1. Introduction

There have been longstanding concerns about the lack of data available at a national level to understand the dental primary care workforce. Therefore, a new dental workforce collection was introduced in October 2023 to be completed by all General Dental Services (GDS) Personal Dental Services (PDS) contractors.

Lessons have been learned from the past 2 collections (October 2023 and April 2024). To balance the benefits of collecting data with reducing the burden on practices, we will move to an annual collection, beginning in January 2025. This timing also removes the need for contractors to calculate a retrospective collection.

We would like to thank all those contractors who completed previous collections and sent us feedback.

2. Completion of the workforce collection

The e-form to complete the national dental workforce collection can be accessed through the NHS Business Services Authority (NHSBSA) compass system and all contractors will receive an email notification when the form is live.

Completion of the form is mandatory for all current GDS contracts and PDS agreements in England.

The workforce collection must be completed at contract level by the Contractor / business owner or by someone nominated on their behalf. Please note that all fields require an entry, even if that is to enter a zero. The only exception is the Free Text Box, which is provided for contractors to provide information on issues that may have affected the data submitted during the reporting period. Please do not include any personal and potentially identifiable information within any fields.

The data submitted should provide a summary for each staff group.

Annual data is to be provided each January, covering the previous 12 months (1 January to 31 December). We will write to all contractors before the collection opens detailing the time period for completion and when the submission window opens and closes.

Where a contractor or practice has multiple contracts or contract numbers which are delivered by all the same staff, please respond using a single data collection form and enter the contract numbers for any additional contracts that relate to the same staff in the Free Text Box field. Any contract number in the Free Text Box field will be covered by this single response.

Please provide each additional contract number in full with no breaks or non numeric characters such as “-“ or “/”.

3. Data relating the practice

3.1 Dental chairs

Please provide the total number of all dental chairs at the practice, whether or not they are currently in regular use.

Please estimate the percentage of time that dental chairs in the practice are usually used for NHS services, to the best of your knowledge. Where an NHS patient opted for a private treatment during the same appointment visit then this can be included as NHS time. If the patient opted for private treatment and this was undertaken during a separate appointment visit, then this would be included as private time. This approach should be taken irrespective of the staff group using the chair.

Where chairs are not used in the delivery of NHS work these should be included and their non-NHS utilisation reflected in the percentage of NHS use. For example, if there are three chairs, one of which is purely for non-NHS use, and the NHS utilisation of the two other chairs was 50%, then the overall NHS chair time used would be calculated to be one chair out of the three, 33%.

The data submitted should reflect the number of dental chairs at the practice during a typical, full working week for the period the return covers. To estimate chair usage in a typical, full working week please use the following methodology to calculate the NHS chair usage and return the percentage of NHS use as 100*[total hours NHS chair use]/[total hours chair usage both NHS and private]

We appreciate contractor’s efforts in aiming to make these estimates as accurate as reasonably possible to minimise the impact on data quality issues but understand that any method of estimation will be subject to a small level of uncertainty.

3.2 Opening hours

The opening hours are the number of hours the practice is open each day to provide services. This is not the same as staff working hours.

NHS hours should reflect the number of contracted hours (as per GDS contract or PDS agreement) the practice is available for NHS services each day.

For the annual data collection, we require contractors to use a typical week that falls between 30 November and 31 December. Choose a normal working week that:

- does not include a bank holiday

- shows opening hours

- shows NHS opening hours

- shows staff working hours

If the return is for multiple practices, or if opening hours vary on a weekly basis, the opening hours should reflect the longest opening hours for each day.

4. Data relating to staff

4.1 Total headcount

The term “headcount” relates to distinct individuals for each staff group and covers all members of staff and should include staff members who do not deliver NHS activity.

Please provide the total number of distinct individuals for each staff group. For the purposes of the workforce collection any Specialist Dentists or Dentists with Special Interests should be recorded under the staff group General Dentists. Foundation dentists should continue to be recorded separately.

An option is available to include other staff not included on the return, this should be used to record any other staff, for example Practice Managers, and Technicians/Clinical Technicians, that the contractor wishes to include to reflect, as accurately as possible, how they utilise staff to operate their services.

