Revenue

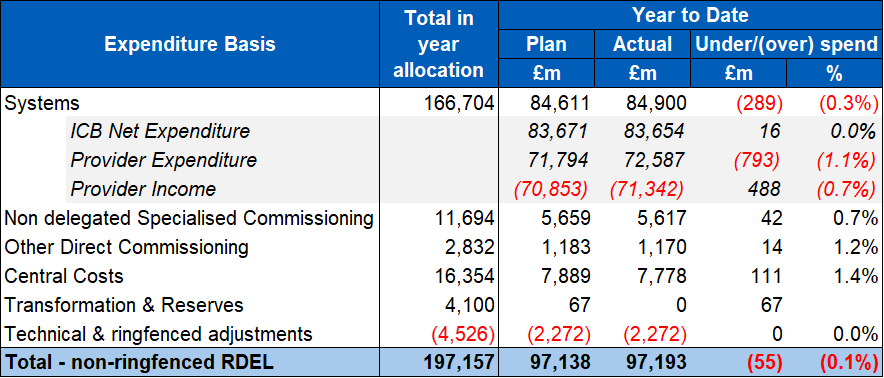

1. The NHS is broadly balanced at month 6 with a revenue (non-ringfenced RDEL) position to the end of September 2025 of £55m overspend (0.1% of YTD allocation).

2. The month 6 year to date (YTD) financial position is driven by overspends in systems of £289m, which includes some of the impact of industrial action, and reflects held-back deficit support funding. Adjusting for these items, the system position is closer to breakeven in aggregate.

3. Six systems account for more than half of the total overspend. Twenty-two systems (52%) and 68% of providers have delivered in line with their plans to month 6. At the same point last year systems had overspent by £697m with only 3 systems delivering plans. Details of individual system variances are set out in annex 1, providers with a YTD adverse variance to plan of greater than £1m are listed in annex 2.

Table 1: YTD system financial position at month 6

4. At month 6, adverse system YTD variances are impacted by slippage against efficiency plans, including workforce costs above planned levels. Equally the financial impact of five days of industrial action in July also adversely impacts system positions. This includes the increased cost of staff cover during the strikes.

5. Total Deficit Support Funding (DSF) held back YTD totals £67m – this relates to 3 systems, one of which also had funding held back at Quarter 1. Adjusting for the lost DSF and the financial impact of industrial action would bring the aggregate year to date system position even closer to plan.

6. Review of the month 6 financial position has since resulted in 11 systems having their Quarter 3 DSF held back. Whilst systems are broadly delivering in line with their plans so far, efficiency delivery is weighted towards the latter half of the year, which presents a risk to delivery.

7. In line with the planned efficiency profile, we expect ICBs and providers to improve their expenditure run rate in the final months of the year. However to the extent that systems fall short of their board-approved plans, we expect that underspends within NHS England, as a result of increased financial controls, will be sufficient to deliver balance across the NHS as a whole.

8. Latest trust productivity estimates show an improvement of 3.2% for all trusts (compared to the same period last year), which is made up of 3.3% cost weighted activity growth and 0.2% real terms resource growth. For acute trusts (where data is most reliable), productivity growth is estimated at 2.5% at M5 YTD.

Other risks to the financial position

9. The most significant risk to the financial position is the risk of system overspends. The impact of November and potential future industrial action in 25/26 continues to pose significant risk to financial delivery in 2025/26.

Capital

10. Providers have spent £2,089 million on capital schemes to month 6 (including IFRS 16 expenditure relating to lease assets), representing 22% of their full year budget. The DHSC provider and commissioning capital budget for 2025/26 (including IFRS16) is set at £10,105 million against which we are currently forecasting an underspend of £286m. We will redeploy these underspends to help manage the Group overcommitment and/or fund pressures and new priorities as part of our ongoing review of budgets.

Planning for 26/27 onwards

11. ICBs and providers are now underway with developing their financial and operational plans for 26/27 onwards. To support the planning process, NHS England has published new financial rules, financial allocations and proposals for reforms to the NHS Payment Scheme. Two-year revenue allocations (with a third year to follow shortly) and four-year capital allocations will now enable providers and commissioners to develop multi-year plans.

12. A revised rules-based financial framework will support clearer organisational accountability and transparency, alongside moving towards a fairer distribution of resources and the elimination of deficit support funding. The “deconstruction” of block contracts and the introduction of a blended payment approach to urgent and emergency care are intended to provide greater transparency over activity and expenditure, and to enable a more considered approach to investment in UEC services and in out-of-hospital/neighbourhood alternatives.

13. We are also working with ICBs and providers to develop new payment models for neighbourhood health services to support the left shift. We are introducing new best practice tariffs to drive greater efficiency and improved patient care in elective services.

Annex 1: financial position by system at month 6 (surplus / deficit basis)

Annex 2: Providers with a YTD overspend worse than £1m at month 6