Introduction

This guidance contains the National Cost Collection (NCC) reconciliation and submission information for the ambulance sector that was formerly contained in separate volumes of the NCC guidance. Integrated NCC guidance for the acute, mental health, Talking Therapies for Anxiety and Depression and community sectors can be found separately in the Integrated collections guidance. Note that Talking Therapies was previously called IAPT and the data feed on the extract specification that trusts will submit will still be called IAPT for 2024 NCC.

It refers to supporting information that can be found on our FutureNHS workspace. You can access FutureNHS if you have an NHS email address or email costing@england.nhs.uk to request access if you do not.

Reconciliation and exclusions: how to obtain and record your cost quantum

Introduction

Purpose and context

The National Cost Collection (NCC) collects data about the costs of patient care in the NHS. This means only costs that relate to the ongoing running costs of your trust and not those that are one off.

Some of the costs your trust incurs are not collected, for example:

- caring for another NHS provider’s patients

- caring for non-NHS patients

- services which are funded by non-NHS bodies such as the local authority

- services for which there is no requirement to understand the costs or for which it is not possible to collect the cost.

There are also certain types of income that offset the cost of patient care.

Therefore, you are required to reconcile your trust’s audited year-end accounts and the costs your trust submits in the NCC for its cost quantum because otherwise they will differ.

Completion of the reconciliation must be completed before preparing patient-level costs (PLICS) XML files to obtain your NCC cost quantum. You should not try to work backwards from your submission files to create your NCC cost quantum. Use your draft final accounts to start to prepare this reconciliation.

Reconciliation to your trust’s audited year-end accounts is important for assuring the quality of costing outputs. You need to understand how your organisation’s cost quantum is derived from these accounts, to ensure that your cost model includes all costs and produces reliable and comparable results. As some of your trust’s audited accounts are not part of its cost quantum, a reconciliation is needed to establish the links between the two. The information included in your reconciliation is published as part of the NCC publication.

This section describes the reconciliation process for cost data submitted in the NCC. It is supported by Standard CP5: Reconciliation.

Cost reconciliation

The reconciliation feed type within the extract specification enables you to submit the information from your trust’s audited financial accounts and any adjustments required to your total cost quantum.

The feed name is AMBREC.

You must ensure the income and expenditure amounts entered in each line of the cost reconciliation feed are not duplicated on another line in the feed.

In 2024 the final accounts document will not be finalised until after the NCC guidance is published and therefore the FIN codes used in the reconciliation template, XML reconciliation reference data and integrated technical document will need mapping to the final accounts.

We will supply a mapping table to final accounts template coding on FutureNHS. This can also be useful to draft your reconciliation in preparation for finalising your XML reconciliation.

Reconciliation process

We recommend you review the AMBREC worksheet in the extract specification when you start preparing your annual costing submission. You must be able to accurately map the costing quantum back to your audited financial accounts right from the start of the costing process. Otherwise, reconciliation may prove more complex later.

You must obtain values for the operating expenses, activities other than patient care and accounting adjustments sections of the reconciliation template from the final audited accounts.

In 2024, we will focus our reconciliation checks on the operating expenses, activities other than patient care, accounting adjustments and agreed adjustment sections of the reconciliation. Where there are material differences, you will be required to resubmit.

We also advise scoping all the services your organisation delivers as early as possible to give yourself adequate time to include all of those within your operating expenses that are permitted to be in your cost quantum.

Where one provider is acquired by another mid-year, the acquiring provider must contact us on costing@england.nhs.uk with the subject line Where one provider is acquired by another mid-year, the acquiring provider must contact us on costing@england.nhs.uk with the subject line

Merger group trusts to clarify the action it needs to take for reconciliation.These are the steps we recommend you take to carry out your organisation’s reconciliation.

Financial accounting element

Step 1: Ensure the financial accounts are closed and the final version of the general ledger (GL) is available. Ask colleagues in financial accounts for the information from the final audited accounts.

Step 2: Obtain the final trial balance and/or the GL output, and ensure they agree at the detailed account code level. Familiarise yourself with which income centre each GL code is categorised into.

Step 3: Allocate the lines on the trial balance/output to the relevant lines on the cost reconciliation in partnership with your financial accountant. You can also use Spreadsheet CP2.1: Standardised cost ledger in the technical document.

Step 4: Together with your financial accountant check the figures in Step 3 agree with those in the final audited accounts spreadsheets.

Step 5: Complete the reconciliation up to the pre-costing software subtotal. Ensure your adjustments are a true and fair representation of your audited accounts. Perform a sense check at this point against last year.

The financial accounting element is now complete and you should move onto working with the costs from your costing software to finalise your cost quantum for the financial year. Your subtotal should now only relate to the costs for delivering patient care.

