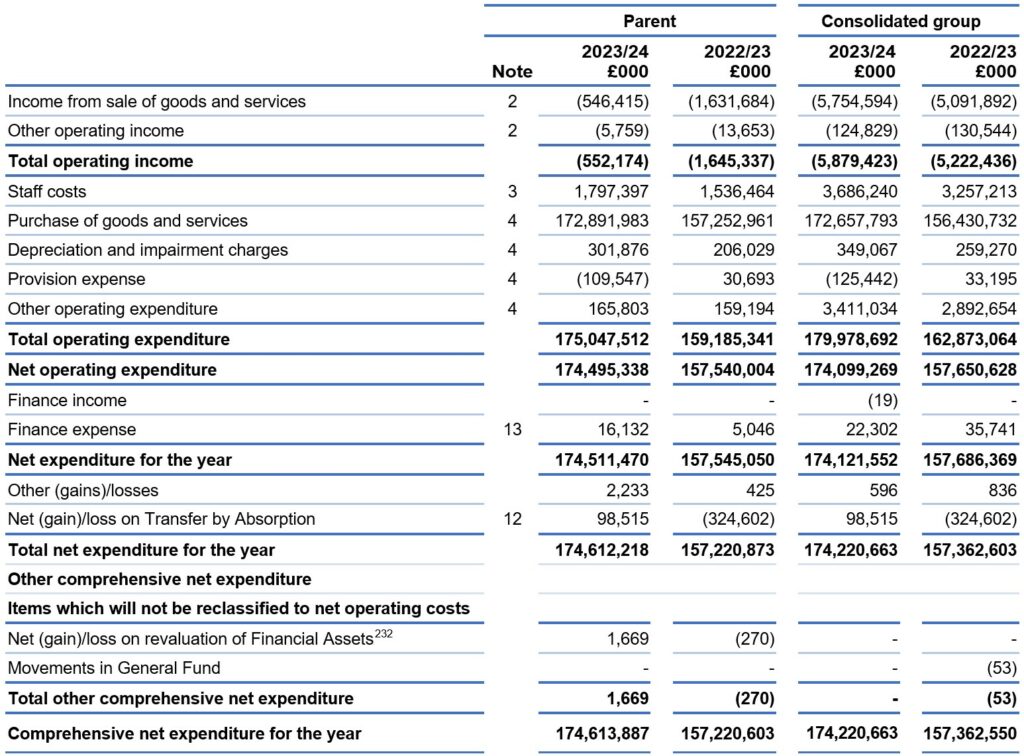

Statement of comprehensive net expenditure for the year ended 31 March 2024

On 1 April 2023 Health Education England became part of the NHS England parent account. As a result, the assets, liabilities and ongoing operational income and expenditure relating to former Health Education England functions form part of the NHS England parent from that date.

On 1 February 2023, NHS Digital became part of the NHS England parent account. As a result, the assets, liabilities and ongoing operational income and expenditure relating to former NHS Digital functions form part of the NHS England parent account from this date.

The notes below form part of this statement.

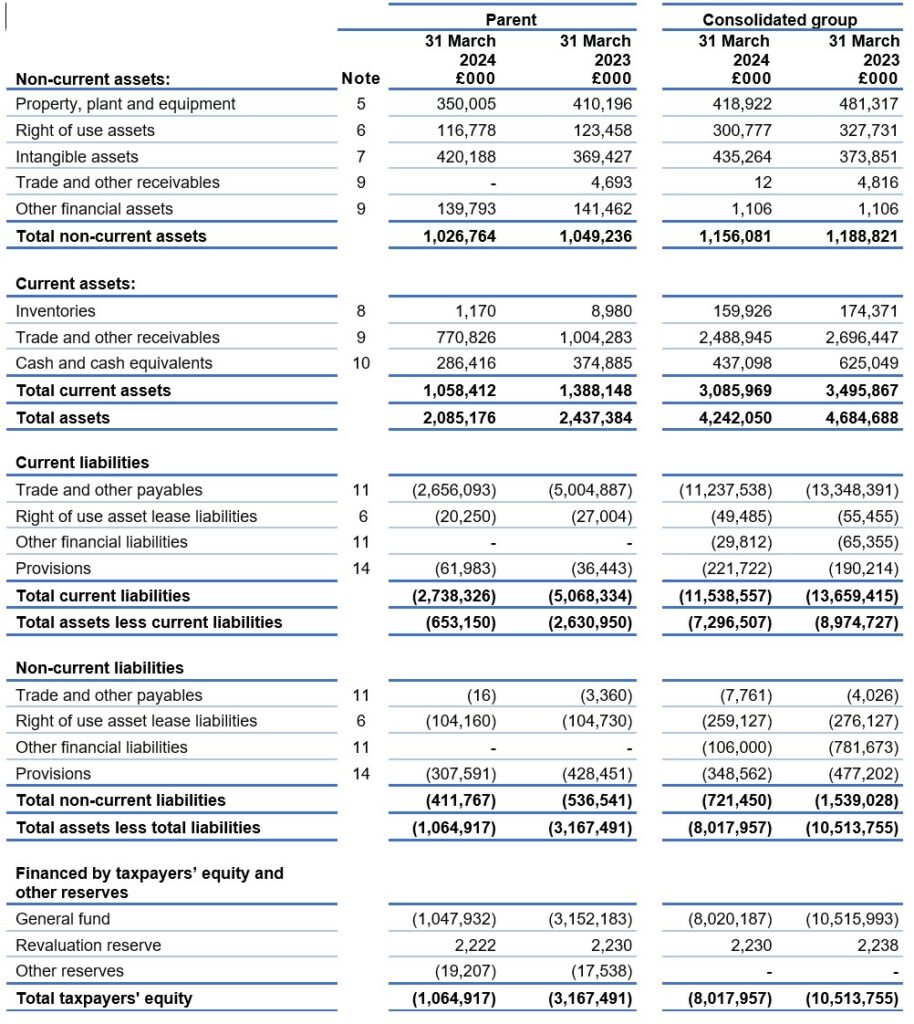

Statement of financial position as at 31 March 2024

The notes below form part of this statement.

The financial statements below were approved by the Board and signed on its behalf by:

Amanda Pritchard, Accounting Officer

4 October 2024

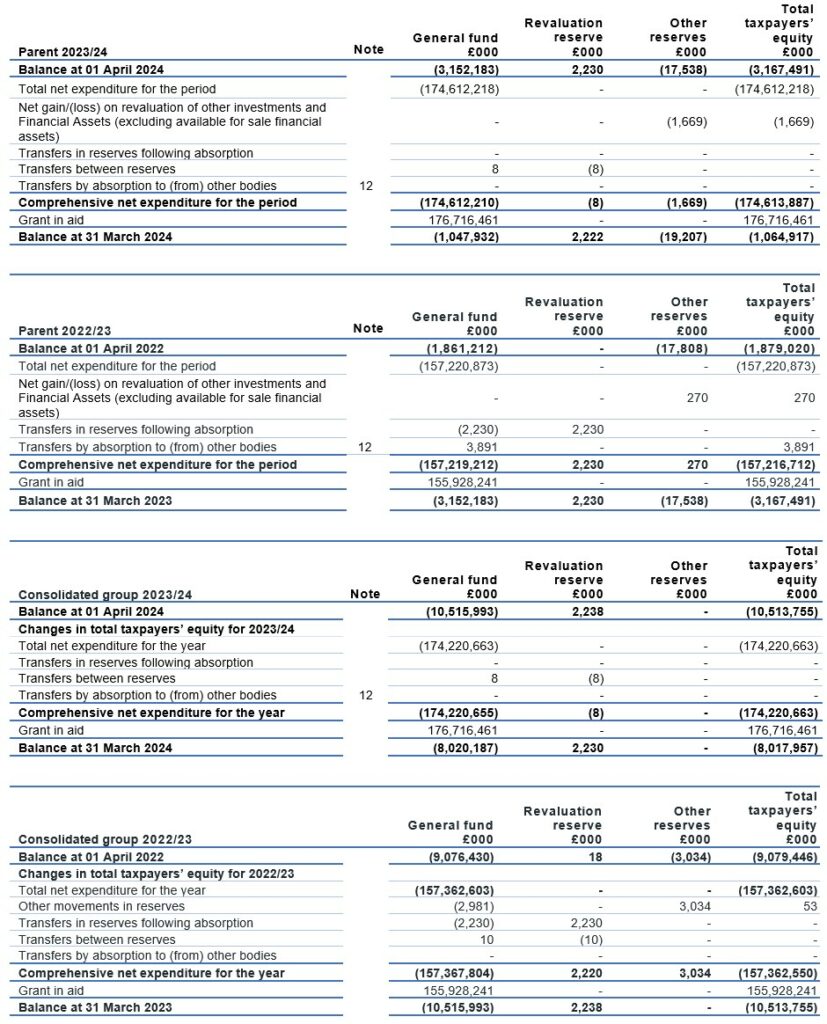

Statement of changes in taxpayers’ equity for the year ended 31 March 2024

The general fund is used in public sector accounting to reflect the total assets less liabilities of an entity, which are not assigned to another reserve.

Other reserves in the parent relate to fair value losses on equity investments designated as fair value through other comprehensive income under IFRS 9

Other reserves in the group in 2022/23 reflect pension assets/liabilities in respect of staff in non NHS defined benefit schemes in CCGs/ICBs. Full details can be found in the CCG/ICBs statutory accounts published on their websites.

The notes below form part of this statement.

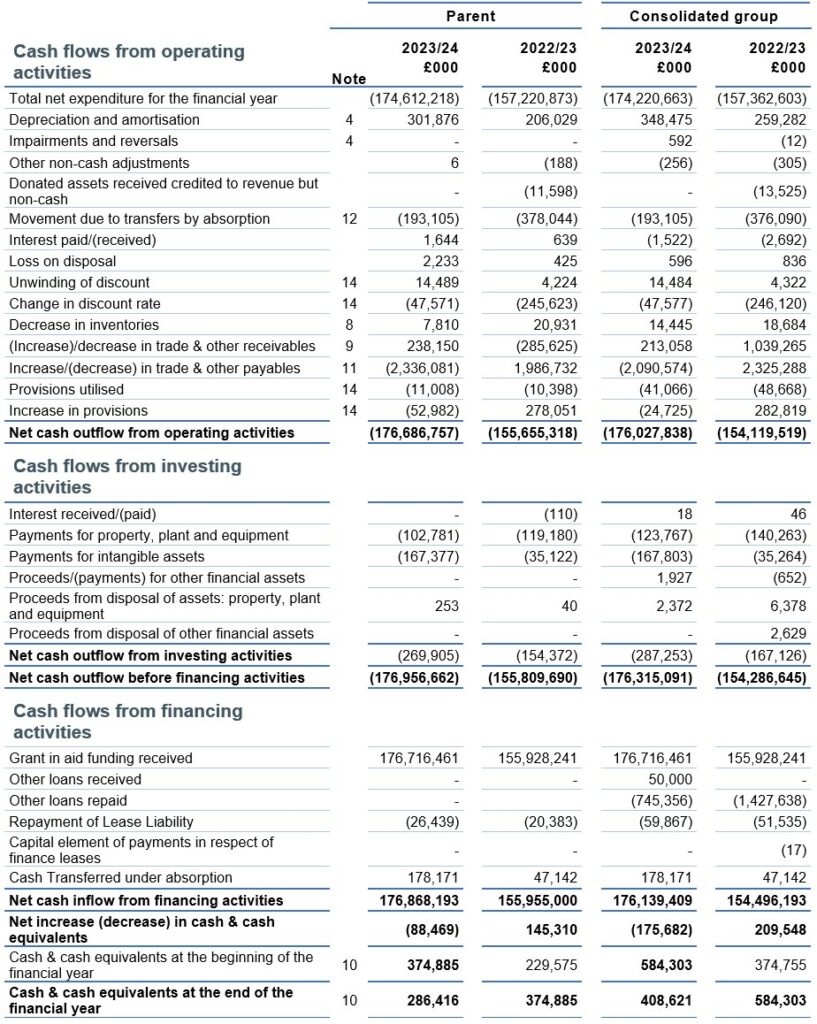

Statement of cash flows for the year ended 31 March 2024

The notes below form part of this statement. There is no separate disclosure under IAS 7 for cash and non-cash movements for financing activities because the values are immaterial.

Notes to the financial statements

1. Statement of accounting policies

These financial statements have been prepared in a form directed by the Secretary of State under Schedule 1(A), paragraph 15(2) of the NHS Act 2006 (as amended by the Health and Care Act 2022) and in accordance with the FReM 2023/24 issued by HM Treasury and the DHSC Group Accounting Manual (GAM) issued by the Department of Health and Social Care. The accounting policies contained in the FReM and DHSC GAM apply IFRS as adapted or interpreted for the public sector context. Where the FReM or DHSC GAM permits a choice of accounting policy, the accounting policy which is judged to be most appropriate to the particular circumstances of NHS England for the purpose of giving a true and fair view has been selected. The particular policies adopted by NHS England are described below. They have been applied consistently in dealing with items considered material to the accounts.

The functional and presentational currency is pounds sterling and figures are expressed in pounds thousands unless expressly stated. Two sets of figures are presented – the first relating to NHS England itself (the Parent) and a second set of consolidated figures (Consolidated Group). The entities making up the Consolidated Group are declared in Note 22.

Exchange gains and losses on monetary items (arising on settlement of the transaction or on retranslation at the Statement of Financial Position date) are recognised in the Statement of Comprehensive Net Expenditure in the period in which they arise.

1.1 Operating segments

Income and expenditure are analysed in the Operating Segments Note 18 and reflect the management information used within NHS England. Information on assets less liabilities is not separately reported to the Chief Operating Decision Maker and therefore in accordance with IFRS 8 does not form part of the disclosure in Note 18.

1.2 Accounting convention

These accounts have been prepared under the historical cost convention, modified to account for the revaluation of property, plant and equipment, intangible assets, and certain financial assets and financial liabilities.

1.3 Basis of consolidation

These accounts comprise the results of the NHS England statutory entity as well as the consolidated position of NHS England, 42 ICBs and SCCL. Transactions between entities included in the consolidation are eliminated.

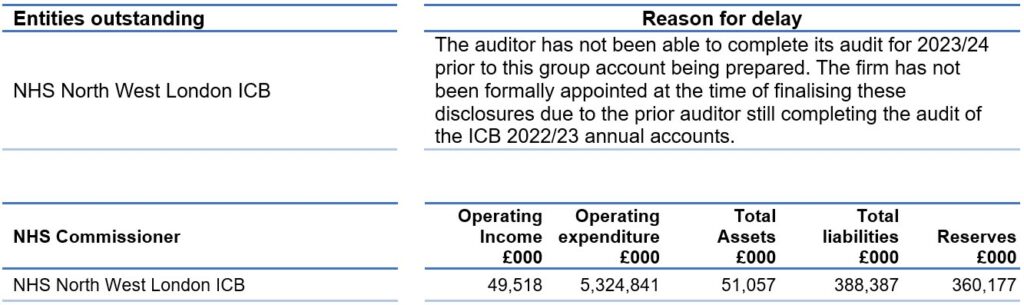

For 2023/24, 1 ICB audit was incomplete at the time of finalising the NHS England group account on 27 September 2024. Unaudited information has been used to prepare the NHS England group account.

Details of the entity outstanding is shown in the table below:

Operating expenditure for this entity is material so we have performed additional assurance procedures on this balance. Following these procedures, we are satisfied that the residual balances over which uncertainty remains are not material to these consolidated accounts.

The NHS England group account for 2023/24 was finalised using unaudited information for one NHS commissioner (NHS North West London ICB). This commissioner has yet to publish audited accounts for 2023/24.

CSUs form part of NHS England and provide services to ICBs. The CSU results are included within the Parent accounts as they are not separate legal entities.

From 1 April 2023 NHS England took on the functions of Health Education England and on this date its functions, assets and liabilities were transferred into the NHS England statutory entity.

1.4 Comparative information

The comparative information provided in these financial statements is for the year ended 31 March 2023.

1.5 Going concern

NHS England’s financial statements are produced on a going concern basis. Public sector bodies are assumed to be going concerns where the continuation of the provision of a service in the future is anticipated, as evidenced by inclusion of financial provision for that service in published documents. NHS England is financed by grant-in-aid and draws its funding from the DHSC. Parliament has demonstrated its commitment to fund the DHSC for the foreseeable future via the latest Spending Review and the passing of the Health and Care Act 2022. In the same way, the DHSC has demonstrated commitment to the funding of NHS England. It is therefore considered appropriate to adopt the going concern basis for the preparation of these financial statements.

