Introduction

This guidance contains the information requirements, costing processes and costing methods for the acute, mental health, Talking Therapies for Anxiety and Depression and community sectors. Guidance for the ambulance sector is available separately. Note that Talking Therapies was previously known as IAPT and the data feed on the extract specification will still be call IAPT for 2024 NCC.

The integrated technical document provides detailed information on the data items, terminology and the calculations of the prescribed Approved Costing Guidance. It is important to work through it with the relevant costing standard for full understanding.

The guidance also refers to supporting information on our FutureNHS platform. You can access FutureNHS if you have an NHS email address or email costing@england.nhs.uk to request access if you do not.

You will find the Costing glossary invaluable for understanding the concepts and terminology underpinning the standards.

Information requirement

Before you implement Information Requirement (IR) standard IR1: Collecting information for costing, you should read and understand:

- Costing principle: Materiality

- bring in the information feeds that cover the largest service areas first.

- Sources for national datasets: learning extension available on FutureNHS.

You should have access to the integrated technical document, in particular:

- Spreadsheet IR1.1: Patient-level feeds

- Spreadsheet IR1.2: Patient-level field requirements for costing.

IR1: Collecting information for costing

Scope

-

This standard specifies the requirement for the activity feeds as prescribed in the Approved Costing Guidance for integrated trusts: most are at patient level and some require aggregated information.

-

The information feeds described in this standard include prescribed and development feeds.

Overview

-

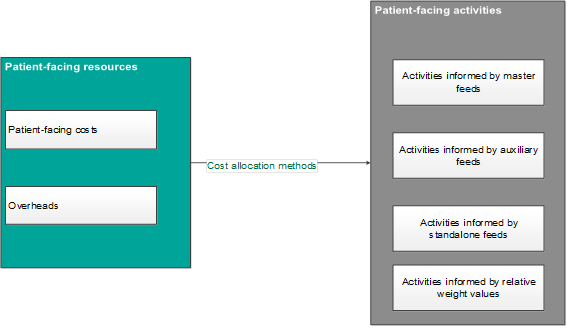

This standard describes the main information feeds for input into the costing system:

- master feeds (patient event information feeds): for example the admitted patient care (APC), non-admitted patient care (NAPC) and emergency department (ED) feeds

- auxiliary feeds: the patient-level activity feeds that contain the components of the care, for example the diagnostic imaging and pathology feeds

- standalone feeds: for example to provide records to be costed for services that are not costed at patient level and are not matched to any patient event, for example the cancer multidisciplinary team (MDT) meeting feed

- allocation feeds: local information sources to support relative weight values, for example the estates floor area data showing square metres per service.

-

Critical care is also a master feed but has special properties. Where the trust does not have separate episodes for critical care it will be the main feed and for others it will be an auxiliary. Other auxiliary feeds such as pathology can be matched to it. This improves the quality of the costing of critical care stays. See Critical Care feeds 6a, 6b and 6c

-

Master feed events show the unit of care that is costed – a patient event. For example, an inpatient episode or community care contact.

-

Auxiliary feeds and allocation feeds are used to provide proportional information on which patients have used a service and so will have cost from that service allocated to them. For example, which patients have used a ward or received high-cost medicines.

-

The auxiliary feeds match components of the care for a specific patient on a specific date (tests, scans and medicines,) to the patient event on the master feed.

-

Some patient-level feeds will include the specific cost of item or care provided for the patient but most will not include cost as a data item.

-

Most of the data items required for master feed patient events are available in the submission your trust makes to the national dataset for the service area. You should use the national definitions of activity from these data sources. A list of the national datasets used for costing is given in the FutureNHS Sources for national datasets: learning extension. This list is not exhaustive and other national datasets may provide extra information.

-

Spreadsheet IR1.1 provides a list of the data feeds needed to bring data into your costing system.

-

Spreadsheet IR1.2 contains the activity data fields for the feeds in spreadsheet IR1.1, following national naming conventions for the national activity datasets.

-

In the integrated technical document in spreadsheet IR1.2 state the activity data extract specification field code and field name as required by the National Cost Collection (NCC).

-

The data fields required in each information feed are for costing, collection, matching or business intelligence. The reason each field is included in a feed is given in spreadsheet IR1.2.

