Organisation objective

- Statutory item

Executive summary

This paper provides the Board with an update on the month 4 financial position for 2023/24.

Action required

The Board is asked to note the month 4 2023/24 financial performance of the NHS.

Month 4 financial position 2023/24

Headline revenue forecast

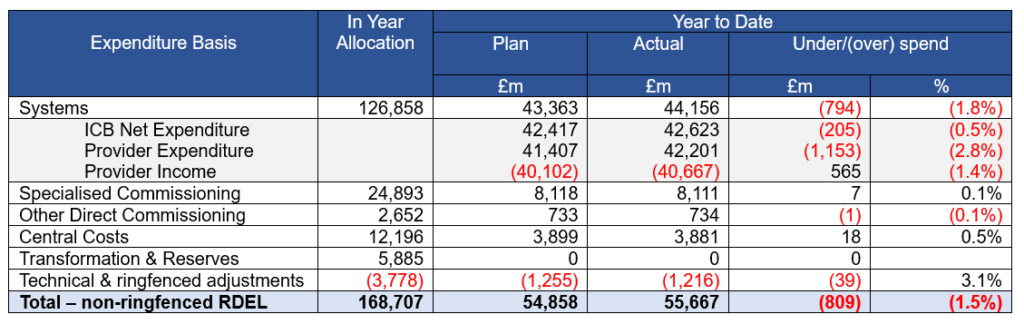

1. Table 1 sets out the revenue expenditure position to the end of July 2023. The bottom-line position is shown on a non-ringfenced RDEL basis. Compared to plan, the aggregate YTD system position shows expenditure to be above plan by £794m (1.8% variance versus allocation).

Table 1: Financial position at month 4

|

Expenditure basis |

In year allocation |

Year to date |

|||

|

Plan |

Actual |

Under/(over) spend |

|||

|

£m |

£m |

£m |

% |

||

|

Systems |

126,858 |

43,363 |

44,156 |

(794) |

(1.8%) |

|

ICB Net Expenditure Provider Expenditure Provider Income |

|

42,417 41,047 (40,102) |

42,623 42,201 (40,667) |

(205) (1,153) 565 |

(0.5%) (2.8%) (1.4%) |

|

Specialised Commissioning |

24,893 |

8,118 |

8,111 |

7 |

0.1% |

|

Other Direct Commissioning |

2,652 |

733 |

734 |

(1) |

(0.1%) |

|

Central Costs |

12,196 |

3,899 |

3,881 |

18 |

0.5% |

|

Transformation & Reserves |

5,885 |

0 |

0 |

0 |

|

|

Technical & ringfenced adjustments |

(3,778) |

(1,255) |

(1,216) |

(39) |

3.1% |

|

Total – non-ringfenced RDEL |

168,707 |

54,858 |

55,667 |

(809) |

(1.5%) |

2. The full year expenditure limit as at month 4 of £168.7bn includes a number of additional funding streams confirmed by DHSC but not yet recognised in the published financial directions. The most significant of which being additional funding for the pay award.

3. ICS’s financial positions continue to be impacted by the ongoing industrial action, which is driving additional expenditure as well as impacting on efficiency delivery. Without further support for costs of industrial action, there is significant risk that many systems will overspend this year. To the end of July we have estimated a cost impact of ~£550m and described lost activity valued at a further ~£550m.

4. The transformation and reserves funding shown in the table above comprises pay award funding, SDF and ERF funding which is not yet allocated to systems but is fully committed. Transformation and reserves also includes a small contingency which is required to offset the start-of-year planning gap.

Capital expenditure

5. Providers have spent £1,162 million on capital schemes to month 4 (excluding IFRS 16 expenditure relating to lease assets), representing 14% of their full year budget which is in line with spending at the same stage last year. The DHSC provider capital budget for 2023/24 (excluding funding for leases) is set at £8,076 million against which we are currently forecasting an overspend of £121 million primarily related to providers’ forecast of spend above the available budget on STP upgrade schemes.

Public Board paper (BM/23/30(Pu)