Finalising your cost quantum

Step 6: From the costing system outputs identify the costs of services performed for/by another NHS provider, services out of scope of the NCC and care of non-NHS patients. Adjust for these costs in the appropriate lines of the reconciliation.

Step 7: Request approval from the NHS England costing team before making any extra requirements not explicitly captured in the reconciliation. If approved, we will send you an authorisation code and you need to log this in your cost reconciliation. Adjust the lines in the cost reconciliation.

Development and quality assurance of your costing model in preparation for submission may take some weeks before you move onto Step 8 and Step 9.

Final check

Step 8: Ensure the total cost quantum for the files you are submitting for your cost collection agrees to within ±1% of the total quantum in the reconciliation.

Step 9: Perform a final check of the reconciliation against last year’s to identify any material or unexpected variations. If variations exist, investigate them and make changes as needed.

Operating expenses

Your operating expenses are the starting point for your reconciliation. You derive your cost quantum by adjusting the operating expenses figure, but this must be done transparently using the reconciliation template and not by adjusting the operation expenses figure directly.

Your cost quantum should include costs incurred for any discontinued operations within the financial year. If a patient care operation is discontinued, it should be matched to the appropriate activity. If another type of activity is discontinued, it should be netted off and you need to request an agreed adjustment from us.

Your general ledger (GL) output will often not correlate to your final audited accounts. The basis for the NCC is that your cost quantum is derived from your trust’s final audited accounts. Therefore, you need to work closely with your financial accounting team to understand and interpret the differences between the two and derive costs that relate only to the patient care your trust is responsible for delivering.

Increase in employer’s superannuation

In 2019/20, the employer’s superannuation contribution increased from 14.38% to 20.68%, with the increase of 6.3% being funded centrally by NHS England. Trusts are required to account for the full cost (20.68%) in their operating expenses (TAC08) which will come from ESR allocated in line with staff cost arrangements.

The notional income of 6.3% should be recorded in patient income and will not affect the quantum of costs or the trust’s bottom line. If your trust has recorded this notional income in other operating income in error, please request an agreed adjustment.

We understand this will also be operational for 2023/24.

The cost of the pension increase will inflate the quantum costed by practitioners this year. As this is a recurrent cost of delivering healthcare it should be included in the quantum and allocated to patients.

The income, regardless of how it has been coded, should not be netted off the cost of the increased premiums as it is a cost of providing a service.

To apportion this cost where trusts are unable to easily link this to a specific individual via ESR information, use gross payroll as the basis of apportionment.

Other operating income

This details how you need to submit your trust’s other operating income in the NCC AMBREC. It will ensure only the costs that relate to patient care are included in your cost quantum by reducing the operating expenditure by the value of non-patient care activities.

Non-patient care income categories are:

- education and training (E&T)

- research and development (R&D)

- commercial or other activities not primarily related to providing care to NHS patients.

You will adjust for the income your trust receives for these activities in both the NCC reconciliation and your costing model.

National policy is if the income received for services is more than it costs your organisation to provide them, this contributes to provision of NHS patient care. Therefore, the NCC requires you to net off all income from activities other than patient care from the appropriate cost centre in your cost ledger (CL).

Income from activities other than patient care should be matched to the service that generated the income, offsetting the cost of providing that service. In the AMBREC, income from activities other than patient care is deducted from the total operating expenses.

You need to understand the different types of income recorded in the general ledger and what costs the income relates to, so the outputs from the costing system can be reconciled to the audited accounts. Income groups need to be separated into income that relates and does not relate to patient care. We recommend you familiarise yourself with which income centre each general ledger code is categorised into.

The AMBREC requires you to deduct income from E&T and R&D activities. The totals for other operating income (all) and other operating income – not permitted, should balance with the other operating income in your organisation’s final audit accounts.

Education and training

E&T income should be deducted from the operating expenses in other operating income.

Research and development

R&D comprises the following funding streams:

- Research: Research grant funding to pay for the costs of the R&D itself (for example writing the research paper) received from the Department of Health and Social Care (DHSC) and other bodies including the National Institute for Health Research (NIHR), other government departments, charities and the Medical Research Council (MRC), and which includes funding for biomedical research centres, biomedical research units and collaborations for leadership in applied health research and care (CLARHC).

- NHS support: Funding from DHSC and NIHR to cover extra patient care costs associated with the research (for example extra blood tests, extra nursing time) that end when the research ends.

- Flexibility and sustainability funding: Funding from DHSC mainly to support the NIHR faculty and associated workforce.

Other R&D funding streams relating to patient care costs continue after the research ends. Where there is no income to match to a cost, the income must not be deducted from operating expenses.

- Treatment costs, including excess treatment costs: Funding from normal commissioning arrangements to cover patient care costs associated with the research that would continue to be incurred after the research ends were the service in question to continue.

