Introduction

Requirements for foundation trust annual reports and accounts

In this document, the NHS foundation trust annual reporting manual 2025/26 (FT ARM 2025/26), we set out the requirements for foundation trusts’ annual reports. It contains the formal accounts direction for foundation trusts and the requirements for the basic structure, but foundation trusts should also follow the Department of Health and Social Care Group accounting manual 2025/26 (DHSC GAM 2025/26) for detailed requirements for their accounts.

As explained in chapter 1, an NHS foundation trust’s annual report and accounts should be presented as 1 document.

This document does not relate to NHS trusts, which should solely refer to the Department of Health and Social Care Group accounting manual 2025/26 (DHSC GAM 2025/26).

Summary of changes for 2025/26: annual reports

For ease of reference, the main changes in annual report requirements compared to the NHS foundation trust annual reporting manual 2024/25 (FT ARM 2024/25) are set out in the summary of changes document.

For changes in accounts requirements, please see the DHSC GAM 2025/26 and accompanying consultation document.

Signature arrangements

Where signed documents relating to the annual report and accounts are submitted to NHS England, electronic signatures in documents will be accepted.

1. Annual report and accounts preparation and submission requirements

Statutory requirements for NHS foundation trusts’ annual reports

1.1 Schedule 7, paragraph 26 of the NHS Act 2006 (the 2006 Act) requires NHS foundation trusts to prepare an annual report. Paragraph 26(3) of schedule 7 provides that it is for NHS England to decide the form of the reports, when the reports are to be submitted, and the periods to which the reports relate.

1.2 NHS England’s decision as to the requirements for NHS foundation trusts’ annual reports is set out in annex 1 to this chapter.

1.3 The detailed requirements for foundation trusts’ annual reports are set out in chapter 2. We base these requirements on those contained in HM Treasury’s financial reporting manual (FReM), adapted as necessary for NHS foundation trusts.

Statutory requirements for NHS foundation trusts’ annual accounts

1.4 Schedule 7, paragraph 25(1) of the 2006 Act requires NHS foundation trusts to prepare annual accounts. Paragraph 25(2) of schedule 7 provides that it is for NHS England to decide the form and content of the accounts.

1.5 NHS England’s directions to NHS foundation trusts are set out in annex 1 to this chapter.

1.6 The detailed requirements for foundation trusts’ accounts are set out in the DHSC GAM 2025/26, as guided by our accounts direction. The annual accounts for NHS foundation trusts must include 4 primary statements (statement of comprehensive income, statement of financial position, statement of changes in equity and a statement of cash flows), which should follow the presentational form set out in the summarisation schedules for providers issued by NHS England, although lines that are nil in the current and prior year can be omitted for clarity. Immaterial lines may be aggregated. Items must not be moved in or out of operating income or operating expenditure compared to the summarisation schedules.

The summarisation schedules for foundation trusts are termed trust accounts consolidation (TAC) schedules and are included in NHS England’s provider financial return (PFR) forms. The accounts should also contain the notes to the accounts. Disclosures entitled ‘note’ (rather than ‘table’) in the TAC schedules should be included in the accounts, but entities have discretion over their precise format and these may be omitted if immaterial.

1.7 The DHSC GAM will be supported by the following materials to be issued by NHS England:

- the TAC schedules must be submitted to NHS England to support production of the provider consolidated accounts

- an accounts template, which is not mandatory for use

- template NHS provider accounting policies. Any deviation from the accounting policies in the DHSC GAM upon which these are based should be confirmed to NHS England via the confirmation question in the TAC schedules

1.8 These materials will be issued as follows:

- in December 2025 and January 2026, for use in the month 9 exercise submitted in January 2026

- in March 2026 for use in the year end accounts

1.9 The DHSC GAM sets out how these materials should be used.

Content of the annual report and accounts

1.10 The annual report and accounts of an NHS foundation trust consist of:

- the performance report comprising:

- overview of performance

- performance analysis

- the accountability report, comprising:

- directors’ report

- remuneration report

- staff report

- the disclosures set out in the Code of governance for NHS provider trusts

- NHS oversight framework

- statement of accounting officer’s responsibilities

- annual governance statement

- the auditor’s report

- the foreword to the accounts which should state that the accounts are prepared in accordance with paragraphs 24 and 25 of schedule 7 to the NHS Act 2006 and are presented to Parliament pursuant to schedule 7, paragraph 25 (4) (a) of the National Health Service Act 2006

- 4 primary financial statements (see paragraph 1.6)

- the notes to the accounts

1.11 NHS foundation trusts are able to present their annual report and accounts in any way they choose, providing they are compliant with this manual for the annual report and with International Financial Reporting Standards (IFRS) and the additional requirements in the DHSC GAM for the annual accounts. The sections of the annual report and accounts must follow the overall format set out in paragraph 1.10.

Deadlines, approval and publication procedures

1.12 The deadlines for the production of the NHS foundation trust annual reports and accounts for the year ended 31 March 2026 will be published separately and available on the NHS England website. Please note it is the responsibility of the trust’s accounting officer (not the auditor) to comply with these requirements. Our annual report and accounts timetable forms part of our direction to foundation trusts on the requirements for annual accounts.

1.13 Auditors are required to read the information in the annual report and refer to this in their audit report. Therefore, the draft annual report must be submitted to the auditor to allow them sufficient time to do this prior to signing their opinion on the accounts.

1.14 The annual report and accounts submitted after audit (per timetable referred to in paragraph 1.12) must be formally approved by the NHS foundation trust board of directors (the board). After approval by the board, the chief executive, as the accounting officer, should sign and date the statement of financial position and annual report (as guided in our direction) as evidence of this. As accounting officer, the chief executive should also sign the foreword to the accounts, the annual governance statement and the remuneration report. The annual report and accounts should disclose the name of the person who signed them. Once the annual report and accounts have been approved the auditor will sign the opinion on the accounts.

1.15 Once the annual report and accounts have been approved, the chief executive (in capacity as accounting officer) and director of finance must sign a certificate which states that the consolidation schedules are consistent with the annual accounts. Annex 2 to this chapter includes the required wording for such a certificate.

1.16 All documents referenced in the FT ARM to be signed by the chief executive (in capacity as accounting officer) refer to the chief executive in post at the date of signing, even if, for example, that chief executive was not in post during the financial year. The previous chief executive should not sign, or countersign with the current chief executive. The principle is that the accounting officer must ensure they have sufficient assurance to personally sign the documents.

1.17 NHS foundation trusts are required to lay their annual report and accounts, with any report of the auditor on them, before Parliament (paragraph 25(4)(a)), schedule 7 of the 2006 Act) to enable parliamentary scrutiny.

1.18 The requirement to lay the annual report and accounts before Parliament means that they are classified as an act paper and become the property of Parliament. There are strict rules about the format of the publication and these must be followed in every case. Full details are contained in annex 5 to chapter 2 of the DHSC GAM 2025/26 and in separate guidance issued by the Department of Health and Social Care.

1.19 The annual report and accounts that are laid before Parliament must include the full statutory accounts and not summarised information. The annual report and accounts each NHS foundation trust submits to Parliament to be laid must be 1 document.