1.6 Transfer of functions

As public sector bodies within a departmental Boundary are deemed to operate under common control, business reconfigurations are outside the scope of IFRS 3 Business Combinations. When functions transfer between two public sector bodies the FReM requires the application of “absorption accounting.” Absorption accounting requires that entities account for their transactions in the period in which those transactions took place. Where assets and liabilities transfer, the gain or loss resulting is recognised in the Statement of Net Comprehensive Expenditure and is disclosed separately from operating costs.

1.7 Revenue recognition

In the application of IFRS 15 a number of practical expedients have been employed. These are as follows:

- NHS England is not required to disclose information regarding performance obligations that are part of a contract that has an original expected duration of one year or less

- NHS England is not required to disclose information where revenue is recognised in line with the practical expedient offered in the Standard, where the right to consideration corresponds directly with the value of the performance completed to date.

The main source of funding for NHS England is grant-in-aid from the Department of Health and Social Care. NHS England is required to maintain expenditure within this allocation.

The Department of Health and Social Care also approves a cash limit for the period.

NHS England is required to draw down cash in accordance with this limit. Grant-in-aid is drawn down and credited to the general fund. Grant-in-aid is recognised in the financial period in which it is received.

Revenue in respect of services provided is recognised when (or as) performance obligations are satisfied by transferring promised services to the customer and is measured at the amount of the transaction price allocated to that performance obligation.

IFRS 15 is applicable to revenue in respect of dental and prescription charges in line with the adaptation in IFRS 15 which states that the definition of a contract includes revenue received under legislation and regulations. Revenue for these charges is recognised when the performance event occurs, such as the issue of a prescription or payment for dental treatment.

Income received in respect of penalty charge notices issued in relation to non-payment of prescribing and dental charges is recognised on a cash receipts basis.

Where income is received for a specific performance obligation that is to be satisfied in the following year, that income is deferred.

Other operating revenue is recognised when the service is rendered and the stage completion of the transaction at the end of the reporting period can be measured reliably, and it is probable that the economic benefit associated with the transaction will flow to the group. Income is measured at fair value of the consideration receivable.

The value of the benefit received when NHS England accesses funds from the government’s apprenticeship service are recognised as income in accordance with IAS 20, Accounting for Government Grants. Where these funds are paid directly to an accredited training provider, non-cash income and a corresponding non-cash training expense are recognised, both equal to the cost of the training funded.

1.8 Employee benefits

Recognition of short-term benefits – retirement benefit costs:

Past and present employees are covered by the provisions of the NHS Pensions schemes. The schemes are unfunded, defined benefit schemes that cover NHS employers, general practitioners and other bodies allowed under the direction of the Secretary of State in England and Wales. The schemes are not designed to be run in a way that would enable NHS bodies to identify their share of the underlying assets and liabilities. Therefore, the schemes are accounted for as if they were a defined contribution scheme; the cost recognised in these accounts represents the contributions payable for the year. Details of the benefits payable under these provisions can be found on the NHS Pensions website at www.nhsbsa.nhs.uk/pensions.

For early retirements other than those due to ill health, the additional pension liabilities are not funded by the scheme. The full amount of the liability for the additional costs is charged to expenditure at the time the organisation commits itself to the retirement, regardless of the method of payment.

Salaries, wages and employment related payments, including payments arising from the apprenticeship levy, are recognised in the period in which the service is received from employees. The cost of leave earned but not taken by employees at the end of the period is recognised in the financial statements to the extent that employees are permitted to carry forward leave into the following year.

1.9 Other expenses

Other operating expenses are recognised when, and to the extent that, the goods or services have been received. They are measured at the fair value of the consideration payable.

1.10 Value added tax

Most of the activities of the group are outside the scope of value added tax (VAT). Irrecoverable VAT is charged to the relevant expenditure category or included in the capitalised purchase cost of non-current assets. Where output tax is charged or input VAT is recoverable, the amounts are stated net of VAT.

1.11 Property, plant and equipment

Recognition

Property, plant and equipment is capitalised if:

- it is held for use in delivering services or for administrative purposes

- it is probable that future economic benefits will flow to, or service potential will be supplied to, the group

- it is expected to be used for more than 1 financial year

- the cost of the item can be measured reliably; and either

- the item cost at least £5,000, or

- collectively, a number of items have a total cost of at least £5,000 and individually have a cost of more than £250, where the assets are functionally interdependent, they have broadly simultaneous purchase dates, are anticipated to have simultaneous disposal dates and are under single managerial control

Where an asset includes a number of components with significantly different asset lives, the components are treated as separate assets and depreciated over their individual useful economic lives.

Measurement of property, plant and equipment

All property, plant and equipment is measured initially at cost, representing the cost directly attributable to acquiring or constructing the asset and bringing it to the location and condition necessary for it to be capable of operating in the manner intended by management. Assets that are held for their service potential and are in use are measured subsequently at their current value in existing use.

IT equipment, transport equipment, furniture and fittings, and plant and machinery that are held for operational use are valued at depreciated historical cost as a proxy for current value in existing use. This is in accordance with FReM requirements as these assets have short useful lives or low values or both.

Balances held in the Revaluation reserve relate to balances inherited from 1 April 2013. In line with our accounting policy, no further revaluation gains have been recognised.

Subsequent expenditure

Where subsequent expenditure enhances an asset beyond its original specification, the directly attributable cost is capitalised. Where subsequent expenditure restores the asset to its original specification, the expenditure is capitalised and any existing carrying value of the item replaced is charged to operating expenses.

1.12 Intangible non-current assets

Intangible non-current assets are non-monetary assets without physical substance that are capable of sale separately from the rest of the group’s business or arise from contractual or other legal rights. They are recognised only when it is probable that future economic benefits will flow to, or service potential be provided to, the group; where the cost of the asset can be measured reliably; and where the cost is at least £5,000 or collectively the cost is at least £5,000 with each individual item costing more than £250.

Intangible non-current assets acquired separately are initially recognised at cost. Software that is integral to the operation of hardware is capitalised as part of the relevant item of property, plant and equipment. Software that is not integral to the operation of hardware is capitalised as an intangible asset.

Following initial recognition, intangible assets are carried at depreciated historic cost as a proxy for current value in existing use.

1.13 Research and development

Expenditure on research is not capitalised; it is recognised as an operating expense in the period in which it is incurred.

Internally generated assets are recognised if, and only if, all of the following have been demonstrated:

- the technical feasibility of completing the intangible asset so that it will be available for use

- the intention to complete the intangible asset and use it

- the ability to sell or use the intangible asset

- how the intangible asset will generate probable future economic benefits or service potential

- the availability of adequate technical, financial, and other resources to complete the intangible asset and sell or use it

- the ability to reliably measure the expenditure attributable to the intangible asset during its development.

The amount initially recognised for internally generated intangible assets is the sum of the expenditure incurred from the date when the criteria for recognition are initially met. Where no internally generated intangible asset can be recognised, the expenditure is recognised in the period in which it is incurred.

1.14 Depreciation, amortisation and impairments

Freehold land, assets under construction, stockpiled goods and assets held for sale are neither depreciated nor amortised.

Otherwise, depreciation or amortisation, as appropriate, is charged to write off the costs or valuation of property, plant and equipment and intangible non-current assets, less any residual value, on a straight-line basis over their estimated remaining useful lives. The estimated useful life of an asset is the period over which economic benefits or service potential is expected to be obtained from the asset. Estimated useful lives and residual values are reviewed each year end, with the effect of any changes recognised on a prospective basis. Assets held under finance leases are depreciated over the shorter of the lease term and the estimated useful life.

Depreciation/amortisation is charged as follows:

| Minimum life (years) | Maximum life (years) | |

| Buildings excluding dwellings | 5 | 20 |

| Plant and machinery | 5 | 10 |

| Transport equipment | 5 | 10 |

| Information technology | 2 | 10 |

| Furniture and fittings | 5 | 10 |

| Computer software: purchased | 2 | 5 |

| Licences and trademarks | 2 | 5 |

| Development expenditure (internally generated) | 2 | 5 |

1.15 Government grants

Government grant funded assets are capitalised at their fair value on receipt, with a matching credit to income. Deferred income is recognised only where conditions attached to the grant preclude immediate recognition of the gain.

1.16 Leases

A lease is a contract or part of a contract that conveys the right to use an asset for a period of time in exchange for consideration.

IFRS 16 Leases was effective across the NHS from 1 April 2022. The transition to IFRS 16 was completed in accordance with paragraph C5 (b) of the Standard, applying IFRS 16 requirements retrospectively recognising the cumulative effects at the date of initial application.

In the transition to IFRS 16 a number of elections and practical expedients offered in the Standard were employed. These were as follows:

NHS England has applied the practical expedient offered in the Standard per paragraph C3 to apply IFRS 16 to contracts or arrangements previously identified as containing a lease under the previous leasing standards IAS 17 Leases and IFRIC 4 Determining whether an Arrangement contains a Lease and not to those that were identified as not containing a lease under previous leasing standards.

On initial application NHS England has measured the right of use assets for leases previously classified as operating leases per IFRS 16 C8 (b)(ii), at an amount equal to the lease liability adjusted for accrued or prepaid lease payments.

No adjustments have been made for operating leases in which the underlying asset is of low value per paragraph C9 (a) of the Standard.

The transitional provisions were not applied to operating leases whose terms end within 12 months of the date of initial application has been employed per paragraph C10 (c) of IFRS 16.

Hindsight was used to determine the lease term when contracts or arrangements contain options to extend or terminate the lease in accordance with C10 (e) of IFRS 16.

Due to transitional provisions employed the requirements for identifying a lease within paragraphs 9 to 11 of IFRS 16 was not employed for leases in existence at the initial date of application. Leases entered into on or after 1 April 2022 will be assessed under the requirements of IFRS 16.

There are further expedients or elections that have been employed by NHS England in applying IFRS 16. These include:

The measurement requirements under IFRS 16 are not applied to leases with a term of 12 months or less under paragraph 5 (a) of IFRS 16.

The measurement requirements under IFRS 16 are not applied to leases where the underlying asset is of a low value which are identified as those assets of a value of less than £5,000, excluding any irrecoverable VAT, under paragraph 5 (b) of IFRS 16.

NHS England will not apply IFRS 16 to any new leases of intangible assets applying the treatment described in section 1.12 instead.

HM Treasury have adapted the public sector approach to IFRS 16 which impacts on the identification and measurement of leasing arrangements that will be accounted for under IFRS 16.

NHS England is required to apply IFRS 16 to lease like arrangements entered into with other public sector entities that are in substance akin to an enforceable contract, that in their formal legal form may not be enforceable. Prior to accounting for such arrangements under IFRS 16 NHS England has assessed that in all other respects these arrangements meet the definition of a lease under the Standard.

NHS England is required to apply IFRS 16 to lease like arrangements entered into in which consideration exchanged is nil or nominal, therefore significantly below market value. These arrangements are described as peppercorn leases. Such arrangements are again required to meet the definition of a lease in every other respect prior to inclusion in the scope of IFRS 16. The accounting for peppercorn arrangements aligns to that identified for donated assets. Peppercorn leases are different in substance to arrangements in which consideration is below market value but not significantly below market value.

The nature of the accounting policy change for the lessee is more significant than for the lessor under IFRS 16. IFRS 16 introduces a singular lessee approach to measurement and classification in which lessees recognise a right of use asset.

For the lessor leases remain classified as finance leases when substantially all the risks and rewards incidental to ownership of an underlying asset are transferred to the lessee. When this transfer does not occur, leases are classified as operating leases.

1.16.1 NHS England as a lessee

At the commencement date for the leasing arrangement a lessee shall recognise a right of use asset and corresponding lease liability. NHS England employs a revaluation model for the subsequent measurement of its right of use assets unless cost is considered to be an appropriate proxy for current value in existing use or fair value in line with the accounting policy for owned assets. Where consideration exchanged is identified as below market value, cost is not considered to be an appropriate proxy to value the right of use asset.

Lease payments are apportioned between finance charges and repayment of the principal. Finance charges are recognised in the Statement of Comprehensive Net Expenditure. Irrecoverable VAT is expensed in the period to which it relates and therefore not included in the measurement of the lease liability and consequently the value of the right of use asset.

The incremental borrowing rate of 0.95% has been applied to the lease liabilities recognised at the date of initial application of IFRS 16. Where changes in future lease payments result from a change in an index or rate or rent review, the lease liabilities are remeasured using an unchanged discount rate.

Where there is a change in a lease term or an option to purchase the underlying asset NHS England applies a revised rate to the remaining lease liability.

Where existing leases are modified NHS England must determine whether the arrangement constitutes a separate lease and apply the Standard accordingly.

Where an implicit rate cannot be determined, the incremental borrowing rate determined by HM Treasury annually is applied. A nominal rate of 3.51% applied to new leases commencing in 2023 and 4.72% to new leases commencing in 2024.

Lease payments are recognised as an expense on a straight-line or another systematic basis over the lease term, where the lease term is in substance 12 months or less or is elected as a lease containing low value underlying asset by NHS England.

1.17 Non-current assets held for sale

Non-current assets are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use. This condition is satisfied once both of the following criteria are met:

- the asset is available for immediate sale in its present condition subject only to terms which are usual and customary for such sales; and

- the sale is highly probable

Non-current assets held for sale are measured at the lower of their previous carrying amount and fair value less costs to sell. Fair value is open market value including alternative uses.

The profit or loss arising on disposal of an asset is the difference between the sale proceeds and the carrying amount and is recognised in the statement of comprehensive net expenditure. On disposal, the balance for the asset in the revaluation reserve is transferred to retained earnings.

Property, plant and equipment that is to be scrapped or demolished does not qualify for recognition as held for sale. Instead, it is retained as an operational asset and its economic life is adjusted. The asset is derecognised when it is scrapped or demolished.

1.18 Inventories

Inventories are valued at the lower of cost and net realisable value and are utilised using the First in First Out method of inventory controls.

1.19 Cash and cash equivalents

Cash is cash in hand and deposits with any financial institution repayable without penalty on notice of not more than 24 hours. Cash equivalents are investments that mature in 3 months or less from the date of acquisition and are readily convertible to known amounts of cash with insignificant risk of change in value.

In the statement of cash flows, cash and cash equivalents are shown net of bank overdrafts that are repayable on demand and that form an integral part of cash management. Cash, bank and overdraft balances are recorded at current values.

1.20 Provisions

Provisions are recognised when there exists a present legal or constructive obligation as a result of a past event, it is probable that the group will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation. The amount recognised as a provision is the best estimate of the expenditure required to settle the obligation at the end of the reporting period, taking into account the risks and uncertainties. Where a provision is measured using the cash flows estimated to settle the obligation, its carrying amount is the present value of those cash flows using HM Treasury’s discount rates.

Provisions are subject to 3 separate discount rates according to the expected timing of cashflows:

- a nominal short-term rate of 4.26 percent (2022/23: 3.27 percent in real terms) is applied to inflation adjusted expected cash flows up to and including 5 years from Statement of Financial Position date

- a nominal medium-term rate of 4.03 percent (2022/23: 3.20 percent in real terms) is applied to inflation adjusted expected cash flows over 5 years up to and including 10 years from the Statement of Financial Position date

- a nominal long-term rate of 4.72 percent (2022/23: 3.51 percent in real terms) is applied to inflation adjusted expected cash flows over 10 years and up to and including 40 years from the Statement of Financial Position date

1.21 Clinical negligence costs

NHS Resolution operates a risk pooling scheme under which NHS England and ICBs pay an annual contribution to NHS Resolution, which in turn settles all clinical negligence claims. The contribution is charged to expenditure. Although NHS Resolution is administratively responsible for all clinical negligence cases, the legal liability rests with the group.

1.22 Non-clinical risk pooling

The NHS England group participates in the Property Expenses Scheme and the Liabilities to Third Parties scheme. Both are risk pooling schemes under which NHS England and ICBs pay an annual contribution to NHS Resolution and, in return, receive assistance with the cost of claims arising. The annual membership contributions, and any excesses payable in respect of particular claims, are charged to operating expenses when they become due.

1.23 Contingent liabilities and contingent assets

A contingent liability is:

- a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the organisation

- a present obligation that is not recognised because it is not probable that a payment will be required to settle the obligation, or the amount of the obligation cannot be measured sufficiently reliably

A contingent liability is disclosed unless the possibility of a payment is remote.

A contingent asset is a possible asset that arises from past events and whose existence will be confirmed by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the organisation. A contingent asset is disclosed where an inflow of economic benefits is probable.

Where the time value of money is material, contingent liabilities that are required to be disclosed under IAS37 are stated at discounted amounts.

1.24 Financial assets

Financial assets are recognised on the statement of financial position when the group becomes party to the financial instrument contract or, in the case of trade receivables, when the goods or services have been delivered. Financial assets are de-recognised when the contractual rights have expired, or the asset has been transferred and the group has transferred substantially all of the risks and rewards of ownership or has not retained control of the asset.

