Introduction

This guidance was amended on 9 April 2024 to correct a link in paragraph 286, 22 April 2024 to correct a link and add codes in paragraph 280, and 23 April 2024 to correct codes in paragraph 472.

-

This guidance contains National Cost Collection (NCC) reconciliation and submission information for the acute, mental health, Talking Therapies for Anxiety and Depression and community sectors. NCC guidance for the ambulance sector is available separately. Note that Talking Therapies was previously called IAPT and the data feed on the extract specification that trusts will submit will still be called IAPT for 2024 NCC.

-

Supporting information is on our FutureNHS workspace. You can access FutureNHS if you have an NHS email address or email costing@england.nhs.uk to request access if you do not, using the subject line ‘FutureNHS’.

Reconciliation and exclusions: how to obtain and record your cost quantum

Introduction

Purpose and context

-

The National Cost Collection (NCC) collects data about the costs of patient care in the NHS. This means only costs that relate to the ongoing running costs of your trust and not those that are one off.

-

Some of the costs your trust incurs are not collected, for example:

- caring for another NHS provider’s patients

- caring for non-NHS patients

- services which are funded by non-NHS bodies such as the local authority

- services for which there is no requirement to understand the costs or for which it is not possible to collect the cost

-

There are also certain types of income that offset the cost of patient care.

-

Therefore, you are required to reconcile your trust’s audited year-end accounts and the costs your trust submits in the NCC cost quantum because otherwise they will differ.

-

Completion of the reconciliation must be completed before preparing patient-level costs (PLICS) XML files to obtain your NCC cost quantum. You should not try to work backwards from your submission files to create your NCC cost quantum. Use your draft final accounts to start to prepare this reconciliation.

-

Reconciliation to your trust’s audited year-end accounts is important for assuring the quality of costing outputs. You need to understand how your trust’s cost quantum is derived from these accounts, to ensure that your cost model includes all costs and produces reliable and comparable results. As some of your trust’s audited accounts are not part of its cost quantum, a reconciliation is needed to establish the links between the two. The information included in your reconciliation is published as part of the NCC publication.

-

This section describes the reconciliation process for cost data submitted in all National Cost Collections, whether patient-level information and costing system (PLICS) or aggregate costs. It is supported by Standard CP5: Reconciliation.

Cost reconciliation

-

The reconciliation feed type in the extract specification enables you to submit the information from your trust’s audited financial accounts and any adjustments required to your total cost quantum.

-

The feed name is INTREC.

-

You must ensure the income and expenditure amounts entered in each line of the cost reconciliation feed are not duplicated on another line in the feed.

-

In 2024 the final accounts document will not be finalised until after the NCC guidance is published and therefore the FIN codes used in the reconciliation template, XML reconciliation reference data and integrated technical document will need mapping to the final accounts.

-

We will supply a mapping table to final accounts template coding on FutureNHS. This can also be useful for drafting your reconciliation in preparation for finalising your XML reconciliation.

Reconciliation process

-

We recommend you review the INTREC worksheet in the extract specification when you start preparing your annual costing submission. You must be able to accurately map the costing quantum back to your audited financial accounts right from the start of the costing process. Otherwise, reconciliation may prove more complex later.

-

You must obtain values for the operating expenses, activities other than patient care and accounting adjustments sections of the reconciliation template from the final audited accounts.

-

In 2024, when we carry out our reconciliation checks if there are material differences, you will be required to resubmit.

-

We also advise scoping all the services your organisation delivers as early as possible to give yourself adequate time to include all of those within your operating expenses that are permitted to be in your cost quantum.

-

Where one provider is acquired by another mid-year, the acquiring provider must contact us on costing@england.nhs.uk with the subject line Merger group trusts to clarify the action it needs to take for reconciliation.

-

These are the steps we recommend you take in carrying out your organisation’s reconciliation.

Financial accounting element

Step 1: Ensure the financial accounts are closed and the final version of the general ledger (GL) is available. Ask colleagues in financial accounts for the information from the final audited accounts.

Step 2: Obtain the final trial balance and/or the GL output, and ensure they agree at the detailed account code level. Familiarise yourself with which income centre each GL code is categorised into.

Step 3: Allocate the lines on the trial balance/output to the relevant lines on the cost reconciliation in partnership with your financial accountant. You can also use Spreadsheet CP2.1: Standardised cost ledger in the technical document.

Step 4: Together with your financial accountant check the figures in Step 3 agree with those in the final audited accounts spreadsheets.

Step 5: Complete the reconciliation up to the pre-costing software subtotal. Ensure your adjustments are a true and fair representation of your audited accounts. Perform a sense check at this point against last year.

The financial accounting element is now complete and you should move onto working with the costs from your costing software to finalise your cost quantum for the financial year. Your subtotal should now only relate to the costs for delivering patient care.

Finalising your cost quantum

Step 6: From the costing system outputs identify the costs of services performed for/by another NHS provider, services out of scope of the NCC and care of non-NHS patients. Adjust for these costs in the appropriate lines of the reconciliation.

Step 7: Request approval from the NHS England costing team before making any extra requirements not explicitly captured in the reconciliation. If approved, we will send you an authorisation code and you need to log this in your cost reconciliation. Adjust the lines in the cost reconciliation.

Development and quality assurance of your costing model in preparation for submission may take some weeks before you move onto Step 8 and Step 9.

Final check

Step 8: Ensure the total cost quantum for the files you are submitting for your cost collection agrees to within ±1% of the total quantum in the reconciliation.

Step 9: Perform a final check of the reconciliation against last year’s to identify any material or unexpected variations. If variations exist, investigate them and make changes as needed.

Operating expenses

-

Your operating expenses are the starting point for your reconciliation. You derive your cost quantum by adjusting the operating expenses figure but this must be done transparently using the reconciliation template and not by adjusting the operation expenses figure directly.

-

Your cost quantum should include costs incurred for any discontinued operations within the financial year. If a patient care operation is discontinued, it should be matched to the appropriate activity. If another type of activity is discontinued, it should be netted off and you need to request an agreed adjustment from us.

-

Your general ledger (GL) output will often not correlate to your final audited accounts. The basis for the NCC is that your cost quantum is derived from your trust’s final audited accounts. Therefore, you need to work closely with your financial accounting team to understand and interpret the differences between the two and derive costs that relate only to the patient care your trust is responsible for delivering.

Increase in employer’s superannuation

-

In 2019/20, the employer’s superannuation contribution increased from 14.38% to 20.68%, with the increase of 6.3% being funded centrally by NHS England. Trusts are required to account for the full cost (20.68%) in their operating expenses (TAC08) which will come from ESR allocated in line with staff cost arrangements.

-

The notional income of 6.3% should be recorded in patient income and will not affect the quantum of costs or the trust’s bottom line. If your trust has recorded this notional income in other operating income in error, please request an agreed adjustment.

-

We understand this will also be operational for 2023/24.

-

The cost of the pension increase will inflate the quantum costed by practitioners this year. As this is a recurrent cost of delivering healthcare it should be included in the quantum and allocated to patients.

-

The income, regardless of how it has been coded, should not be netted off the cost of the increased premiums as it is a cost of providing a service.

-

To apportion this cost where unable to easily link it to a specific individual via ESR information, use gross payroll as the basis of apportionment.

Other operating income

-

This details how you need to submit your trust’s other operating income in the NCC INTREC. It will ensure only the costs that relate to patient care are included in your cost quantum by reducing the operating expenditure by the value of non-patient care activities.

-

Non-patient care income categories are:

- education and training (E&T)

- research and development (R&D)

- commercial or other activities not primarily related to providing care to NHS patients.