1.20 The annual report submitted at the end of the audit process (see timetable referred to in paragraph 1.12) must include all of the text which will be included in the final publication submitted to Parliament. This is because the auditors will need to see the form of the annual report prior to signing their opinions. The period before submission to Parliament is to allow NHS foundation trusts time to format the document to the standards required for publication.

1.21 Until the annual report and accounts have been laid before Parliament nothing can be published by the NHS foundation trust for the wider public.

1.22 Once laid before Parliament the annual report and accounts cannot be changed. However, NHS foundation trusts have the discretion to publish an additional summarised document locally; see paragraph 1.28 for more details.

1.23 Copies of the audited annual accounts, any report of the auditor and the latest annual report must be made available for inspection by members of the public free of charge at all reasonable times. It is the foundation trust’s own responsibility to ensure that once laid before Parliament, the annual report and accounts are made available to the public. The foundation trust should publish the annual report and accounts on its website to facilitate this. Any person who requests a copy of or an extract from any of these documents must be provided with one, although a reasonable copying charge may be levied where the person requesting a physical copy or extract is not a member of the NHS foundation trust (paragraph 22(4), schedule 7 of the 2006 Act).

1.24 Local auditors of NHS foundation trusts will issue a certificate of audit completion alongside the audit report to mark the completion of their responsibilities under the National Audit Office’s (NAO) Code of Audit Practice. The finalised annual report and accounts as laid before Parliament and published must contain the audit report but the certificate of audit completion may be published separately at a later date. Where the certificate of audit completion is received later, it must be published separately on the foundation trust’s website alongside the annual report and accounts. The annual report and accounts document itself is not amended. The certificate of audit completion is not laid before Parliament.

1.25 The NAO’s guidance to auditors requires foundation trust auditors to issue an auditor’s annual report. The auditor’s annual report is intended to be a public document and foundation trusts must ensure that the document is made available to members of the public free of charge. The document should not be made publicly available until after the annual report and accounts have been laid before Parliament. The auditor’s annual report should be published on the foundation trust’s website alongside the annual report and accounts.

Annual general meeting of the council of governors

1.26 The annual report and accounts and auditor’s report* on the accounts must be presented to the council of governors at a meeting of the council of governors (paragraph 28, schedule 7 of the 2006 Act). This meeting of the council of governors should be convened within a reasonable timescale after the end of the financial year but must not be before the annual report and accounts have been laid before Parliament.

*The auditor’s report contains the audit opinion and is included within the annual report and accounts. The audit report does not include the audit completion certificate.

1.27 It is suggested that an advertisement be placed in the local media not less than 14 days prior to the date of the meeting, stating:

- the time, date and location of the meeting

- that copies of the annual report and accounts (or annual report and summary financial statements) of the NHS foundation trust are available, on request, prior to the meeting and how copies can be obtained

Performance report: overview with supplementary material

1.28 Once the full annual report and accounts have been laid before Parliament, NHS foundation trusts have discretion as to whether they wish to publish a separate performance report: overview* together with supplementary material in addition to the full annual report and accounts.

*The Companies Act 2006 refers to publishing a strategic report with supplementary material. The FReM has replaced the strategic report in the public sector with the performance report. NHS England considers that the performance report: overview section (as defined in chapter 2) is the equivalent to the strategic report for these purposes.

1.29 The performance report: overview and supplementary material must be made available to the public free of charge, although a reasonable copying charge may be levied for hard copies of the full audited accounts. The supplementary material must, as a minimum in accordance with s426A of the Companies Act 2006:

- contain a statement that the performance report: overview with supplementary material is only part of the foundation trust’s annual report and accounts

- state how a person can obtain a copy of the foundation trust’s full annual report and accounts

- state whether the auditor’s report on the full annual report and accounts was unmodified or modified and, if qualified, set out the auditor’s report in full together with any further material needed to understand the modification

- state whether, in that auditor’s report, the auditor’s statement as to whether the performance report and accountability report was consistent with the accounts was unqualified or qualified and, if it was qualified, set out the qualified statement in full together with any further material needed to understand the qualification

- contain a copy of that part of the directors’ remuneration report which sets out the single total figure table in respect of the foundation trust’s directors’ remuneration (in accordance with the requirements of chapter 2 of this manual)

1.30 The performance report: overview and supplementary material must also contain the annual governance statement.

1.31 The performance report: overview and supplementary material must not be published before the full annual report and accounts have been laid before Parliament.

NHS foundation trusts in their first period of operation

1.32 In the first period of operation of an NHS foundation trust as a new legal entity (including authorisation of a predecessor NHS trust), any requirement in the FT ARM to provide a prior period comparative against a disclosure should be ignored and no comparatives presented. Where a disclosure shows movements in the current year (for example the table for total pension entitlements), ‘1 April xxxx’ should instead be substituted with the start of the current reporting period.

NHS foundation trusts in their first period of operation following authorisation of an existing NHS trust

1.33 When an NHS trust is authorised as an NHS foundation trust, an annual report and accounts must still be published for the final period of the NHS trust’s existence. This may cover a full financial year where the change in status occurs on 1 April or a shorter period where the change in status occurs during the financial year. NHS foundation trusts will be required to prepare the final accounts and summarisation schedules for the predecessor NHS trust and meet the deadlines set by NHS England.

1.34 A public meeting must be held by 30 September following the end of the financial year in which the NHS foundation trust was authorised at which the predecessor NHS trust’s final annual report and accounts for the final period of NHS trust status must be presented.

1.35 The annual report, annual accounts and consolidation schedules for the final period of NHS trust status must be prepared in accordance with the DHSC GAM for the period in question as applicable to NHS trusts. 2 separate annual reports and accounts should be produced (rather than combined into 1) as the corporate governance regimes and reporting frameworks are different for each type of body.

1.36 Further details are set out in annex 9 to chapter 4 of the DHSC GAM.

NHS foundation trusts in their final period of operation

1.37 Where an NHS foundation trust ceases to exist during or at the end of a financial year, the annual report and accounts should be prepared for that period in accordance with this manual and the DHSC GAM. The annual report and accounts should be prepared for the period from 1 April up to the date that the NHS foundation trust ceased to exist. This date may be considered to be the day before the date cited in a transfer order and/or legislation which transfers assets and liabilities to other bodies and dissolves the trust at midnight on that date. For example, if the trust is dissolved on 1 October (at midnight), it is reasonable to prepare the final period accounts as at 30 September, immediately prior to the outward transfers. References to 31 March elsewhere in this manual should be read as the date at the end of the reporting period. The final period annual report and accounts should be submitted in line with the standard timetable referred to in paragraph 1.12 above.

1.38 When an NHS foundation trust ceases to exist and its services, assets and liabilities are transferring to another NHS body/(ies) or the Secretary of State, one of the receiving bodies will assume responsibility for the preparation of the final period annual report and accounts. Where the transfer and closure occurs significantly earlier than 31 March, the receiving body may wish to prepare the final period accounts in advance of the deadlines referred to in paragraph 1.12. In any case, the annual report and accounts can only be finalised once the post-consultation FT ARM and DHSC GAM for that year have been issued. The receiving body will also be asked to provide a later events after the reporting period confirmation to NHS England for the purposes of the consolidated foundation trust accounts and the whole of government accounts.