As available for sale financial assets, the group’s investments are measured at fair value. With the exception of impairment losses, changes in value are taken to the revaluation reserve. Accumulated gains or losses are recycled to the consolidated statement of net comprehensive expenditure on de- recognition.

Financial assets are classified into the following categories: financial assets at amortised cost, financial assets at fair value through other comprehensive income, and financial assets at fair value through profit and loss. The classification is determined by the cash flow and business model characteristics of the financial assets, as set out in IFRS 9, and is determined at the time of initial recognition.

1.24.1 Financial assets at amortised cost

Financial assets measured at amortised cost are those held within a business model whose objective is to hold financial assets in order to collect contractual cash flows and where the cash flows are solely payments of principal and interest. This includes most trade receivables, loans receivable, and other simple debt instruments.

After initial recognition, these financial assets are measured at amortised cost using the effective interest method, less any impairment. The effective interest rate is the rate that exactly discounts estimated future cash receipts through the life of the financial asset to the gross carrying amount of the financial asset.

1.24.2 Financial assets at fair value through other comprehensive income

Financial assets measured at fair value through other comprehensive income are those held within a business model whose objective is achieved by both collecting contractual cash flows, and selling financial assets and where the cash flows are solely payments of principal and interest.

1.24.3 Financial assets at fair value through profit and loss

Financial assets measured at fair value through profit or loss are those that are not otherwise measured at amortised cost or fair value through other comprehensive income. This includes derivatives and financial assets acquired principally for the purpose of selling in the short term.

1.24.4 Impairment

For all financial assets measured at amortised cost or at fair value through other comprehensive income (except equity instruments designated at fair value through other comprehensive income), lease receivables and contract assets, NHS England recognises a loss allowance representing expected credit losses on the financial instrument.

NHS England adopts the simplified approach to impairment, in accordance with IFRS 9, and measures the loss allowance for trade receivables, contract assets and lease receivables at an amount equal to lifetime expected credit losses. For other financial assets, the loss allowance is measured at an amount equal to lifetime expected credit losses if the credit risk on the financial instrument has increased significantly since initial recognition (stage 2), and otherwise at an amount equal to 12-month expected credit losses (stage 1).

HM Treasury has ruled that central government bodies may not recognise stage 1 or stage 2 impairments against other government departments, their executive agencies, the Bank of England, Exchequer Funds, and Exchequer Funds’ assets where repayment is ensured by primary legislation. NHS England therefore does not recognise loss allowances for stage 1 or stage 2 impairments against these bodies. Additionally, the Department of Health and Social Care provides a guarantee of last resort against the debts of its ALBs and NHS bodies (excluding NHS charities), and NHS England does not recognise loss allowances for stage 1 or stage 2 impairments against these bodies.

For financial assets that have become credit impaired since initial recognition (stage 3), expected credit losses at the reporting date are measured as the difference between the asset’s gross carrying amount and the present value of the estimated future cash flows discounted at the financial asset’s original effective interest rate. Any adjustment is recognised in profit or loss as an impairment gain or loss.

1.25 Financial liabilities

Financial liabilities are recognised in the statement of financial position when the group becomes party to the contractual provisions of the financial instrument or, in the case of trade payables, when the goods or services have been received. Financial liabilities are de-recognised when the liability has been discharged; that is, the liability has been paid or has expired.

Financial liabilities are initially recognised at fair value.

After initial recognition, financial liabilities are measured at amortised cost using the effective interest method. The effective interest rate is the rate that exactly discounts estimated future cash payments through the life of the asset to the net carrying amount of the financial liability. Interest is recognised using the effective interest method.

1.26 Accounting standards that have been issued but have not yet been adopted

The FReM does not require the following Standards and Interpretations to be applied in 2023/24. These standards are still subject to HM Treasury FReM adoption.

IFRS 17 Insurance Contracts – Application required for accounting periods beginning on or after 1 January 2023. IFRS 17 is yet to be adopted by the FreM which is expected to be from 1 April 2025: early adoption is not therefore permitted.

IFRS 14 Regulatory Deferral Accounts: Not UK-endorsed. Therefore, not applicable to DHSC group bodies.

IFRS 18 Presentation and Disclosure in Financial Statements: Applies to an annual reporting period beginning on or after 1 January 2027.

As IFRS 18 has not yet been endorsed by the UK Endorsement Board and has not yet been considered by the Financial Reporting Board (FRAB), it is too early to make an assessment of the impact on the accounts. NHS England will consider the detailed implications for future years.

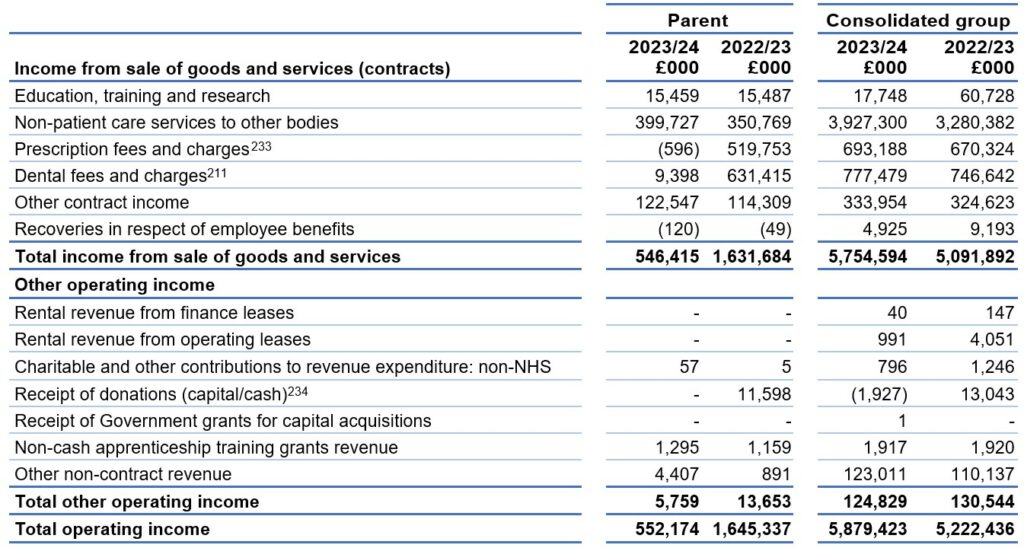

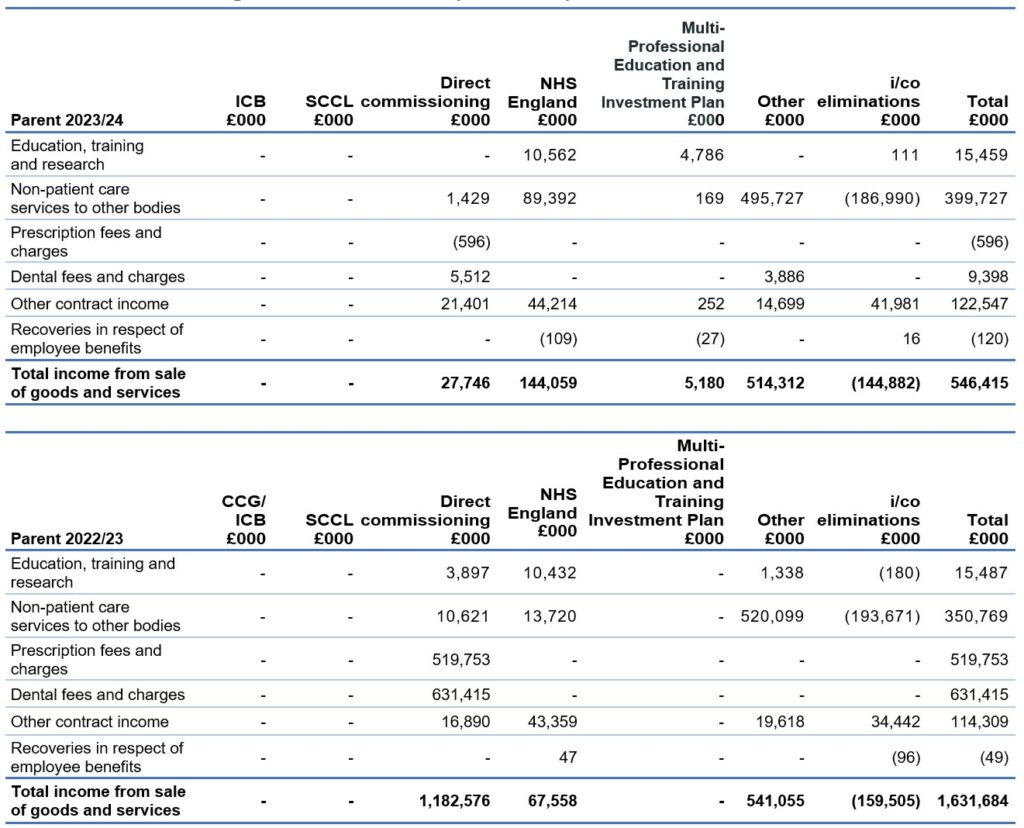

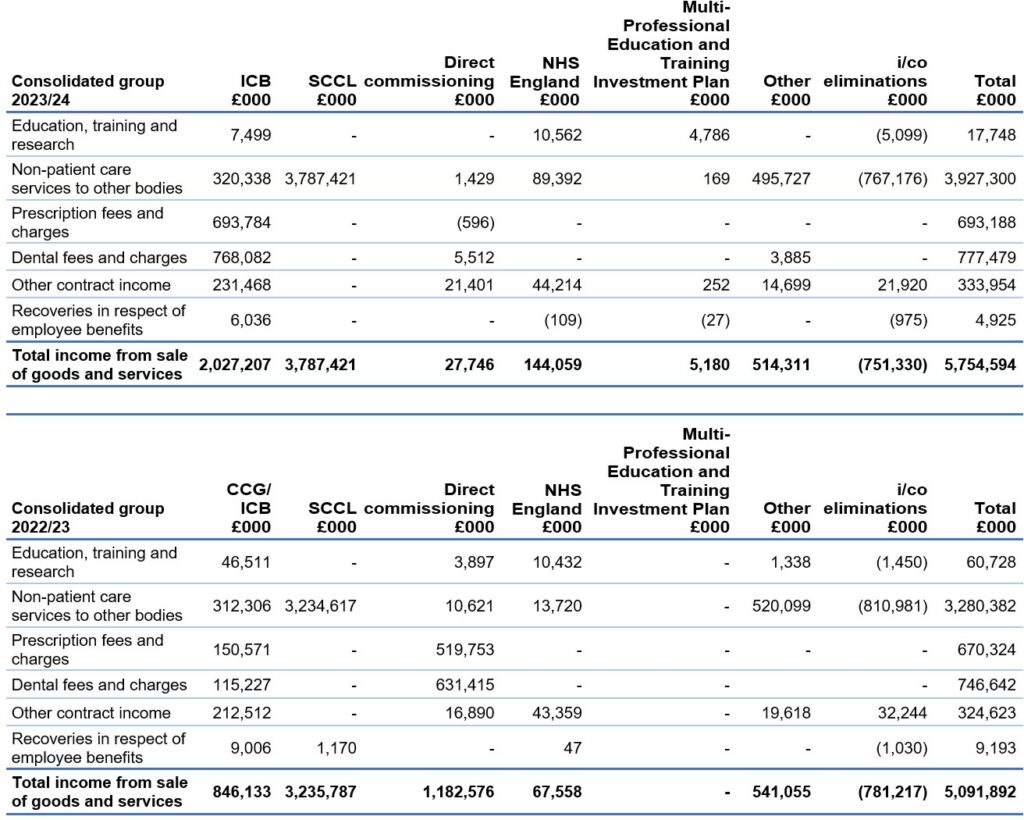

2. Operating income

Intercompany trading is eliminated between bodies within the NHS England group upon consolidation.

From 1 April 2023 ICBs assumed delegated responsibility for commissioning pharmaceutical, general ophthalmic and dentistry services. A consequence of the delegation is that NHS England parent no longer received the fees and charges levied for pharmacy and dental services.

Education, training and research income has fallen within the consolidated group due to the transfer of Health Education England activities into NHS England. The ICBs now receive group funding from NHS England rather than income.

2.1 Disaggregation of revenue

We disaggregate our revenue from contracts with customers by the nature of the revenue. This is shown in Note 2. Note 2.1 provides the disaggregation in line with our operating segments reported in Note 18.

Income from sale of goods and services (contracts)

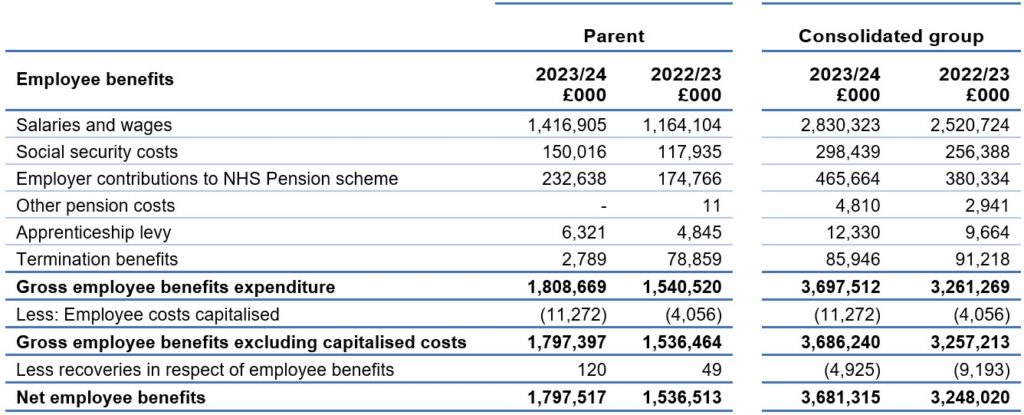

3. Employee benefits

3.1. Employee benefits table

Staff numbers can be found in the Accountability Report.

3.2 Pension costs

Past and present employees are covered by the provisions of the NHS Pension Schemes. Details of the benefits payable and rules of the schemes can be found on the NHS Pensions website. Both the 1995/2008 and 2015 schemes are accounted for, and the scheme liability valued, as a single combined scheme. Both are unfunded defined benefit schemes that cover NHS employers, GP practices and other bodies, allowed under the direction of the Secretary of State for Health and Social Care in England and Wales. They are not designed to be run in a way that would enable NHS bodies to identify their share of the underlying scheme assets and liabilities. Therefore, each scheme is accounted for as if it were a defined contribution scheme: the cost to the NHS body of participating in each scheme is taken as equal to the contributions payable to that scheme for the accounting period.

In order that the defined benefit obligations recognised in the financial statements do not differ materially from those that would be determined at the reporting date by a formal actuarial valuation, the FReM requires that “the period between formal valuations shall be four years, with approximate assessments in intervening years.” An outline of these follows:

3.2.1 Accounting valuation

A valuation of scheme liability is carried out annually by the scheme actuary (currently the Government Actuary’s Department) as at the end of the reporting period. This utilises an actuarial assessment for the previous accounting period in conjunction with updated membership and financial data for the current reporting period and is accepted as providing suitably robust figures for financial reporting purposes. The valuation of the scheme liability as at 31 March 2024, is based on valuation data as 31 March 2023, updated to 31 March 2024 with summary global member and accounting data. In undertaking this actuarial assessment, the methodology prescribed in IAS 19, relevant FReM interpretations, and the discount rate prescribed by HM Treasury have also been used.

The latest assessment of the liabilities of the scheme is contained in the Statement by the Actuary, which forms part of the annual NHS Pension Scheme Annual Report and Accounts. These accounts can be viewed on the NHS Pensions website and are published annually. Copies can also be obtained from The Stationery Office.

Full actuarial (funding) valuation

The purpose of this valuation is to assess the level of liability in respect of the benefits due under the schemes (taking into account recent demographic experience), and to recommend contribution rates payable by employees and employers.

The latest actuarial valuation undertaken for the NHS Pension Scheme was completed as at 31 March 2020. The results of this valuation set the employer contribution rate payable from 1 April 2024 to 23.7% of pensionable pay. The core cost cap cost of the scheme was calculated to be outside of the 3% cost cap corridor as at 31 March 2020. However, when the wider economic situation was taken into account through the economic cost cap cost of the scheme, the cost cap corridor was not similarly breached. As a result, there was no impact on the member benefit structure or contribution rates.

