the excess bed day costs at the chapter or sub chapter level. There is a split either between HRGs for under- and over-18s for most chapters, or between HRGs for neonatal and under-18s for the paediatrics chapter.

Remove costs of high cost drugs and devices (APC and OPATT)

- Specified high cost drugs and devices are excluded from NHSPS prices (see Tabs 12a and 12b of Annex A). Where a high cost device or high cost drug is on the lists of exclusions from that years’ national tariff prices at the time of the cost collection (see the National Tariff/NHSPS Annex A workbook for the financial year in which the cost collection took place), the costs of the high cost device or high cost drug is unbundled (ie accounted for separately) from the core HRG/TFC costs.

- By contrast, the core HRG/TFC costs submitted by providers as part of the national cost collection include the costs of any high cost devices and high cost drugs that were not on the lists of exclusions from that years’ national tariff prices – and therefore not unbundled (and so not accounted for separately) – at the time of the cost collection.

- Where a high cost device or high cost drug is included in core HRG/TFC costs in the cost collection, but is excluded from (core HRG/TFC) NHSPS prices, we need to remove (or unbundle) the costs of the excluded high cost items from the total costs for specific HRGs/TFCs. Conversely, where a high cost device or high cost drug is excluded from core HRG/TFC costs in the cost collection, but is included in (core HRG/TFC) NHSPS prices, we need to add (or rebundle) the costs of the previously excluded high cost items to the total costs for specific HRGs/TFCs.

- The cost adjustments made here are restricted to no more than 50% of the total cost of the HRG/TFC after the removal of the high cost item cost. If the adjustment would exceed 50%, the rest of the high cost item cost is removed through top-slicing.

- Top-slices for high cost drugs and devices exclusions – and top-ups for high cost drugs and devices which were excluded during the costing year but will be included in HRGs/TFCs prices in the NHSPS year – are comprised of:

- costs calculated as described above

- costs for which there is insufficient information to allocate them to specific HRGs/TFCs.

- Top-slices/top-ups for costs as described in paragraph 137 are applied at this step in the calculation. Top-slices/top-ups for costs for which there is insufficient information to allocate them to specific HRGs/TFCs are applied as cash in/cash out adjustments (see ‘Implement cash in/cash out adjustments’ and Appendix 2).

Revise total APC costs after short-stay emergency adjustments (APC)

- Certain HRGs attract a reduced short-stay emergency (SSEM) payment for adult emergency spells with a length of stay less than two days. The level of the SSEM is based on the average NE length of stay of the HRG because emergencies are, by definition, always non-elective.

- Before this stage, the model assumes that all NE spells attract the full price. From this point on, however, the model differentiates between SSEM and non-SSEM spells. Due to the reduction in the overall non-elective cost as a result of SSEM reductions, spell costs are increased to ensure that the overall cost remains the same before and after the adjustment.

Remove costs for Injury Cost Recovery Scheme

- The Injury Cost Recovery Scheme (ICRS) aims to recover the cost of NHS treatment where personal injury compensation is paid, for example, after a road traffic accident. These costs are paid outside of the NHSPS so are removed only from NE HRGs. Again, this is done as a top-slice.

Combine day case and elective prices (APC)

- In line with NHSPS policy, the day case and elective price for each APC HRG is combined. This is done to encourage day case activity where clinically appropriate as it is usually associated with better patient experience. This is done by calculating the weighted average price of the two.

Combine AE costs

- The price for any activity undertaken in a Type 3 A&E department (minor injury unit), irrespective of the HRG to which it groups, is set to the same price as for HRG VB11Z (Emergency Medicine, No Investigation with No Significant Treatment) for Type 1 and Type 2 A&E departments.

Implement the first quantum reconciliation factor – QR1

- The purpose of the QR1 reconciliation is to reconcile the total model cost quantum to the total national cost quantum used to inform the prices. The formula is:

- QR1 = ((Total National Cost Quantum) / (Modelled Quantum)) – 1

Implement cost based adjustment factor

- This step accounts for costs that should not be considered for the NHSPS.

