Action required

The Board is asked to note the month 4 financial position in 2025/26.

Revenue

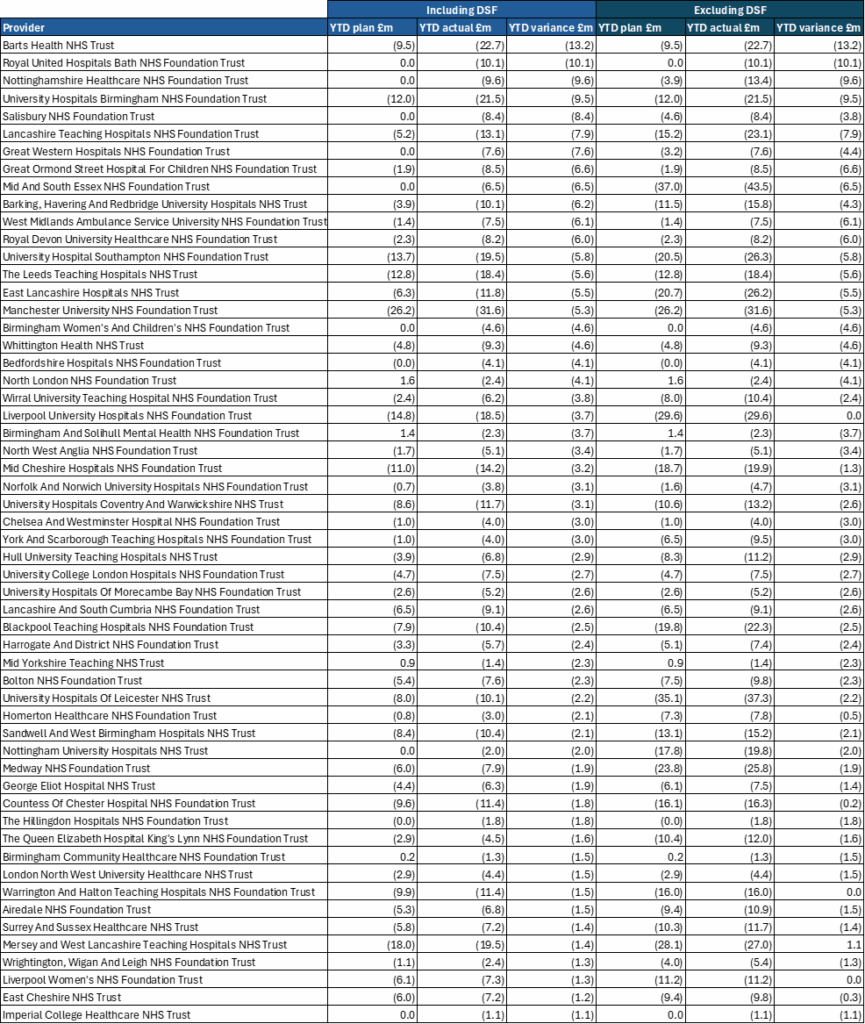

1. Table 1 below sets out the revenue position to the end of July 2025. The bottom-line position is shown on a non-ringfenced RDEL basis, which is the key measure for financial performance. The overall year-to-date (YTD) position shows an overspend of £57m (0.1% of YTD allocation).