-

You will adjust for the income your trust receives for these activities in both the NCC reconciliation and your costing model.

-

National policy is if the income received for services is more than it costs your trust to provide them, this contributes to the provision of NHS patient care. Therefore, the NCC requires you to net off all income from activities other than patient care from the appropriate cost centre within your cost ledger (CL).

-

Income from activities other than patient care should be matched to the service that generated the income, offsetting the cost of providing that service. In the INTREC, income from activities other than patient care is deducted from the total operating expenses.

-

You need to understand the different types of income recorded in the general ledger and what costs the income relates to, so the outputs from the costing system can be reconciled to the audited accounts. Income groups need to be separated into income that relates and does not relate to patient care. We recommend you familiarise yourself with which income centre each general ledger code is categorised into.

-

The INTREC requires you to deduct income from E&T and R&D activities. The totals for other operating income (all) and other operating income – not permitted, should balance with the other operating income in your organisation’s final audit accounts.

Education and training

- E&T income should be deducted from the operating expenses in other operating income.

Research and development

-

Research and development (R&D) comprise the following funding streams:

- Research: Grant funding to pay for the costs of the R&D itself (for example writing the research paper) received from the Department of Health and Social Care (DHSC) and other bodies including the National Institute for Health Research (NIHR), other government departments, charities and the Medical Research Council (MRC), and which includes funding for biomedical research centres, biomedical research units and Collaborations for Leadership in Applied Health Research and Care (CLARHC).

- NHS support: Funding from DHSC and NIHR to cover extra patient care costs associated with the research (for example extra blood tests, extra nursing time) that end when the research ends.

- Flexibility and sustainability funding: Funding from DHSC mainly to support the NIHR faculty and associated workforce.

-

Other R&D funding streams relating to patient care costs continue after the research ends. Where there is no income to match to a cost, the income must not be deducted from operating expenses. For example:

- treatment costs, including excess treatment costs: funding from normal commissioning arrangements to cover patient care costs associated with the research that would continue to be incurred after the research ends if the service in question were to continue

- subventions: exceptional funding from DHSC that contributes to the cost of very expensive excess treatment costs.

-

We are reviewing how excess treatment costs might be funded differently in future. This could have implications for the reporting of these costs in future NCCs.

-

All R&D income regardless of the accounting treatment (IFRS 15 or non-IFRS 15) and from the above funding streams should be deducted from the operating expenses in other operating income.

Apprenticeship levy

-

Expenditure in relation to the apprenticeship levy will be recorded in operating expenditure, however this should be removed as the value should not be included in the overall cost quantum.

-

Two income elements make up the apprenticeship levy balance: one from HMRC and one notional amount. Only the notional amount should be adjusted for, however, providing the balance is recorded in other operating income. This will already reduce the balance of your operating expenditure and no further adjustment is required.

-

If your notional income is within patient income, you will need to adjust for this in the reconciliation line ‘Non-patient care income recorded in patient care’. The remaining balance from HMRC should remain in your cost quantum.

Remaining operating income including clinical excellence awards

-

Income for clinical excellence awards (CEAs) should have been recorded in your organisation’s other operating income and should not be adjusted for. However, if your CEA income was included as patient income in your audited accounts, you should adjust for it in non-patient care income recorded in patient care.

-

If you discover patient income within your other operating income, you must ask NHS England for an agreed adjustment. This ensures costs are not artificially reduced. For more information see the government financial reporting manual.

-

The remaining balance in other operating income should not need to be adjusted but if you are not sure how to treat a source of income, contact the NHS England costing team on costing@england.nhs.uk.

Other operating income – not permitted

-

NHS England does not allow you to take away some income streams from your organisation’s operating expenses known as ‘other operating income – not permitted’.

-

If you have patient-related income in your other operating income, you should not take this away from your operating expenditure.

-

The income streams you are not permitted to take away are listed in the FutureNHS Adjustments to operating income: learning extension. For transparency, adjust for this income in ‘other operating income – not permitted’.

-

For assurance, the FutureNHS Other operating income: learning extension also lists the types of income that can be included appropriately as part of the total you have used in other operating income.

Non-patient care income recorded in patient care

-

If you discover non-patient care income that has been incorrectly recorded in patient care income, you must adjust for this in the NCC reconciliation line ‘non-patient care income recorded in patient care’.

-

The income for FP10 prescriptions should be within other operating income. If this income is incorrectly recorded in patient income, you should adjust for this in ‘non-patient care income recorded in patient care’.

Accounting adjustments

-

Further adjustments must be made to the ‘operating expenses’ reported in operating expenses from consolidated accounts of the reconciliation. Several non-cash items, such as donations and government grants for non-current assets, must be separately deducted from the operating expenses. Additionally, some income deducted as part of ‘other operating income’ that relates to patient care must be added back to the operating expenses.

Finance income and expenses

- Finance income is unrelated to patient care and should be deducted from the operating expenses, whereas finance expenses should be added. Finance expenses for the unwinding of discount should be treated as part of finance expenses.

Public dividends capital

-

The provider’s public dividends capital (PDC) should be added to the operating expenses.

Profits and losses

-

Profits from the sale of an asset that contributed to patient care should be deducted from the operating expenses, whereas losses should be added. The sale can be either at fair value or recycled.

-

Shares of profit from subsidiaries, associates or joint ventures (that is, from group accounts) should be deducted from the operating expenses, whereas shares of loss should be added. The net effect of profits and losses should be calculated, and the resulting adjustment made to the operating expenses, as this figure will not be reflected in your organisation’s cost quantum.

-

Any profit or loss from the sale of non-current assets in a private finance initiative (PFI) or Local Improvement Finance Trust (LIFT) deal should be deducted from the operating expenses to net off the gain or loss. Only the profit or loss from sales as part of a new PFI or LIFT scheme apply.

Impairments

-

Impairments charged through the statement of comprehensive income are not included in the NCC and must be removed. The balance of this line should be the net value of the impairment. This could be a positive or negative value.

-

Impairments should be deducted from the operating expenses, whereas reversals of impairments should be added.

-

The balance charged to revaluation of reserves does not relate to the operating expenditure for the year and should not be deducted from operating expenses.

Private finance initiative and Local Improvement Finance Trust expenditures

-

As a general principle, PFI and LIFT set-up costs include one-off revenue costs incurred in setting up a new scheme from the initial business case to financial close.

-

They include fees (consultancy, legal, financial, etc) and other costs such as planning applications. Set-up costs do not include the cost of services and other costs such as interest expenses. There a FutureNHS learning extension clarifying the treatment of PFI and LIFT costs.

Donations and government grants for non-current assets

-

The depreciation relating to donated or government-granted on current assets charged to expenditure in-year should be deducted from the operating expenses. This is because the whole cost of the purchase is recognised in the year of the purchase.

-

You will have removed the depreciation of the donated asset and therefore the whole cost of the purchase is recognised in the year of the donation.

-

Any income received in-year to fund non-current assets must be added back to the operating expenses, as it is deducted as part of other operating income.

-

Take care not to remove impairments that will already have been deducted in ‘Impairments net of (reversals)’. The income may be actual cash donated to purchase an asset or the asset value where an asset has been donated; the treatment here will be the same.

-

The treatment of the credit entry relating to donated assets is not held in reserves and is used to offset charges to expenditure. Instead, the funding element is recognised as income in-year as required by IAS 20 and as interpreted by the HM Treasury Financial Reporting Manual.