Apply cost uplifts from data input to current year

- As the prices are based on 2018/19 cost data, to make the prices comparable to the current year (2025/26), they are uplifted by applying the efficiency, inflation and Clinical Negligence Scheme for Trusts (CNST) adjustment factors for 2018/19 – 2024/25.

Apply the scaling factor

- At this stage we apply a scaling factor which will ensure that the total modelled price quantum in the model is equal to an externally set target quantum. This factor is calculated through a separate payment engine.

Implement manual adjustments

- It is important that the prices are a robust reflection of clinical reality. At this stage, the draft prices are therefore shared with the National Casemix Office clinical Expert Working Groups (EWGs). Each HRG chapter has an EWG with specialism in that service area.

- The EWGs review the prices for their chapter and recommend adjustments that should be made to address illogical relativities (ie where the price assigned to a less complex procedure is higher than the price for a more complex one) and clinical needs. The adjustments do not change the total quantum for the chapter, so any increase in prices is compensated for by reductions in others

- The EWG recommendations are considered and applied as manual adjustments unless there are valid reasons not to.

Implement the second reconciliation factor – QR2

- This reconciliation ensures that the overall HRG chapter quantum is the same before and after manual adjustments and affects all prices. The formula is:

- QR2 = ((Quantum prior to manual adjustments) / (Quantum post manual adjustments)) – 1

Implement cash in/cash out adjustments

- To account for significant price changes at different levels (global, point of delivery, chapter, subchapter or HRG level), cash in/cash out adjustments are used to ensure that:

- prices do not move by too much year on year

- providers are not disproportionately affected by the changes

- prices move to take into account cost or scope changes to services.

- Appendix 2 gives details of the cash in/cash out adjustments used for 2024/25. Examples of adjustments to take into account cost or scope changes to services include:

- General top slices across APC and OPATT core HRG/TFC cost quantum for removal of cancer genetic testing from the scope of the NHSPS

- General top-ups to the APC and OPATT core HRG/TFC cost quantum for a number of drugs removed from the high cost drugs exclusion list – and therefore included in the scope of NHSPS prices.

- Applied specific changes to HRG/TFC and clinical specialties where the actual amount are to be distributed to prices.

- In these examples, the adjustment could be applied generally across APC and OPATT where there is insufficient information to allocate the adjustments to specific HRGs/TFCs.

Apply the prospective adjustments

- Adjust prices to 2025/26 levels by applying the cost uplift and efficiency factors (see Section 3).

Final prices prepared for publication

- The final prices are moved into Annex A of the NHSPS.

Appendix 2: Cash in/cash out adjustments

|

Policy Adjustment Area |

More details |

Amount being moved |

Cash out from |

Cash in to |

|

A&E |

Uplifting A&E prices to return these services to their pre-pandemic cost base. |

£693,141,044 |

N/A |

A&E services |

|

Maternity |

Uplifting maternity prices to return these services to their pre-pandemic cost base. |

£308,313,068 |

N/A |

Maternity services |

|

Non-elective |

Uplifting maternity prices to return these services to their pre-pandemic cost base. |

£1,975,101,544 |

N/A |

Non-elective services |

|

BZ subchapter |

Adjusted modelled prices to set prices for the new Right Procedure Right Place (RPRP) best practice tariff (BPT) |

£534,961 |

Excess from RPRP BPT |

Subchapter |

|

CA subchapter |

Same as above BZ |

£388,624 |

Excess from RPRP BPT |

Subchapter |

|

HN |

Same as above |

£1,627,189 |

Excess from RPRP BPT |

Subchapter |

|

JC |

Same as above |

£1,807,338 |

Excess from RPRP BPT |

Subchapter |

|

LB |

Same as above |

£6,048,079 |

Excess from RPRP BPT |

Subchapter |

|

MA |

Same as above |

£415,924 |

Excess from RPRP BPT |

Subchapter |

Appendix 3: Glossary

|

Term |

Description |

|

British Association Of Day Surgery (BADS) |

The British Association Of Day Surgery (BADS) is a multidisciplinary organisation, promoting excellence and enhancing education in the delivery of day surgery. They publish a directory of Procedures which provides recommended day case rates. |