3.2 Pension costs

3.2.2 Scheme provisions

The NHS Pension Scheme provided defined benefits, which are summarised below. This list is an illustrative guide only, and is not intended to detail all the benefits provided by the Scheme or the specific conditions that must be met before these benefits can be obtained:

- The Scheme is a “final salary” scheme. Annual pensions are normally based on 1/80th for the 1995 section and of the best of the last three years pensionable pay for each year of service, and 1/60th for the 2008 section of reckonable pay per year of membership. Members who are practitioners as defined by the Scheme Regulations have their annual pensions based upon total pensionable earnings over the relevant pensionable service.

- With effect from 1 April 2008 members can choose to give up some of their annual pension for an additional tax free lump sum, up to a maximum amount permitted under HMRC rules. This new provision is known as “pension commutation.”

- Annual increases are applied to pension payments at rates defined by the Pensions (Increase) Act 1971 and are based on changes in retail prices in the twelve months ending 30 September in the previous calendar year. From 2011/12 the Consumer Price Index (CPI) has been used and replaced the Retail Prices Index (RPI).

- Early payment of a pension, with enhancement, is available to members of the scheme who are permanently incapable of fulfilling their duties effectively through illness or infirmity. A death gratuity of twice final year’s pensionable pay for death in service, and five times their annual pension for death after retirement is payable.

- For early retirements other than those due to ill health the additional pension liabilities are not funded by the scheme. The full amount of the liability for the additional costs is charged to the employer.

- Members can purchase additional service in the NHS Scheme and contribute to money purchase AVC’s run by the Scheme’s approved providers or by other Free Standing Additional Voluntary Contributions providers.

3.2.3 Local government pension scheme

Past and present employees are covered by the provisions of the Principal Civil Service Pension Scheme and the Civil Servant and Other Pension Scheme. These schemes are unfunded, defined benefit schemes covering civil servants. The schemes are not designed in a way that would enable employers to identify their share of the underlying scheme assets and liabilities. Therefore, the schemes are accounted for as though they were defined contribution schemes: the cost to NHS England of participating in a scheme is taken as equal to the contributions payable to the scheme for the accounting period.

For defined contribution schemes, such as Civil Service partnership pensions, NHS England recognises the contributions payable for the year.

NHS England recognises the full cost of benefits paid under the Civil Service Compensation Scheme, including the early payment of pensions.

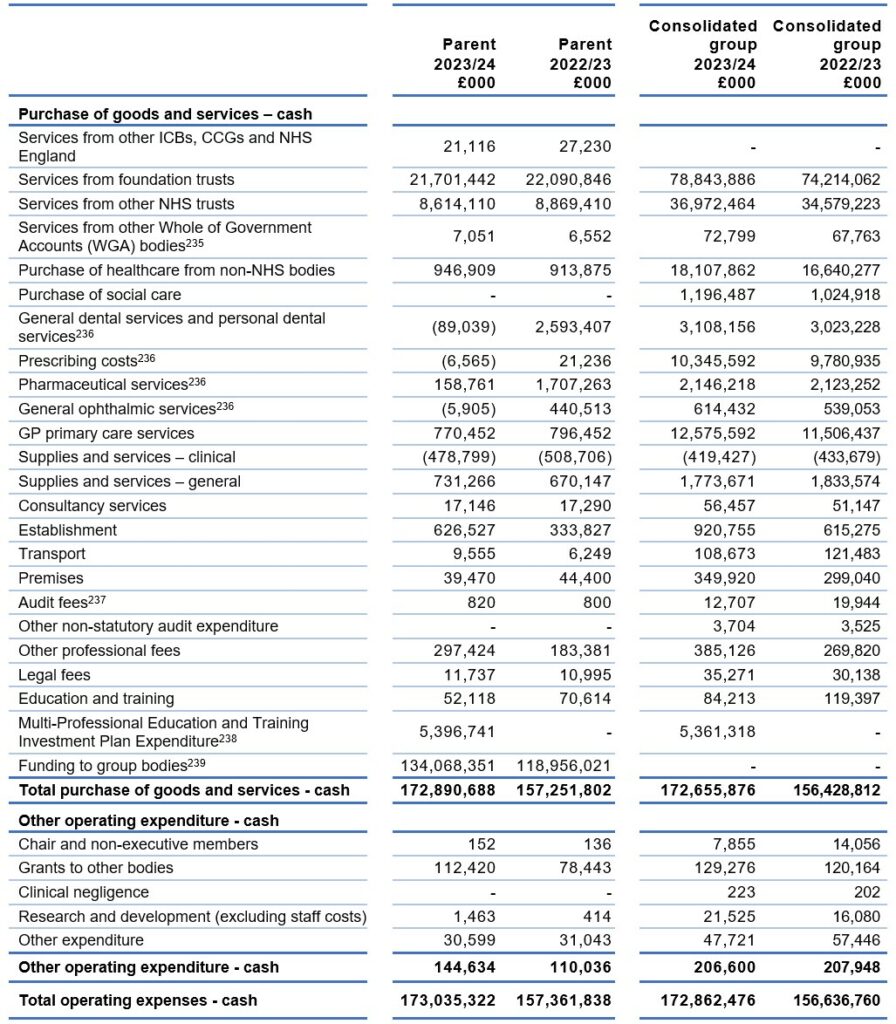

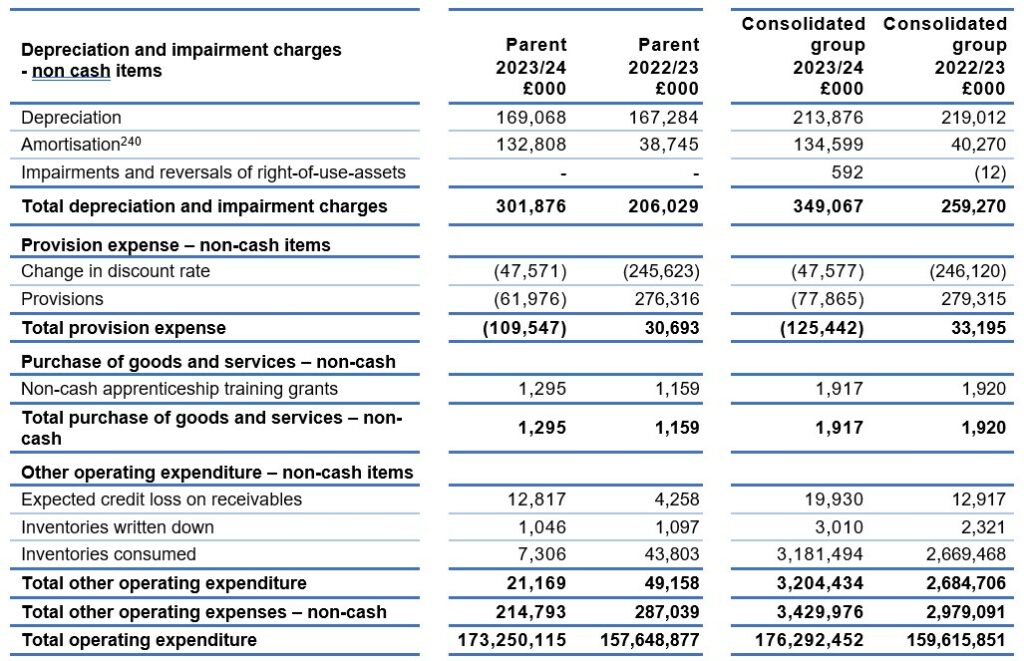

4. Operating expenses

[235] Services from other WGA bodies comprises expenditure with the DHSC, DHSC arm’s length bodies and NHS Blood and Transplant.

[236] From 1 April 2023 responsibility for commissioning pharmacy, dental and ophthalmic services transferred to ICBs. This has resulted in a significant fall in expenditure in the Parent in 2022/23.

[237] In both financial years NHS England purchased no Non Audit services from NAO. Details of ICB/CCG non audit expenditure can be found in the underlying individual ICB/CCG accounts. The audit fees within Parent cover NAO fees for the NHS England audit and the audit of the Consolidated Provider Accounts.

[238] Responsibility relating to Multi-Professional Education and Training Investment Plan Expenditure was transferred to NHS England Group as part of the Health Education England transfer of functions in 2023/24.

[239] Funding to group bodies is shown above and represents cash funding drawn down by the ICBs and CCGs. These balances are eliminated on consolidation.

Intercompany trading is eliminated between bodies within the NHS England group upon consolidation.

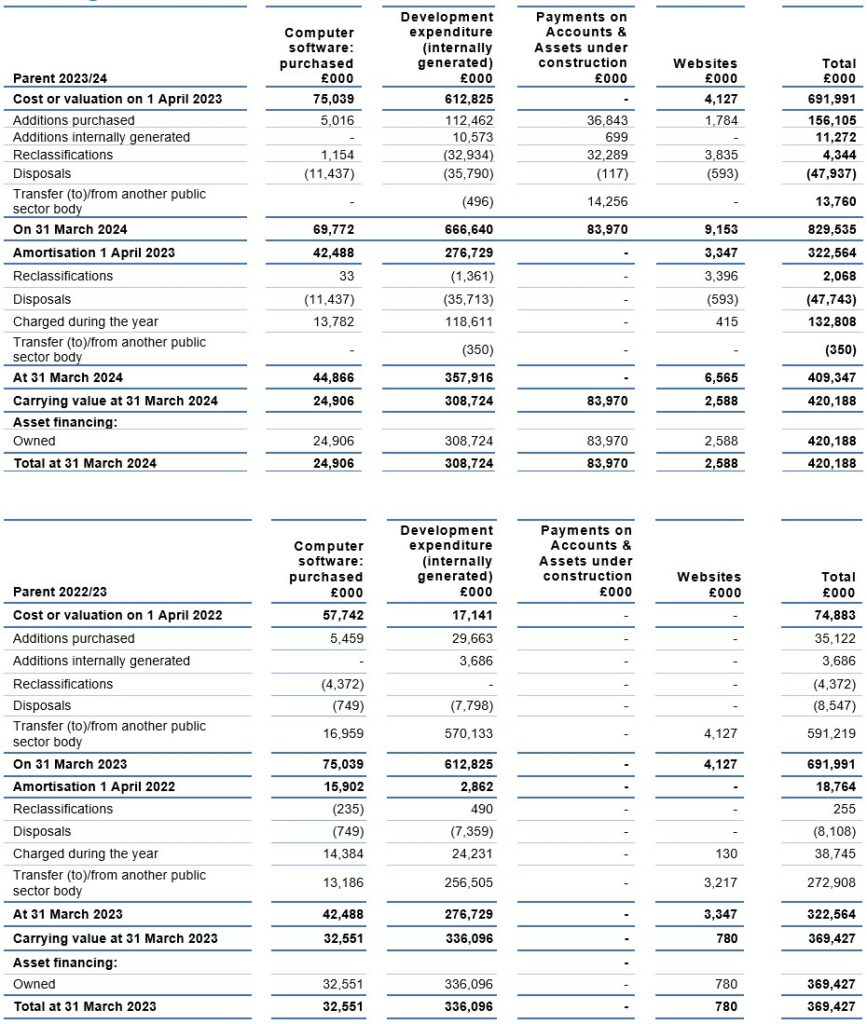

[240] Funding to group bodies is shown above and represents cash funding drawn down by the ICBs/CCGs. These balances are eliminated on consolidation. The significant increase in amortisation in the parent and the consolidated group account is due to the full year effect of transactions relating to ex-NHS Digital functions.