-

The information feeds provide four types of information to inform cost allocation:

- activities that have occurred, for example the NAPC feed itemises contacts with the patient

- the cost driver needed to allocate costs, for example ward minutes

- information to weight costs, for example the medicine cost included in the medicines dispensed feed

- information about the clinical care pathway, for example procedure codes that are used to allocate specific costs in the costing process.

-

The information feeds include data items for the NCC: for example patient information for linking PLICS across organisations and sectors, for example NHS number.

-

The information feeds also contain data items used in CP4: Matching costed activities to patients. The matching process uses a combination of data items to create a Patient Level Extract Matching Identifier (PLEMI) linking between auxiliary feeds and the master feed patient event.

-

The PLEMI may contain data items such as a unique patient identifier, service code, and the date and time of the episode but this concatenated code must be unique within the trust.

-

Work with your informatics department to understand the different types of activity captured and reported for each data feed. You may need to contact the service areas for some feeds, as they have their own data managers. For example, pharmacy departments often manage the medicines information.

-

The standards prescribe the information to be collected but not how it is collected. If you collect several of the specified feeds in one data source, continue to do so. Record the source of the data item and any local definitions for patient events or component costs in the integrated costing assurance log (ICAL) worksheet 3: Local activity definitions.

-

Where a prescribed data item is not part of national dataset and you use a local dataset, also record the source of the data item and local definitions for this activity in ICAL worksheet 3: Local activity definitions.

-

You are not required to collect a patient-level feed if your trust does not provide that activity, for example a provider with no mental health care is not required to assemble the mental health feeds.

-

If your trust provides mental health, community or maternity services, you need to identify whether the Mental Health Services Data Set (MHSDS), the Community Services Data Set (CSDS) or the Maternity Services Data Set (MSDS) submission contains special characters. For onward linkage after collection, the data items in the costing system that are used for linking, should match the submission your trust made to the national dataset. If the PLICS feeds do not match the national data submission, your NCC submission will be compromised, as it linking to the national dataset will not be possible.

-

For the MHSDS, CSDS and MSDS, to build the relevant patient-level feed, you will need to work with your service teams or informatics department to map local field names to the information feed data items in spreadsheet IR1.2.

-

Any costs not allocated by the patient-level feeds need allocation feeds. These hold the local information sources that inform relative weight values (RWVs).

-

Where you use local sources of information for costing, document them in your ICAL worksheet 2: Additional information sources.

-

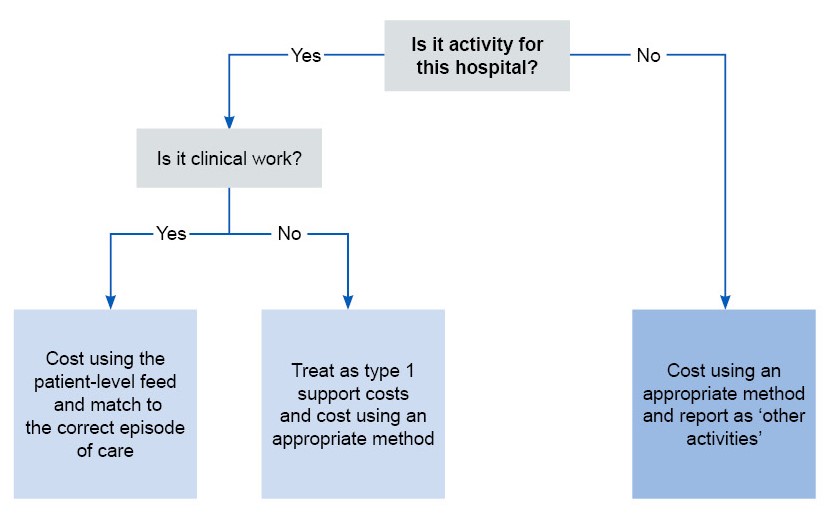

If you have activity in your data feeds where the costs are reported in another provider’s accounts, report this under ‘cost and activity reconciliation items’ as described in cost groups in CP5: Reconciliation. This is so your own patient costs are not allocated to this activity, deflating the cost of your own patients.

-

For internal reporting, the patient events where costs are reported in another provider’s accounts can be reported as part of patient pathways, even though the cost to the organisation is zero.

Additional patient-level activity feeds and data fields

-

The patient-level activity feeds specified above do not cover all patient activities involved in providing healthcare services or overheads.

-

You need to decide whether you require additional patient-level feeds to meet specific and material costing needs such as:

- offsite educational awareness/promotion

- immunisation programmes (for example site visits to schools)

- services provided to prisons and other secure locations

- primary care services.