|

Casemix |

The term casemix has a number of meanings, from the literal mix of cases (patients) seen by a consultant, hospital or region, to the way patient care and treatments are classified into groups. In the method description, casemix refers to the classification into groups. |

|

Currency |

A unit of healthcare for which a price is set. The currencies for national tariff prices are either healthcare resource groups (HRGs) or treatment function codes (TFCs). TFCs are used for outpatient attendances. |

|

Episode |

An episode is an agreed time period during which healthcare is provided to a patient. An episodic payment approach is the payment of an agreed price for all the healthcare provided to a patient during an episode. |

|

Excess bed day (EBD) |

When the duration of an Admitted Patient Care episode/spell exceeds the trimpoint number of days (as calculated/set for the HRG in the relevant HRG grouping), each day in the period after the trimpoint number of days until discharge is an excess bed day. |

|

Excess bed day payment |

For patients who remain in hospital beyond an expected length of stay for clinical reasons, there is a reimbursement in addition to the tariff price called an ‘excess bed day payment’ (sometimes referred to as a ‘long-stay payment’). The long-stay payment applies at a daily rate where the length of stay of the spell exceeds a ‘trimpoint’ specific to the HRG. |

|

Expert working groups (EWGs) |

EWGs are groups of clinical experts, managed by the National Casemix Office and include representatives of medical colleges, associations and societies. |

|

Groupers |

Groupers are published by the National Casemix Office and combine clinical diagnosis and treatment codes to group activity into HRGs. |

|

Healthcare resource groups (HRGs) |

Groupings of clinically similar treatments that use similar levels of healthcare resource. HRGs are split into ‘chapters’ and ‘subchapters’ denoting clinical areas (eg Chapter P is paediatrics). HRG4+ is the current version of the system in use for payment. HRGs are used as the basis for many of the currencies. |

|

Hospital Episode Statistics (HES) |

A data warehouse containing details of all admissions, outpatient appointments and A&E attendances at NHS hospitals in England. This data is collected during a patient’s treatment at a hospital to enable hospitals to be paid for the care they deliver. HES data are designed to enable secondary use for non-clinical purposes. https://digital.nhs.uk/data-and-information/data-tools-and-services/data-services/hospital-episode-statistics |

|

National Cost Collection |

The National Cost Collection comprises aggregated costs (the average unit cost of providing defined services to NHS patients in England) and patient-level costs/PLICS. |

|

Patient-level cost data (PLICS) |

Patient-level cost data (known as PLICS) are costs based on the specific interactions a patient has, and the events related to their healthcare activity. |

|

Quantum |

Quantum refers to the total amount of money. |

|

Scaling factor |

The factor used to ensure that the total quantum in the model is equal to an externally set target (cost base). |

|

Spell |

The period from the date that a patient is admitted into hospital until the date they are discharged, which may contain one or more episodes of treatment. |

|

Short stay emergency tariff (SSEM) |

Mechanism for ensuring appropriate reimbursement for lengths of stay of less than two days, where the average HRG length of stay is longer. This forms part of the blended payment arrangements for emergency care payments. |

|

Top-slicing |

Top-slicing is the process of reducing all prices by a small percentage to provide funding to be reallocated to target specific areas. |

|

Treatment function codes (TFCs) |

Outpatient attendance prices are based on TFCs. Main specialty codes represent the specialty within which a consultant is recognised or contracted to the organisation. Outpatient attendance activity is generally organised around clinics based on TFC specialties and they are used to report outpatient activity and also to set prices for outpatient procedure activity where there is no unit price for the HRG in the outpatient setting. |

|

Trimpoint |

For each HRG, the trimpoint is calculated as the upper quartile length of stay for that HRG plus 1.5 times the inter-quartile range of length of stay, rounded to the nearest whole day. After the spell of treatment exceeds this number of days, a provider will receive payment for each additional day the patient remains in hospital. This is referred to as an excess bed day payment or a long stay payment. |

|

Unbundled |

To enable HRGs to represent activity and costs more accurately, some significant elements can be “unbundled” from the core HRGs that reflect the primary reason for a patient admission or treatment. These unbundled HRGs better describe the elements of care that comprise the patient pathway and can be commissioned, priced and paid for separately. |