The data submitted should reflect the total headcount for each staff group at the end of the reporting period. The entry should reflect data as of 31 December. If this is someone’s last day of employment, please still include them.

The data submitted should reflect the total headcount for each staff group at the end of the reporting period. The entry should reflect data as of 31 December. If this is someone’s last day of employment, please still include them.

Where a distinct individual works across multiple staff groups, for example nurse and reception duties, the headcount should be counted once under their main staff group’s heading.

Please include all staff, including those on short term leave (less than 1 month) at the end of the reporting period and treat these staff as if they were working.

Please exclude staff who have been absent for longer than 1 month at the end of the reporting period. These staff will be recorded separately under section 4.9 Total headcount of staff absent for longer than 1 month.

4.2 Total sum of hours for all staff in a typical, full working week (one that doesn’t include leave or a bank holiday)

We require practices to provide the total sum of hours (contracted or worked) for all staff in a typical, full working week within one month of 31 December – one that doesn’t include leave or a bank holiday. We expect that these may vary week to week so provide guidance on how to make these estimates here. We would like contractors to use the following methodology.

Contractors should use a full working week (one that doesn’t include leave or a bank holiday) for each member of staff to calculate total hours the staff member has worked. These individual calculations should then be added together to give a total for each staff group. Please include time spent providing both patient care and administrative time, such as NHS patient administration, professional management and business management.

For example, if there are 5 staff recorded as General Dentists this would be the total hours they worked added together during a typical, full working week (one that doesn’t include leave or a bank holiday) close to the end of the reporting period the return covers.

Please use staff contracted hours to calculate this where available. If this is not possible, please use the hours worked in a full working week. If Associates or other members of staff do not have contracted hours, then please estimate the working hours in a typical, full working week (one that doesn’t include leave or a bank holiday) close to the end of the reporting period.

Please provide the total contract hours or hours worked for all members of staff within each staff group added together not the average contracted hours for staff groups.

Please note where a unique individual works across multiple staff groups, for example nurse and reception duties, we do not require that contractors try to split this activity. These hours should be reported once under their main staff group heading.

A staff member who does not deliver NHS activity should still be included when calculating Total Contract Hours.

Please include all staff, including those on short term leave (less than 1 month) at the end of the reporting period and treat these staff as if they were working using a week where they are not on leave to calculate working hours.

We appreciate contractor’s efforts in aiming to make these estimates as accurate as reasonably possible to minimise the impact on data quality issues but understand that any method of estimation will be subject to a small level of uncertainty.

4.3 Estimated total sum of NHS hours for staff delivering NHS services in a typical, full working week (one that doesn’t include leave or a bank holiday)

This request for information is linked to the previous question (4.2) to help us better understand the working patterns of the dental workforce delivering NHS services.

Please estimate the total sum of hours delivering NHS services only for all staff, within each staff group during a typical, full working week (which doesn’t include leave or a bank holiday) that falls within 30 November and 31 December 2024.

Please include clinical and administrative time.

We understand from feedback that it may be difficult to accurately determine every person’s working time split between NHS and non NHS activity. Please provide your best estimates of NHS activity hours.

Please include all staff, including those on short term leave (less than 1 month) at the end of the reporting period and treat staff as if they were working using a week where they are not on leave to calculate working hours.

4.4. Total hours of all vacant posts

Please provide the total hours of all vacant posts that you would like to fill as at 31 December, for each staff group.

For example, for a full time post of 40 hours and a part time post of 20 hours, put 60 hours in total, if you are seeking to fill those posts as at 31 December.

If a vacancy has been filled but the person has not yet started in the role please do not report this as a current vacancy as at 31 December.

Please do not count staff on short term leave, less than 1 month, (for example, short periods of sick leave or holiday) as vacancies.

4.5 Total NHS hours of vacant posts

This request for information is linked to the previous question.

Please provide the estimated total NHS hours of vacant posts that you would like to fill, as of 31 December for each staff group.

For example, for a post that you expect to provide 30 hours of NHS care and a post you think will provide 5 hours of NHS care, put 35 hours in total.

If a vacancy has been filled but the person has not yet started in the role, please do not report this as a current vacancy as of 31 December.

Please do not count staff on short term leave, less than 1 month, (for example, short periods of sick leave or holiday) as vacancies.