1.39 The chief executive of the nominated receiving body referred to in paragraph 1.38 will be required to take on the role of accounting officer for this final period annual report and accounts. The chief executive should ensure they are able to obtain the necessary assurances to enable them to make the required declarations. The previous chief executive should not sign or countersign the final period annual report and accounts with the current chief executive.

1.40 NHS foundation trusts are reminded to refer to the DHSC GAM which sets out how the going concern concept is adapted for the public sector. This definition will continue to apply to the final period annual report and accounts.

1.41 Where an NHS foundation trust in special administration has ceased to provide services and its NHS provider licence has been revoked during the year but the entity continued to exist at the end of the financial year, it remains that foundation trust’s responsibility to prepare an annual report and accounts for the year and have them audited. The annual report and accounts will be prepared for the full financial year and should be prepared in accordance with the requirements of this manual. It is likely that such a shell organisation will have arrangements in place with another entity (probably a receiving body for its former services) to prepare the annual report and accounts on its behalf, but it is the accounting officer of the now unlicensed foundation trust who will certify the annual report and accounts.

1.42 The requirement in paragraph 28, schedule 7 of the 2006 Act that an NHS foundation trust’s annual report and accounts must be presented to the council of governors does not apply to the final period annual report and accounts. This is because the council of governors for that NHS foundation trust will no longer exist when the final period annual report and accounts are prepared.

1.43 The requirement in paragraph 25(4a), schedule 7 of the 2006 Act that an NHS foundation trust’s annual accounts should be laid before Parliament will continue to apply. This responsibility will fall to the receiving body referred to in paragraphs 1.38 and 1.39. Where the foundation trust continues to exist but is unlicensed at the end of the financial year, that foundation trust is responsible for ensuring the annual report and accounts are laid before Parliament, although this may be performed with the support of another organisation as envisaged by paragraph 1.41.

1.44 Quality accounts are prepared for a 12-month period*; therefore an organisation that demises before 31 March is not required to prepare a quality account.

1.45 Further guidance is provided in annex 9 to chapter 4 of the DHSC GAM.

*Specified in section 9(2) of the Health Act 2009

Annex 1 to chapter 1: decisions and directions

National Health Service Act 2006

Decision by NHS England in respect of NHS foundation trusts’ annual reports

NHS England, in exercise of powers conferred on it by paragraph 26 of schedule 7 to the National Health Service Act 2006, hereby decides that:

- The annual report of each NHS foundation trust shall be in the form and provide such information as laid down in the annual reporting guidance for NHS foundation trusts within the NHS foundation trust annual reporting manual (FT ARM) that is in force for the relevant financial year.

- The annual report of each NHS foundation trust shall be submitted in accordance with the requirements specified in the FT ARM and accompanying timetable as to when such reports must be sent to NHS England.

- The following sections contained in each annual report shall be signed and dated by the chief executive of the NHS foundation trust to which it relates:

- the performance report

- the accountability report

- the remuneration report

- the annual governance statement

Signed by authority of NHS England

Signed:

Name: Sir James Mackey (NHS England Chief Executive)

Dated: February 2026

National Health Service Act 2006

Directions by NHS England in respect of NHS foundation trusts’ accounts

NHS England, with the approval of the Secretary of State, in exercise of powers conferred on it by paragraphs 24(1A) and 25(1) of schedule 7 to the National Health Service Act 2006 (the ‘2006 Act’), hereby gives the following directions:

1. Application and interpretation

(1) These directions apply to NHS foundation trusts in England.

(2) In these directions:

(a) references to “the accounts” and to “the annual accounts” refer to:

for an NHS foundation trust in its first operating period since being authorised as an NHS foundation trust, the accounts of an NHS foundation trust for the period from point of licence until 31 March

for an NHS foundation trust in its second or subsequent operating period following initial authorisation, the accounts of an NHS foundation trust for the period from 1 April until 31 March

for an NHS foundation trust in its final period of operation and which ceased to exist as an entity during the year, the accounts of an NHS foundation trust for the period from 1 April until the end of the reporting period

(b) ‘the NHS foundation trust’ means the NHS foundation trust in question.

2. Form and content of accounts

(1) The accounts of an NHS foundation trust kept pursuant to paragraph 24(1) of schedule 7 to the 2006 Act must comply with the requirements of the Department of Health and Social Care Group accounting manual (DHSC GAM) in force for the relevant financial year.

3. Annual accounts

(1) The annual accounts submitted under paragraph 25 of schedule 7 to the 2006 Act shall show, and give a true and fair view of, the NHS foundation trust’s income and expenditure, cash flows and financial state at the end of the financial period.

(2) The annual accounts shall follow the requirements as to form and content set out in chapter 1 of the NHS foundation trust annual reporting manual (FT ARM) in force for the relevant financial year.

(3) The annual accounts shall comply with the accounting requirements of the Department of Health and Social Care Group accounting manual (DHSC GAM) as in force for the relevant financial year.

(4) The statement of financial position shall be signed and dated by the chief executive of the NHS foundation trust.

4. Annual accounts: statement of accounting officer’s responsibilities

(1) The statement of accounting officer’s responsibilities in respect of the accounts shall be signed and dated by the chief executive of the NHS foundation trust.

5. Annual accounts: foreword to accounts

(1) The foreword to the accounts shall be signed and dated by the chief executive of the NHS foundation trust.

Signed by the authority of NHS England

Signed:

Name: Sir James Mackey (NHS England Chief Executive)

Dated: February 2026

Annex 2 to chapter 1: example certificate on summarisation schedules

Download annex 2 to chapter 1: example certificate on summarisation schedules.

2. Annual reporting guidance for NHS foundation trusts

21. This chapter sets out the requirements for the content and format of the annual report element of the annual report and accounts of NHS foundation trusts.

Content of the annual report

2.2 The annual report of NHS foundation trusts must, as a minimum, include:

- the performance report, comprising:

- overview of performance

- performance analysis

- the accountability report, comprising:

- directors’ report

- remuneration report

- staff report

- the disclosures set out in the Code of governance for NHS provider trusts

- NHS oversight framework

- statement of accounting officer’s responsibilities

- annual governance statement.

2.3 The annual report may, at the NHS foundation trust’s discretion, include additional reporting covering equality, the Modern Slavery Act 2015 and the NHS Constitution.

Principles to follow when preparing the annual report

2.4 The annual report should be prepared on the same ‘group’ basis as the accounts, including narrative. If the foundation trust has judged that it controls 1 or more entities under accounting standards for the purposes of its accounts, those entities should be included in the annual report disclosures where relevant. For example, when determining ‘senior managers’ for the remuneration report as required by paragraph 2.54, if a controlled entity is material then consideration should be given to whether any senior managers of that entity meet the definition of a senior manager for the foundation trust group as a whole.