-

Future development areas should be prioritised according to the costing principles and the following three criteria:

- value of service

- volume of service

- priority of the service within the provider and the healthcare economy.

-

If your trust already collects extra patient-level activity feeds in costing, we encourage you to continue and to record them in ICAL worksheet 2: Additional information sources.

-

Overheads and areas of general ledger (GL) disaggregation will need extra information entered in your costing system to create relative weight values (RWVs), so that the prescribed allocation calculation can be based on sound data. You should ensure this data comes from an appropriate source, the source is recorded and it is updated regularly.

Approach

Patient-level information for the costing process

- This section describes each information feed, explaining:

- accompanying costing standard(s)

- data collection source

- feed detail.

-

You should read the following sections describing the feeds listed in spreadsheet IR1.1 Patient-level activity feeds required for costing, in conjunction with spreadsheet IR1.2: Patient-level field requirements for costing and the FutureNHS Sources for national datasets: learning extension.

-

Your informatics team will be able to advise how to use the activity data in your local data systems, so you are working with the data sent to the national dataset and can reconcile to the patient events in your costing system.

-

You should reconcile your activity data regularly, to reduce the burden of the year-end process.

-

Activity for NHS-funded patients, private patients, overseas visitors, non-NHS patients and patients funded by the Ministry of Defence should be included in the costing system and costed. However, it is important to understand the type of patient for some cost allocations, and for reporting. The patient’s administrative category code in spreadsheet IR1.2 will supply this information. See CM7: Private patients and other non-English NHS-funded patients.

- Where your trust does not submit data to a national dataset but this is part of your ‘own patient care’ patient events, you should still have an electronic patient record. You should bring the events into the relevant feed, so all patient events can be costed. You should:

- Ensure your PLICS steering group is aware this information is not being submitted.

- Record this data in the local activity definitions on the ICAL worksheet tab 3, Local activity definitions and in your NCC activity reconciliation.

- Inform NHS England of why no submission is made to the relevant national dataset, and there can be no reconciliation between your National Cost Collection and the national dataset for this service. You should complete this MS form. This issue should also be logged and should form part of the NCC sign-off process.

Master Feed 1a and Feed 1b: Admitted patient care (CM13 Admitted patient care)

Data source

-

This data will come from the source used at your trust for the nationally collected and mandated admitted patient care (APC) Commissioning Data Set (CDS) (Feed 1a) or Mental Health Services Data Set (MHSDS) (Feed 1b).

-

The APC feed name is shown in spreadsheet IR1.2. The fields shown in this must be contained in the APC feed as these are required for the NCC.

-

For the most accurate mapping to mental health APC data, use spreadsheet IR1.2, which shows the MHSDS unique identifier codes for Feed 1b. There is no corresponding unique ID in the acute/community CDS for Feed 1a, so the field names listed should be used as the specific identifier.

-

You should take the data from the same source as your trust’s submission to the national dataset, using the same data as sent to the PLICS team at NHS England (formerly NHS Digital). This will allow the best possible reconciliation of your costed information to the national dataset.