-

In the year when the asset is received, the provider will have income equal to the value of the asset and a much smaller depreciation charge to expenditure. To prevent any instability in the cost quantum caused by this large net income in the year of receipt followed by years of increased costs (that is, the depreciation charge, etc), all income and expenditure relating to donated assets must be excluded from the NCC.

- Impairments will not be an issue as these are also excluded from the NCC.

Corporation tax

- A row has been added to the extract specification AMBREC for corporation tax. Corporation tax will normally only be part of the final audited accounts if it is paid for regarding subsidiaries, associates or joint ventures. If your final audited accounts include this, then you should remove the value on this line of the reconciliation statement.

Services provided to or by another NHS provider

-

This guidance ensures you capture only the costs of caring for your organisation’s own patients in your reconciliation. It details the correct treatment in the reconciliation of services provided to or received from another NHS organisation.

-

A provider’s operating expenses minus its other operating income should typically equal its cost quantum. This may not be the case when one NHS provider performs services for another, such as elective operations for a provider that is struggling to meet its operational targets. Reconciliation adjustments are therefore needed.

Services supplied and received (provider to provider)

-

The standards refer to services provided to other organisations as ‘clinical services supplied’ and services received from other organisations as ‘clinical services received’. See Standard CM8: Clinical and commercial services supplied or received.

-

The management of patients by a third-party organisation but on behalf of an NHS commissioning body is a type of contracted service. If in doubt about this, please contact us on costing@england.nhs.uk.

-

Activity contracted out to the private sector is discussed separately in ‘Care contracted out to private providers’ in Services excluded from the NCC.

-

The trust supplying the service provides the activity but does not receive patient income as part of its integrated care board (ICB) commissioned contract; rather it receives payment from the service recipient.

-

The receiving trust is invoiced for the services provided to its patients by the supplying trust. It is therefore the final recipient of the cost of caring for the patient and responsible for reporting the activity and costs of the activity in its NCC, as if it had provided the service itself. Its operating expenses will include the payments it has made for the services it contracted out.

-

The receiving trust should include the cost of the invoice in the operating expenses. As it will then flow through to the receiving trust’s cost quantum, no adjustments in the reconciliation are necessary.

-

The trust supplying the service should not report the cost or the activity in its NCC submission. The profit or loss from supplying the service should remain in the total quantum of the supplying trust’s costs.

-

This means that instead of adjusting the cost quantum for the true cost of supplying the service, you should adjust it for the income generated by the supplied activity.

-

The way income is treated depends on where it has been coded in the general ledger:

- other operating income – no adjustment required

- patient income – adjust in clinical and support services supplied to or received from other organisations (P2P).

-

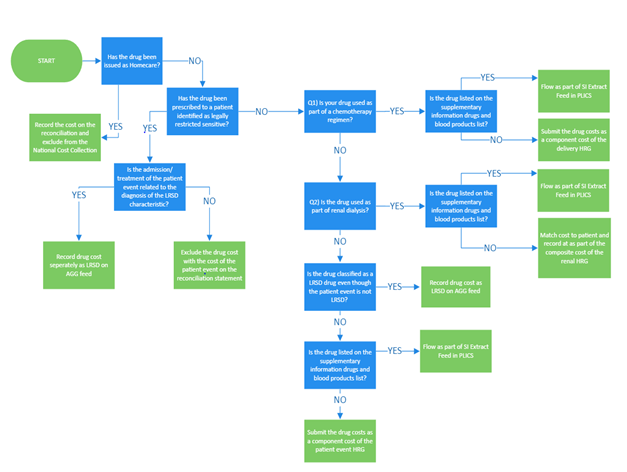

Figure 1 shows how trusts should treat the costs of contracted services in their NCC reconciliation.

-

In your activity reconciliation, you should ignore any activity in the patient activity feeds (for example diagnostic imaging and pathology) relating to services supplied; it should be reported only by the trust receiving and paying for the services.

-

Since 2022 an extra field has been added to the extract specification to flag where a trust has part costs because of some resources being provided by a supporting organisation.

-

Trusts that are a supporting organisation providing some of the resource to another organisation, should exclude the costs of the resource given in the provider-to-provider line of the reconciliation.

Figure 1: Cost and reconciliation reporting for services supplied and received

-

The INTREC should not be adjusted for any profit or loss made on these arrangements; instead profit or loss should remain as part of the cost quantum

-

Costs relating to any qualified providers should be adjusted for in clinical and support services supplied to or received from other organisations (P2P).

Services excluded from the National Cost Collection

-

This section details the services excluded from the NCC that should still be reported on the INTREC. This is required as there is still a national requirement to understand the costs of these services that are not collected at PLICs or aggregate level.

-

The main services excluded are described in Annex 1.

National screening programmes

- These are national screening programmes included in the NCC with details of where costs should be included:

- NHS Fetal Anomaly Screening Programme: included in relevant maternity outpatient and admitted patient costs.

- NHS Infectious Diseases in Pregnancy Screening Programme: Included in relevant maternity outpatient and admitted patient costs.

- NHS Linked Antenatal and Newborn Sickle Cell and Thalassaemia Screening Programme: Included in relevant maternity outpatient and admitted patient costs except for a few genetic tests that are excluded and should be funded directly by ICBs.

- NHS Newborn and Infant Physical Examination Screening Programme: Included in the cost of maternity delivery HRGs or postnatal visits.

- NHS Newborn Blood Spot Screening Programme: The cost of taking the sample is included in the cost of maternity delivery HRGs or postnatal visits. The cost of its analysis by regional newborn screening services is excluded from the NCC.

- NHS Newborn Hearing Screening Programme: Included in audiology services as neonatal screening.

- National Screening Programme for Diabetic Retinopathy: Included in diabetic retinal screening, which should be reported as a directly accessed diagnostic service against HRG WH15Z.

- NHS abdominal aortic aneurysm screening programme: Included in the AGG feed type with activity count number of tests.

- NHS breast screening programme: Included in the AGG feed type with activity count number of tests.

- NHS cervical screening programme: Included in the AGG feed type with activity count number of tests.

- NHS bowel cancer screening programme: Included in the AGG feed type with activity count number of tests.

- Several other national screening programmes are excluded from the NCC. Only those listed above should be included in the NCC.

Services excluded from the NCC in 2024

- Some services are not collected as part of the NCC because they meet one or more of the following criteria:

- no national requirement to understand the costs

- lack of clarity about the unit that could be costed

- no clear national definitions of the service

- no clearly identifiable national classification or currency

- underlying information flows do not adequately support data capture

- overlaps with social care or other funding.

-

Annex 1 gives the details of these services. Only these services may be excluded. The total cost of patient events should be excluded using full absorption costing and recorded on the INTREC.

-

This guidance ensures that in your reconciliation you only capture the costs your organisation incurs caring for patients whose care is funded by the NHS. Costs for patients not funded by the NHS in England should not flow through your NCC cost collection and instead should be included on the reconciliation.

-

Therefore, this guidance applies only if your provider is submitting these costs as part of its operating expenditure.

-

It details the correct treatment in the reconciliation for services provided by your organisation to non-NHS patients or to your patients by private providers. When following the PLICS costing process, please refer to Standard IR1: Collecting information for costing and Standard CM8: Clinical and commercial services supplied or received.

Private patients

- Deduct the costs of providing care to private patients who are funded by private medical insurers or pay for their treatment themselves.

Overseas visitors

-

Deduct the costs of providing care to overseas visitors who are not exempt from charge under the NHS (Charges to Overseas Visitors) Regulations 2011. This includes most irregular migrants, visitors from a country that the UK does not have a reciprocal agreement with and some UK citizens living overseas.