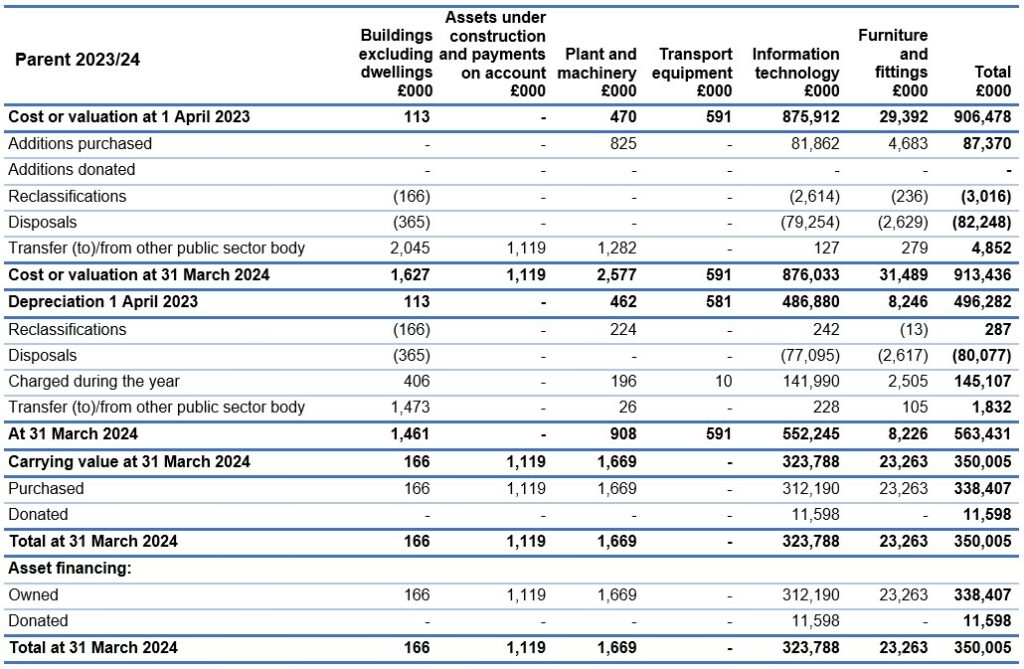

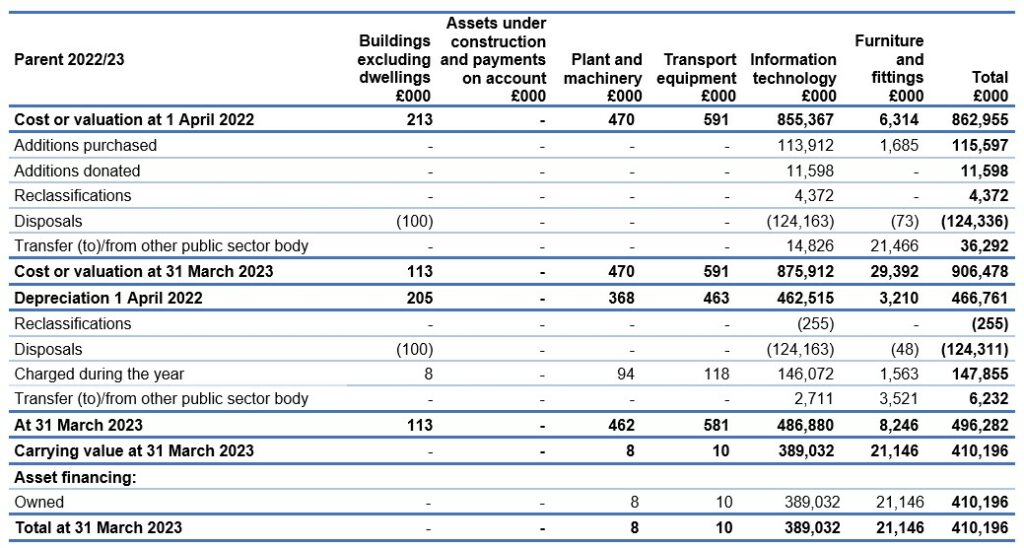

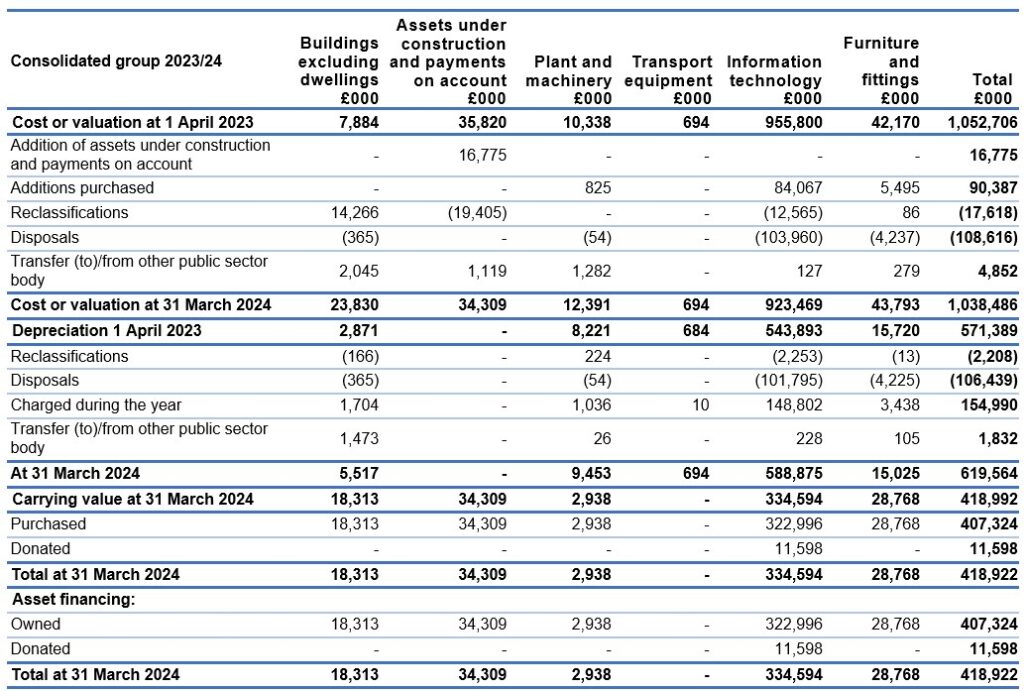

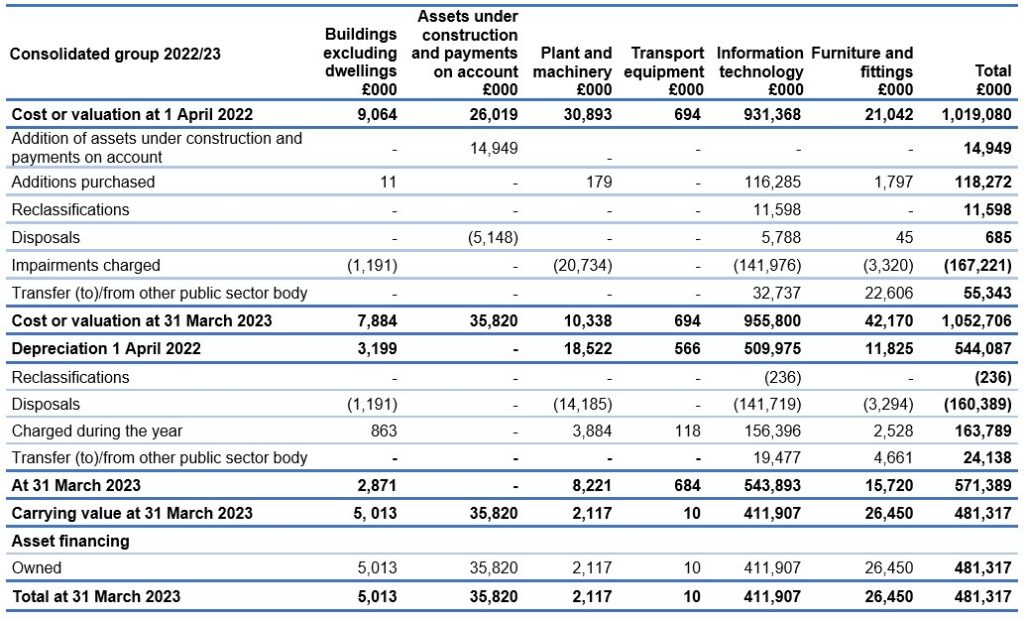

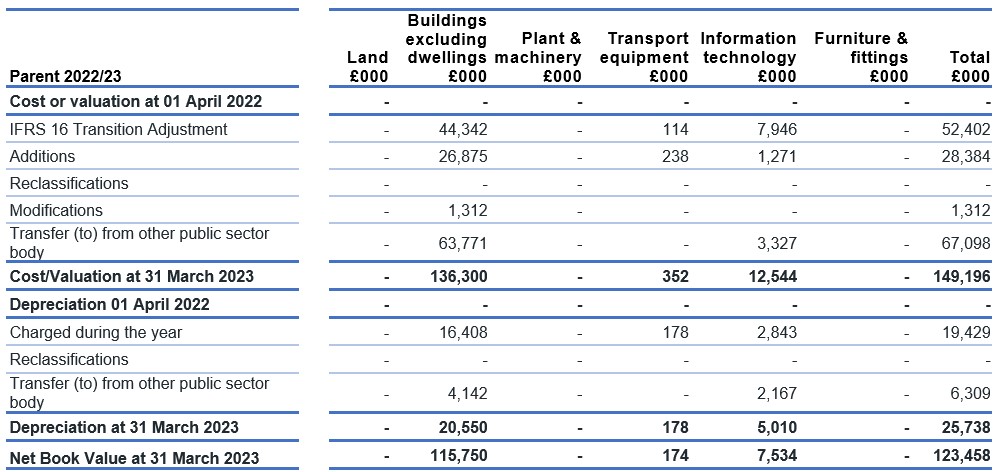

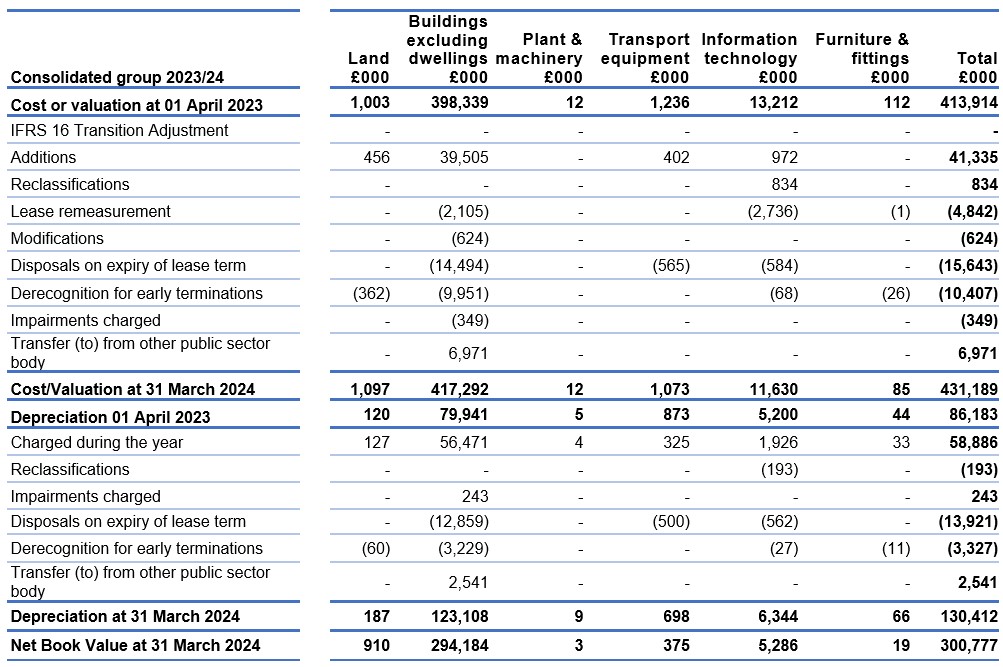

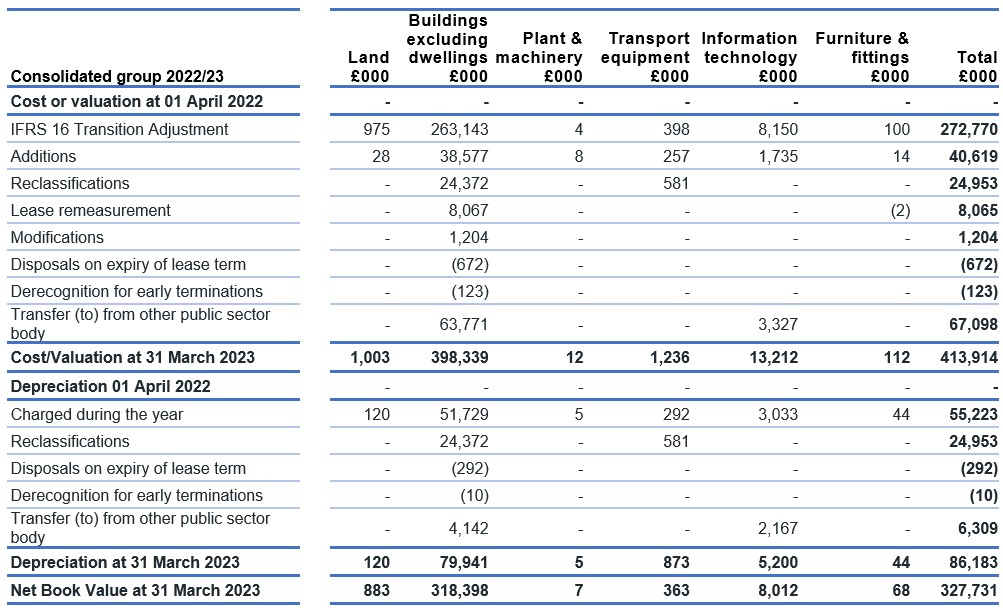

5. Property, plant, and equipment

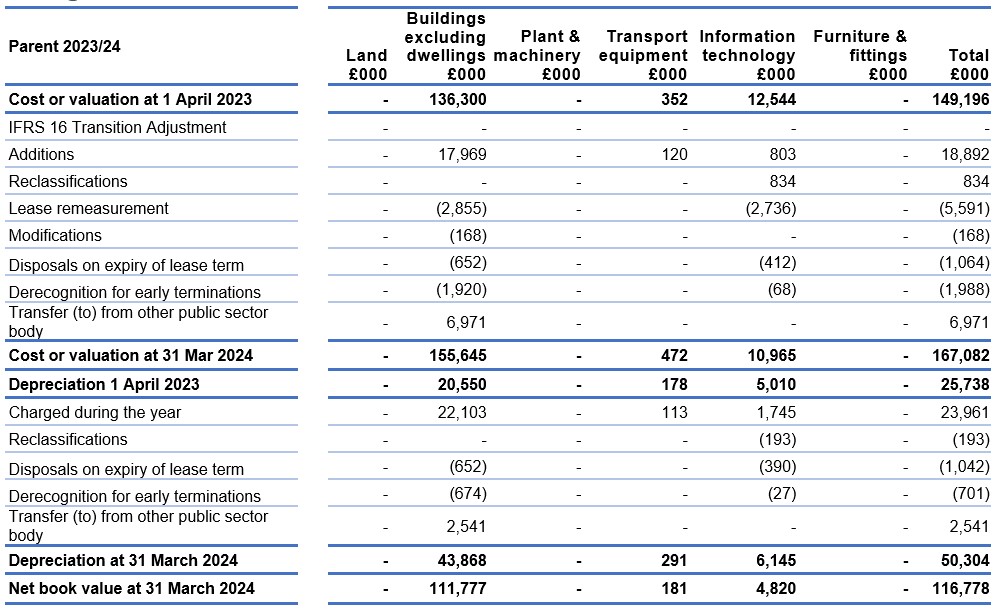

6. Right-of-use assets

6.1 Right-of-use assets

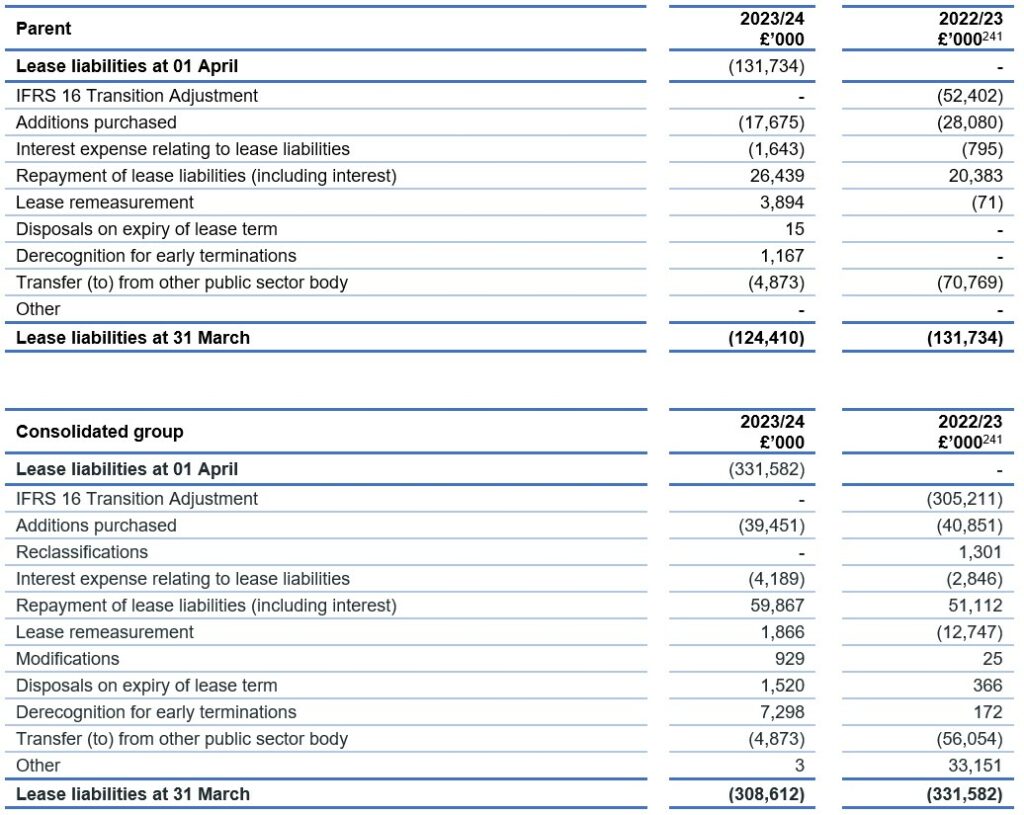

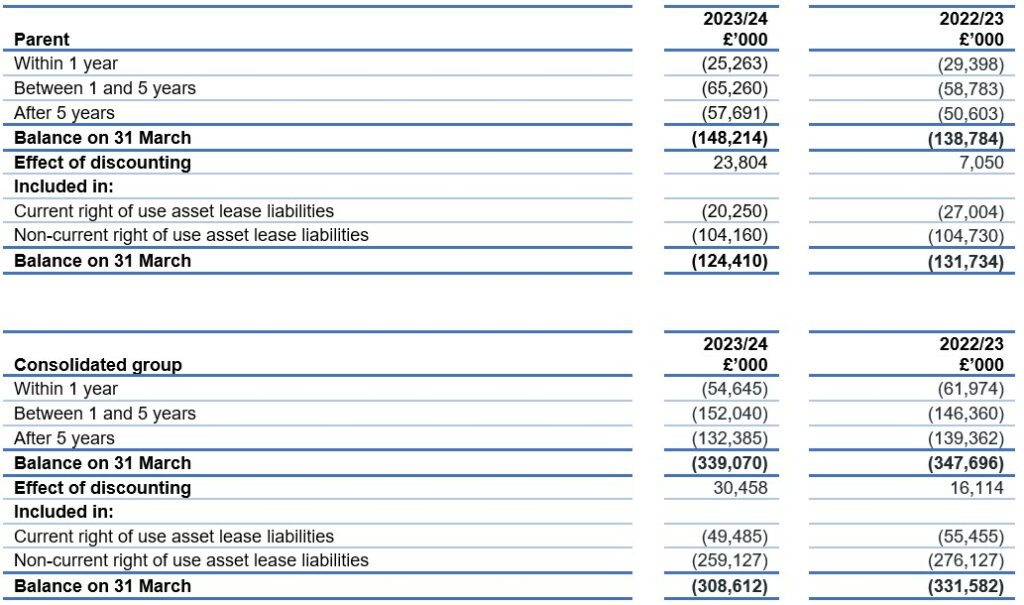

6.2 Right of use asset lease liabilities

[241] Prior year comparatives had been allocated to the incorrect account lines in the prior year. This has been corrected in the current year accounts as above.

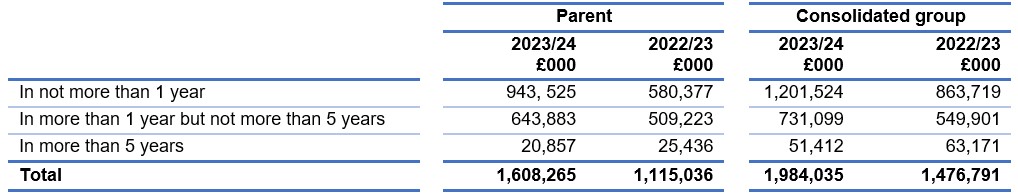

6.3 Right of use asset lease liabilities – maturity analysis of undiscounted future lease payments

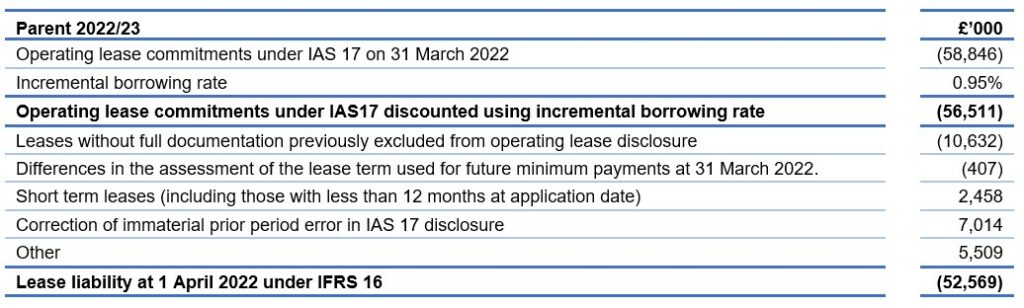

6.4 Impact of IFRS 16 Parent

The table below reconciles the amount disclosed as future operating lease commitments on 31 March 2022 as disclosed in the NHS England parent 2021/22 financial statements to the amount recognised on the Statement of Financial Position in respect of right of use lease liabilities on adoption of IFRS 16.