- Subventions: Exceptional funding from DHSC that contributes to the cost of very expensive excess treatment costs.

We are reviewing how excess treatment costs might be funded differently in future. This could have implications for reporting these costs in future NCCs.

All R&D income regardless of the accounting treatment (IFRS 15 or non-IFRS 15) and from the above funding streams should be deducted from the operating expenses in other operating income.

Apprenticeship levy

The expenditure in relation to the apprenticeship levy will be recorded in operating expenditure, however this should be removed as the value should not be included in the overall cost quantum.

Two elements of income make up the apprenticeship levy balance: one from HMRC and one notional amount. Only the notional amount should be adjusted for, however, providing the balance is recorded in other operating income. This will already reduce the balance of your operating expenditure and no further adjustment is required.

If your notional income is within patient income, you will need to adjust for this in the reconciliation line ‘Non-patient care income recorded in patient care’. The remaining balance from HMRC should remain in your cost quantum.

Remaining other operating income including clinical excellence awards

Income for clinical excellence awards (CEAs) should have been recorded in your organisation’s other operating income and this should not be adjusted for. However, if your CEA income was included as patient income in your audited accounts, you should adjust for it in non-patient care income recorded in patient care.

If you discover patient income within your other operating income, then you must ask for an agreed adjustment from NHS England. For more information This ensures that costs are not artificially reduced. For more information see the government financial reporting manual.

The remaining balance in other operating income should not need to be adjusted, but if you are not sure how to treat a source of income, do contact the NHS England costing team on costing@england.nhs.uk.

Other operating income – not permitted

NHS England does not allow you to take away some income streams from your organisation’s operating expenses known as other operating income – not permitted.

If you have patient-related income in your other operating income, you should not take this away from your operating expenditure.

The income streams you are not permitted to take away are listed in the FutureNHS Other operating income: learning extension. For transparency, adjust for this income in other operating income – not permitted.

For assurance, the Learning extension also lists the types of income that can be included appropriately as part of the total you have used in other operating income.

Non-patient care income recorded in patient care

If you discover non-patient care income that has been incorrectly recorded in patient care income, you must adjust for this in the NCC reconciliation line ‘non-patient care income recorded in patient care’.

The income for FP10 prescriptions should be within other operating income, if this income is incorrectly recorded in patient income, you should adjust for this in ‘non-patient care income recorded in patient care’.

Accounting adjustments

Further adjustments must be made to the ‘operating expenses’ reported in operating expenses from consolidated accounts of the reconciliation. Several non-cash items, such as donations and government grants for non-current assets, must be separately deducted from the operating expenses. Additionally, some income deducted as part of ‘other operating income’ that relates to patient care must be added back to the operating expenses.

Finance income and expenses

Finance income is unrelated to patient care and should be deducted from the operating expenses, whereas finance expenses should be added. Finance expenses for the unwinding of discount should be treated as part of finance expenses.

Public dividends capital

The provider’s public dividends capital (PDC) should be added to the operating expenses.

Profits and losses

Profits from the sale of an asset that contributed to patient care should be deducted from the operating expenses, whereas losses should be added. The sale can be either at fair value or recycled.

Shares of profit from subsidiaries, associates or joint ventures (that is, from group accounts) should be deducted from the operating expenses, whereas shares of loss should be added. The net effect of profits and losses should be calculated, and the resulting adjustment made to the operating expenses, as this figure will not be reflected in your organisation’s cost quantum.

Any profit or loss from the sale of non-current assets in a private finance initiative (PFI) or Local Improvement Finance Trust (LIFT) deal should be deducted from the operating expenses to net off the gain or loss. Only the profit or loss from sales as part of a new PFI or LIFT scheme apply.

Impairments

Impairments charged through the statement of comprehensive income are not included in the NCC and must be removed. The balance of this line should be the net value of the impairment. This could be a positive or negative value.

Impairments should be deducted from the operating expenses, whereas reversals of impairments should be added.

The balance charged to revaluation of reserves do not relate to the operating expenditure for the year and should not be deducted from operating expenses.

Private finance initiative and Local Improvement Finance Trust expenditures

As a general principle, PFI and LIFT set-up costs include one-off revenue costs incurred in setting up a new PFI or LIFT scheme from the initial business case to financial close.

This includes fees (consultancy, legal, financial, etc) and other costs such as planning applications. Set-up costs do not include the cost of services and other costs such as interest expenses. There is a learning extension on the treatment of PFI and LIFT costs on our FutureNHS workspace.

Donations and government grants for non-current assets

The depreciation relating to donated or government-granted on current assets charged to expenditure in-year should be deducted from the operating expenses. This is because the whole cost of the purchase is recognised in the year of the purchase.

You will have removed the depreciation of the donated asset and therefore the whole cost of the purchase is recognised in the year of the donation.