-

Where the UK has a reciprocal agreement with another country you should not deduct the costs of caring for patients from that country as it is part of NHS activity. ICBs commission the care of these patients and their costs should be included in the same way as if they were registered or resident in England.

Other non-NHS patients

- Deduct the costs of providing care to the following non-NHS patients:

- Armed forces personnel: These patients are funded by the Ministry of Defence (MoD) where the requirement varies from the standard NHS pathways in either the treatment requested or management requirements (for example fast-track care or non-standard treatment). Their attendances or episodes are identified by the code ‘XMD’ rather than the ICB code for data submission purposes. Non-standard care arrangements are normally covered in specific MoD contracts or by prior agreement with the MoD referrer. For some mental health services, MoD funding does not apply and therefore the cost of these services should be included in the quantum.

- Patients from the devolved administrations (Scotland, Wales and Northern Ireland): Parliament sets the NHS budget based on the requirements of NHS patients in England; that is, those resident in England and legally entitled to NHS care.

Care contracted out to private providers

- Deduct the costs of outsourced activity that is:

- contracted out to private providers (care contracted out to other NHS providers is discussed in Services provided to or by another NHS provider)

- patient activity rather than outsourcing of functions, for example payroll

- patient activity where the whole episode is carried out by a private provider.

-

Commissioners may pay the increased cost of these patients; if so, the only cost that can be attributed by your trust is the administration of these patients (waitlist office, informatics, etc).

-

Your organisation’s costs may include those for services it performs to facilitate the care of patients under the care of a private provider located within your organisation, for example nursing or administrative support.

Networks

-

Operational delivery networks support the regional care for specialised services. There are 14 specialised commissioning networks that should be treated as exclusions for the 2024 NCC.

-

The funding is sent to a host trust that runs the clinical leadership and administration for the network. The cost of this service is not solely for the patients in the host trust, so should not be included in ‘own patient care’ for that trust.

-

The principle of keeping this type of cost separate from the cost of own patient care has been well established in the cancer multidisciplinary team (MDT) meetings submission within the National Cost Collection.

-

Similarly, the cost of these meetings relates to patients from a wider clinical responsibility than just one trust, and so separation is needed from the cost of own patient care.

Agreed adjustments

-

All adjustments below should be agreed with NHS England before being included in the reconciliation.

-

To request an agreed adjustment please complete the MS form which can be found here.

-

Requests for an agreed adjustment must be sent to the costing team at NHS England no later than two weeks before the submission window opens.

-

Agreed adjustments requested after this date must be requested from your trust’s director of finance.

-

Any change to the approved agreed adjustment value must be detailed in the NCC sign off or the final submission board report. See the introduction to the Approved Costing Guidance for more information. If the value change is more than 10% a new agreed adjustment request must be made for the updated value.

-

Agreed adjustments must be reported with one approval reference per line. Values for multiple adjustments per trust should not be added together.

-

We monitor the entries in agreed adjustment lines throughout the submission window. If we find entries that have not been previously agreed with us and for which there is no appropriate explanation, we may contact your provider and ask for a resubmission.

-

Adjustments must be agreed on an annual basis – that is, for each collection. Do not roll over those agreed in previous years as there is no guarantee they will be agreed in subsequent years.

-

Agreed adjustments codes will not be issued without an estimated value for the adjustment.

Non patient income recorded in patient care income

-

In some instances, activities other than patient care will be miscoded to patient care income in the final audited accounts.

-

You should adjust for this in the agreed adjustments section to ensure the other operating income figure recorded in your reconciliation matches back to the final audited accounts.

Final accounts – FAQ adjustments

-

Five lines have been provided for any adjustments that need to be made because of the final accounts being released later than the costing guidance.

-

An FAQ will be published explaining any additional adjustment required and which row to be used.

Other trust-specific agreed adjustments

- Trusts may ask for additional exclusions in exceptional circumstances where including the cost would mean the costing quantum did not represent the provider costs that relate to the ongoing running costs of the trust and for NHS services.

Activity reconciliation

-

Reconciliation of submitted activity has always been a requirement of the National Cost Collection.

-

For the 2024 NCC all trusts should attempt to reconcile their activity information to the mandated dataset where possible. For HES, MHSDS and IAPT submitted activity we expect this to be with +/- 1%. Where you have a material difference you should report this on your NCC sign off.

-

It is best practice for community contacts to reconciled to CSDS and record this on their NCC sign off.

-

You should reconcile to the versions of mandated datasets shown below:

- HES: version CDS V6.3, final cut (M13), feeds APC and OP

- ECDS: version 4.0, feed EC

- MHSDS: version 5.0, feeds MHCC and MHPS

- Talking Therapies/IAPT: version V2.1, feed IAPT

- CSDS: version V1.6, feed CSCC.

-

You do not need to reconcile activity to mandated datasets for high cost drugs, high cost blood or high cost devices and unbundled imaging.

-

Historically, trusts have been asked to reconcile their activity to within 1% of the mandated dataset. However, in certain cases this may not be possible, for example due to timing differences or pilot schemes outside the remit of the mandated dataset.

-

Where activity cannot be reconciled within 1% of the mandated dataset you must record this in your NCC sign off.

-

Trusts that deliver mental health activity must consider where their activity data is submitted to complete the activity reconciliation. Mental health activity should be submitted to MHSDS; however some acute trusts with small activity levels currently submit to HES.

-

Where your costing system activity data represents a more accurate picture of your trust’s activity than HES, you should not change your costing system to reconcile. Instead, you should:

- retain the emails and/or meeting notes between yourself and your informatics department or operational colleagues as verification of the reason for the difference

- record this difference in your ICAL so it can be easily understood in the future either internally or externally

- record this difference in your NCC sign off so we can record the difference in our systems for future reference.

-

A trust’s NCC reconciliation should be retained on file for audit and assurance reasons. There is a proforma activity reconciliation template in the updated ICAL on FutureNHS.

-

Further information on how we match your submitted PLICS data to the mandatory dataset can be found in Annex 2.

National Cost Collection submission overview

Introduction

-

This section sets out the scope and governance for the 2024 National Cost Collection (NCC) and should be read by all organisations that submit data for the NCC. It gives you the information you need to participate in the mandated collection during 2024. The year 2024 here refers to the cost collection for the financial year 2023/24.

-

You should read our introduction to the Approved Costing Guidance and Reconciliation and exclusions before reading this section.

-

It is mandatory for all NHS trusts and NHS foundation trusts in existence between 1 April 2023 and 31 March 2024 to comply with the NCC guidance and the collection timetables.

-

You should read the Integrated extract specification in conjunction with this section.

-

To maintain consistency and minimise burden, we have designed a collection of minimal changes only in 2023/24. We hope this will allow the sector to work from a stable foundation of relatively unchanged guidance and collection.

-

Details of our main support contacts during the collection are also in our introduction to the Approved Costing Guidance which also contains information on how your data is used and shared.

Changing operational structures

- Several changes in a trust may affect its NCC submission:

- mergers

- acquisitions

- integrations

- major service reconfiguration.

- If any of these affect your trust for the 2024 National Cost Collection or future collections, please contact the costing team at costing@england.nhs.uk to ensure your submission is in line with the mandation.

If your trust is merging with or being acquired

- In line with the Treasury’s financial reporting manual, two or more public bodies that are combining or transferring functions should apply absorption rather than merger accounting. Your collection for 2024 may be affected by a merger or acquisition either in the financial year for which data is being submitted or in the year of collection. For example:

- date of merger 31 January 2024 – merger during financial year being submitted

- date of merger 28 April 2024 – merger during year of collection.

