Action required

The Board is asked to note the month 2 system position in 2025/26.

Spending review outcome

1. On 11 June the Chancellor’s announcement marked the conclusion of phase 2 of the Spending Review 2025 (SR25), which sets departmental budgets for revenue (day to day) spending until 2028 29, and until 2029 30 for capital investment. This follows announcements previously confirmed at the Autumn Budget 2024, which confirmed funding for phase 1 of SR25 (covering 2025/26).

2. The Chancellor confirmed the Department of Health and Social Care’s (DHSC’s) revenue budget will increase from £202 billion in 2025-26 to £232 billion in 2028-29 – a real-terms average increase of 2.7% over the full SR25 period (including 25/26). Most of this budget will be allocated to the NHS, whose funding will see 3% average real-terms growth over 2025/26-2028/29 – an increase from £195.6bn in 2025/26 to £226bn in 2028/29. Capital spending will increase from £13.6 billion in 2025-26 to £14.6 billion in 2029-30 – equivalent to 3.2% average real-terms growth across the full SR25 period, although the next four years will see flat real-terms growth, as most of the funding increase is in 2025/26 (per CDEL uplift previously announced at the Autumn Budget 2024).

3. The Government expects this settlement to cover the costs of delivering BAU demand and activity, pay, non-pay inflation and other cost pressures and expectations; alongside enabling the NHS to deliver wide-ranging reform and performance ambitions. This includes delivery of the government’s priority Plan for Change commitment to reduce elective waiting times – with the ambition to achieve 92% of patients starting treatment within 18 weeks of referral by the end of Parliament; delivery of 2% productivity growth each year – an ambitious target relative to historic average, and equivalent to c£17bn savings over the SR period; work to repair the NHS estate and tackle critical safety risks, building on investment confirmed in SR Phase 1; and supporting delivery of the 10 Year Health Plan.

Month 2 financial position 2025/26

4. The planning round for the 2025/26 is now concluded and we are pleased to report was completed significantly faster than in recent years, and (after applying £2.2bn of deficit support funding) has all 42 systems with balanced plans for the year.

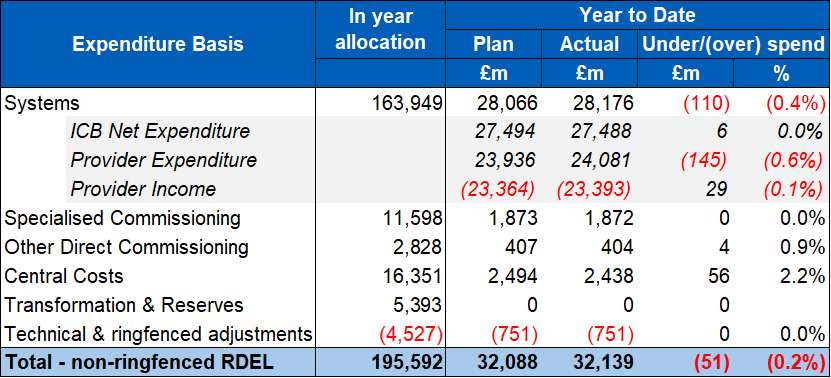

5. Table 1 below sets out the revenue position to the end of May 2025. The bottom-line position is shown on a non-ringfenced RDEL basis, which is the key measure for financial performance. The overall year-to-date (YTD) position shows an overspend of £51m (0.2% of YTD allocation).