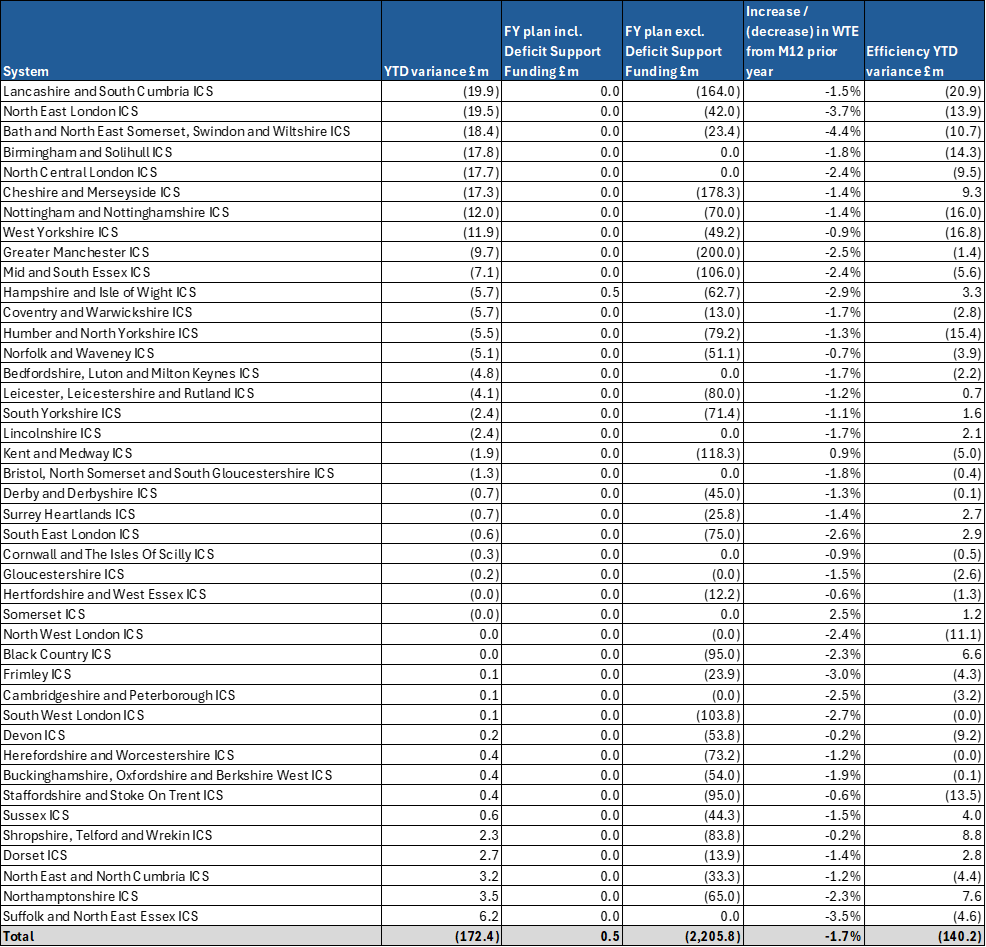

2. The overall adverse variance reported at month 4 is driven by overspends in systems of £172m, which includes some of the impact of industrial action, and reflects held back deficit support funding. Adjusting for these items, the system position is close to breakeven in aggregate.

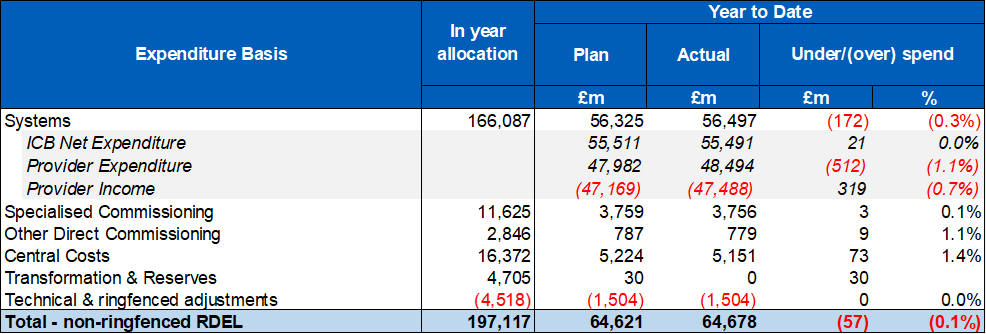

3. Six systems account for more than half of the total overspend. Sixteen systems and 44% of providers have delivered to plan at month 4. At the same point last year systems had overspent by £487m. Details of individual system variances are included in annex 1, providers with a YTD variance to plan worse than £1m are included in annex 2.

Table 1: YTD system financial position at month 4

4. At month 4, adverse system YTD variances are impacted by slippage against efficiency plans, including workforce increases beyond planned levels. The financial impact of five days of industrial action in July has also adversely impacted system positions. This includes the increased cost of staff cover during the strikes. It is expected that YTD system overspends will be recovered in the latter part of the year resulting in a forecast position in line with plan.

5. Five systems have had their Deficit Support Funding (DSF) held back at Quarter 2, one of which also had funding held back at Quarter 1. Total funding held back at month 4 totals £30m.