- As each merger is unique, please contact us at costing@england.nhs.uk with the subject line merger group trusts as early as possible so we can lead you through the process and offer targeted guidance.

Submission window for 2024

- The dates for the submission window for 2024 NCC will be shared on FutureNHS.

Our support during the collection

-

We can support you in many ways leading up to and during the submission period. For more details, see FutureNHS.

-

We will publish frequently asked questions (FAQs) on FutureNHS starting after the publication of the Approved Costing Guidance.

-

Please do not contact members of the NHS England costing team directly.

-

If you leave your trust or your trust costing practitioner changes, please let us know via costing@england.nhs.uk so we can update our communication lists.

Scope of activity and costs to be collected

-

The NCC collects data about the costs of patient care in the NHS. This means some of the costs your organisation incurs are not collected. This details the scope of activity and costs your organisation should submit.

-

You should use the 2023/24 National Costs Grouper.

Costing period

-

The costing period begins on 1 April 2023 and ends on 31 March 2024.

-

For patient-level cost collections of admitted patient care (APC) all patient episodes completed within the costing period or still open at the end of the costing period are in scope. Episodes are classified by type according to their completion status. Please see Standard IR1 in Integrated costing standards, for more detail.

-

The emergency care (EC) extract list in the extract specification details the period of expected values for arrival date, and time and date of departure from the emergency department that should be accounted for in the financial year 2023/24.

-

The specialist ward care (SWC) feed type specifies the costing period is for all occupied bed days in 2023/24.

-

All mental health provider spells (MHPS) completed within the collection year, or hospital provider episodes still open at the end of the collection year, are in scope of this collection. A spell or episode that is unfinished at the end of the financial year must be collected as part of the month 12 file.

-

All mental healthcare contacts (MHCC) completed within the collection year are in scope of this collection.

-

All IAPT care contacts attended within the collection year are in scope of this collection.

-

All community health service (CHS) care contacts within the collection year and in scope of this collection.

-

For supplementary information: high-cost drugs, high-cost blood products, high-cost excluded devices, unbundled imaging and virtual wards are in scope of this collection.

-

For aggregated costs, the type of care should be assessed and the rules noted above should be applied to their inclusion.

-

Only resources used and activities undertaken within the costing period should be included, regardless of when the patient event started or ended.

What do providers need to submit in 2024?

- Patient-level costs are collected at the level of each patient event. A patient event is:

- an attendance, episode or contact for acute activity

- a spell or care contact for mental health activity

- a care contact (attendance) for IAPT activity

- a care contact for community services

- an incident for ambulance activity.

-

For each patient event costing data is collected for resources used and activities undertaken. These are listed in the appendices to the extract specification relevant to your primary or integrated sector.

-

The extract specification spreadsheet documents the fields to be collected for each sector. If your trust provides the relevant services, the following PLICS extracts should be reported at patient level for this collection:

- admitted patient care (APC) complete and incomplete episodes, including regular day or night admissions and community inpatients

- outpatients (OP) non-admitted patient care (NAPC) attendances, including ward attenders, any community attendances reported on the commissioning dataset (CDS) and wheelchair attendances

- emergency care (EC) accident and emergency attendances, including minor injury units, urgent treatment centres and walk in centres

- specialist ward care (SWC) adult, paediatric and neonatal critical care bed days

- supplementary information (SI) high-cost drugs, blood products and devices, unbundled imaging and virtual wards

- mental health provider spells (MHPS) complete and incomplete spells: trusts that submit their inpatient mental health data to Hospital Episode Statistics (HES) should submit their costs on the APC XML extract; trusts that submit their inpatient mental health activity to MHSDS should submit costs on the MHPS XML extract

- mental health care contacts (MHCC) non-admitted patient care (NAPC)

- Talking Therapies care contact (attendances)

- community services care contacts (CSCC) contacts in a patient’s home or community setting including non-face to face contacts such as telemedicine

- aggregate (AGG) patient events that are unable to be collected at patient level due to volume or legal restrictions.

-

If you are unable to meet the requirements of the extract specifications, please complete the MS form found here.

-

Aggregated unit costs are collected for some services that cannot be collected at patient level. These costs should be submitted on the AGG feed in the extract specification.

Education and training

-

Separate education and training (E&T) costs are not part of the mandated 2024 National Cost Collection.

-

In 2024 trusts are required to net off their E&T income from patient care costs. The E&T transitional method in CM35: Education and training gives guidance on how to do this in a transparent way; organisations that provide E&T should follow this method.

-

We will not be changing the NCC process for E&T costs (where income is used as a proxy for cost) in 2024.

Sign off process

-

The trust director of finance must send sign-off to the NHS England Costing Team on the day of their trust’s final NCC submission.

-

While the trust director of finance is overall responsible for the accurate completion of the combined costs collection return the submission should be subjected to the same scrutiny and diligence as any other financial returns submitted by the provider. Therefore for 2024 NCC you are also required to obtain board level sign-off.

-

Two reports should be taken to the board:

- a pre-submission report – before the submission window opens for 2024

- a final submission report – at around the time of or following submission.

- At pre submission stage, a report should be taken to the board confirming:

- The costing process has been approved ahead of the collection.

- The return has been prepared in accordance with the Approved Costing Guidance, which includes the NCC guidance.

- Information, data and systems underpinning the combined costs collection return are reliable and accurate.

- There are proper internal controls over the collection and reporting of the information included in the combined costs collection, and these controls are subject to review to confirm that they are working effectively in practice.

- The costing team is appropriately resourced to complete the National Cost Collection return, accurately within the timescales set out in the guidance.

- Any actions from previous NHS costing assurance process (CAP) reviews of costing or data quality have been formally followed up and completed (as appropriate).

- A second report should be tabled, just prior to final submission confirming that:

- The information included in the submission – both cost and activity – has been reviewed and verified as accurate.

- All mandatory and significant non-mandatory validations have been reviewed and verified.

- Any significant areas where the trust has varied from the mandation (ie unable to submit at patient-level or issues around activity or methods of apportionment) have been agreed with NHS England and have been reported to the Board.

-

An editable version of the board assurance pro forma will be available on FutureNHS.

-

We list the checks you should make as part of your internal assurances before submitting your cost collection in a learning extension on FutureNHS but we will not collect this information.

Main changes for 2024 National Cost Collection

Mental health provider spells

-

In the 2023 NCC with the removal of clustering, mental health trusts were asked to submit mental health service or team type. Following feedback received we have been made aware that this field is not relevant for inpatient services.

-

For the 2024 NCC we want to improve this and are asking trusts to submit hospital bed type (mental health) also known as mental health admitted patient classification. This field should be populated for trusts who provide inpatient services however as it is only a required field in the mental health data set (MHSDS), some trusts may not have populated this field however we expect this to be the minority.

-

Where your trust does not have this field populated in MHSDS you should leave this field blank.

-

If you have multiple currencies or commissioners within one provider spell, you can choose to identify this in your submission by creating a duplicate record in the data feed. However, if you do this you must leave the spell dates the same for both records and the cost must be split appropriately between the multiple currencies or commissioners. You must not leave the whole spell cost in both episodes of data as this will stop your cost quantum reconciling.

Extract specification changes

-

In the aggregate data feed a legally restricted sensitive data indication has been added to flag if data is LRSD or not. As a result of this new flag being added the ACSIU field has been expanded. See the extract specification for the full list of ACSIU expected values.

-

In the EC data feed the data item Urgent and emergency care activity type has been updated to include codes 05 ‘Same Day Emergency Care’ and 06 ‘Urgent and Emergency Care Extended Care Episode’.