Feed detail

-

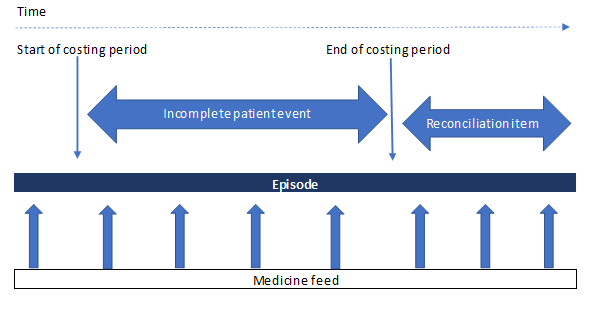

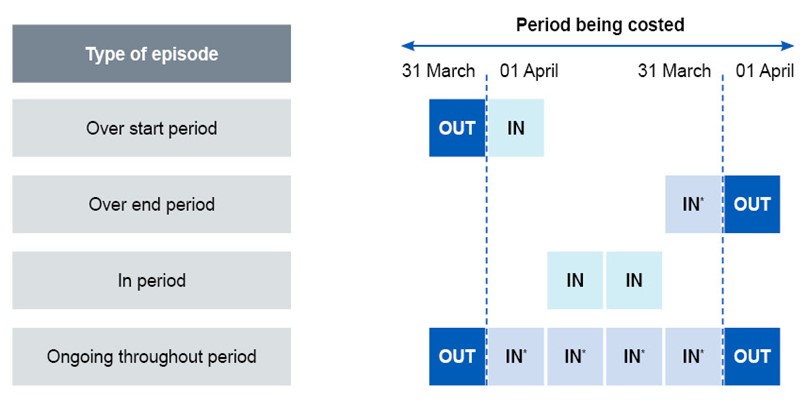

Scope: all admitted patient episodes (all sectors) within the costing period, including all patients discharged in the costing period and patients still in bed at midnight on the last day of the costing period. This includes regular day or night admissions.

-

Each record is:

- an episode in Feed 1a (CDS)

- a spell in Feed 1b (MHSDS).

-

Use the patient discharged flag in spreadsheet IR1.2 to identify whether a patient has been discharged. Including patients who have not been discharged as incomplete patient events reduces the amount of unmatched activity and ensures discharged patients are not allocated costs that relate to patients who have yet to be discharged. See CM2: Incomplete patient events.

-

We recognise that some patient-level information, such as clinical coding, may not be available until after a patient is discharged. However, information on ward stays and named healthcare professionals will be available and can be used in the costing process.

-

Feed 1a includes one row for ‘ICD10 – secondary and subsequent diagnosis codes’. You can repeat this row by adding a #2, #3, #4, etc, to include as many ICD10 codes, in order, as required locally. This will allow improved reporting of specific diseases or comorbidities within the costing system.

-

Acute and community patients on Feed 1a should be identified as one of the nine ‘Episode Groupings’. See CM13: Admitted patient care, spreadsheet IR1.2 and the integrated extract specification for more information.

-

This data item enables the identification of community inpatients within the same feed as the acute inpatients, and so avoids the need for another input feed or output feed. Episode groupings are for patient-level costing use only.

-

Some patients may return home for planned or trial periods while still admitted to an inpatient bed. In acute settings this may be a ‘hospital at home’ arrangement for step down care, and in mental health settings it may be ‘home leave’ designed to ensure a bed is reserved for their care. The APC feeds include this home leave to reflect the organisation’s continuing responsibility for the patient. You should review CM13: Admitted patient care when costing home leave.

-

For private patients, the designation of ‘administrative category’ may change during an episode or spell. For example, the patient may opt to change from NHS to private healthcare. In this case, the start and end dates for each new administrative category period should be recorded in the start and end date fields respectively, in spreadsheet IR1.2.

-

Where a patient has a care programme approach (CPA) meeting during a mental health admission, the date of this will be included in the field ‘care programme approach review date’. This will be used to identify a ‘contact’ with the patient. The cost will therefore not be part of the admission, it will be costed and reported separately as a patient event. See CM3: Non-admitted patient care.

Master feeds 2a and 2b: Urgent care (emergency departments/minor injury units/walk-in centres) (CM4: Emergency care attendances)

Data source

-

The data will come from the source used at your trust for the nationally collected Emergency Care Data Set (ECDS) and the emergency department (ED) Commissioning Data Set (CDS).

-

The data for some walk-in centres and other unplanned care centre attendances may need to be collected locally where not included in the ECDS. This data will need grouping to an HRG to complete the information for reporting and the NCC.

-

The ECDS is the mandated dataset for emergency care and has replaced the CDS dataset in national commissioning. However, ECDS does not include the investigation and treatment fields used to group to the HRG codes, which are still required for costing, and a manual mapping table has been provided by the National Casemix Office. You should bring sufficient information into the costing system to perform the costing process from the ECDS and the ED CDS sources.

-

For clarity, we have retained the original Feed 2 (now renamed Feed 2a) and have added Feed 2b ECDS to signal the move towards the new dataset when the HRG grouping issue has been resolved.

Feed detail

-

Scope: all emergency department (ED), minor injury unit (MIU) and walk-in centre (WIC) attendances within the costing period, including all patients discharged in the costing period and patients still in the department at midnight on the last day of the costing period.

-

The ED feed requires the same terminology as the ECDS, so SNOMED-CT codes should be brought into the costing system for the emergency care procedure field.

