Organisation objective

- Statutory item

Executive summary

This paper provides the Board with an update on the month 2 financial position for 2023/24 including an update on 2023/24 plans.

Action required

The Board is asked to note the month 2 2023/24 financial performance of the NHS.

2023/24 Planning Update

1. Final plans were received from systems on 4 May; 15 out of 42 systems have a deficit plan for the year with a total overspend of £720m.

2. A tighter control regime has been agreed with systems and providers that have planned deficits.

3. As reflected in the planned position there remains a significant financial challenge for systems to address in-year in particular because of the impact of strikes which:

- 4. Increase direct costs due to paying senior staff premium rates to cover striking staff for urgent and emergency care;

- Consume bandwidth to deliver changes in service, waste reduction initiatives and savings plans; and

- Lose working days for planned care which are not recoverable without additional funding at premium rates.

4. We estimate that the April industrial action means we can afford 2% less elective activity across the whole year, a total financial impact of £360m. We have therefore agreed with ministers to reduce the elective activity goals for systems so they reflect those impacts, and we are discussing with government the impact of the June and July industrial action.

5. We have held onto investment plans and our medium to longer term goals. The NHS has continued to recover services from the continued impact of COVID, we have reduced 18-month waits by over 90%, ensured cancer referrals are back above pre-pandemic levels and responded to sustained record levels of demand across urgent and emergency care. It is therefore right that the essential work of frontline NHS staff is properly recognised and rewarded.

6. DHSC has identified funding from other sources to cover the cost of the pay award above the 3% level at which the NHS was funded while holding some risk against the overall DHSC position. We will be funding systems in full for the pay award and have been asked not to make further cuts to any national programmes. In 2024/25 DHSC has indicated potentially asking the NHS to make £100m contribution to the recurrent cost. We will need to consider this with the department as we plan for 2024/25. As we are already delivering £12bn of efficiency savings over three years, our current assessment is this may require cuts to national programmes. The approach to 2024/25 will be considered in the Autumn.

Month 2 Financial Position 2023/24

Headline Revenue Forecast

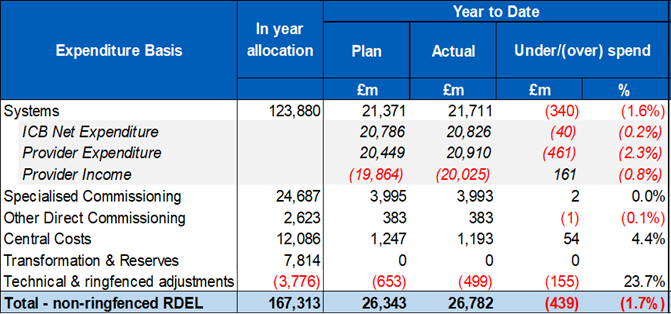

7. Table 1 sets out the revenue expenditure position to the end of May 2023. The bottom-line position is shown on a non-ringfenced RDEL basis. Compared to plan, the aggregate YTD system position shows expenditure to be above plan by £340m (1.7% variance versus allocation). This is an overspend of £749m against the available funding of £167.3bn, driven largely by the system planning gap as above.

Table 1: Financial position at month 2

8. The month 2 expenditure limit of £167.3bn includes a number of additional funding streams confirmed by DHSC but not yet recognised in the published financial directions. The most significant of which being additional funding for the pay award.

9. We are seeing the early signs of tighter control of workforce costs in the first two months of the year. Systems are currently forecasting to underspend against the agency spend cap for 23/24, which represents a significant decrease on agency spending compared to 22/23.

Capital expenditure

10. Providers have spent £511 million on capital schemes to month 2 (excluding IFRS 16 expenditure elating to lease assets), representing 6% of their full year budget which is in line with spending at the same stage last year. The DHSC provider capital budget for 2023/24 (excluding funding for leases) is set at £8,076 million against which we are currently forecasting an overspend of £151 million primarily related to providers’ forecast of spend above the available budget on STP upgrade schemes.