Developing currencies

Mental health

- The Payment Development team at NHS England have developed new currencies for mental health. These have been added to the MHPS and MHCC feed in the extract specification and we will operate dual running of these currencies in the 2024 National Cost Collection. This new data item is called ‘Mental Health Services Currencies in Development’ and the data items are:

- A000: Adult: Psychosis and Bipolar Disorders

- B000: Adult: Mood and Anxiety Disorders

- C000: Adult: Eating and Feeding Disorders

- D000: Adult: Neuro-cognitive Disorders

- E000: Adult: Personality Disorders and Complex Trauma

- F000: Children: Getting Advice

- G000: Children: Getting Help

- H000: Children: Getting More Help.

- You should refer to the extract specification for a further breakdown of the settings that can be attributed to adult currencies.

Community services

- For community care the Payment Development team have developed new currencies for frailty and end of life. These have been added to the CSCC feed in the extract specification and we will operate dual running of these currencies in the 2024 National Cost Collection. This new data item is called ‘Community Health Services PLICS Currencies in Development’, the data items are:

- FR00: Frailty Group

- LYOL00: Last Year of Life Group

- SEOC00: Single Episode of Care Group

- CYP00: Children and Young People Group

- LTC00: Long Term Conditions Group.

-

You should refer to the extract specification for a further breakdown of the categories that fall into the Frailty and Last Year of Life groups.

-

We plan to share a mapping document to these new currencies on FutureNHS.

-

If you are able to submit data for these new mental health or community currencies, it must be in addition to the existing mandatory community currencies.

Preparing PLICS files

Medicines in 2024

-

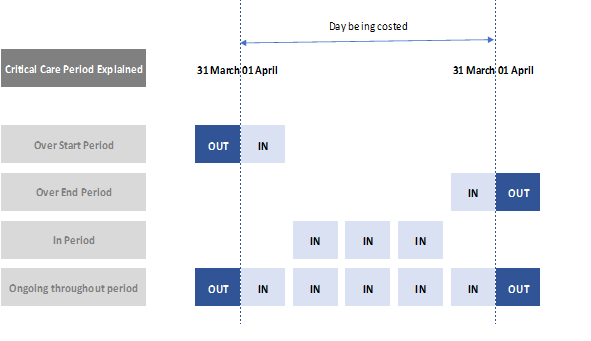

For 2024, the cost of medicines is split between the AGG feed and the patient-level collection. In the latter, medicines are identifiable in the collection resource CPF005 Drugs (including drugs on the supplementary information (SI) drugs and blood products list). More detail of high-cost drugs is given in the SI feed.

-

Annex 3 provides a diagram for how medicines should flow in the NCC.

-

In the extract specification reference tables the three types of patient-level drugs have the following prefix codes in the currency.

- PCTD – patient level chemotherapy drugs

- PHCD – patient level high-cost drugs

- PSCD – patient level specialised commissioning drugs.

- There are two drugs lists in the extract specification. One for drugs that should flow in the supplementary information (SI) feed and one for drugs that are legally restricted sensitive data (LRSD) and should flow in the AGG feed.

- Medicines for patients designated as having an LRSD characteristic, including in vitro fertilisation: collect in the AGG data feed

- Medicines for patients who have an LRSD characteristic but the attendance/ treatment is not for this characteristic: exclude on the INTREC with the patient event

- High-cost drugs and blood products (including high-cost renal drugs): SI feed (PLICS) – only high-cost drugs and blood products identified as not LRSD

- High-cost drugs and blood products (including high-cost renal drugs): AGG feed: any high-cost drugs and blood products identified as LRSD

- Chemotherapy drugs: flow as part of PLICS; should be part of the cost of the delivery HRG unless it is a drug listed on the SI drugs and blood products list, in which case it should be included in the SI feed. If you have chemotherapy drugs that do not match to a chemotherapy delivery HRG they should flow as part of the composite cost of the core HRG

- Homecare drugs: excluded – reconciling item too burdensome to collect at aggregated level or patient level. Where a drug is both chemotherapy or high-cost drugs and homecare, treat it as homecare first, so the cost of all homecare drugs is excluded from the collection

- Non high-cost renal drugs: flow as part of PLICS, should be part of the composite cost of the episode or attendance.

- Cystic fibrosis drugs: flow as part of PLICS; should be part of the cost of the episode or attendance unless it has been listed as a high-cost drug, in which case it should be included on the SI feed.

- Any other drug: flow as part of PLICS; part of the composite cost of the episode or attendance.

- Red Book drugs: flow as part of PLICS; Red Book drugs should be submitted on the SI feed where they are drugs on the high-cost drugs list in the data extract specification. There will be no patient identifiers for them as there is no patient identifiable data in the SI feed. Any Red Book drugs that are not on the high-cost drugs list would be treated as an overhead to the relevant service.

PLICS extract matching identifier

-

As defined in the costing methodologies, matching should be used to attribute support service costs in auxiliary feeds to the master feeds of the clinical event. Once the support service costs have been attributed to the master feeds, you should then link unbundled costs to the core clinical event through the generation of a PLICS extract matching identifier (PLEMI).

-

The PLEMI should enable linkage of all elements of a spell/episode/attendance/care contact/event so the total cost of the clinical event can be understood, regardless of how the elements of the unit costs are submitted in the collection. It also has the benefit of reducing the volume of data that needs to be collected.

-

For example, linking a critical care patient event to an admitted patient care (APC) patient event, the specialist ward care (SWC) PLEMI will be the same as the PLEMI in the APC patient event. Or, if a patient is given a high-cost drug during an inpatient episode, the rows for the inpatient episode will have the same unique ID as the high-cost drug.

-

We do not specify the exact structure of the PLEMI, you can create this yourself; however, it does need to be unique for each episode/attendance/ care contact/event. The identifier format is alphanumeric (including special characters) and has a maximum length of 50 characters.

-

There is a learning extension on FutureNHS giving examples of the inpatient journey using the PLEMI but this identifier can be applied to all extracts collected at PLICS level.

- The PLEMI is already established in costing systems but may have a different name. If you are unsure about this, please ask your software supplier.

Patient-level costing collection activity count

-

In the extract specification for feed types APC, EC, OP, SWC, SI, MHPS, MHCC, Talking Therapies (known as IAPT in the extract specification) and CSCC, you are required to submit the ‘activity count’. This is the number or duration of activities undertaken, for example number of tests or length of time in theatre.

-

The complete list of activity counts with the corresponding collection activity is shown in the integrated data extract specification, worksheet: Ref Data – Activities.

-

In previous years the data quality of the activity count field has been poor because of multiple pre-collection allocation drivers being assimilated into one count on the XML file. There is a learning extension on FutureNHS with worked examples of how to complete the activity count field.

Integrated extract specification

-

The data feeds remain split by the type of care being delivered. For example, APC collects APC for acute and community services (episodes), MHPS collects inpatient stays for mental health services (spells) and CSCC collects care contacts for community services (care contacts).

-

There is also a new feed for the collection of aggregate data.

-

The separately published extract specification sets out the exact structure of the CSV or XML files you need to produce for the collection: field names and formats, with valid codes for fields where applicable. CSV extract files must be converted to XML before making your NCC submission.

Part costs

-

In some cases, patient care is provided by resources supplied from two or more organisations (NHS or non-NHS) without a corresponding cost recharge. These patient events should be identified with an indicator in the extract specification, indicating that the costed patient event includes only part of the cost.

-

This indicator was introduced to ensure all patient events are costed within the NCC submission but the costs are not artificially lower because of these shared provider arrangements. The patient events flagged as part costs must still include overheads.