-

The Casemix groupers do not yet group to the emergency care HRGs from SNOMED-CT, so you should also include the investigation and treatment fields and HRG codes from the previous dataset – the A&E CDS. These can be mapped from the SNOMED-CT codes using the mapping tool supplied on the Secondary Uses Services webpage. The process of mapping from SNOMED-CT to investigation and treatment codes and grouping to HRG is used for contracting, so your local contracting/income team may have further information

-

The ED, MIU and WIC attendances are not admitted patient care. If a patient requires admission, they will have an episode which will show on Feed 1a. If the patient is admitted to a hospital bed in the ED unit, they should have a treatment function code (TFC) of 180 – these are still admissions and not ED patient events. Use the patient discharged flag in spreadsheet IR1.2 to identify if a patient has been discharged from ED (including where they are admitted to a bed in the ED unit).

Feeds 3a, 3b and 3c: Non-admitted patient care (patient events from CDS, MHSDS and CSDS) (CM3: Non admitted patient care)

Data source

-

This data will come from your patient administration system (PAS) but relates to three different national datasets. The feed should be built based on how your activity data is submitted in the mandated national data weekly/monthly submissions:

- Your trust’s outpatient appointments submitted to the nationally collected Outpatient CDS, should be included in the PLICS on Feed 3a NAPC.

- Your trust’s mental health care contacts submitted to the nationally collected MHSDS, should be included in the PLICS on Feed 3b NAPC (mental health).

- Your trust’s community care contacts submitted to the nationally collected CSDS, should be included in the PLICS on Feed 3c NAPC (community).

-

You should take the data from the same source as the national submission of the CDS, MHSDS or CSDS for Feeds 3a, 3b and 3c respectively, before the data is sent. This will allow the best possible reconciliation of your costing data to the national dataset.

Feed detail

-

Scope: all outpatient or clinic attendances, care contacts or other patient events in a non-admitted care setting or within the community within the costing period. This includes non-face-to-face contacts such as telephone calls.

-

This feed captures activity recorded on the PAS but not reported in the other master feeds, including:

- outpatient attendances and procedures – formal booked or drop-in sessions in a clinic setting

- community contacts, including those in the patient’s own residence or mutually agreed location

- telemedicine consultations, including telephone calls, video conference, text, email and online patient model

- ward attenders (outpatient attendances where the patient is seen in a ward environment but does not need an admission)

- day care (patients attending for general supportive activities throughout a day, sometimes but not necessarily including clinical therapy); patients are not admitted, but are present for far longer than a standard NAPC contact

- NAPC contacts in groups for care, education, therapy

- individuals who are well but have contacts with clinical services for example, for health promotion, preventive medicine and education

- did not attend (DNA) – note: these are included on the feed for information but are not patient events in the costing standard. See CM3: Non-admitted patient care.

-

The NAPC feeds (feeds 3a, 3b and 3c) should not include the following areas, which have different field requirements and separate feeds:

- Feed 3d: Community midwifery contacts

- Feed 3e: Home births

- Feed 16: Improving Access to Psychological Therapies

- Feed 17: Sexual health anonymised contacts

- Feed 18: Community dentistry

- Feed 19: Wheelchair service

- Feed 26: Direct access audiology.

-

We recognise not all NAPC activity is captured in the PAS. You may need to work with your informatics department and the relevant department to get the activity information at patient level and log this local information source in the ICAL worksheet 2: Additional information sources. See also the FutureNHS Managing information for costing: learning extension on FutureNHS.

Master Feed 3d: Non-admitted patient care (NAPC) (Community Midwifery) (CM3: Non-admitted patient care)

Data source

-

This data will come from the source used at your trust for the nationally collected Maternity Services Dataset (MSDS).

Feed detail

-

Scope: all community midwifery care contacts within the costing period, including antenatal and postnatal contacts.

-

This feed is separate to feeds 3a, 3b and 3c as community midwifery is not a mandatory part of submissions to CDS, MHSDS or CSDS national datasets.

Master Feed 3e: Non-admitted patient care (NAPC) (home births) (CM3 Non-admitted patient care)

Data source

-

This data will come from the source used at your trust for the nationally collected Maternity Services Dataset (MSDS).

Feed detail

-

Scope: all patients who have a home birth recorded within the costing period.

-

This feed is separate to Feed 1a as we are aware, not all home births are recorded on the submissions to the CDS national dataset due to local trust issues. The clinical record in MSDS is a separate mandated dataset. You should ensure there is no duplication of home births when setting up this feed.

-

Given the nature of the patient events, matches to this feed are unlikely.