Any income received in-year to fund non-current assets must be added back to the operating expenses, as it is deducted as part of other operating income.

Take care not to remove impairments that will already have been deducted in ‘Impairments net of (reversals)’. The income may be actual cash donated to purchase an asset or the asset value where an asset has been donated; the treatment here will be the same.

The treatment of the credit entry relating to donated assets is not held in reserves and is used to offset charges to expenditure. Instead, the funding element is recognised as income in-year as required by IAS 20 and as interpreted by the HM Treasury Financial Reporting Manual.

In the year when the asset is received, the provider will have income equal to the value of the asset and a much smaller depreciation charge to expenditure. To prevent any instability in the cost quantum caused by this large net income in the year of receipt followed by years of increased costs (that is, the depreciation charge, etc), all income and expenditure relating to donated assets must be excluded from the NCC.

Impairments will not be an issue as these are also excluded from the NCC.

Corporation tax

A row has been added to the extract specification AMBREC for corporation tax. Corporation tax will normally only be part of the final audited accounts if it is paid for regarding subsidiaries, associates or joint ventures. If your final audited accounts include this, then you should remove the value on this line of the reconciliation statement.

Services provided to or by another NHS provider

This guidance ensures you capture only the costs of caring for your organisation’s own patients in your reconciliation. It details the correct treatment in the reconciliation of services provided to or received from another NHS organisation.

A provider’s operating expenses minus its other operating income should typically equal its cost quantum. This may not be the case when one NHS provider performs services for another, such as elective operations for a provider that is struggling to meet its operational targets. Reconciliation adjustments are therefore needed.

Services supplied and received (provider to provider)

The standards refer to services provided to other organisations as ‘clinical services supplied’ and services received from other organisations as ‘clinical services received’. See Standard CM8: Clinical and commercial services supplied or received.

The management of patients by a third-party organisation, but on behalf of an NHS commissioning body, is a type of contracted service. If in doubt about this, please contact us on costing@england.nhs.uk.

Activity contracted out to the private sector is discussed separately in ‘Care contracted out to private providers’ in Services excluded from the NCC.

The trust supplying the service provides the activity but does not receive patient income as part of its integrated care board (ICB) commissioned contract; rather it receives payment from the service recipient.

The receiving trust is invoiced for the services provided to its patients by the supplying trust. It is therefore the final recipient of the cost of caring for the patient and responsible for reporting the activity and costs of the activity in its NCC, as if it had provided the service itself. Its operating expenses will include the payments it has made for the services it contracted out.

The receiving trust should include the cost of the invoice in the operating expenses. As it will then flow through to the receiving trust’s cost quantum, no adjustments in the reconciliation are necessary.

The trust supplying the service should not report the cost or the activity in its NCC submission. The profit or loss from supplying the service should remain in the total quantum of the supplying trust’s costs.

This means that instead of adjusting the cost quantum for the true cost of supplying the service, you should adjust it for the income generated by the supplied activity.

The way income is treated depends on where it has been coded in the general ledger:

- other operating income – no adjustment required

- patient income – adjust in clinical and support services supplied to or received from other organisations (P2P).

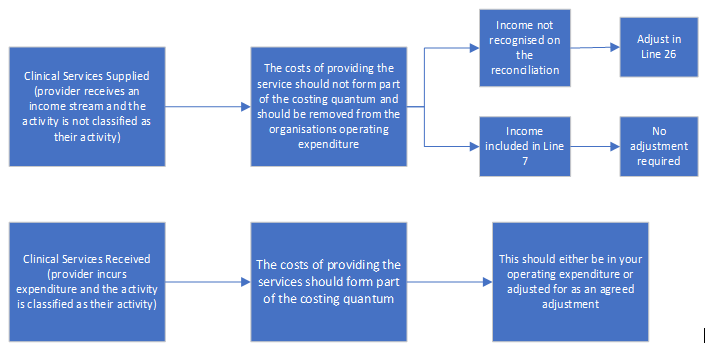

Figure 1 shows how trusts should treat the costs of contracted services in their NCC reconciliation.

In your activity reconciliation, you should ignore any activity in the patient activity feeds (for example diagnostic imaging and pathology) relating to services supplied; it should be reported only by the trust receiving and paying for the services.

Since 2022 an additional field has been added into the extract specification to flag where a trust has part costs, due to some resources being provided by a supporting organisation.

Trusts that are a supporting organisation providing some of the resource to another organisation, should exclude the costs of the resource given in the provider-to-provider line of the reconciliation.

Figure 1: Cost and reconciliation reporting for services supplied and received

Figure 1 describes the reporting for clinical services supplied and received. Clinical services supplied should not form part of the cost quantum and are either not recognised on the reconciliation statement with an adjustment in line 26 or included in line 7 in which case no adjustment required. Clinical services received should form part of the costing quantum and should either be in operating expenditure or adjusted.