-

To ensure PLICS data is useful for local and national analysis it is important to identify these events so they can be excluded or included, depending on the need of the stakeholder.

-

The patient event data item should be costed and reported by the main provider organisation. The organisation supporting that patient event should identify the cost of the staff support or care provided and exclude this cost on the INTREC.

-

Examples of where a part cost indicator might be needed:

- integrated care systems (ICS), where staff from multiple trusts contribute to the care for an ICS managed pathway

- where national programmes contribute to patient care via staff or non-pay items rather than by funding the items via income

-

A part cost indicator does not have to be applied where the cost of the patient event is materially appropriate, and the cost of care provided by another organisation is negligible.

-

Only the main organisation recording the activity should use the part cost indicator. The supporting organisation should exclude the costs of the resource given in the provider-to-provider line of the INTREC.

-

From 2024 the part costs indicator is shown in all feed types, excluding EC.

-

The part costs flag should only be used where items are material to the cost quantum and without would lead to inaccurate conclusions being drawn from the costing data.

Acute, mental health and community inpatients

Collection scope

-

All inpatient episodes and hospital provider spells completed within the collection year or still open at the end of the collection year are in the scope of this collection. Further information on incomplete patient events is below.

-

An episode or spell unfinished at the end of the financial year must be collected as part of the Month 12 XML file.

-

Only include resources used and activities undertaken within the collection year, regardless of when the hospital provider spell started or ended. For example, only costed ward care bed days within the collection year should be reported.

-

The cost of these items must be reported using the appropriate collection resource and collection activities at a patient level in the PLICS XML files. Costs and activity should be submitted by episode for APC and by occupied bed day for MHPS.

-

As part of the mandation of community, admissions reported as intermediate care bed days are in the scope of the PLICS collection but should be submitted per episode, not per bed day.

Incomplete patient episodes and spells including clinical event type

-

To identify and calculate the cost of incomplete patient episodes, refer to Standard CM2: Incomplete patient events.

-

For APC, the point of delivery (POD) submitted for an incomplete episode must be that of the episode if it were complete (see example below), so that on linking type 1 to type 2 episodes, the correct POD is in both records. The data validation engine (DVE) analyses types 1 and 2 length of stay separately from type 3.

-

For example, the admission of a patient as an emergency on 31 March 2024 at 14:40 and their discharge on 10 April 2024 should be recorded as non-elective (NEL), not non-elective short stay (NELST).

-

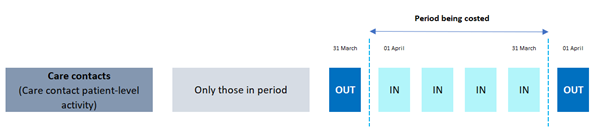

Four types of episodes or spells are collected, and should be grouped by the ‘EpType: Episode Type’ data item:

- All episodes or spells started in a previous year (over start period) and finished in the current collection year. To correctly allocate the right proportion of costs, for example ward costs, to these spells in your costing system, calculate the proportion of the episodes or spells in days falling in-year.

- All spells started in the current collection year but incomplete at year-end (over end period).

- All spells that started and finished in the period (in period). These do not require a specific calculation at year-end.

- All spells started in a previous year and incomplete at year-end (ongoing throughout the period). To cost these long-stay patients, count the number of in-year days to ensure the in-year costs only are allocated to in-year activity.

- Episodes or spells with a start date before the costing period, should flow with the actual start date of the episode or spell, so there is no change to the nationally reported episode or spell start date. You should not adjust the start date to be the start date of the costing period.

Admitted patient care episodes

- The following types of admitted patient care (APC) should form the basis of the episodes collected in the APC PLICS data feed:

- day case electives

- ordinary electives

- ordinary non-electives

- regular day or night admissions

- community inpatients.

- The 2023/24 National Costs Grouper attaches a core HRG to every finished consultant episode (FCE). Activity run through the grouper that gets attributed a core HRG will be reported in APC.

Episode grouping in APC

-

Community inpatients will be reported on the APC feed but may not include sufficient clinical coding to calculate an appropriate HRG. These community inpatients will be categorised using a new field: ‘EpGro: Episode grouping’.

-

Episode grouping is the patient care group for the episode and identifies whether a patient episode has sufficient clinical coding to have a reliable HRG in the HRG field. The episode grouping codes and description are shown below:

- 01 Episode with costing grouper HRG (all but undefined groups)

- 02 Community medical episode

- 03 Community surgical episode

- 04 Community intermediate care episode

- 05 Community neuro rehabilitation (long stay unit) episode

- 06 Other community rehabilitation episode

- 07 Community palliative care episode

- 08 Other community episode

- 09 Other episode with undefined group HRG

- 10 Mini episode for patient with rehabilitation complexity scale

- 11 Specialist rehabilitation patient at bed day level.

-

Acute trusts already submitting episode data at patient level are expected to use the episode grouping codes of 01 HRG data, or in some situations, code 09 UZ01Z HRG.

-

Providers of community inpatient services (including trusts designated as mental health for their primary sector and acute trusts with some community hospitals) will use codes 02–08, to add detail to the episode record. These community inpatient records may have an HRG attached, using the limited clinical coding information available.

-

High-cost drugs, devices and blood products are unbundled from the core HRG. The cost of these items must be reported using the appropriate collection resource and collection activity at a patient level in the SI extract (see Supplementary information in 3.13: 2024 National Cost Collection overview).

-

Adult, paediatric and neonatal critical care is unbundled from the core HRG. The cost of the days within the financial year of the collection must be reported using the appropriate collection resource and collection activity at a patient level in the SWC extract (see Specialist ward care).

-

The episode grouping data item has been expanded to provide options to flag the way you submityour trust’s specialist rehabilitation data. You must use one of the following categories:

- 01 Episode with costing grouper HRG (all but undefined groups)

- 10 Mini episode for patient with rehabilitation complexity scale

- 11 Specialist rehabilitation patient at bed day level.

Ordinary non-elective short stays and long stays

-

All ordinary non-elective activity must be separately identified as either long or short stay by completing the input fields required by the grouper for critical care, rehabilitation and specialist palliative medicine length of stays. The grouper deducts these days from the core stay when processing your APC data.

-

A short stay is one day. The grouper automatically adds one day to admissions with a zero-day length of stay. All other stays are long.

Regular day or night admissions

- Regular day or night admissions are reported in the APC collection for PLICS. Admissions for specialist palliative medicine, chemotherapy, radiotherapy or renal dialysis, should be reported against the relevant sections of the collection, not under regular day or night admissions.

Mental health provider spells

-

This section covers mental health provider spells (MHPS) and APC, which are the basis of the spells collected in the MHPS PLICS data feed.

-

Mental health trusts will submit both complete and incomplete costed spells for APC. There is a learning extension on FutureNHS with an example of trimming spell dates to match the costing period.

-

In some circumstances, a patient may:

- take home leave or mental health leave of absence for a period of 28 days or less

- have a current period of mental health absence without leave of 28 days or less which does not interrupt the hospital provider spell

- be transferred temporarily to an acute provider for treatment.

- You are not required to amend the length of stay for home leave as there is a mandatory field in the MHDS which can be matched to and adjusted if needed.

Outpatients

Collection scope

- This section covers the following types of outpatient activity and should form the basis of the activity collected in the OP PLICS data feed:

- outpatient attendances, including ward attenders

- procedure-driven HRGs in outpatients.

-

Outpatient attendances and procedures in outpatients should be reported by HRG and TFC service identifiers at patient level.

-

The grouper may attach one or more unbundled HRGs to the core HRG produced. Only core attendances should be reported on the OP extract for acute providers.