Other risks to the financial position

6. In addition to system delivery risk, there are other significant risks to the financial position in 2025/26. These include the net impact of unfunded redundancy costs across integrated care boards, providers and NHS England, financial risk posed by the recent high growth trend in specialised commissioning high cost devices and the impact of further in-year industrial action.

Capital

7. Providers have spent £1,282 million on capital schemes to month 4 (including IFRS 16 expenditure relating to lease assets), representing 13% of their full year budget. The Department of Health and Social Care provider and commissioning capital budget for 2025/26 (including IFRS16) is set at £10,231 million against which we are currently forecasting an underspend of £240m. We will redeploy these underspends to help manage the Group overcommitment and/or fund pressures and new priorities as part of our mid-year review of budgets in the usual way.

Drug pricing dispute

8. Earlier this year, His Majesty’s Government (HMG) launched an expedited Voluntary Scheme for Branded Medicines Pricing and Access (VPAG) review with the Association of the British Pharmaceutical Industry (ABPI) to ensure that it continues to serve both industry and the NHS. In response to concerns raised by ABPI, in June HMG put forward an ambitious set of proposals that would increase spending on medicines, support greater access to innovative medicines, and incentivise further industry investment into the UK, whilst balancing other spending pressures in a tough fiscal environment. Following protracted delays, the ABPI were unwilling to take HMG proposals to revise the VPAG agreement to a vote of its Board, resulting in the conclusion of the review, with the scheme unamended – to run until the end of 2028.

9. Public comments from the ABPI and member companies suggest that they are prepared to take steps to limit their investment in the UK, including clinical trials, drug manufacturing and new medicines launches, which would jeopardise NHS patients’ access to new treatments. One major pharmaceutical company has already announced it will withhold a breast cancer drug from hundreds of women in the UK as it does not believe it could make an “appropriate profit”.

10. To help develop an attractive medicines access environment, against the backdrop of strong US policy that seeks to rebalance global pharmaceutical industry pricing strategies, NHS England will lead delivery of a series of commitments within the 10 Year Health Plan and Life Sciences Sector Plan to speed up access and uptake of new medicines, so the most clinically and cost-effective medicines reach patients faster, including:

- Rolling out confidential commercial pricing models in primary care and streamlining our approach to multi-indication medicines pricing agreements.

- Introducing a Single National Formulary to remove bureaucratic delays to patient access, reduce unwarranted variation in prescribing, and accelerating uptake.

- Establishing partnerships with industry to provide access to new treatments, expanding the role life sciences and technology companies can play in service delivery.

- Driving early and widespread uptake of new biosimilars, by working with local healthcare systems on implementation plans to ensure that switching is introduced as soon as clinically appropriate.

11. In addition, the NHS and the National Institute for Health and Care Excellence have shown commitment to improving the access environment for MedTech, with initiatives including:

- Rules Based Pathway (RBP) for prioritised MedTech solutions.

- NHS ‘Innovator Passport’, enabling innovative MedTech products to validate evidence claims once only.

- Centre led procurement to simplify and accelerate national access to MedTech.

12. Despite the challenging commercial environment, NHS England continues to build successful partnerships with the pharmaceutical industry including:

- establishing the NHS Cancer Vaccine Launch Pad (CVLP) to speed up access to personalised cancer vaccine clinical trials and accelerate their development.

- working with British company, GSK to enable NHS patients to be the first in the world to benefit from the ‘trojan horse’ blood cancer therapy, belantamab mafodotin, which could halt progression of people with incurable multiple myeloma three times longer than other treatments.

- Deepening relationships with manufacturers of off-patent medicines to expand patient access to effective, off-patent medicines – that make up eight in 10 NHS prescriptions – including biosimilars, where Medicines UK has recognised “…the UK is living up to its ambition to be a world leader…”.

13. A pro-innovation, pro-growth NHS, will be a fundamental part of the UK vision to become the leading Life Sciences economy by 2030 and the third most important globally – after the US and China – within a decade. Ongoing discussions are underway.

Annex 1: financial position by system M04 (surplus / deficit basis)

Annex 2: Providers with a YTD overspend worse than £1m at M04