The AMBREC should not be adjusted for any profit or loss made on these arrangements; instead, profit or loss should remain as part of the cost quantum.

Costs relating to any qualified providers should be adjusted for in clinical and support services supplied to or received from other organisations (P2P).

Services excluded from the National Cost Collection

This details the services that are excluded from the NCC but should still be reported on the AMBREC. This is required as there is still a national requirement to understand the costs of these services that are not collected at PLICs or aggregate level.

The main services are described in Annex 1.

Services excluded from the NCC in 2024

Some services are not collected as part of the NCC because they meet one or more of the following criteria:

- no national requirement to understand the costs

- lack of clarity about the unit that could be costed

- no clear national definitions of a service

- no clearly identifiable national classification or currency

- underlying information flows do not adequately support data capture

- overlaps with social care or other funding.

Annex1 gives the details of these services. Only these services may be excluded. The total cost of patient events should be excluded using full absorption costing and recorded on the AMBREC.

This guidance ensures that in your reconciliation you only capture the costs your organisation incurs caring for patients whose care is funded by the NHS. Costs for patients not funded by the NHS in England should not flow through your NCC cost collection and instead should be included on the reconciliation.

Therefore, this guidance applies only if your provider is submitting these costs as part of its operating expenditure.

It details the correct treatment in the reconciliation for services provided by your organisation to non-NHS patients or to your patients by private providers. When following the PLICS costing process, please refer to Standard IR1: Collecting information for costing and Standard CM8: Clinical and commercial services supplied or received.

Private patients

Deduct the costs of providing care to private patients who are funded by private medical insurers or pay for their treatment themselves.

Overseas visitors

Deduct the costs of providing care to overseas visitors who are not exempt from charge under the NHS (Charges to Overseas Visitors) Regulations 2011. This includes most irregular migrants, visitors from a country that the UK does not have a reciprocal agreement with and some UK citizens living overseas.

Where the UK has a reciprocal agreement with another country you should not deduct the costs of caring for patients from that country as it is part of NHS activity. Including patients from the Isle of Man and Jersey (but not other Channel Islands) with which the UK government has reciprocal healthcare agreements. ICBs commission the care of these patients and their costs should be included in the same way as if they were registered or resident in England.

Other non-NHS patients

Deduct the costs of providing care to the following non-NHS patients:

- Armed forces personnel: These patients are funded by the Ministry of Defence (MoD) where the requirement varies from the standard NHS pathways in either the treatment requested or management requirements (for example fast-track care or non-standard treatment). Their attendances or episodes are identified by the code ‘XMD’ rather than the ICB code for data submission purposes. Non-standard care arrangements are normally covered in specific MoD contracts or by prior agreement with the MoD referrer. For some mental health services, MoD funding does not apply and therefore the cost of these services should be included in the quantum.

- Patients from the devolved administrations (Scotland, Wales and Northern Ireland): Parliament sets the NHS budget based on the requirements of NHS patients in England; that is, those resident in England and legally entitled to NHS care.

Care contracted out to private providers

Deduct the costs of outsourced activity that is:

- contracted out to private providers (care contracted out to other NHS providers is discussed in 5 Services provided to or by another NHS provider)

- patient activity rather than outsourcing of functions, for example payroll

- patient activity where the whole episode is carried out by a private provider.

Commissioners may pay the increased cost of these patients; if so, the only cost that can be attributed by your trust is that for the administration of these patients (waitlist office, informatics, etc).

Your organisation’s costs may include those for services it performs to facilitate the care of patients under the care of a private provider that is located within your organisation, for example nursing or administrative support.

Agreed adjustments

All adjustments below should be agreed with NHS England before including in the reconciliation.

To request an agreed adjustment please complete the MS form which can be found here.

Requests for an agreed adjustment must be sent to the costing team at NHS England no later than two weeks before the submission window opens.

Agreed adjustments requested after this date must be requested from your trust’s director of finance.

Any change to the approved agreed adjustment value must be detailed in the NCC sign off or the final submission board report. See the introduction to the Approved Costing Guidance for more information. If the value change is more than 10% then a new agreed adjustment request must be made for the updated value.

Agreed adjustments must be reported with one approval reference per line. Values for multiple adjustments per trust should not be added together.

We monitor the entries in agreed adjustment lines throughout the submission window. If we find entries that have not been previously agreed with us and for which there is no appropriate explanation, we may contact your provider and ask for a resubmission.

Adjustments must be agreed on an annual basis – that is, for each collection. Do not roll over those agreed in previous years as there is no guarantee they will be agreed in subsequent years.

Agreed adjustments codes will not be issued without an estimated value for the adjustment.