2.5 Chapters 2 and 3 of HM Treasury’s financial reporting manual (FReM) offer guidance on best practice in financial and narrative reporting. While primarily written for central government, the principles apply equally to NHS foundation trusts. In particular preparers should be mindful of its guidance on:

- whether information should be published, and questions to ask in determining this

- the importance of linking different parts of the annual report and accounts and achieving a balanced narrative overall

- the value of presenting trend data where available and guidance on the use of graphics and charts

2.6 The National Audit Office has produced good practice in annual reporting which gives examples from actual annual reports of engaging presentation of information. The document is written for use across government but includes examples from NHS bodies.

Performance report

2.7 The purpose of the performance section of the annual report is to provide information on the entity, its main objectives and strategies and the principal risks that it faces. The requirements of the performance report are based on the requirements of a strategic report as set out in with sections 414A, 414C and 414D* of the Companies Act 2006, except for sections 414A(5) and (6) and 414D(2) which are not relevant. These requirements have been adapted for the public sector and NHS foundation trusts. The minimum requirements are contained in the subsequent paragraphs of this manual and foundation trusts do not need to refer to the regulations in order to meet the minimum requirements.

*As inserted/amended by the Companies Act 2006 (Strategic Report and Directors’ Report) Regulations 2013 (SI 2013/1970).

2.8 The performance report must provide a fair, balanced and understandable analysis of the entity’s performance, in line with the overarching requirement for the annual report and accounts as a whole to be fair, balanced and understandable.

2.9 Performance of the organisation in both the overview and performance analysis should cover all aspects of performance and not only financial. This should include delivery against quality improvement priorities and performance against the most pertinent indicators for the NHS foundation trust in the NHS Oversight Framework 2025/26. Linkage should be made to disclosures on quality governance and data quality included in the accountability report.

2.10 As part of the performance report (the overview and performance analysis as appropriate) the NHS foundation trust should review the extent to which the trust has exercised its functions in accordance with the relevant plans of the integrated care board(s) (ICB(s)) for which it is a partner trust; namely (a) the relevant forward plans of the ICB; (b) any joint capital resource plan agreed between the ICB, the trust and the other partner trusts of the ICB*.

*In performing this review the NHS foundation trust may wish to refer to NHS England’s guidance on good governance and collaboration.

2.11 If in the opinion of the directors, the disclosure of impending developments or matters in the course of negotiation would be seriously prejudicial to the interests of the foundation trust, these do not need to be disclosed.

2.12 The performance report shall be signed and dated by the chief executive in their capacity as accounting officer. The auditor will review the performance report for consistency with the financial statements.

2.13 The performance report is required to have 2 sections: an ‘overview’ and a ‘performance analysis’.

Overview

2.14 The purpose of the overview is to give the user a short summary that provides them with sufficient information to understand the organisation, its purpose, the key risks to the achievement of its objectives and how it has performed during the year. In referring to the NHS foundation trust, this should make reference to the objectives of the local health system of which it is a part (see paragraph 2.10). The performance report overview should be a short summary which draws together information from across the annual report and accounts to provide a holistic view of the organisation and its performance during the year. The performance overview should be enough for the lay user to have no need to look further into the rest of the annual report and accounts, unless they were interested in further detail or had specific needs.

2.15 The overview must include:

- a statement from the chief executive providing their perspective on the performance of the foundation trust over the period

- a statement of the purpose and activities of the foundation trust including a brief description of the business model and environment, organisational structure, objectives and strategies

- a brief history of the foundation trust and its statutory background

- a summary of the principal risks faced and how these have affected the delivery of objectives, how they have changed, how they have been mitigated and any emerging risks that may affect future performance. This should only serve as a summary of the further detail on risks provided in the performance analysis section, and cross-referenced to the annual governance statement where relevant*. This should also include the key issues and opportunities arising that could affect the foundation trust in delivering its objectives and/or its future success and sustainability

- a going concern disclosure (as set out below)

- a summary of performance (to the extent not already covered above)

*The description of risk in the overview should serve as a summary of this detail provided in the analysis section. The performance analysis focuses on risks faced and the link to the performance of the organisation. The accountability report (annual governance statement) focuses on the arrangements for risk management, associated internal control, and the effectiveness of those controls. The performance report overview should give a summary. Clear and effective cross-referencing between the 3 sections is encouraged where relevant and appropriate.

Overview: going concern

2.16 There is no presumption of going concern status for NHS foundation trusts. Directors must decide each year whether or not it is appropriate for the NHS foundation trust to prepare its accounts on the going concern basis.

2.17 The FReM explains:

“The anticipated continuation of the provision of a service in the future, as evidenced by inclusion of financial provision for that service in published documents, is normally sufficient evidence of going concern”.

“Where an entity ceases to exist, it should consider whether or not its services will continue to be provided (using the same assets, by another public sector entity) in determining whether to use the concept of going concern for the final set of financial statements”.

2.18 An NHS foundation trust’s assessment of whether the going concern basis is appropriate for its accounts should therefore only be based on whether it is anticipated that the services it provides will continue to be provided with the same assets in the public sector. This is expected to be the case for NHS foundation trusts unless exceptional circumstances indicate otherwise; these should be discussed with NHS England. Where the continued provision of services in the public sector is anticipated to apply, there will not be any material uncertainties over going concern requiring disclosure.

2.19 Where an NHS foundation trust has or is expected to demise in its current organisational form but its services (and accompanying assets) are transferring to another NHS body, this would not prevent the going concern basis for accounts being adopted, and would also not be a material uncertainty on going concern. Clearly the changes to organisational form are important to the user of the annual report and accounts; in this scenario the going concern disclosure should cross-reference to the relevant disclosures elsewhere in the annual report and accounts.

2.20 A typical disclosure would read:

“After making enquiries, the directors have a reasonable expectation that the services provided by the NHS foundation trust will continue to be provided by the public sector for the foreseeable future. For this reason, the directors have adopted the going concern basis in preparing the accounts, following the definition of going concern in the public sector adopted by HM Treasury’s financial reporting manual”.

2.21 Consideration of risks to the financial sustainability of the organisation is a separate matter to the application of the going concern concept. Determining the financial sustainability of the organisation requires an assessment of its anticipated resources in the medium term. Any identified significant risk to financial sustainability is likely to form part of the risks disclosures included in the wider performance report, but is a separate matter from the going concern assessment.

Performance analysis

2.22 The purpose of the performance analysis is for entities to provide a detailed performance summary of how their entity measures its performance, more detailed integrated performance analysis and long-term trend analysis where appropriate.

2.23 As a minimum, the performance analysis must include:

- information on how the foundation trust measures performance, ie what the foundation trust sees as its key performance measures, how it checks performance against those measures and narrative to explain the link between key performance indicators (KPIs), risk and uncertainty

- a more detailed analysis and explanation of the financial and operational performance of the foundation trust during the year and an explanation of the links between different pieces of information, and trend analysis of performance if not included elsewhere. This analysis is required to utilise a wide range of data including key financial information from the financial statements section of the accounts

- further detail on the risk profile of the foundation trust: ie the risks it faces, how risks have affected the organisation in achieving its objectives, how they have been mitigated and how this may affect future plans and performance. This should also cover how risks have changed over time and through the period – including significant changes in risks, such as a change in the likelihood or possible impact, and new and emerging risks. How existing and new risks could affect the entity in delivering its plans and performance in future years should also be discussed. See also note accompanying paragraph 2.15 above

- information about environmental matters, including the impact of the foundation trust’s business on the environment:

- disclose a summary of progress on delivery of the Green Plan*, covering actions taken and planned, and quantitative progress data under a subheading ‘task force on climate-related disclosures’ (TCFD), follow the requirements detailed in annex 7 to chapter 2** on a comply or explain basis. Preparers may also cross-refer to disclosures elsewhere in the annual report such as the annual governance statement or other content such as green plans rather than duplicate this material in this section of the annual report.