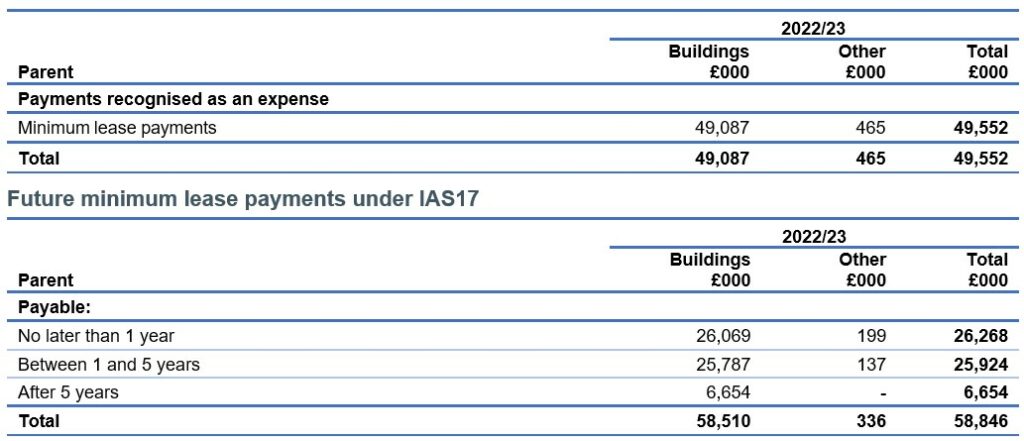

The comparative information for future minimum lease payments under IAS 17 is below.

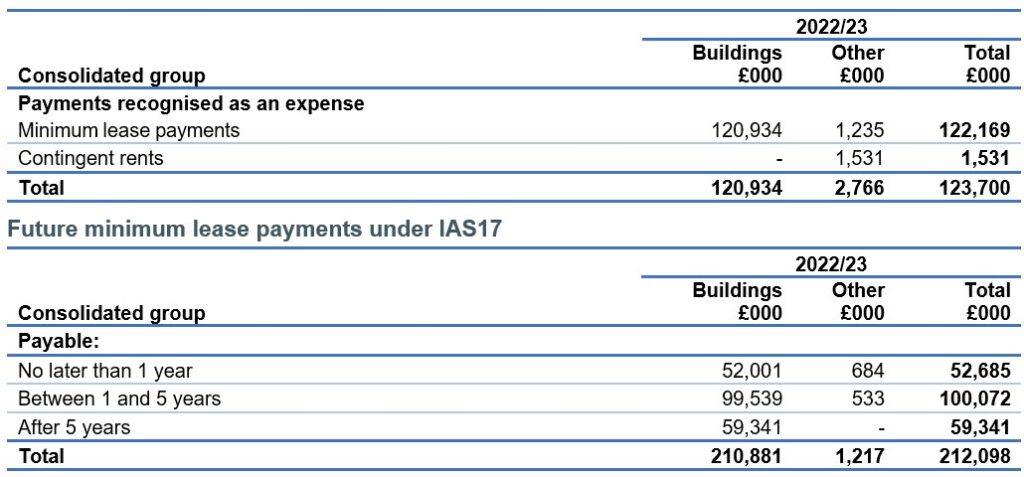

Payments recognised as an expense under IAS17

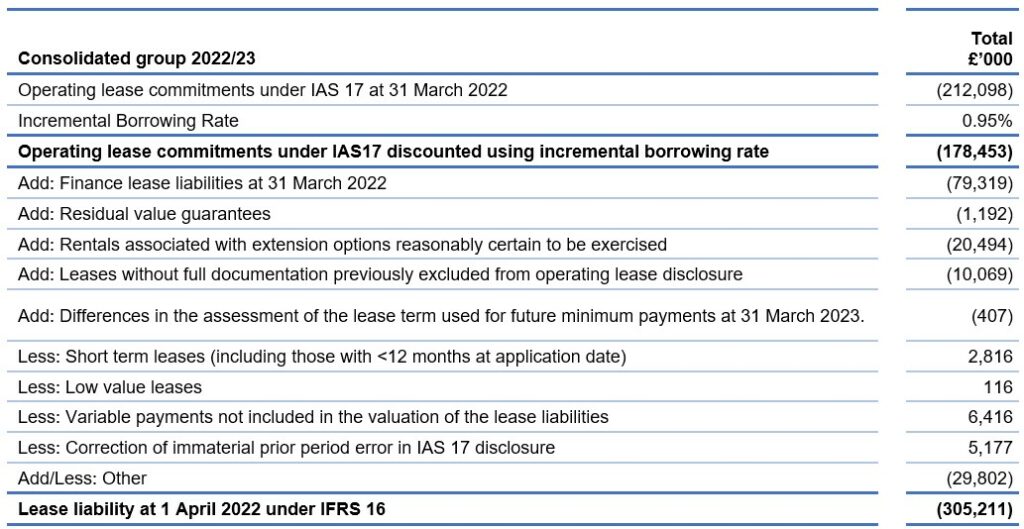

6.4 Impact of IFRS 16 Consolidated group

The table below reconciles the amount disclosed as future operating lease commitments on 31 March 2022 as disclosed in the NHS England parent 2021/22 financial statements to the amount recognised on the Statement of Financial Position in respect of right of use lease liabilities on adoption of IFRS 16.

The comparative information for future minimum lease payments under IAS 17 is below.

Payments recognised as an expense under IAS17

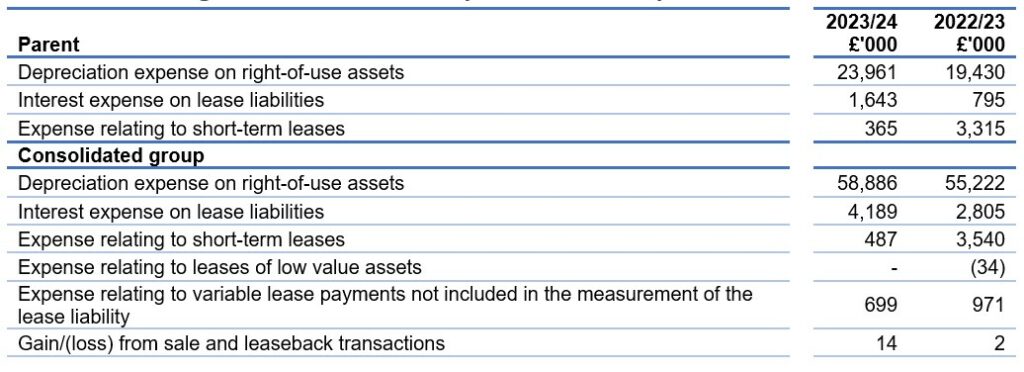

6.5 Amounts recognised in statement comprehensive net expenditure

6.6 Amounts recognised in statement of cash flows

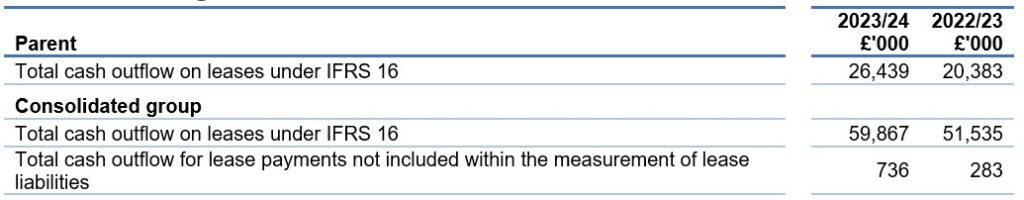

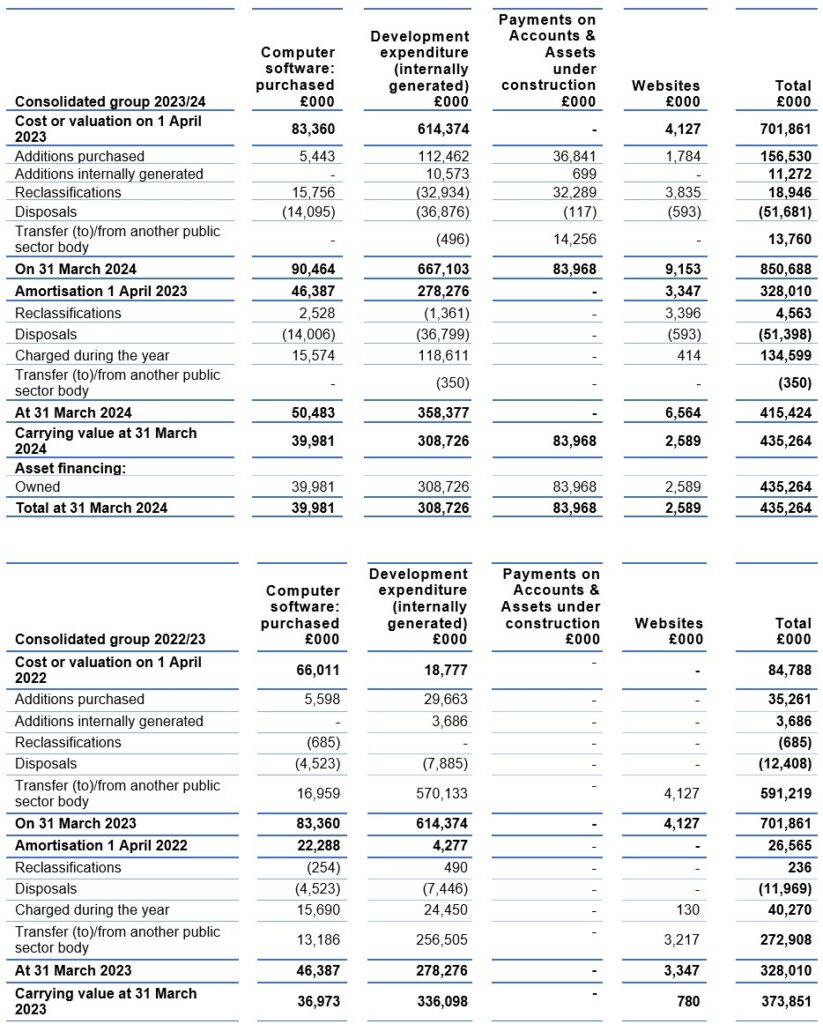

7. Intangible non-current assets

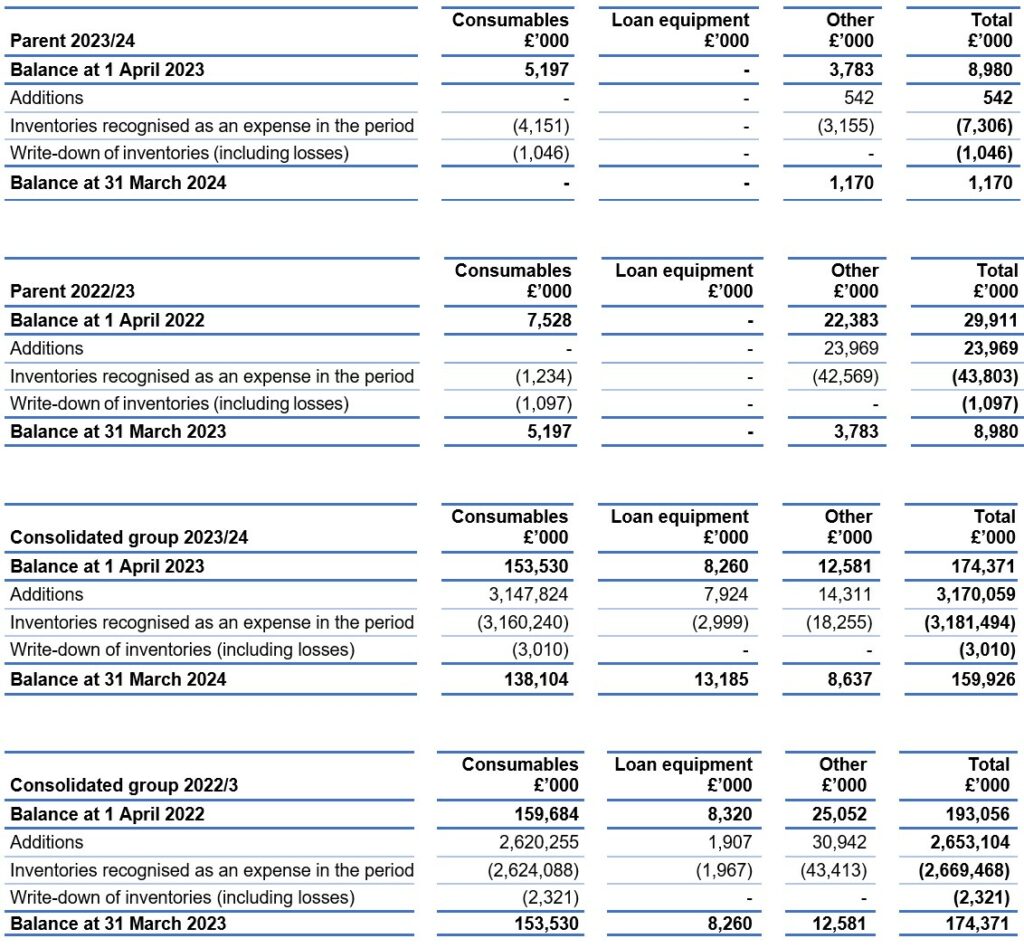

8. Inventories

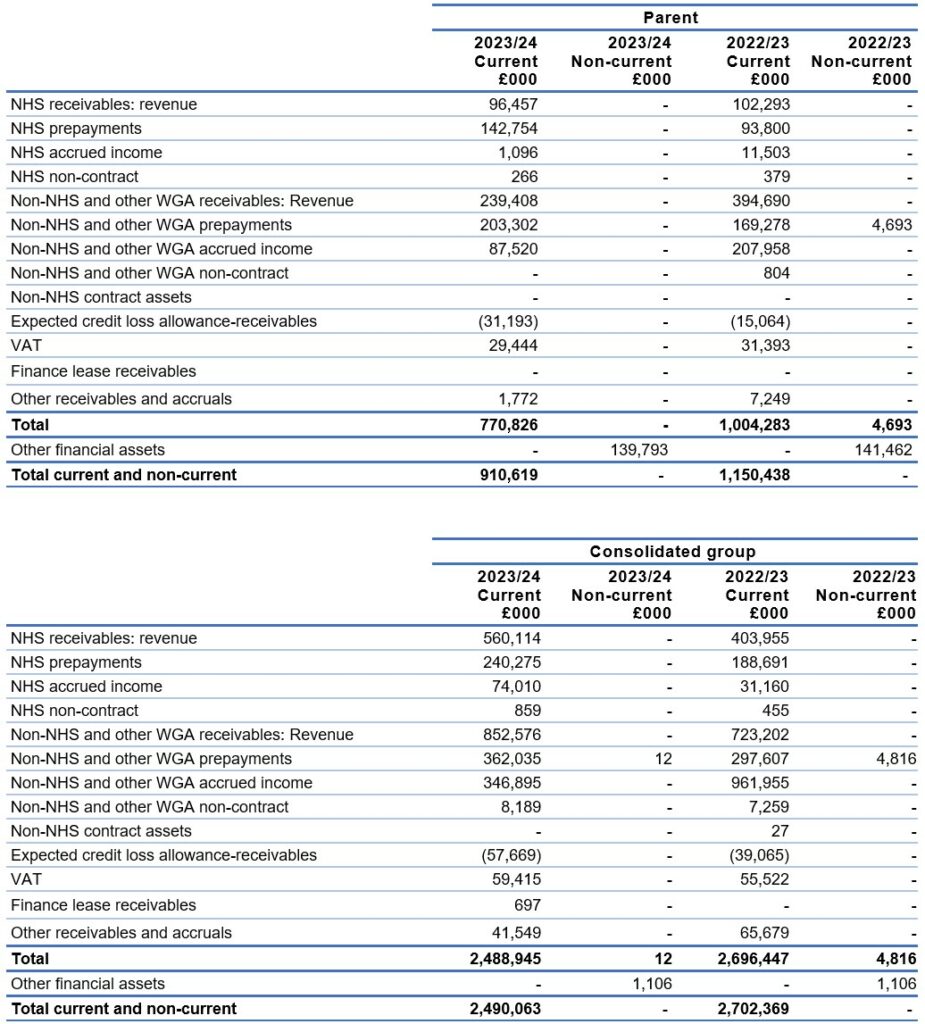

9. Trade and other receivables

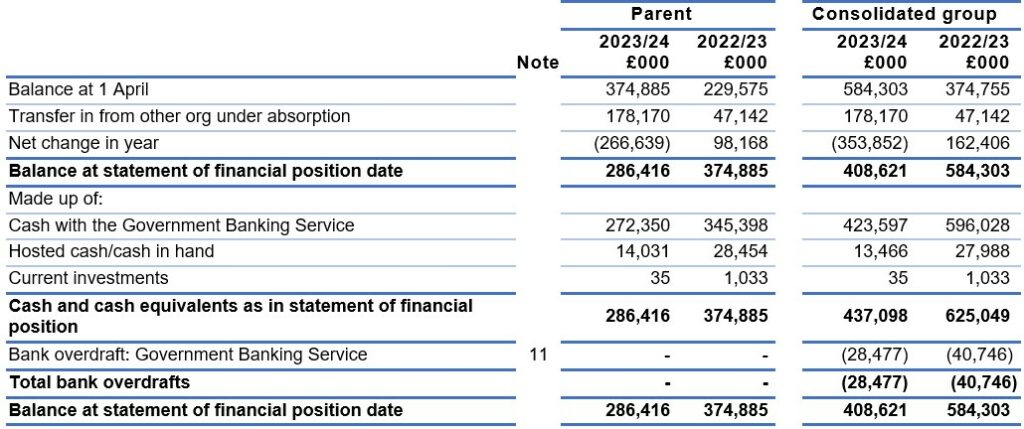

10. Cash and cash equivalents

For details of bank overdraft see Note 11.