Non patient income recorded in patient care income

In some instances, activities other than patient care will be miscoded to patient care income in the final audited accounts.

You should adjust for this in the agreed adjustments section to ensure the other operating income figure recorded in your reconciliation matches back to the final audited accounts.

Final accounts – FAQ adjustments

Five lines have been provided for any adjustments that need to be made because of the final accounts being released later than the costing guidance.

An FAQ will be published explaining any additional adjustment required and which row to be used.

Other trust-specific agreed adjustments

Trusts may ask for additional exclusions in exceptional circumstances where including the cost would mean that the costing quantum does not represent the provider costs that relate to the ongoing running costs of your trust and for NHS services.

Activity reconciliation

The Ambulance Data Set (ADS) was in use for the full 2023/24 financial year. Therefore, for the 2024 NCC all trusts should attempt to reconcile their activity information to the mandated dataset where possible. We expect this to be with +/- 1%. Where you have a material difference you should report this on your NCC sign off.

A trust’s NCC reconciliation should be retained on file for audit and assurance reasons. There is a proforma activity reconciliation template in the updated ICAL on FutureNHS.

Further information on how we match your submitted PLICS data to the mandatory dataset can be found in the FutureNHS National Cost Collection checklist: learning extension.

National Cost Collection submission overview

Introduction

This section sets out the scope and governance for the 2024 National Cost Collection (NCC) and should be read by all organisations that submit data for the NCC. It gives you the information you need to participate in the mandated collection during 2024. The year 2024 here refers to the cost collection for the financial year 2023/24.

You should read our introduction to the Approved Costing Guidance and Section 2: National Cost Collection reconciliation and exclusions before reading this section.

It is mandatory for all NHS trusts and NHS foundation trusts in existence between 1 April 2023 and 31 March 2024 to comply with the NCC guidance and the collection timetables.

You should read the Ambulance extract specification in conjunction with this section.

We have designed a collection of essential changes only in 2023/24.

We hope this will allow the sector to work from a stable foundation of relatively unchanged guidance and collection.

Details of our main support contacts during the collection are also in our introduction to the Approved Costing Guidance which also contains information on how your data is used and shared.

Changing operational structures

Several changes in a trust may affect its NCC submission:

- mergers

- acquisitions

- integrations

- major service reconfiguration.

If any of these affect your trust for the 2024 National Cost Collection or future collections, please contact the costing team at costing@england.nhs.uk to ensure your submission is in line with the mandation.

Submission window for 2024

The dates for the submission window for 2024 NCC will be shared on FutureNHS.

Our support during the collection

We can support you in many ways leading up to and during the submission period. For more details, see FutureNHS.

We will publish frequently asked questions (FAQs) on FutureNHS following the publication of the Approved Costing Guidance.

Please do not contact members of the NHS England costing team directly.

If you leave your trust or there is a change in trust costing practitioner, please let us know via costing@england.nhs.uk so we can update our communication lists.

Scope of activity and costs to be collected

The NCC collects data about the costs of patient care in the NHS. This means some of the costs your organisation incurs are not collected. This details the scope of activity and costs your organisation should submit.

Costing period

The costing period begins on 1 April 2023 and ends on 31 March 2024.

Only resources used and activities undertaken within the costing period should be included, regardless of when the patient event started or ended.

What do providers need to submit in 2024?

Patient-level costs are collected at the level of each patient event. A patient event is an incident for ambulance activity.

For each patient event costing data is collected for resources used and activities undertaken. These are listed in the appendices to the extract specification relevant to your sector.

The extract specification spreadsheet documents the fields to be collected.

If you are unable to meet the requirements of the extract specifications, please complete the MS form found here.

Sign off process

The trust director of finance must send sign-off to the NHS England Costing Team on the day of their trust’s final NCC submission.

While the trust director of finance is responsible for the accurate completion of the combined costs collection return. The submission should be subjected to the same scrutiny and diligence as any other financial returns submitted by the provider. Therefore for 2024 NCC you are also required to obtain board level sign-off.

Two reports should be taken to the board:

- a pre-submission report – before the submission window opens for 2024

- a final submission report – at around the time of or following submission.

At pre submission stage, a report should be taken to the board confirming:

- The costing process has been approved ahead of the collection.

- The return has been prepared in accordance with the Approved Costing Guidance, which includes the combined costs collection guidance.

- Information, data and systems underpinning the combined costs collection return are reliable and accurate.

- There are proper internal controls over the collection and reporting of the information included in the combined costs collection, and these controls are subject to review to confirm that they are working effectively in practice.

- The costing team is appropriately resourced to complete the National Cost Collection return, accurately within the timescales set out in the guidance.

- Any actions from previous NHS costing assurance process (CAP) reviews of costing or data quality have been formally followed up and completed (as appropriate).

