Organisation objective

NHS Mandate from Government

Action required

The Board is asked to note the forecast outturn position of the NHS in 2024/25.

Month 11 revenue position 2024/25

Month 11 revenue position

- Following the October Budget we have confirmed full funding for: agreed plans, the cost of the 2024/25 pay deals, the cost of June’s industrial action, and income to cover elective performance.

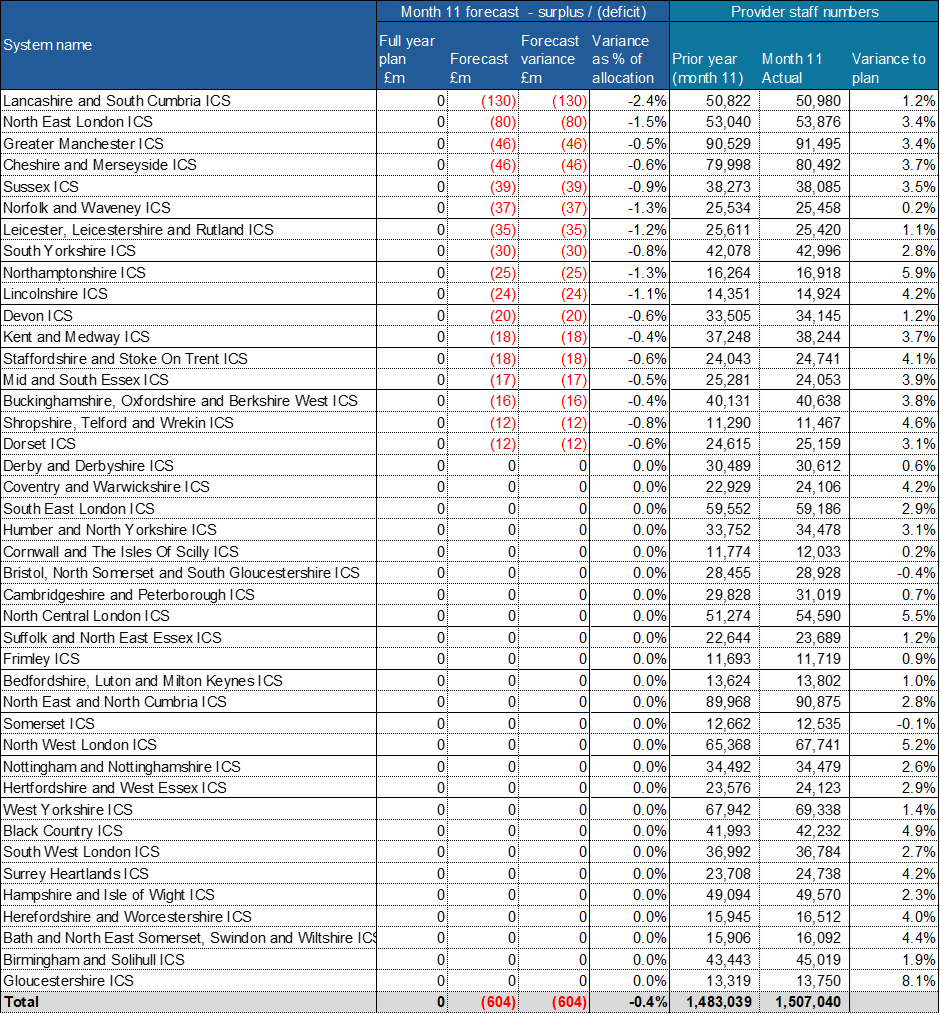

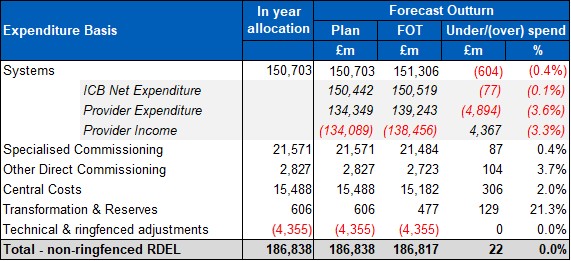

- Table 1 below sets out the current forecast revenue position for 2024/25 of a £22m surplus on a non-ringfenced Revenue Departmental Expenditure Limit (RDEL) basis. The forecast system position which incorporates ICB and provider positions is projected to be a £604m overspend (0.4% variance versus allocation). System financial performance in 2024/25 has improved against the £1.4bn system deficit position reported in 2023/24, with a total of 25 systems expected to hit plan and a further 4 with an overspend of 0.5% or less.