-

All home birth patient events require a valid HRG for reporting.

Feed 4: Ward stay

Data source

-

This data will come from a local source. It will largely be relevant to acute and community providers as the required data will not be in Feed 1a: APC. (For mental health services, ward data is in the MHSDS and so Feed 1b: APC mental health may include sufficient information.)

-

If you also have the required data in your main APC feed, this feed is optional.

Feed detail

-

Scope: All patients with part or all of an admission within the costing period: both those discharged and those still in a bed at midnight on the last day of the costing period. This includes but is not limited to patients on:

- general wards

- ED observation and clinical decisions wards

- rehabilitation and other long stay wards.

-

The ward stay feed is an auxiliary feed that is matched to master feeds.

-

Each record on this feed is either a complete or an incomplete episode.

-

Use the patient discharged flag in spreadsheet IR1.2 to identify if a patient has been discharged or not.

-

The start and end dates on Feed 4 Ward stay and Feed 1a APC should match to a high tolerance level. Any anomalies will be data quality issues and should be reviewed if there is a material number.

-

Critical care patient-level information is collected in a separate feed, so you need to exclude the critical care ward stay information from Feed 4: Ward stay, to avoid costing critical care twice. See feeds 6a, 6b and 6c: Critical care.

-

The applicable types of CDS ward stays are:

- 120 – Finished birth episode

- 130 – Finished general

- 140 – Finished delivery

- 150 – Other birth event

- 160 – Other delivery event

- 170 – Detained and/or long-term psychiatric census

- 180 – Unfinished birth

- 190 – Unfinished general

- 200 – Unfinished delivery.

Master feeds 6a, 6b, 6c: Acute critical care – neonatal, paediatric and adult (CM6: Critical care)

Data source

-

This data should come from the source used at your trust for the nationally collected:

- Neonatal Critical Care Minimum Data Set (NCCMDS)

- Paediatric Critical Care Minimum Data Set (PCCMDS)

- Critical Care Minimum Data Set (CCMDS).

-

This data source should show the bed days of the critical care period separately from the patient’s episode. This information is required for the NCC.

-

You should discuss with your informatics department how to obtain the data that is submitted to the national system, so you can reconcile the bed days to the relevant national dataset.

-

We know some providers open a new episode of care when a patient is transferred to a critical care unit, whereas others do not. We do not advocate one approach over the other. You should therefore understand whether your trust holds the critical care data:

- as a discrete episode with a transfer of care to a consultant, or

- as part of a patient episode under the surgical or medical consultant, where another data item (such as the type of ward) or source (such as the CCMDS for the area) will identify the critical care.

-

Your costing system should create an identifiable record for critical care, separate from the APC record, showing each bed day (or part thereof) in critical care.

-

In adult critical care we recognise that not all episodes are recorded at bed day level. Ways to do this include:

- using the separate episode from Feed 1a: APC, as the critical care record

- creating a separate critical care period record showing the bed days where there is no separate APC episode using:

- Feed 6: Critical care, as it will show the dates the patient had a critical care period according to CCMDS (recommended option) or

- Feed 4: Ward stay, to identify the patient moving to the relevant critical care unit. Please note this option may require extra attention where dates on the ward stay feed do not match Feed 6: Critical care, which could cause problems with reconciling the costed data to the CCMDS.

-

Whichever approach your costing system uses, you need to ensure there is a critical care record to keep these costs separate from the APC data record. Consult your software supplier for more information on how your costing system creates the costed record for critical care.

Feed detail

-

Scope: All patients who had a critical care stay within the costing period, including patients still in a critical care bed at midnight on the last day of the costing period. These patient events should be recorded on the national datasets noted above.

-

This includes but is not limited to patients on:

- intensive care units, also called intensive therapy units

- specialist care units, including specialist care baby units

- high dependency units

- general wards, with a CCMDS record (see CM6: Critical care).

-

We recognise not all critical care activity is reported to national datasets. You should note in your ICAL worksheet 26: CM6: Critical care, where the data is not reported nationally.

-

Where costing processes require your APC length of stay to be adjusted to distinguish the time spent on critical care, use the prescribed matching rules on spreadsheet CP4.1 to identify the appropriate dates/times and create the net length of stay on the APC feed.

-

Spreadsheet CP4.1 also includes the matching rules for feed 4: Ward stay, if you are using that method to identify the critical care days.