- A second report should be tabled, just prior to final submission confirming that

- The information included in the submission – both cost and activity – has been reviewed and verified as accurate.

- All mandatory and significant non-mandatory validations have been reviewed and verified.

- Any significant areas where the trust has varied from the mandation (ie unable to submit at patient-level or issues around activity or methods of apportionment) have been agreed with NHS England and have been reported to the Board.

An editable version of the board assurance pro forma will be available on FutureNHS.

The FutureNHS NCC checklist: learning extension lists the checks you should make as part of your internal assurances before submitting your cost collection but we will not collect this information.

Ambulance collection overview

This section provides an overview of the 2023/24 NCC.

Providers are asked to submit activity and financial data for all incidents going through 999 call centres or dispatch centres.

For the purposes of this collection, an incident is defined as:

- a discrete event where one or more responses are dispatched

- clinical advice given over the phone

- an information only or no treatment required call.

Alongside in-house provision the collection includes the following services:

- activity completed by third-party providers

- activity completed by hazardous area response teams (HART)

- medical emergency response incident teams (MERIT)

- healthcare professional responses

- air ambulance responses (staff only).

The PLICS extracts that should be reported at incident level (with patient details) for this collection are AMB (Ambulance) – ambulance incidents.

The following services are out of scope of the collection:

- other patient-facing services, for example GP out-of-hours, patient transport service (PTS) and NHS 111

- HART non-responding time.

Other operating income relating to commercial services (for example first aid training and cover for sporting events) should be netted off from the costs of providing these services, as part of the reconciliation process to establish the provider’s total costs.

Preparing PLICS files for ambulance services

The extract specification sets out the exact structure of the files you need to produce for the collection: the field names and formats, along with valid codes for certain fields where applicable.

The nature of ambulance service provision means cost collection is at the incident level, not the patient level. The number of vehicles arriving at a treatment location is used as a proxy for the number of patients associated with each incident. If no vehicles arrive at a treatment location, the incident is assumed to involve a single patient.

Ambulance incidents

Collection scope

This section covers ambulance incidents (AMB). Incidents collected in the AMB PLICS data feed should be based on AMB.

For the purposes of PLICS Ambulance, the scope of an incident includes ‘hear and treat’, ‘see and treat’, ‘see and convey’ and ‘other’ incident currencies.

An incident begins at the point the call is connected or a request for an ambulance is received. An incident ends when:

- the last responder type is clear to respond to future incidents

- when the call ends for hear and treat incidents

- when the call ends for ‘other’ calls.

The collection year begins on 1 April 2023 and ends on 31 March 2024.

All incidents started within the collection year are in scope of this collection. For example, if an incident started on 31 March 2024 at 23:50 and ended on 1 April 2024 at 02:00, then all the resources and activities should be allocated, even though the incident ended outside the collection year.

Incident-level data is to be submitted, with some information included on response(s) and patient(s). The list of fields to be collected for each incident is shown in the ambulance extract specification file.

NHS number and handover destination will not be submitted as multiple value fields and will be limited to one NHS number and one handover destination per incident.

The NHS number should only be submitted where the incident involved a single patient and should be recorded as multi-patient incident = N. In the small number of incidents where the data has more than one NHS number, the NHS number should be left blank and should be recorded as multi-patient incident = Y.

For incidents with more than one handover destination, only the details of the first handover destination reached should be submitted. The earliest entry in the data for the handover destination field should be selected and all other data (for this field) removed from the collection files to be submitted.

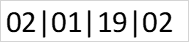

The only field that will be enabled to accept multiple values is ‘responder type’. Each responder type should be pipe delimited (|); the maximum number of responder types per incident will be limited to 10, with the first 10 responder types selected based on at-scene date and time. This field will have a maximum string length of 29. A full list of responder types is available in the extract specification.

Where responders of the same type are on the scene for the same incident, codes for every responder should be supplied.

Figure 2 shows how 2 × RRV 1 × DCA and 1 × FAL should presented.

Figure 2: Example responder type

In the small number of incidents where the data has more than 10 responder types, you will be required to select the 10 earliest entries in the data for this field and remove all other data (for this field) from the collection files to be submitted.

Currencies

The currencies were developed and agreed with ambulance trusts and commissioners to support the contracting and payment of emergency and urgent ambulance services from April 2012. We plan to align their definitions with the ambulance quality indicators. The four currencies are:

- 01 – hear and treat

- 02 – see and treat

- 03 – see and convey

- 04 – other.

Hear and treat

The activity measure is the number of patients, following emergency or urgent calls, whose issue was resolved by providing clinical advice over the telephone or referral to a third party.

This includes patients whose call is resolved without despatching a vehicle, or where a vehicle is despatched but is called off from attending the scene before arrival, by providing advice through a clinical decision support system or from a healthcare professional, or by transferring the call to a third-party healthcare provider.