Table 1: Forecast financial position at month 11

- Key variances in the system £604m deficit:

- delivery of elective activity attracting additional planned income through the Elective Recovery Scheme

- shortfalls in efficiency plans of £539m including provider workforce increases above planned levels

- pressures on CHC and prescribing within ICB positions

- The overall system position has been managed through a series of early interventions for those systems we assessed as having the highest risk of overspending their plans. This intervention included engagement of external support to ensure effective expenditure controls were embedded and operating consistently, accelerate their efficiency plan delivery and ultimately to reduce their rate of spend to match the available resource. This work has been directly beneficial to the specific systems and has also provided the wider NHS with valuable learning which has been applied to other systems.

- Tighter cash-borrowing controls have been introduced since the start of the year, to help make sure that spending is kept under control as far as possible and to strengthen appropriate financial discipline.

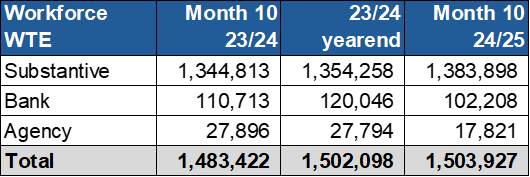

- Systems planned to deliver the most significant efficiency savings that have ever been delivered totalling £9.3bn (equivalent to 6.1% of their total allocation); and an aggregate reduction in WTE staffing and pay bill of 1.2% compared to 2023/24. At month 11 systems are forecasting to deliver £8.7bn of savings which is only £0.5bn lower than plan. This represents a 21% increase compared to the £7.2bn of efficiencies delivered in 2023/24. Overall workforce levels have increased by 0.1% since the end of the prior financial year although this is 2.6% higher than 24/25 planned levels, whilst the monthly pay bill has fallen by 0.7% demonstrating the financial benefit of switching temporary staffing for substantive staff

- Agency spending has reduced significantly in the last two years and is continuing to fall in 2024/25. Cash spending on agency staff is lower now than at any point in recent years and as a percentage of total pay is lower than at any point since 2017 (when the current data goes back to). Cash spending on agency staff is currently forecast at £2.1 billion for 2024/25, which would be a reduction of £1.4 billion from 2022/23 (~38% reduction).

- After driving through planned headcount reductions through the successful delivery of the [35%] reduction to the size of NHS England delivering £490m of savings and by making further savings through robust financial management of NHSE central costs of £306m, we have reinvested over £500m in frontline services and offset overspending in particular by acute providers.