-

Unbundled imaging HRGs that unbundle from the core HRG should be reported on the SI feed.

-

Missed appointments (did not attends – DNAs) and cancelled appointments should not be recorded, and their cost should be treated as an overhead.

-

Advice and guidance should be allocated as an overhead to the service as there is currently no specified currency for them. This includes admission avoidance where advice is sought between clinicians.

General outpatients

- Outpatient attendances in HRG4+ (WF01* and WF02*), generated from mandated fields in the outpatient Commissioning Data Set (CDS), are organised by:

- first and follow-up attendance

- face-to-face and non face-to-face attendance

- single and multi professional attendance.

-

The above terms are defined in the NHS Data Model and Dictionary.

-

Where a patient sees a healthcare professional in an outpatient clinic for a consultation this counts as valid outpatient activity, regardless of whether they receive any treatment during the attendance. NHS providers offer outpatient clinics in a variety of settings, and these should all be included in the cost collection where the cost is part of your operating expenditure (see How to obtain your cost quantum).

-

For the purposes of the NCC, outpatient clinical events submitted as part of the Commissioning Data Set (CDS) should be submitted as part of the OP feed. Any clinical events submitted as part of the Community Services Data Set (CSDS) should not be submitted in the OP feed.

-

The NCC does not distinguish between attendances that are pre-booked and those that are not.

-

The patient event is recorded under the same TFC for the appointment (for example a physiotherapist assessing an orthopaedic patient) regardless of whether they see the clinician they were referred to or another healthcare professional.

Maternity non-admitted patient care

- Hospital maternity attendances should be included in the OP extract. Maternity outpatient services include:

- hospital clinics (obstetric and midwifery)

- midwifery antenatal and postnatal care undertaken by NHS providers in GP surgeries and community-based clinics

- midwifery or other maternity community care contacts with patients in their own home

- ward attenders.

- Within the appointment (regardless of whether this has included a consultation) there may be costs for:

- routine scans

- routine screens and tests.

-

Processing of maternity outpatient activity by the costing grouper may result in an outpatient procedure if the data includes the appropriate OPCS codes. Diagnostic imaging should not be unbundled from outpatient procedures: the cost should be included in the cost of the patient event and therefore not reported on the SI feed.

-

The costs of sample analysis under a separate commissioner contract (such as genetic testing, biochemistry analysis, specialist diagnostic laboratories) should not be included in the obstetrics or maternity costs.

Paediatrics

-

Providers should allocate costs and activity to paediatric TFCs in line with their NHS Data Dictionary definition: “dedicated services to children with appropriate facilities and support staff”.

-

A few patients aged 19 years and over are also cared for by specialist children’s services. Such activity, where the patient is seen by a paediatric care professional, is assumed to use resources similar to those for children rather than those for adults and should be reported under the relevant paediatric TFC.

Therapy services

-

Where patients have been referred directly to a hospital therapy service by a healthcare professional, including a GP, or have self-referred and are seen in a discrete therapy clinic solely for the purpose of receiving treatment, the attendance should be submitted as outpatients as reported on the CDS.

-

Where these services form part of an inpatient event or outpatient attendance in a different specialty, the costs form part of the composite costs of that episode or attendance and should not be reported as a therapy outpatient attendance.

Wheelchair contacts

-

Wheelchair services remain at soft implementation level for 2024.

-

The wheelchair contacts (attendances to a clinic and home visits) will be collected in the OP extract with specific data items to identify the activity instead of relying on the TFC.

-

Wheelchair categories created for the purpose of the collection have been added to the OP table in the reference data. The wheelchair contacts should use the collection activity COM003 Wheelchair contact.

-

Wheelchair equipment costs should be submitted on the AGG feed. This includes repair and maintenance.

-

Wheelchair contacts should not be submitted in the CSCC file.

Mental health and community care contacts

Collection scope

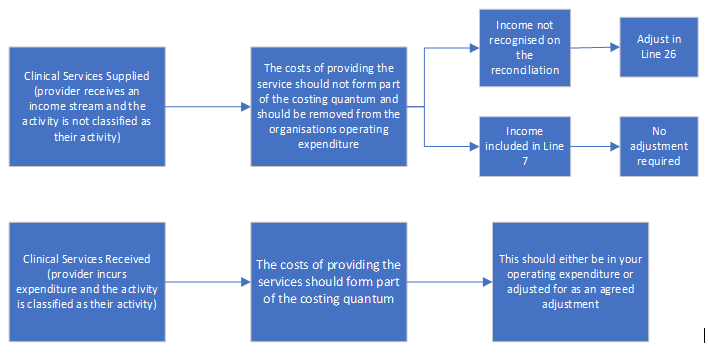

- All mental health care contacts (MHCC) and community services care contacts (CSCC) within the collection year are in scope of this collection as shown in Figure 2.

Figure 2: Scope of care contacts collected

-

Where a care contact starts in one costing period and ends in another (for example for night care), the start date determines whether it should be included in the cost collection, not the end date.

-

Missed appointments (DNAs) and cancelled care contacts should not be recorded and the cost should be treated as an overhead. Only attended care contacts are in scope for the PLICS collection.

Mental health care contacts

-

This section covers mental health non-admitted patient care contacts collected in the mental health care contact (MHCC) PLICS data feed.

-

Trusts that submit their acute services outpatient MH data to HES should submit their costs on the OP XML extract. If your MH care contacts are submitted to MHSDS, costs should be submitted on the MHCC ‘Feed Type: Patient-level costing care activity type code’.

-

Learning disabilities data that is submitted to MHSDS can be submitted in your NCC for 2024.

-

If you are unable to disaggregate learning disabilities or the data is not submitted to MHSDS then the costs can be excluded from the NCC in 2024 and should be recorded on the appropriate line of the INTREC.

Community services care contacts

-

This section focuses on community health services previously submitted at aggregate level on the CHS worksheet where the patient activity is mandated as part of the Community Services Data Set (CSDS).

-

Specialist acute non-admitted patient care activity in the community is part of the Commissioning Data Set (CDS), with a community ‘location’ and should be reported in the OP extract. The community location will be identifiable with an activity type location code that is the patient’s home or a community setting. The dataset is the method of identifying the cost collection file.

-

For the community sector in 2024 , cystic fibrosis drugs and high-cost devices remain as excluded items in the National Cost Collection and therefore should be on the XML reconciliation as an agreed adjustment. Please email the costing inbox costing@england.nhs.uk with ‘Agreed adjustment’ in the subject line.

-

Allied health professions, including podiatry, are in scope of the collection. These care contacts should be submitted to CSDS and will therefore flow in PLICS on the CSCC feed.

-

The services described in this section may be provided in various locations/settings in the community, such as a patient’s home, clinics, community hospitals, GP practices or health centres, and will include non-face-to-face contacts as recorded on the CSDS. Community rehabilitation is within scope of the patient-level collection, however the data feed for PLICS is determined by where the activity is submitted:

- Community nursing PLICS should be submitted on the CSCC feed. You should identify whether the activity is for:

- a community nurse as reported to the CSDS; for example district nurses or

- a specialist nurse who would normally be in an acute setting but is visiting a patient’s home for specialist care. These patient events may be reported on the CSDS, and if so, should be included in the CSCC file. If this specialist nursing is reported on CDS, the patient events should be included on the OP feed.

-

Daycare facilities are a community care contact and will use duration of contact to allocate the cost. They should be submitted on the CSCC feed if your trust’s activity data is submitted to CSDS. If your trust’s activity is submitted to CDS, not CSDS, the PLICS OP data feed should be used.

-