- information on the trust’s work to tackle health inequalities, including the extent to which the trust has exercised its functions consistent with NHS England’s statement under section 13SA(1) of the NHS Act 2006 on how NHS bodies should exercise their powers to collect, analyse and publish information related to health inequalities. This statement is available on the NHS England website.

- information about social, community, anti-bribery and human rights issues including information about any trust policies and the effectiveness of those policies

- any important events since the end of the financial year affecting the foundation trust and

- details of any overseas operations.

*Guidance on preparing a green plan is provided by the Greener NHS programme and is required by service condition 18 of the NHS Standard Contract.

**These requirements from HM Treasury apply to entities that have more than 500 employees or have operating income exceeding £500m. All NHS foundation trusts have more than 500 employees.

2.24 The performance analysis should provide a summary of how equality of service delivery to different groups has been promoted through the organisation. The disclosure may include information regarding the following, or cross-referenced to other publications containing such information:

- how the entity has had due regard to the aims of the public sector equality duty where applicable

- customer satisfaction scores broken down by protected characteristics where collected

- performance against equality of service delivery KPIs and metrics if applicable

- explanations of activities the entity is undertaking to promote equality of service delivery

Accountability report

2.25 The accountability report of the annual report comprises:

- directors’ report

- remuneration report

- staff report

- the disclosures set out in the Code of governance for NHS provider trusts

- NHS oversight framework

- statement of accounting officer’s responsibilities

- annual governance statement.

2.26 The accountability report shall be signed and dated by the chief executive in their capacity as accounting officer.

2.27 The auditor will review the accountability report for consistency with the financial statements. The following parts of the accountability report will also be subject to audit:

- the elements of the remuneration report designated as subject to audit (see paragraphs 2.51 to 2.99) which comprise:

-

-

- single total figure table of remuneration for each senior manager

- pension entitlement table and other pension disclosures for each senior manager

- fair pay disclosures

- payments to past senior managers, if relevant

- payments for loss of office, if relevant

-

- staff report: exit packages, if relevant

- staff report: analysis of staff numbers

- staff report: analysis of staff costs

Directors’ report

2.28 The Directors’ report should include the items listed below, unless disclosed elsewhere in the annual report and accounts in which case a cross-reference may be provided. These requirements are based on the requirements of the FReM, together with some additional requirements adopted by NHS England from the regulations*.

- the names of the chairperson, the deputy chairperson (where there is one) and the chief executive

- the names of individuals who at any time during the financial year were directors of the NHS foundation trust

- details of company directorships and other significant interests held by directors or governors which may conflict with their management responsibilities. Where the NHS foundation trust maintains a register of interests that is open to the public, the disclosure may be limited to a comment on how access to the information in that register may be obtained

- (for public sector information holders only) – a statement that the NHS foundation trust has complied with the cost allocation and charging guidance issued by HM Treasury**

- details of any political donations

- a statement describing the better payment practice code, or any other policy adopted on payment of suppliers, and performance achieved. The disclosure of performance should include the number and value of (i) invoices paid within 30 days (ii) invoices that were or should have been paid within that 30-day period, and (iii) the proportion of (i) compared to (ii). To retain consistency with the disclosure made by NHS trusts, this should be split between NHS and non-NHS payables

- the total amount of any liability to pay interest which accrued by virtue of failing to pay invoices within the 30 day period where obligated to do so, and the total amount of interest actually paid in discharge of any such liability

- disclosures relating to the well-led framework (see below)

- information on fees and charges (income generation) if not included in the accounts (see below)

- income disclosures as required by section 43(2A) of the NHS Act 2006.

*The requirements are based on sections 415, 416 and 418 of the Companies Act 2006 (section 415(4) and (5) and section 418(5) and (6) would not apply to NHS foundation trusts) as inserted by SI 2013(1970) and regulation 10 and schedule 7 of the Large and medium-sized companies and groups (accounts and reports) regulations 2008 (‘the Regulations’).

**This guidance relates to chapter 6 of Managing public money

The Care Quality Commission and NHS England well-led framework

2.29 NHS foundation trusts are required to include in the directors’ report a section which gives a brief overview of the arrangements in place to ensure that services are well-led*. This should provide information or signpost the reader to where the trust’s approach to ensuring services are well led is discussed in more detail in the annual report (for example, in the annual governance statement or performance report). The section should summarise briefly:

- how the foundation trust has had regard to the well-led framework in arriving at its overall evaluation of the organisation’s performance, internal control and board assurance framework, and a summary of action plans to improve the governance of quality

- material inconsistencies (if any) between the annual governance statement, other parts of the annual report, and reports arising from Care Quality Commission planned and responsive reviews of the NHS foundation trust and any consequent action plans developed by the NHS foundation trust

*The Care Quality Commission and NHS England well-led framework is published on the CQC’s website.

2.30 In addition to the recommended disclosures in respect of the strategies, performance, resources and financial position of the business in the performance report and directors’ report, NHS foundation trusts may wish to consider highlighting information about patient care activities and stakeholder relations, for example:

Patient care

- descriptions of how the NHS foundation trust is using its foundation trust status to develop its services and improve patient care

- performance against key healthcare targets

- arrangements for monitoring improvements in the quality of healthcare and progress towards meeting any national and local targets, incorporating Care Quality Commission assessments and reviews and the NHS foundation trust’s response to any recommendations made

- progress towards targets as agreed with local commissioners, together with details of other key quality improvements

- any new or significantly revised services

- service improvements following staff or patient surveys/ comments and Care Quality Commission reports

- improvements in patient/carer information

- information on complaints handling

Stakeholder relations

- descriptions of significant partnerships and alliances entered into by the NHS foundation trust to facilitate the delivery of improved healthcare. These should be described together with the benefits to patients and the methods used to fund these activities

- development of services involving other local services/agencies and involvement in local initiatives

- consultation with local groups and organisations, including the overview and scrutiny committees of local authorities covering the membership areas

- any other public and patient involvement activities

Fees and charges (income generation)

2.31 Foundation trusts should disclose the income and full cost associated with fees and charges levied by the trust where the full cost exceeds £1 million or the service is otherwise material to the accounts. If this disclosure is included in the accounts (per DHSC GAM chapter 5) it need not be repeated in the annual report*.

*Further information can be found in chapter 6 of Managing Public Money (MPM). MPM gives guidance on how to measure the ‘full cost’: this includes a sensible apportionment of overheads associated with delivery of the activity.

Income disclosures required by section 43(2A) of the NHS Act 2006

2.32 Section 43(2A) of the NHS Act 2006 (as amended by the Health and Social Care Act 2012) requires that the income from the provision of goods and services for the purposes of the health service in England must be greater than its income from the provision of goods and services for any other purposes. NHS foundation trusts should include a statement in their annual report that they have met this requirement, or where they have not met the requirement this fact should be disclosed, together with the principal reasons and the actions that the NHS foundation trust is taking to ensure that they meet the requirement in future financial years.