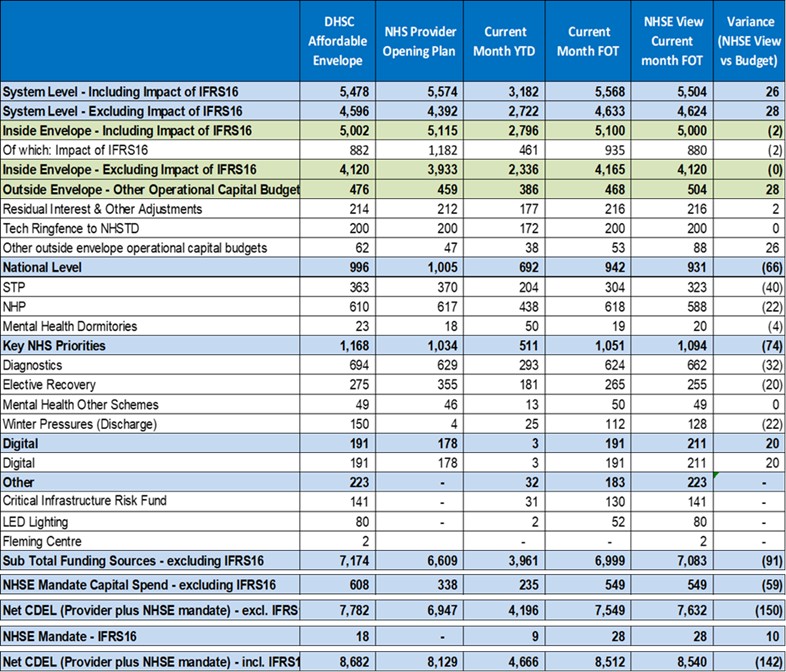

Month 10 capital position

- Providers have spent £3,961 million on capital schemes to month 10 (excluding IFRS 16 expenditure relating to lease assets), representing 55% of their full year budget (compared to 52% at the same stage last year). The DHSC provider and commissioning capital budget for 2024/25 (including IFRS16) is set at £8,682 million against which we are currently forecasting an underspend of £142 million.

- In addition to their ongoing work to maintain their physical and digital infrastructure, during 24/25 systems will have completed a large number of capital schemes including 10 further Community Diagnostic Centres and 25 further surgical hub schemes, completed RAAC eradication on 9 sites, and implemented Electronic Patient Records Systems in a further 2 trusts.

Table 2: M10 Provider capital position

Underlying position and looking ahead

- 2024/25 has been the most stable year for the NHS since the Covid pandemic began recognising that in addition to the pressures of covid we had major industrial action during2023/24 and the impact of significant inflationary pressures which had to be absorbed over that period within fixed budgets (around £1,5bn more than the assumptions made by HMT). Over the last four years and through the instability we have been resetting the finances and focusing on recovering performance.

- For 2024/25 NHS providers are forecasting a deficit of £787m, a significant improvement from the £1,316m deficit reported in 2023/24. While provider finances remain stressed this improvement compares to the position at the point NHSE and NHSI were brought together where providers had a £3.5bn aggregate deficit. These figures represent the aggregate provider position and even when the sector has been in balance there have been individual providers reporting deficit positions.

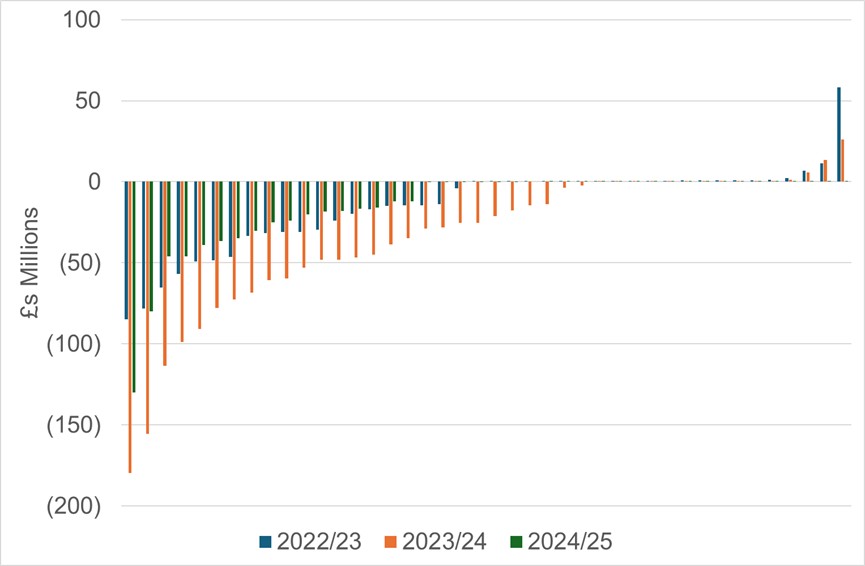

- Chart 2 shows the system surplus / deficit positions in size order over the last three years. It shows the significant financial challenge, with an aggregate deficit in 2022/23 of £604m, and of £1,425m in 2023/24 as the impact of IA and inflation worked through the NHS. In 2024/25 we are forecasting an improvement to a deficit of £604m, (0.4% of expenditure.

Chart 2 – NHS system surplus / deficits 2022/23 to 2024/25

- The individual position of systems is set out in Annex A, In the current year, 25 of the 42 systems (60%) are forecasting a breakeven position.

- As we look ahead to 2025/26, planning is progressing. We are forecasting submissions on 27 March will show financial plans are within [200m-300m] of allocations with 36 systems having plans that balance. Given the delays in starting the planning round we will continue to work with systems and providers where issues remain to conclude it by the end of April.