Included within hosted cash/cash in hand above is £14.0 million (2022/23 £21.5 million) held on behalf of NHS England by the NHS BSA.

Current investments within cash and cash equivalents include cash held in solicitor commercial escrow accounts that is not available for use by the group.

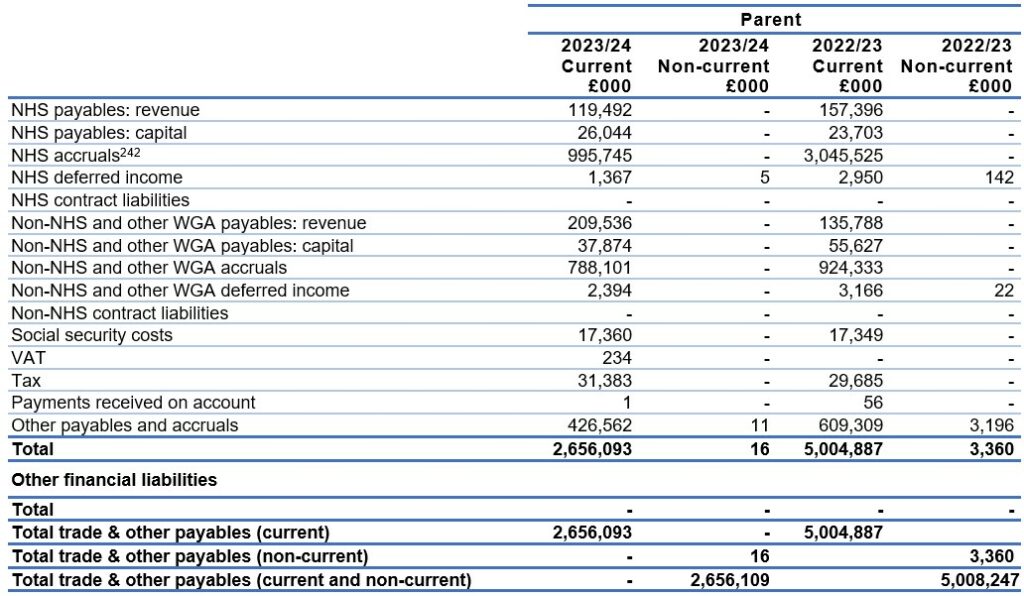

11. Trade and other payables

[242]NHS accruals in 2022/23 included the pay award funding for foundation trusts and NHS trusts, which has been paid in 2023/24.

[243] NHS accruals in 2022/23 included the pay award funding for foundation trusts and NHS trusts, which has been paid in 2023/24.

[244] Loans from the Department of Health and Social Care represent amounts issued to SCCL to provide a working capital facility

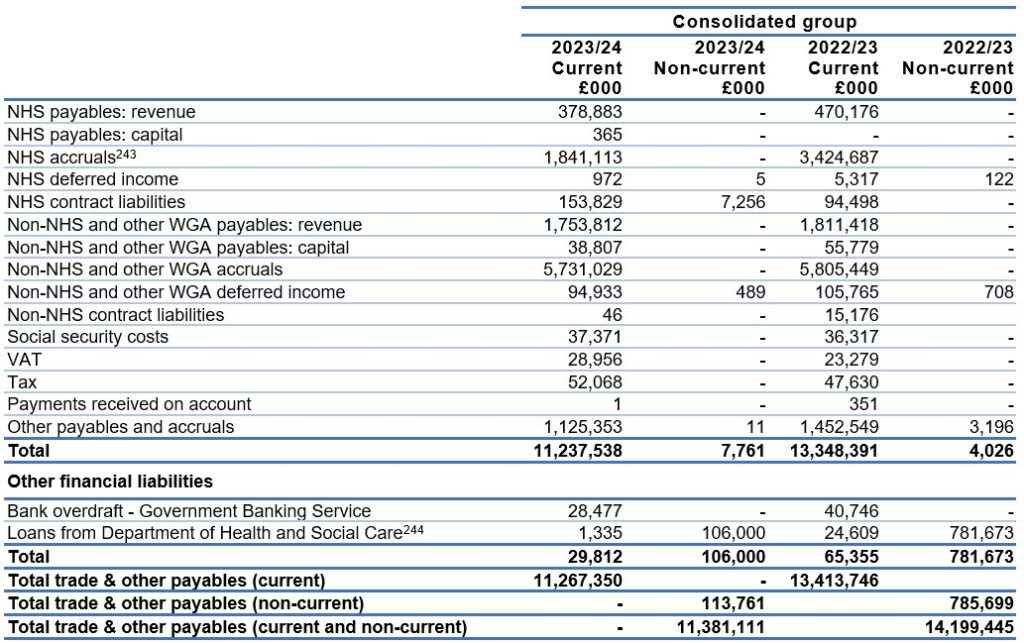

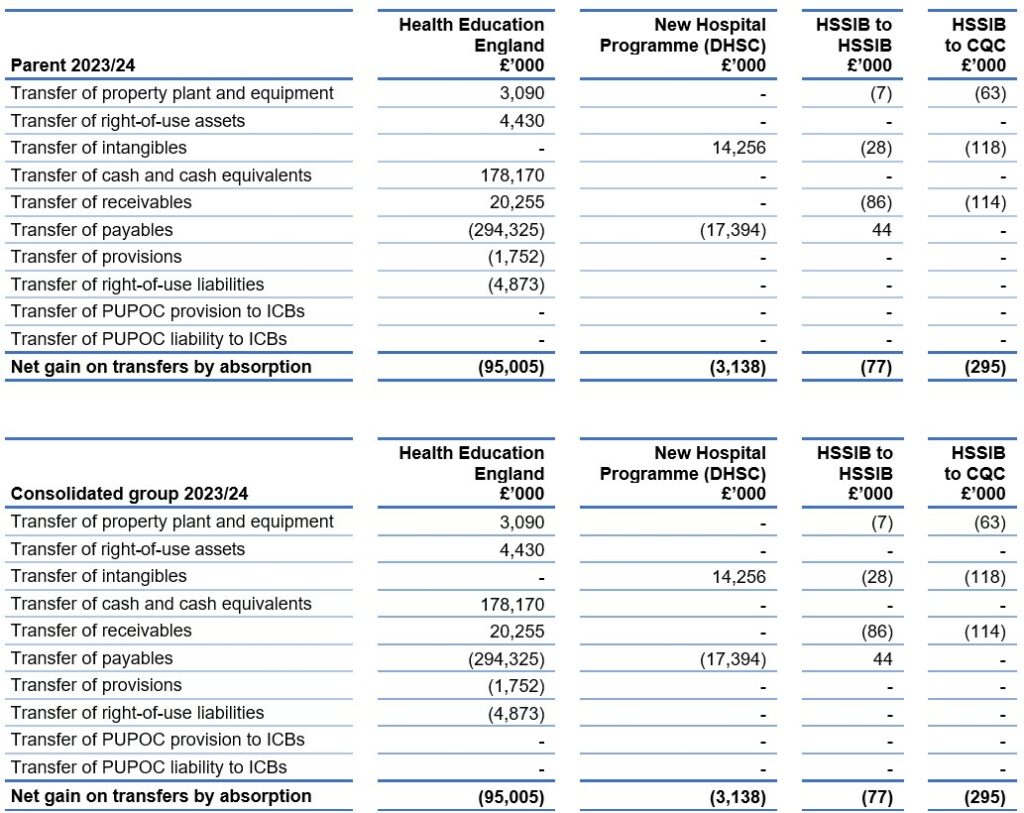

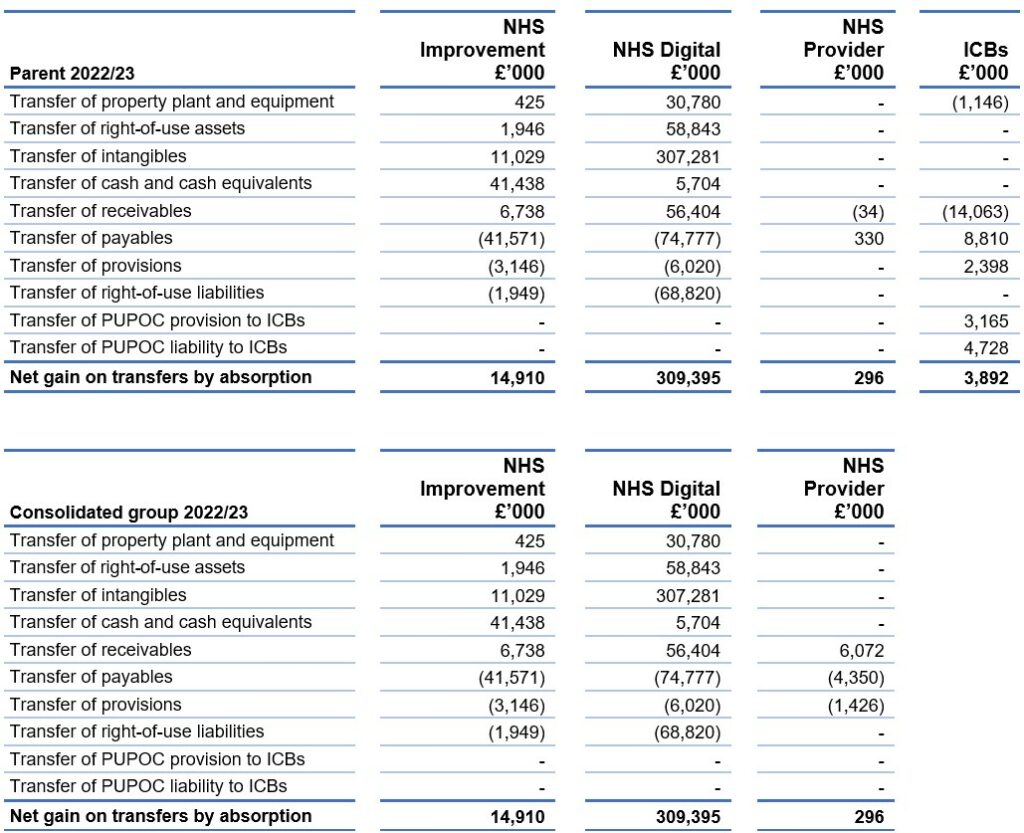

12. Net gain/(loss) on transfer by absorption

Business combinations within the public sector are accounted for using absorption accounting principles.

2023/24

On 1 April 2023, the functions of Health Education England transferred to NHS England.

The assets and liabilities related to the transfer are shown in the table below.

On 1 October 2023 NHS England transferred responsibility for the functions of the Health Services Safety Investigation Branch, to the Health Services Safety Investigation Body and CQC. The assets and liabilities related to the transfer are shown in the table below.

On 1 February 2024, the Department of Health and Social Care transferred some responsibilities, such as delivering hospitals in the New Hospital Programme to NHS England in line with the transition to the Sponsor-Delivery model of operation. The assets and liabilities related to the transfer are shown in the table below.

2022/23

On 1 July 2022, the functions of NHS TDA and Monitor transferred to NHS England. The impact of the transfer of the assets and liabilities is shown under NHSI. In addition, the CCGs were dissolved under the Health and Care Act 2022 and the liabilities of the CCGs were transferred in full to the ICBs. There is no impact on the group position as the transactions eliminate in full.

On 1 October 2022 NHS England transferred responsibility for the provisions and liabilities held by NHS England in relation to previously unassessed periods of care (PUPOC) transactions. These transfers eliminate on consolidation to leave nil impact in the group position.

On 1 February 2023, the functions of NHS Digital transferred to NHS England. The assets and liabilities related to the transfer are shown in the table below.

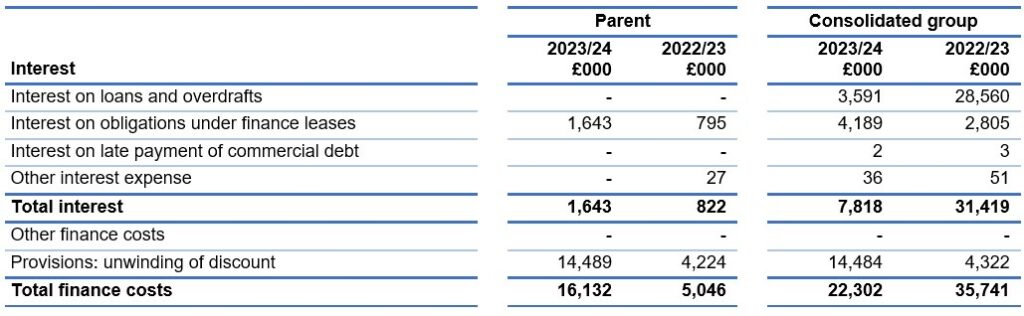

13. Finance costs

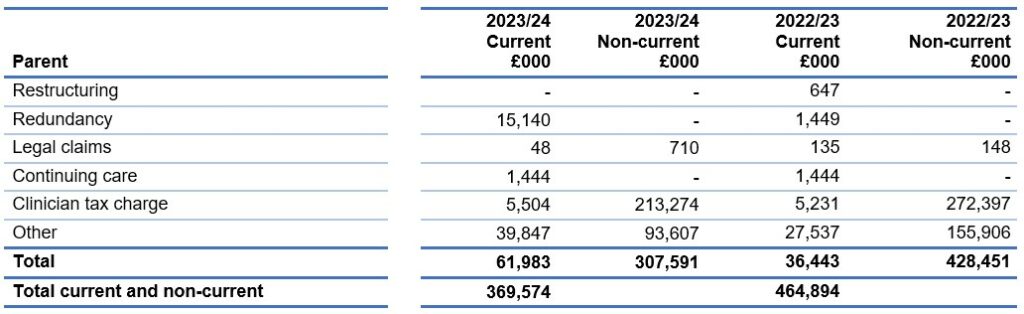

14. Provisions

‘Continuing Care’ refers to NHS funding for complex packages of care in the community. This includes the following: NHS Continuing Healthcare, where an individual, aged 18 or over, has been assessed as having a ‘primary health need’ and the NHS has responsibility for arranging and funding a package of health and social care. Children and Young People’s Continuing Care, where individuals, up to their 18th birthday, have complex needs arising from disability, accident or illness and require care and support that cannot be met by existing universal or specialist services alone the NHS can fund an additional a package of health care. Joint packages of health and social care, where an individual’s care or support package is funded by both the NHS and the local authority. NHS-funded Nursing Care, where funding is provided by the NHS to care homes with nursing, to support the provision of nursing care by a registered nurse. These are set out in the National Framework for NHS Continuing Healthcare and NHS-funded Nursing Care. The amount included in the table above as ‘Continuing Care’ represents the best estimate, at the year-end date, of the liabilities of NHS England group relating to the obligation of the NHS to pay for cases of such care and deliver these services.

The Clinical Tax Charge provision in the parent is £219 million for the commitment to pay clinicians in the NHS Pension Scheme for the effect of the 2019/20 Scheme Pays deduction on their income from the NHS Pension Scheme in retirement, in line with the ministerial direction to DHSC and NHS England.