2.33 As required by section 43(3A) of the NHS Act 2006, an NHS foundation trust must provide information on the impact that other income it has received has had on its provision of goods and services for the purposes of the health service in England.

Remuneration report

2.34 The FReM requires NHS foundation trusts to prepare a remuneration report in their annual report and accounts. The FReM and NHS England requires that this remuneration report complies with:

- sections 420 to 422 of the Companies Act 2006 (section 420(2) and (3), section 421(3) and (4) and section 422(2) and (3) do not apply to NHS foundation trusts)

- regulation 11 and parts 3 and 5 of schedule 8* of the Large and medium-sized companies and groups (accounts and reports) regulations 2008 (SI 2008/410) (“the Regulations”)

- parts 2 and 4 of schedule 8 of the regulations as adopted by this manual

- elements of the Code of governance for NHS provider trusts

*Schedule 8 as substituted by The Large and medium-sized companies and groups (accounts and reports) (amendment) regulations 2013 (SI 2013/1981).

2.35 The remuneration report must be signed by the chief executive.

2.36 The remuneration report must disclose information on those persons in senior positions having authority or responsibility for directing or controlling the major activities of the NHS foundation trust. This means those who influence the decisions of the NHS foundation trust as a whole rather than the decisions of individual directorates or sections within the NHS foundation trust. Such persons will include advisory and non-executive board members. In the following paragraphs, such persons are described as “senior managers”. As guided by paragraph 44(1) of part 7 of schedule 8 to the Regulations, figures included in this table should include the aggregate amount paid to a senior manager in respect of their services as a senior manager of the foundation trust and amounts received in respect of their services as a senior manager of a subsidiary or other undertaking of the foundation trust. Preparers should refer to the Regulations for more guidance if required.

2.37 The remuneration report comprises the following 3 sections:

- annual statement on remuneration

- senior managers’ remuneration policy

- annual report on remuneration (of which some elements are subject to audit)

Each of these three sections is described below.

Annual statement on remuneration

2.38 The remuneration report should contain an annual statement from the chair of the remuneration committee summarising for the financial year:

- the major decisions on senior managers’ remuneration

- any substantial changes relating to senior managers’ remuneration made during the year

- the context in which those changes occurred and decisions have been taken

Senior managers’ remuneration policy

2.39 The information required below must be set out in a separate section of the remuneration report and constitutes the senior managers’ remuneration policy of the foundation trust.

2.40 Future policy table:

- In table form, a description of each of the components of the remuneration package for senior managers which comprise the senior managers’ remuneration policy (including, but not limited to the items which are relevant for the purposes of the single total figure table). Where the explanation describes components that apply generally to all senior managers, the table must also include any particular arrangements which are specific to any individual senior manager.

- For each component described in the table, set out:

- how that component supports the short- and long-term strategic objectives of the foundation trust

- an explanation of how that component operates

- the maximum that could be paid in respect of that component (which may be the monetary amount or a description)

- where applicable, a description of the framework used to assess performance, including:

- a description of any performance measures that apply, and where more than 1 performance measure an indication of the weightings used

- details of the performance period

- the amount (expressed in monetary terms or otherwise) that may be paid in respect of

- the minimum level of performance that results in any payment under the policy

- any further levels of performance set in accordance with the policy

and in a note accompanying the table, an explanation of why any performance measures were chosen and how any performance targets are set

-

-

- an explanation of whether there are any provisions for the recovery of sums paid to directors or for withholding the payments of sums to senior managers

-

- Accompanying notes setting out, where applicable:

- for any new components of the remuneration package, why they have been introduced

- any changes made to existing components of the remuneration package

- an explanation of the differences between the foundation trust’s policy on senior managers’ remuneration and its general policy on employees’ remuneration.

- For non-executive directors, the policy for the components of their remuneration may be set out in a separate table, which must include:

- the fee payable to such directors

- any additional fees payable for any other duties to the foundation trust

- such other items that are considered to be remuneration in nature

2.41 The NHS very senior managers pay framework is published by the Department of Health and Social Care (DHSC) and NHS England and states that all NHS trusts and NHS foundation trusts are expected to comply with the framework.

- As part of the disclosure of remuneration policy, entities must include a statement that they have complied with the framework. In addition where national approval for a pay case was required by the framework during the reporting year, the disclosure should include confirmation that approval was sought and received.

- Any departure from the NHS very senior manager pay framework should be explained within the remuneration report policy disclosure for the reporting year in which the decision was made.

2.42 Service contracts obligations

- A description of any obligation on the foundation trust which:

- is contained in all senior managers’ service contracts

- is contained in the service contracts of any one or more existing senior managers (not including any obligations in the preceding disclosure) and/or

- the foundation trust proposes would be contained in senior managers’ service contracts to be entered into

and which could give rise to, or impact on, remuneration payments or payments for loss of office but which is not disclosed elsewhere in the remuneration report.

2.43 Policy on payment for loss of office

- The policy on the setting of notice periods under senior managers’ service contracts.

- The principles on which the determination of payments for loss of office will be approached, including:

- an indication of how each component will be calculated

- whether, and if so how, the circumstances of the loss of office and the senior manager’s performance are relevant to any exercise of discretion

2.44 Statement of consideration of employment conditions elsewhere in the foundation trust

- a statement of how the pay and conditions of employees (including any other group entities) were taken into account when setting the remuneration policy for senior managers

- whether, and if so how, the foundation trust consulted with employees when preparing the senior managers’ remuneration policy

- whether any remuneration comparisons were used and if so, what they were and how the information was taken into account

2.45 The policy on diversity and inclusion used by the remuneration committee, the policy objectives and link to the trust’s strategy, how it has been implemented and progress on achieving the objectives. This can cross-reference to disclosure provided in the staff report (as required by paragraph 100) as appropriate.

Annual report on remuneration

2.46 This section of the remuneration report includes some elements that are subject to audit.

2.47 In making the required remuneration report disclosures, entities may need to use estimates and make judgements. These should be clearly explained to assist users. Where expected approaches to disclosure requirements are impracticable for the entity to follow this should be stated and the approach taken by the entity should be disclosed.

Information not subject to audit

2.48 Service contracts

For each senior manager who has served during the year, disclose the date of their service contract, the unexpired term, and details of the notice period.