Auxiliary Feed 7: Supporting contacts – mandated for selected services

Data source

- This data will be available from local systems.

Feed detail

-

Scope:

- Patients receiving specialist rehabilitation outreach supporting contacts and specialist palliative care supporting contacts. These supporting contacts will be mandatory from 2023/24.

- Patients receiving care from interventional radiology and audiology as part of an episode under a different TFC. These supporting contacts will be mandatory from 2024/25.

- Patients receiving care from critical care outreach teams while on a non-critical care ward. These supporting contacts will be mandatory from 2025/26.

- All other patients who had contacts from anyone other than the healthcare professional named on the master record within the costing period.

-

A patient often receives multiprofessional services during their patient event, but this may not be noted on the master record. Feed 7: Supporting contacts is designed to reflect the multiprofessional nature of the patient’s pathway and the costs associated with it: for example, physiotherapists working with orthopaedic patients on a ward.

-

There is no national source data for this feed:

- where data is available from the service, there may be multiple sources for the different types of supporting contact activities. For example, physiotherapy supporting contacts will be on a different feed from the critical care outreach team contacts. They should all be brought into a single feed using the feed structure in spreadsheet IR1.2

- where no electronic data is available, you should consider the materiality of the cost allocation. If you consider it to be material, work with the service and informatics to record the necessary supporting contacts.

-

An admitted patient can be expected to have contact with their named care professional during their admission as part of standard ward rounds and ward care. This does not need to be included on Feed 7 supporting contacts but can be added if it enhances the detail available to the costed record; for example, where a consultant’s medical ward round data is available at patient level.

-

Spreadsheet CP4.1 contains the prescribed matching rules for this feed.

Auxiliary Feed 8: Pathology

Data source

-

This data will be available from local systems.

Feed detail

-

Scope: All types of pathology tests undertaken by the trust or purchased for patients within the costing period.

-

Direct access tests should be identifiable from the ‘direct access flag’ field, as shown in spreadsheet IR1.2. See also CM23: Direct access.

-

Pathology tests, especially specialist tests, are often run via operational partnership agreements for provider-to-provider services. See CM8: Clinical and commercial services.

- You should ensure you can identify tests performed for other organisations, and not include them in the matched activity to your trust’s own patient care events.

- Where your trust received tests from another organisation for your own patient care, obtain the data and add it to the feed, to be matched to patient events in the same way as for your own pathology department.

-

Certain pathological tests may be purchased from highly specialist private sector organisations; for example, genetic testing or products in the research and development phase. Where these are of material cost and relate to your trusts ‘own patient events’, get the cost of these tests and match to the patient event. See also CM21: Clinical non-pay items.

Auxiliary Feed 9: Blood service products (CM28: Blood services)

Data source

-

This data will be available from local systems.

Feed detail

-

Scope:

- units of blood and blood components used in transfusion (red cells, white cells, platelets, plasma and other blood products)

- also Car-T Cell therapy, which is the patient’s own blood, collected, processed by a third party and given back to the patient.

Auxiliary Feed 10a Medicines dispensed and standalone Feed 10b: Home delivery medicines dispensed from third party (CM10: Pharmacy and medicines)

Data source

-

Feed 10a data will be available at patient level from local systems and will include the NHS Payment Scheme high cost drugs, chemotherapy drugs and the mandated drugs patient-level monitoring (DrPLCM) specification for specialised commissioning of high cost drugs. This covers approximately 70% of high cost medicines nationally, which may be extended by including locally commissioned high cost medicines.

-

Feed 10b may be used to include data from homecare medicine delivery contracts, where this data is available.

Feed detail

-

Scope: medicines dispensed in all provider locations including:

- medicines issued to the patient’s residence

- medicines attributable to individual patients (including high cost drugs, controlled medicines, medicine gases issued in bulk and discharge items)

- chemotherapy medicines

- medicines not attributable to individual patients (for example ward stock) within the costing period.

-

The medicines feeds will contain the cost of the medicine dispensed, to be used for a proportional allocation of cost. See CM10: Pharmacy and medicines.

-

FP10s are the prescriptions issued from hospitals and are out of scope of the medicines dispensed feed. You may include an FP10 feed at patient level as a superior costing method if this information is available.

Auxiliary feeds 12a, 12b, 12c: Diagnostics – imaging, maternity ultrasound and clinical physiology services

Data source

-

This data will be available from a range of clinical information systems.