An ambulance trust healthcare professional does not arrive on scene.

The unit cost is the cost per incident.

See and treat

The activity measure is the number of incidents, following emergency or urgent calls, resolved by the patient being treated and discharged from ambulance responsibility on scene. The patient is not taken anywhere.

It includes incidents where ambulance trust healthcare professionals on the scene refer (but do not convey) the patient to any alternative care pathway or provider.

It includes incidents where, on arrival at the scene, the ambulance trust healthcare professional is unable to locate a patient or incident.

It includes incidents where responders are despatched by third parties (such as NHS 111 or other emergency services) directly accessing the ambulance control despatch system.

The unit cost is the cost per incident.

See and convey

The activity measure is the number of incidents, following emergency or urgent calls, where at least one patient is conveyed by ambulance to an alternative healthcare provider.

Alternative healthcare providers include any other providers that can accept ambulance patients, such as A&Es, minor injury units, walk-in centres, major trauma centres and independent providers.

It includes incidents where responders are despatched by third parties (such as NHS 111 or other emergency services) directly accessing the ambulance control despatch system.

It excludes patient transport services (PTS) and other private or non-NHS contracts.

The unit cost is the cost per incident.

Other

The activity measure is the number of emergency and urgent calls to the switchboard that are answered.

This includes 999 calls, calls from other healthcare professionals requesting urgent transport for patients and calls transferred or referred from other services (such as other emergency services, NHS 111, other third parties).

This includes hoax calls, hang-ups before coding is complete, caller not with patient and unable to give details, caller refusing to give details and response cancelled before coding complete.

When submitting PLICS data, if non-identifiable, a duplicate call relating to a previously recorded call (recorded as incident currency 01, 02 or 03), should be submitted on an unrelated row(s) of data recorded as incident currency 04.

Where a duplicate call can be identified, the cost should be absorbed as an overhead absorbed back to the primary incident/call.

It excludes calls abandoned before they are answered, PTS requests and calls under any private or non-NHS contract.

The unit cost is the cost per incident.

Data validation engine for XML files

You must only use the NHS England data validation engine (DVE). All essential DVE information is on FutureNHS.

Annex 1: Excluded services

|

Excluded service |

Definition or description |

Why is the service excluded? |

|

Hospital travel costs scheme (HTCS) |

A scheme offering financial help with the cost of travel to and from hospitals and other NHS centres. Note that overnight stays are not part of the HTCS. However, the HTCS guidance states: “Where an overnight stay away from home is unavoidable, either because of the time of the appointment or length of travel required, and the patient is to meet the cost of this stay, the expense should be treated as part of treatment costs or met through non-Exchequer funds. This should be discussed with the relevant ICB before the overnight stay occurs”. Providers should therefore include overnight stays as a support cost in their submission. |

Because this scheme makes fixed payments to eligible NHS patients, there is no requirement to understand or benchmark provider unit costs. |

|

Patient transport services (PTS) |

All costs associated with services run by ambulance trusts and other PTS providers offering transportation of patients to and from their place of residence, premises providing NHS healthcare and/or between NHS healthcare providers for people who have a medical need. Where one trust provides a PTS for another trust, this is a commercial activity. The cost will be excluded from the submission, but the income should not be netted off in the presentation of the cost of PTS in the reconciliation. Please note: patients transported between an organisation’s own sites are a support cost to the admission. |

PTS were included in reference costs between 2006/07 and 2009/10, and excluded from 2010/11. Consultation with the sector suggests that collection of this data would be very complex. |

|

Specified services: ambulance trusts |

The following services or costs are excluded (ambulance trusts only):

No other services are excluded in this category for ambulance trusts and the above services are not excluded from any other provider types without our permission. |

These services are not part of the ambulance service currencies for contracting and no other suitable currency exists. |

|

Pooled or unified budgets |

As a general principle, costs and activity are excluded for services jointly provided under pooled or unified budget arrangements with agencies outside the NHS, such as social services, housing, employment, education (eg Sure Start), home equipment loans or community equipment stores. This also includes:

Where providers are confident they can separately identify a discrete element of the service that is funded by the NHS, identify the total costs incurred by that service, and have accurate and reflective activity data, they are encouraged to include that service. |

Services provided by bodies outside the NHS, such as local government, are outside the scope of PLICS. |

|

Hosted services |

Services hosted by one provider but providing benefit for the patients of other providers. The specified services are:

No other service may be excluded in this category without our permission. |

There is no patient event to which costs can be allocated. The host provider is fully funded, and there is no recharge to other providers. |

|

Critical care transport network |

Providing transport, advice or other services for critical care patients regionally |

There is no national currency for these arrangements. Other transport services are also excluded. |