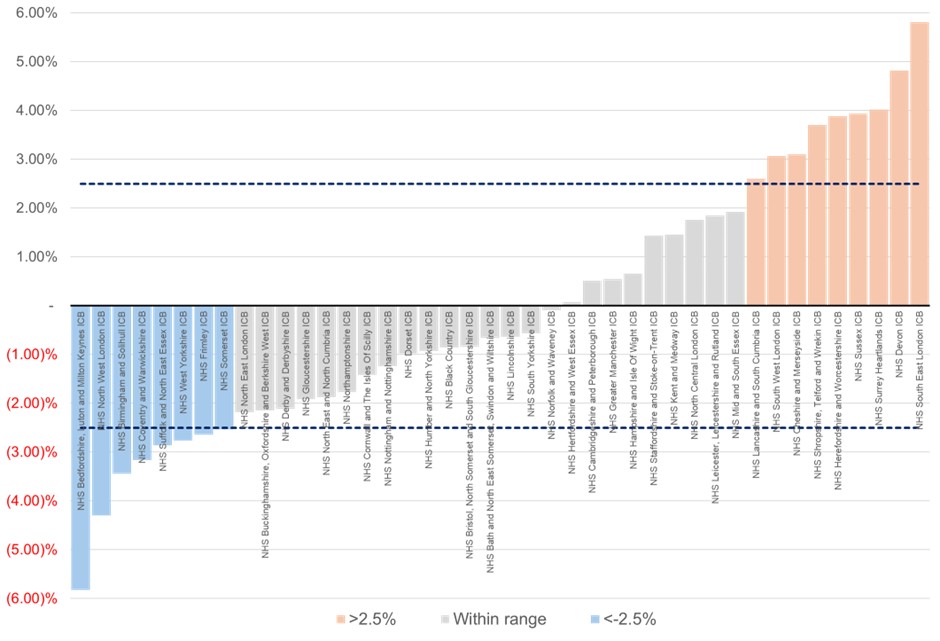

- 2025/26 is the first year since the pandemic, where all funding streams are agreed with Government at the start of the year, and we can now show how total allocations (across core ICB commissioned services and specialised services) compare to the endorsed population needs-based formulas. Chart 3 sets this out. It shows that 25 systems are within the tolerance for being in receipt of fair shares funding. There remain a small number of systems who are under allocation even after allowing positive convergence funding and [9] systems who are receiving materially more than a fair shares allocation and where planning for 2026 and beyond will require significant further convergence steps.

Chart 3 – Percentage difference of total in-scope funding versus a system’s fair share of that funding. [Systems are considered to be within the tolerance of being on fair shares if they are +/- 2.5% of target]

- We have done the groundwork over the last two years for the next steps towards a financial framework for the NHS beyond the recovery phase from the pandemic:

a. a pilot using the Federated Data Platform to collect costing data that will give greater availability and more timely financial information to inform policy

b. capturing and using cost and activity data in non-acute settings to start to measure productivity and have the basis for new funding mechanisms to drive new models of care

c. pricing reform including reintroduction of best practice tariffs

d. reinstating the discipline of counting/coding in acute settings to link cost, activity, planning and contracting as well as real time measurement of productivity and delivery and to consider right payment and contracting mechanisms beyond this year

e. working with ICBs and providers to put in place the data flows and the technology to support a comprehensive approach to population health management and the ability to design a financial system to support it

- However, there remain significant risks to the financial position as we start 2025/26:

a. Pay settlements set by Government following the recommendation of the Pay Review Bodies. We have provided in funding settlements for 2.8% pay settlement. NHSE holds no contingency for higher pay settlements. Any higher pay settlement will either require additional funding from DHSC provisions or will require further cuts in service provision;

b. The risk of non-delivery of plans set and agreed by ICB and provider Boards. Planning Guidance set challenging productivity and performance goals for the NHS with no extra funding for increased demand or activity as the NHS seeks to deliver the next step in reducing waiting lists, improving access to emergency care, GPs and NHS dentists. The NHS has worked hard to develop those plans. Some systems are though clearly further behind in having detailed plans and this needs to be addressed through April.

Annex A: 2024/25 month 11 revenue and WTE position by system