2.49 Remuneration committee

The report must contain the following details in respect of the remuneration committee:

- details of the membership of the remuneration committee. This means the names of the chair and members of the remuneration committee should be disclosed (Code of governance B.2.13)

- the number of meetings and individuals’ attendance at each should also be disclosed (Code of governance B.2.13)

- the name of any person (and in particular any director of the trust who was not a member of the committee) who provided advice or services to the committee that materially assisted the committee in their consideration of any matter

Where such a person was neither a director or employee of the trust, nor someone providing legal advice on compliance with any relevant legislation:- a description of the nature of any other services that person has provided to the trust during the financial year

- by whom the advisor was appointed, whether or not by the committee and how they were selected

- whether and how the committee satisfied itself that the advice received was objective and independent

- the fee or other charge paid by the foundation trust to the advisor for the remuneration advice or services received and the basis on which it was charged

2.50 Disclosures relating to specific pay and remuneration matters

The following information is required by paragraph 26(2) of schedule 7 to the NHS Act 2006, and is not subject to audit:

- information on the corporation’s policy on pay and on the work of the committee established under paragraph 18(2) of schedule 7 to the NHS Act 2006, and such other procedures as the corporation has on pay

- information on the remuneration of the directors and on the expenses of the governors and the directors

The NHS foundation trust should assess whether it considers the requirements of the first bullet point above to be already met by the disclosures in the remuneration report and staff report.

NHS England considers that information relating to the expenses of the governors and the directors should (separately for governors and for directors) include:

- the total number of [governors/directors] in office

- the number of [governors/directors] receiving expenses in the reporting period

- the aggregate sum of expenses paid to [governors/directors] in the reporting period

Disclosures should be made in £00 rather than £000 and be on an accruals basis. Comparative period information should be provided.

Information subject to audit

2.51 The following information is required by paragraphs 4 to 16 inclusive of part 3 of schedule 8 to the Regulations or by the FT ARM, and is subject to audit. The disclosures subject to audit are detailed below in paragraphs 2.52 to 2.99, including the supporting definitions.

2.52 The report should contain a single total figure for remuneration for each senior manager (see definition below) who served during the year shown in tabular form (‘the single total figure table’). The format of this table is as follows:

The single total figure table

|

|

a |

b |

c |

d |

e |

Total |

|

Units |

£000, bands of £5k |

£s, to the nearest £100 |

£000, bands of £5k |

£000, bands of £5k |

£000, bands of £2.5k |

£000, bands of £5k |

|

Director 1 |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

|

Director 2 |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

2.53 In the table above:

- ‘a’ is salary and fees (in bands of £5,000)

- ‘b’ is all taxable benefits (total to the nearest £100)

- ‘c’ is annual performance-related bonuses (in bands of £5,000)

- ‘d’ is long-term performance-related bonuses (in bands of £5,000)

- ‘e’ is all pension-related benefits (in bands of £2,500)

- additional columns must also be included for any other items in the nature of remuneration – but excluding payments to former senior managers (see below)

- the final column is total of the above items (in bands of £5,000)

- each of the above requirements is described in further detail below

- prior year comparatives are required for each of the amounts

- as set out in paragraph 8(3) of the Regulations, where the calculations of any of these columns in accordance with the detail below result in a negative value (other than in respect of a recovery or withholding), the result should be expressed as zero in the relevant column in the table

Definition of ‘senior managers’

2.54 The definition of ‘senior managers’ is “those persons in senior positions having authority or responsibility for directing or controlling the major activities of the NHS foundation trust”. The chief executive should confirm whether this covers more than the chair, the executive and non-executive directors of the NHS foundation trust (who should be treated as senior managers as a matter of course).

2.55 This note covers all those individuals who hold or have held office as chair, non-executive director, executive director or senior manager (as identified by the chief executive) of the NHS foundation trust during the reporting year. It is irrelevant that:

- an individual was not substantively appointed (holding office is sufficient, irrespective of defects in appointment)

- an individual’s title as director included a prefix such as ‘temporary’ or ‘alternate’

- an individual was engaged via a corporate body, such as an agency, and payments were made to that corporate body rather than to the individual directly

2.56 There is a presumption that information about named individuals will be given in all circumstances and all disclosures in the remuneration report will be consistent with identifiable information of those individuals in the financial statements. However, entities must inform individuals in advance of the intention to disclose information about them, invite them to see what is intended to be published, and notify them they can object under article 21 of the General Data Protection Regulation (GDPR).

2.57 If a named individual does not agree to disclosure, the trust must consider its approach to the disclosure. Under such circumstances the GDPR requires entities to demonstrate compelling legitimate grounds for the disclosure which override the interests, rights and freedoms of the named individual or for the establishment, exercise or defence of legal claims. NHS foundation trusts are strongly advised to take legal advice in such cases, because a decision not to publish the information may be challenged under the Freedom of Information Act. Where non-disclosure is agreed, the fact that certain disclosures have been omitted should be disclosed.

2.58 Alongside these steps for the remuneration report, NHS foundation trusts should also consider whether any other personal information contained within the annual report and accounts should also be subject to GDPR considerations as set out here.

Senior managers with additional duties (for example, medical directors)

2.59 Remuneration reports are required to disclose a single total figure of remuneration for each person occupying a director post. This should include all remuneration paid by the entity to the individual in respect of their service for the entity, including remuneration for duties that are not part of their management role.

2.60 The disclosure in single total figure table for medical directors and similar staff should therefore represent their total remuneration package from the entity. For transparency, entities should add a footnote underneath the table specifying the element of the individual’s remuneration from the entity that relates to their clinical role. This footnote need not include details of the individual components (columns) of the single total figure table if the split between elements is not available in this detail.

2.61 Where the individual receives part of their remuneration from another body the entity should make disclosures only in respect of its share of the individual’s remuneration.

Column A: salary and fees

2.62 Salary is the gross salary paid/payable to the individual; this should be shown in £5,000 ranges. Where an individual held a contract of employment for the entire financial year but was only a senior manager for 6 months, it is the remuneration for 6 months which should be shown. Where there has been overlap in a post, for example where there have been 2 finance directors for a month, both must be shown.

2.63 Salary includes:

- all amounts paid or payable by the NHS foundation trust to the individual, including recharges from any other health body

- overtime

- the gross cost of any arrangement whereby a senior manager receives a net amount and an NHS foundation trust pays income tax on their behalf

- any financial loss allowances paid in place of remuneration

- any severance payment, including compensation for loss of office or early retirement (see also paragraph 2.88 for additional separate disclosure requirement)

- recruitment and retention allowances

- geographical allowances such as London weighting and

- any ex-gratia payments

2.65 NHS foundation trusts should consider adding additional information to explain the circumstances of an individual senior manager in footnotes to the table if this will help the reader understand the disclosure.

Column B: taxable benefits

2.66 This is the gross value of such benefits before tax. It includes:

- expenses allowances that are subject to UK income tax and paid or payable to the person in respect of qualifying services

- benefits received by the person (other than salary) that are emoluments of the person and are received by them in respect of qualifying services

2.67 A narrative disclosure detailing the types of benefits and, where significant, the amount should be given after the table. Please note that this column should be disclosed in £s, to the nearest £100.

Column C: annual performance-related bonuses

2.68 These comprise money or other assets received or receivable for the financial year as a result of achieving performance measures and targets relating to a period ending in the relevant financial year other than:

- those which result from awards made in a previous financial year and the final vesting is determined as a result of achieving performance measures or targets relating to a period ending in the relevant financial year

- those which are receivable subject to the achievement of performance measures or targets in a future financial year.

2.69 The amounts should be reported in bands of £5,000.

2.70 Where an amount included in column C is for deferred bonus, the amount and percentage of such deferral should be disclosed in a note accompanying the table.