The entry should reflect data as of 31 December.

4.6 Number of NHS posts that you tried and failed to recruit to

For the first annual collection in January 2025, please provide the number of vacant NHS posts that you would like to have filled but where you had failed to recruit from April 2024 to 31 December 2024.

For subsequent returns, please provide the number of vacant NHS posts that you would like to have filled but were unable to recruit for the previous 12 month period ending 31 December.

4.7 Total headcount of leavers

For the first annual collection in January 2025, please provide the total number of all leavers, for each staff group from April 2024 to 31 December 2024.

For subsequent returns, please provide the total number of leavers, for each staff group, for the previous 12 month period ending 31 December.

Please do not include any staff who are on any long term absence that you expect to return. These staff should be recorded under the question ‘Total headcount of staff absent for any reason for longer than 1 month as of 31 December’.

Please note where a distinct individual worked across multiple staff groups (for example nurse or receptionist) they should be counted as a leaver once under their main staff group’s heading.

4.8 Total headcount of joiners

For the first annual collection in January 2025, please provide the total number of all joiners, for each staff group from April 2024 to 31 December 2024.

For subsequent returns, please provide the total number of joiners, for each staff group, for the previous 12 month period ending 31 December.

Please do not include any staff returning from a long term absence.

Please note where a distinct individual works across multiple staff groups (for example nurse / receptionist) they should be counted as a joiner once under their main staff group’s heading.

4.9 Total headcount of staff absent for any reason for longer than 1 month as of 31 December

For each staff group, please provide the total headcount of any individuals who have been absent for longer than a calendar month for any reason at the end of the reporting period the return covers.

The entry should reflect data as of 31 December.

To avoid double counting of staff, please only include staff absent for longer than 1 month that you have not included under section 4.1 Total Headcount.

Where a distinct individual that is absent for any reason longer than 1 month works across multiple staff groups, for example nurse and reception duties, the headcount should be counted once under their main staff group’s heading.

Please note we do not require the reasons for absence, and you should not include any personal and potentially identifiable information if using the Free Text Box.

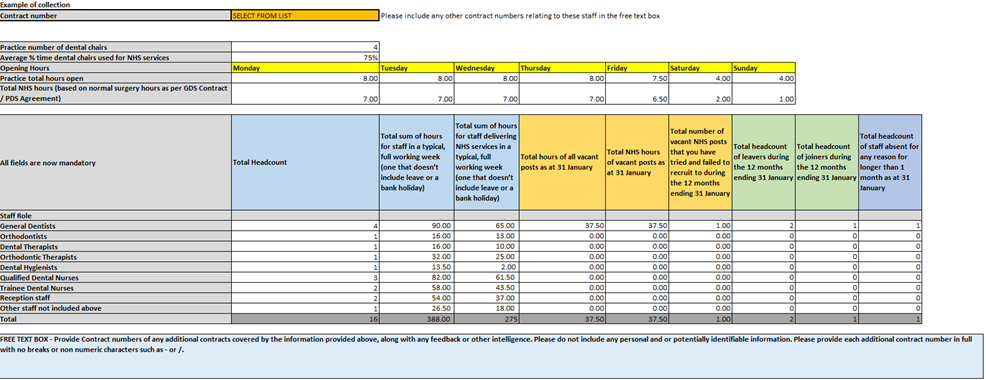

5. Appendix – example of workforce collection

An example of a completed workforce collection is below.

In this example there is a total headcount of 4 general dentists currently working a total sum of 90 hours in a typical, full working week (one that doesn’t include leave or a bank holiday) of which 65 hours are delivering NHS services. This includes a general dentist that is on short term leave (less than 1 month) at the end of the reporting period.

There is currently a 37.5 hours General Dentist vacant post.

In this example there is one general dentist post vacant that the contractor tried and failed to recruit to. This is additional to the current vacant post.

There have been two general dentist leavers over the period of the reporting period and there has been one general dentist joiner.

One general dentist has been absent for longer than 1 month at the end of the reporting period, this member of staff is only recorded under “Total headcount of staff absent for longer than 1 month”.

A template spreadsheet to support you collate information is available on the NHSBSA website. This data must still be transferred to Compass using the workforce data collection form.

Publication reference: PRN001736_ii