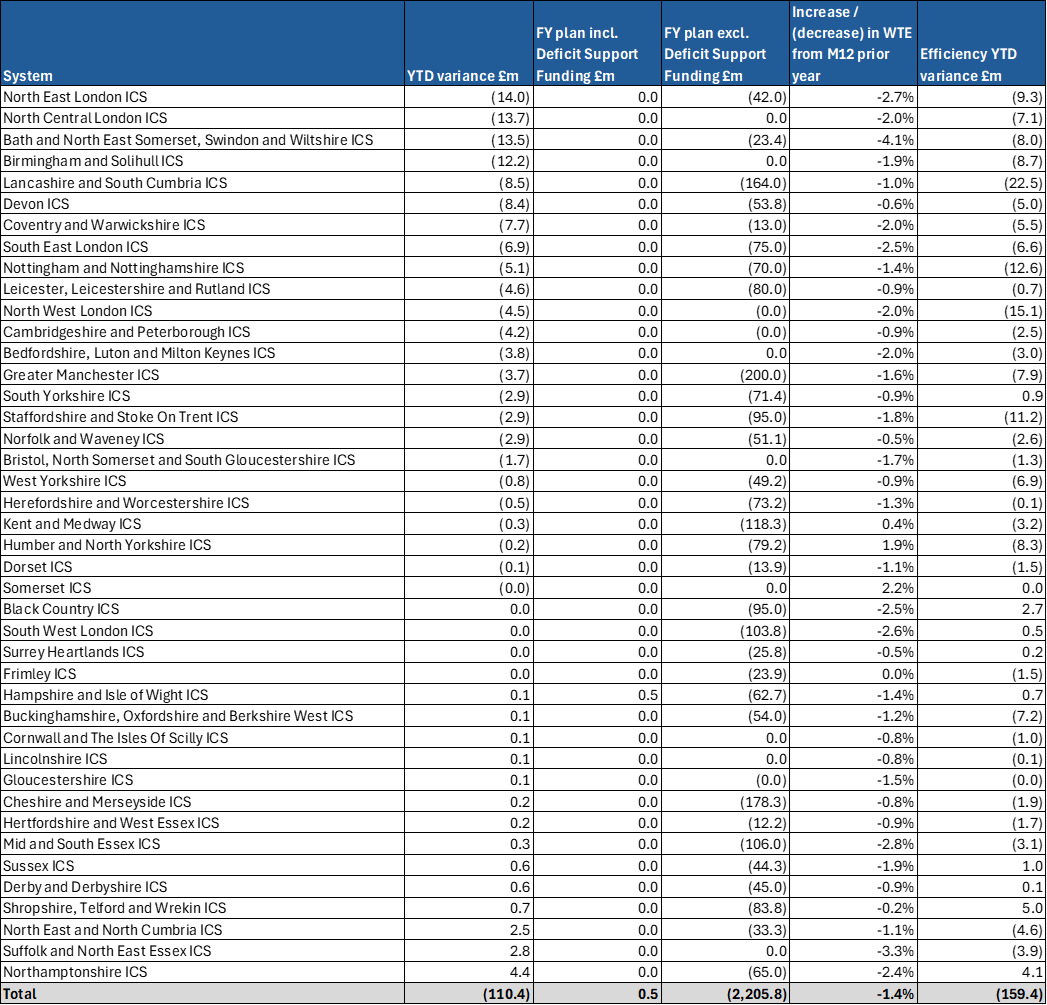

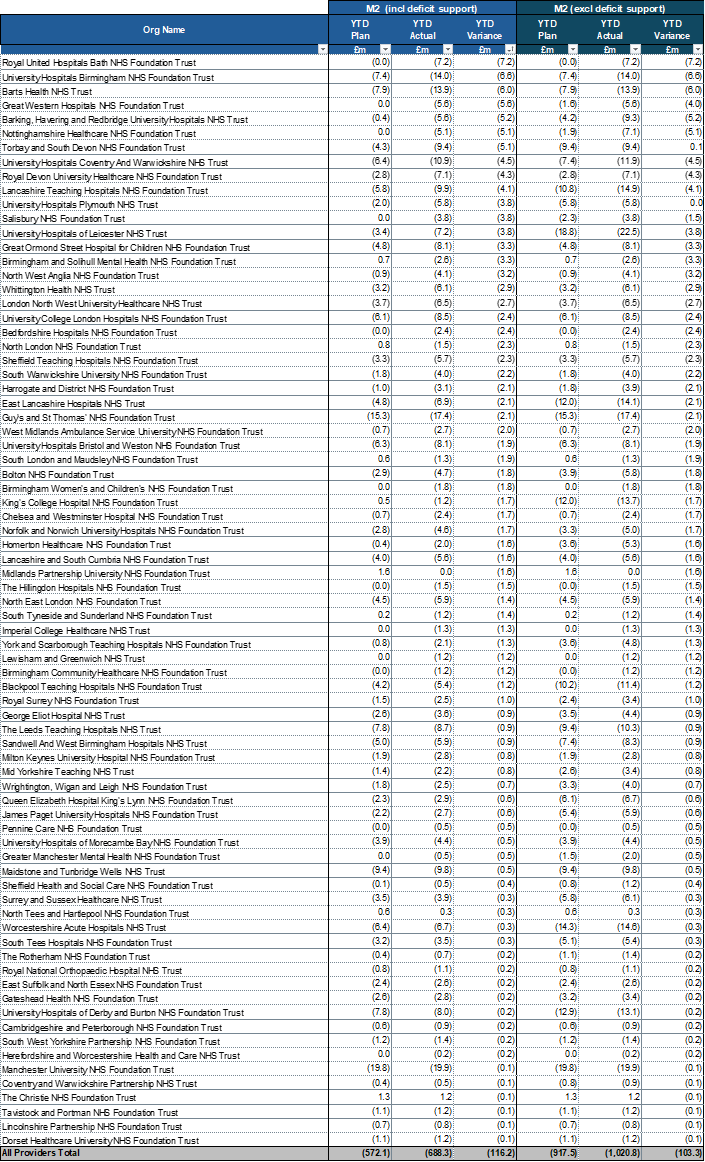

6. The overall adverse variance reported at month 2 is driven by overspends in systems of £110m. Four systems account for just under half of this total. Around half of the systems and 75% of providers have delivered to plan at month 2. At the same point last year systems had overspent by £240m. Details of individual system variances are included in annex 1, providers with a YTD variance to plan are included in annex 2.

Table 1: YTD system financial position at month 2

7. In the systems with the larger overspends, there is correlation between the YTD variance, pay variance, and efficiency shortfall. At month 2, YTD variances are mainly due to a £159m shortfall in efficiency plans, including workforce increases beyond planned levels. Reported provider pay remains flat in real terms compared to months 11 and 12 of the previous year. Total headcount has decreased from 1,518k to 1,497k, a 1.4% reduction. It is expected that YTD system overspends will be recovered in the latter part of the year resulting in a forecast position in line with plan.

8. Further restrictions on cash-borrowing have been introduced since the start of the year, to help make sure that spending is kept under control as far as possible and to strengthen appropriate financial discipline. Systems in receipt of deficit support funding will now receive the funding on a quarterly basis contingent on continued delivery of their plans. Based on the month 2 financial position and assessment of a range of metrics including efficiency and workforce, 5 systems will not receive quarter 2 deficit support funding, of which 1 also did not receive quarter 1 funding.

Other risks to the financial position

9. In addition to system delivery risk, there are other significant risks to the financial position in 2025/26. These include the net impact of unfunded redundancy costs across integrated care boards, providers and NHS England, financial risk posed by the recent high growth trend in specialised commissioning high cost devices and the as yet unquantifiable potential impact of any in-year industrial action.

Annex 1: financial position by system (surplus / deficit basis)

Annex 2: Providers with a deficit YTD variance at M2 (surplus / deficit basis)

Publication reference: Public Board paper (BM/25/25)(Pu)