Other provisions in both the parent and the group are primarily provisions for pension disputes and dilapidations.

The NHS Resolution financial statements disclose a provision of £52,797,322 as at 31 March 2024 in respect of clinical negligence liabilities and employment liability scheme of NHS England (31 March 2023: £70,041,046).

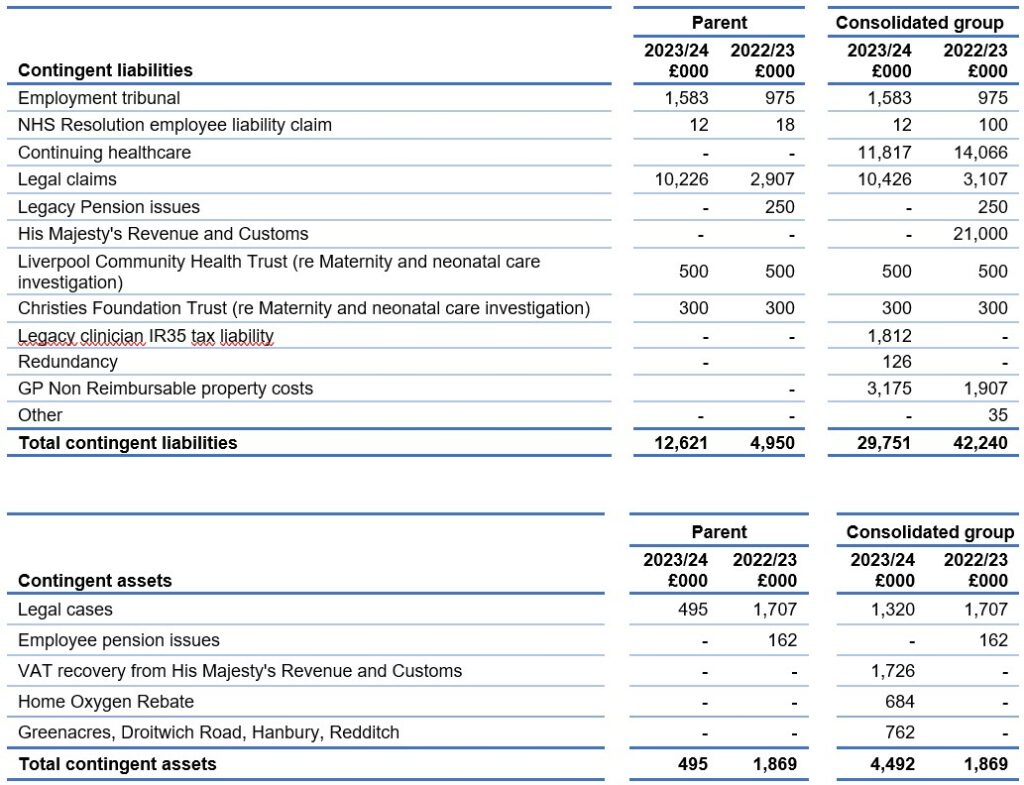

15. Contingencies

Contingent liabilities are those for which provisions have not been recorded as there is a possible obligation depending on uncertain future events, or a present obligation where payment is not probable, or the amount cannot be measured reliably.

Contingent assets are those where a possible asset arises from a past event and whose existence will be confirmed only by the occurrence or non-occurrence of an uncertain future event not wholly within the control of the entity. These are disclosed only when the inflow of economic benefit is probable.

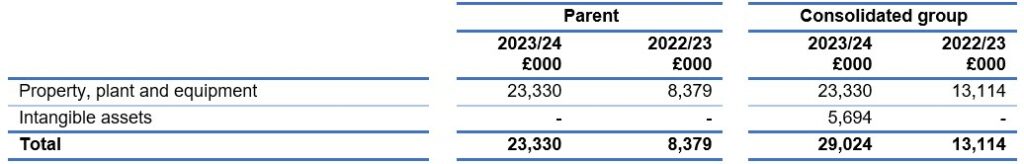

16. Commitments

16.1 Capital commitments

16.2 Other financial commitments

NHS England has entered into non-cancellable contracts (which are not leases, private finance initiative contracts or other service concession arrangements) which expire as follows:

In the parent account the most significant contracts relate to:

- Health and Justice contract with Spectrum

- ISFE contract with NHS SBS

- Delivery of administration services for Primary Care contract with Capita Business Services Ltd

- Federated Data Platform and Associated Services with Palantir

Excluding the largest parent financial commitments already disclosed, the most significant other group commitments relate to:

- a contract between NHS Banes, Swindon & Wiltshire ICB and Wiltshire Health & Care Ltd in relation to the Adult Community Services

17. Financial instruments

17.1 Financial risk management

Financial reporting standard IFRS 7 requires disclosure of the role that financial instruments have had during the period in creating or changing the risks a body faces in undertaking its activities.

Because NHS England is financed through parliamentary funding, it is not exposed to the degree of financial risk faced by business entities. Also, financial instruments play a much more limited role in creating or changing risk than would be typical of listed companies, to which the financial reporting standards mainly apply. NHS England has limited powers to borrow or invest surplus funds and financial assets and liabilities are generated by day-to-day operational activities rather than being held to change the risks facing the ICBs in undertaking its activities.

Treasury management operations are carried out by the finance department, within parameters defined formally within the NHS England SFIs and policies agreed by the ICB governing bodies. Treasury activity is subject to review by the NHS England internal auditors.

17.1.1 Currency risk

NHS England is principally a domestic organisation with the great majority of transactions, assets and liabilities being in the UK and sterling based.

NHS England has no overseas operations. NHS England therefore has low exposure to currency rate fluctuations.

17.1.2 Interest rate risk

NHS England does not have any borrowings that are subject to interest rate risk.

17.1.3 Credit risk

Because the majority of NHS England revenue comes from parliamentary funding, NHS England has low exposure to credit risk. The maximum exposure as at the end of the financial year is in receivables from customers, as disclosed in the trade and other receivables note.

17.1.4 Liquidity risk

NHS England is required to operate within revenue and capital resource limits, which are financed from resources voted annually by Parliament.

NHS England draws down cash to cover expenditure, as the need arises. NHS England is not, therefore, exposed to significant liquidity risks.

17.1.5 Financial instruments

As the cash requirements of NHS England are met through the Estimate process, financial instruments play a more limited role in creating and managing risk than would apply to a non-public sector body. The majority of financial instruments relate to contracts to buy non-financial items in line with NHS England’s expected purchase and usage requirements and NHS England is therefore exposed to little credit, liquidity, or market risk.

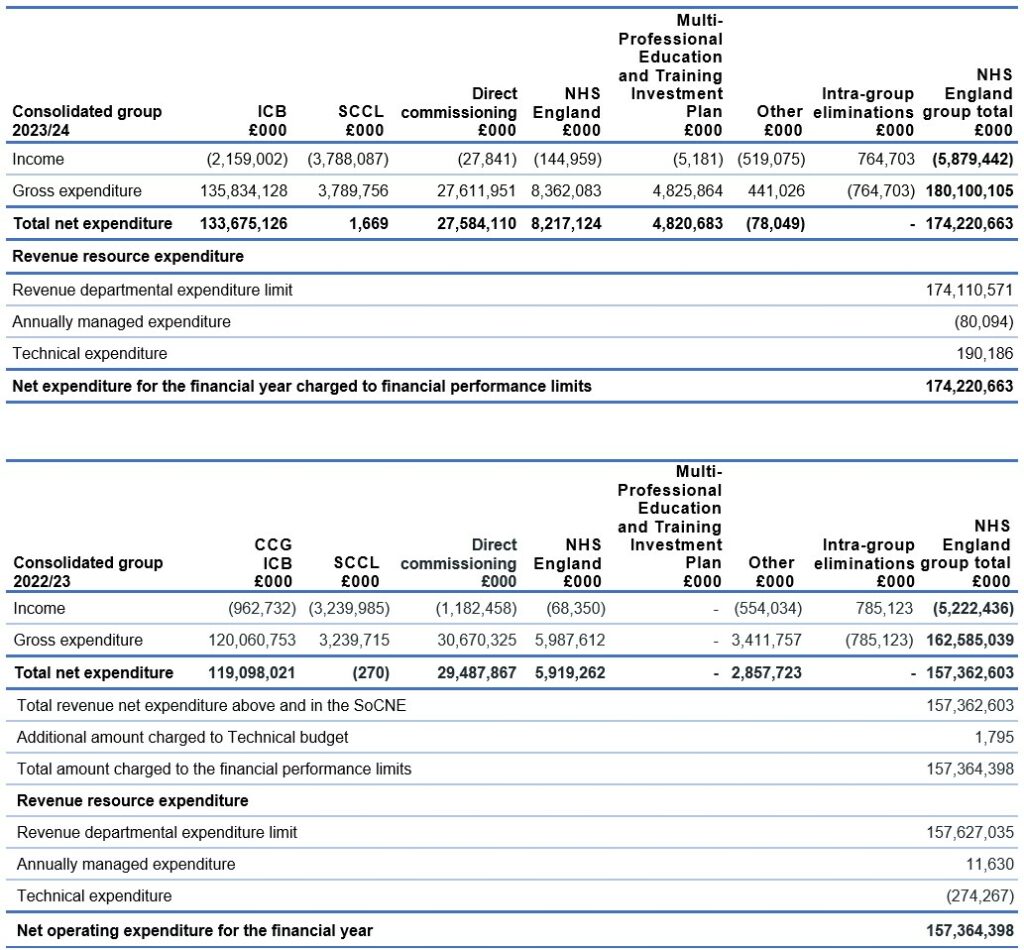

18. Operating segments

The reportable segments disclosed within this note reflect the current structure of NHS England with the activities of each reportable segment reflecting the remit of the organisation. These operating segments are regularly reported to the NHS England Board of Directors for financial management and decision making purposes.

The activities of each segment are defined as follows:-

- CCGs – clinically led groups that were responsible to 30 June 2022 for commissioning healthcare services as defined in the National Health Service Act 2006 (as amended by the Health and Social Care Act 2012)

- ICBs – bodies that are responsible from 1 July 2022 for planning most NHS services in their area including commissioning healthcare services, as defined in the National Health Service Act 2006 (as amended by the Health and Social Care Act 2012 and the Health and Care Act 2022)

- SCCL – the management function for the NHS Supply Chain operating model

- Direct Commissioning – the services commissioned by NHS England as defined in the National Health Service Act 2006 (as amended)

- NHS England – the central administration of the organisation and centrally managed programmes

- Multi-Professional Education and Training Investment Plan – a multi-year view of our future NHS workforce investment. It optimises domestic education and training by balancing professional, geographical, and clinical service demand with education capacity

- Other – includes CSUs, national reserves, technical accounting items and legacy balances

Multiple transactions take place between reportable segments, all of which are eliminated upon consolidation as shown in the “Intra-group eliminations” column. Information on total assets and liabilities and net assets and liabilities is not separately reported to the Chief Operating Decision Maker and thus, in accordance with IFRS 8, does not form part of this disclosure.

19. Related party transactions

Related party transactions associated with the Parent are disclosed within this note. As disclosed in Note 1.3 NHS England acts as the parent to 42 ICBs whose accounts are consolidated within these Financial Statements. These bodies are regarded as related parties with which the Parent has had various material transactions during the year; those transactions are disclosed in those entities’ financial statements.

The Department of Health and Social Care, as the parent of NHS England, is regarded as a related party. During the year NHS England has had a significant number of material transactions with entities for which the Department is regarded as the parent Department.

For example:

- NHS Foundation Trusts

- NHS Trusts

- NHS Litigation Authority

- NHS BSA

- NHS Property Services

In addition, NHS England has had a number of significant transactions with other government departments and their agencies including His Majesty’s Revenue and Customs, Ministry of Justice and His Majesty’s Prison and Probation Service. No related party transactions were noted with key management personnel other than the compensation paid to them which can be found in the remuneration report on page 102.

20. Events after the end of the reporting period

There are no adjusting events after the reporting period which will have a material effect on the financial statements of NHS England.

The Accounts were authorised for issue by the Accounting Officer on the date of the Audit Certificate of the Comptroller and Auditor General.

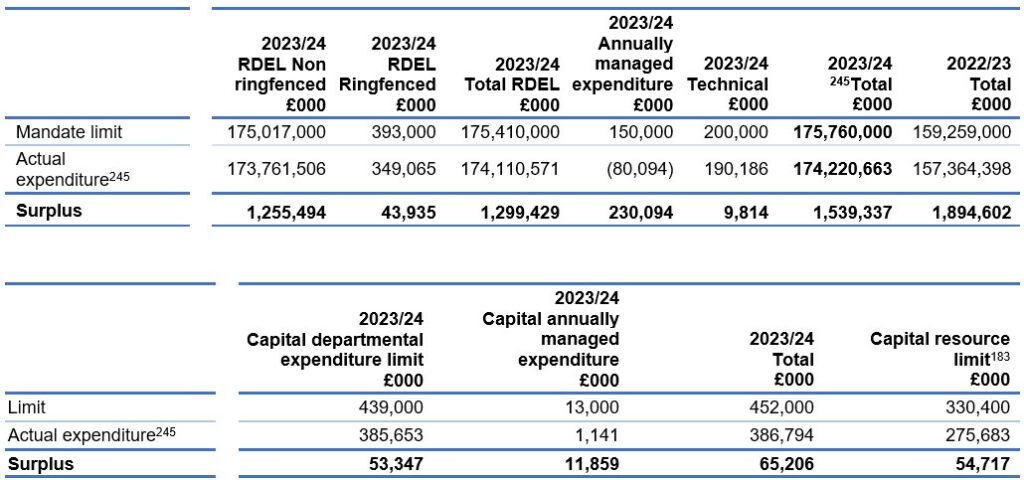

21. Financial performance targets

The Mandate: A mandate from the Government to NHS England: April 2023 to March 2024 published by the Secretary of State under section 13A of the National Health Service Act 2006, and the associated Financial Directions as issued by the Department of Health and Social Care, set out NHS England’s total revenue resource limit and total capital resource limit for 2023/24 and certain additional expenditure controls to which NHS England must adhere. These stem from budgetary controls that HM Treasury applies to DHSC.

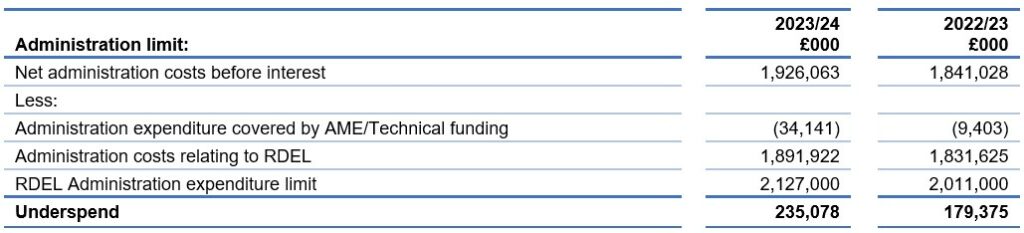

NHS England is required to spend no more than £2,127,000k of its Revenue Departmental Expenditure Limit mandate on matters relating to administration.

The actual amount spent on RDEL administration matters to 31st March 2024 was £1,891,922k as set out below:

In 2022/23, amounts relating to dilapidation provisions on leases within the DHSC group (£1,795k) were charged to the Technical budget rather than to capital annually managed expenditure as directed by DHSC. Total net expenditure excluding this amount is shown in Note 18.

The various limits of expenditure set out in the table above stem from the limits imposed by HM Treasury on the Department of Health and Social Care. Departmental Expenditure Limits are set in the Spending Review, and government departments may not exceed the limits they have been set. This control is passed down to NHS England by the Department of Health and Social Care and NHS England may not therefore exceed its Departmental Expenditure Limit.

Annually Managed Expenditure is subject to budgets set by HM Treasury. Departments must manage AME closely and inform HM Treasury if they expect AME to rise above forecast. Any increase requires HM Treasury approval.

22. Entities within the consolidated group

NHS England acts as the Parent of the group comprising 42 ICBs compared to 106 CCGs for 3 months (April 2022 to June 2022) plus 42 ICBs for 9 months (July 2022 to March 2023) in 2022/23 whose accounts are consolidated within these Financial Statements.

A full list of the ICBs can be found on the NHS England website.

NHS England acts as the Parent of SCCL whose accounts are consolidated within these financial statements. Copies of their accounts can be found on their website https://www.supplychain.nhs.uk/sccl/

The parent entity of NHS England is the Department of Health and Social Care.

The largest group of entities for which group accounts are drawn up and of which NHS England is a member is the Department of Health and Social Care Group.

Copies of the accounts can be obtained from the website.