Column D: long-term performance-related bonuses

2.71 These comprise money or other assets received or receivable for periods of more than 1 year where final vesting:

- is determined as a result of achieving performance measures or targets relating to a period ending in the relevant financial year

- is not subject to the achievement of performance measures or targets in a future financial year.

2.72 The amounts should be reported in bands of £5,000.

Performance bonuses – additional matters

2.73 In respect of columns C and D, where the performance measures or targets are substantially (but not fully) completed by the end of the financial year, the amount shown in the table may include sums which relate to the following financial year but this must be explained in the report. In the following year’s report, the amount must not be included as remuneration for that year.

2.74 For every component of remuneration included in columns C or D, a note accompanying the table must disclose:

- details of any performance measures and the relative weighting of each

- for each performance measure:

- the performance targets set at the beginning of the performance period and the corresponding value of bonus achievable

- details of actual performance against the targets set and measured over the performance period and the resulting bonus awarded

- where discretion has been exercised in the award, details of how the discretion was exercised and how the resulting bonus was determined

Column E: pension-related benefits

2.75 This will apply to executives only as non-executive directors do not receive any pensionable remuneration. The amount included here comprises all pension related benefits, including:

- the cash value of payments (whether in cash or otherwise) in lieu of retirement benefit

- all benefits in year from participating in pension schemes.

2.76 For defined benefit schemes*, the amount included here is the annual increase (expressed in £2,500 bands) in pension entitlement determined in accordance with the ‘HMRC’ method**, less any amounts paid by employees. In summary, this is as follows:

Column E = Increase in entitlement – employee contributions

Increase = ((20 x PE) +LSE) – ((20 x PB) + LSB)

Where:

PE is the annual rate of pension that would be payable to the director if they became entitled to it at the end of the financial year.

PB is the annual rate of pension, adjusted for inflation, that would be payable to the director if they became entitled to it at the beginning of the financial year.

LSE is the amount of lump sum that would be payable to the director if they became entitled to it at the end of the financial year.

LSB is the amount of lump sum, adjusted for inflation, that would be payable to the director if they became entitled to it at the beginning of the financial year.

The ‘Disclosure of senior managers’ remuneration (Greenbury)’ document published by the NHS Business Services Authority includes an example of this calculation.

*This includes the NHS Pension Scheme which is a defined benefit scheme, though accounted for locally as a defined contribution scheme.

**The HMRC method derives from s229 of the Finance Act 2004, but is modified for the purpose of this calculation by paragraph 10(1)(e) of schedule 8 of SI 2008/410 (as replaced by SI 2013/1981).

2.77 To help explain these figures to readers of the remuneration report, the foundation trust may wish to include narrative like the following:

‘The value of pension benefits accrued during the year is calculated as the real increase in pension multiplied by 20, less the contributions made by the individual. The real increase excludes increases due to inflation or any increase or decrease due to a transfer of pension rights.

This value derived does not represent an amount that will be received by the individual. It is a calculation that is intended to provide an estimation of the benefit being a member of the pension scheme could provide.

The pension benefit table provides further information on the pension benefits accruing to the individual’.

2.78 Refer to paragraph 2.86 for guidance on senior managers in post for part of the reporting year.

Total pension entitlement

2.79 Under the Companies Act Regulations, disclosure is required for each senior manager of:

- their pension entitlement: this requirement will be covered by inclusion of the pension entitlements table detailed in paragraph 2.80 below

- a description of any additional benefit that will become receivable by a director in the event that that senior manager retires early

- where a senior manager has rights under more than 1 type of pension, separate details relating to each

2.80 The FReM requires the following to be disclosed:

- the real increase during the reporting year in the pension and (if applicable) related lump sum at pension age in bands of £2,500

- the value at the end of the reporting year of the accrued pension and (if applicable) related lump sum at pension age in bands of £5,000

- the value of the cash equivalent transfer value (CETV) at the beginning of the reporting year to the nearest £1,000

- the real increase in the cash equivalent transfer value during the reporting year, to the nearest £1,000

- the value of the cash equivalent transfer value at the end of the reporting year to the nearest £1,000

- in the case of a stakeholder pension account, the employer’s contribution (in these circumstances the first 4 bullet points in this paragraph will not apply).

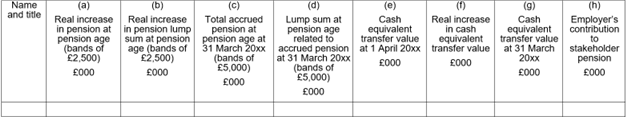

The following tabular format is recommended:

Pension entitlements table

2.81 The CETV is the actuarially assessed capitalised value of the pension scheme benefits accumulated by a member at a particular point in time. The benefits valued are the member’s accumulated benefits and any contingent spouse’s pension payable from the scheme. CETVs are calculated within the guidelines and framework prescribed by the Institute and Faculty of Actuaries.

2.82 The accrued benefits derived from the member’s purchase of added years of service and any ‘transferred-in’ service must be included in these FReM pension disclosures.

2.83 The information required for the senior managers’ pension entitlements will be provided by NHS Pensions. The request for information from NHS Pensions must be made by the NHS foundation trust by the deadline set by NHS Pensions providing complete information at that time.

2.84 Detailed guidance regarding the end of year procedures for requesting information from NHS Pensions can be found on its website.

2.85 Where a senior manager has opted out of the pension arrangements for the whole of the year, no pension figures should be reported and a footnote should be included stating “xxxxx chose not to be covered by the pension arrangements during the reporting year”. If a member opts out or opts in during the year, they should be treated in the same way as a leaver or joiner.

2.86 Where individuals subject to remuneration disclosures have not been a senior manager of the NHS foundation trust for the whole financial year (for example due to joining, leaving, or promotion in the year or due to organisational changes in year), the real increase should be apportioned to reflect the period that the senior manager has been in post at the reporting body, as detailed in guidance from the NHS Business Services Authority (BSA) and the reporting body should make pension disclosures on that basis. The same guidance on apportionment applies to column e in the single total figure table.

2.87 Where the NHS foundation trust has senior managers who are members of a different pension scheme the disclosure information should be requested in good time from the scheme.

Payments for loss of office

2.88 For each individual who was a senior manager in the current or in a previous financial year that has received a payment for loss of office during the financial year, the following must be disclosed:

- the total amount payable to the individual, broken down into each component

- an explanation of how each component was calculated

- any other payments to the individual in connection with the termination of services as a senior manager, including outstanding long-term bonuses that vest on or following termination

- where any discretion was exercised in respect of the payment, an explanation of how it was exercised.

The requirements of annex 1 to chapter 2 which define what should be included in the disclosure of a non-compulsory departure payment also apply to the remuneration report.

Payments to past senior managers

2.89 The report must contain details of any payments of money or other assets to any individual who was not a senior manager during the financial year but has previously been a senior manager at any time. The following payments do not need to be reported in this disclosure:

- payments for loss of office (which are separately reported above)

- payments that are otherwise shown in the single total figure table

- payments that have already been disclosed by the foundation trust in a previous remuneration report

- payments for regular pension benefits that commenced in a previous year

- payments for employment or services provided by the individual other than as a senior manager of the foundation trust.

Fair pay disclosures*