- Feed 12a Diagnostic imaging data will be available from the clinical radiology information system or picture archiving and communications system (PACS) (diagnostic imaging) and other local systems. This system may also be known as radiology information system (RIS) or clinical radiology information system (CRIS).

- Feed 12b Maternity ultrasound data will be recorded in the local maternity system used to submit to the maternity services data set (MSDS).

- Feed 12c Clinical physiology will come from a range of local systems specific to the physiology service.

-

You may bring the data into the costing in a single feed containing all the information, or into multiple feeds, according to local system configuration.

-

Feed 12b should show the ultrasound scans undertaken in maternity patient events which are not recorded on the main diagnostic imaging system but should be clinically coded. It may also include other types of diagnostics if not recorded in another system. See CM24: Maternity.

Feed detail

-

Scope: all diagnostic imaging (Feed 12a) and clinical physiology (Feed 12c) scans and tests performed within the costing period, including maternity ultrasound (Feed 12b).

-

The diagnostic feeds are auxiliary feeds that are matched to master feeds.

-

Direct access tests should be identifiable from the ‘direct access flag’ field as shown in spreadsheet IR1.2.

-

You should ensure that ultrasound scans are not duplicated in both Feed 12a and Feed 12b. The pregnancy identifier is available in Feed 12b: ensure any scans relating to a maternity pathway are included in Feed 12b or elements will be missing from the maternity pathway reporting.

Auxiliary Feed 13: Theatres and specialist procedures suites (CM5 Theatres and specialist procedures suites)

Data source

-

This data will be available from local systems.

Feed detail

-

Scope: all procedures performed in theatres and specialist procedure suites within the costing period.

-

This feed should be at patient level, including time points, so the system can calculate pre-op, anaesthesia, surgical time, recovery and other relevant time sections.

-

This feed should also include session information to enable costing of staff to particular operations.

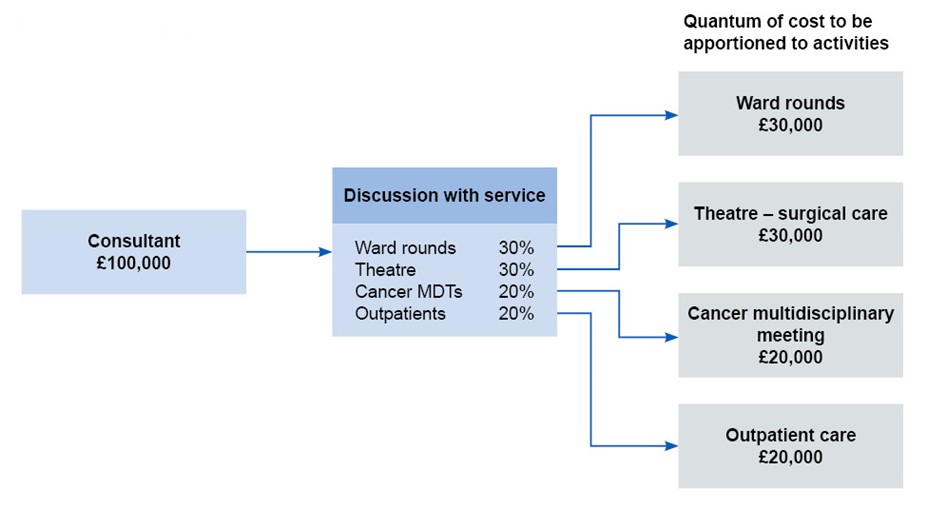

Feed 14: Cancer multidisciplinary team (MDT) meetings (CM9: Cancer MDT meetings)

Data source

-

This data will be available from local systems.

Feed detail

-

Scope: all cancer MDT meetings held within the costing period.

-

This standalone feed is not matched to master feeds and has no auxiliary feeds matched to it.

-

This feed does not have to be at patient level as the costs for MDTs are reported at specialty level rather than patient level.

Auxiliary Feed 15a: Prostheses and other high cost items and Feed 15b Homecare clinical items, personal equipment and consumables

Data source

-

This data will be available from local systems.

-

The high cost drugs and blood products listed in the integrated extract specification should be shown separately to the core patient event by inclusion on the supplementary information (SI) feed. This list has been created by combining worksheet 14b of the NHS Payment Scheme high cost drugs list, the specialised commissioning drugs taxonomy list and the specialist commissioning chemotherapy taxonomy list. Commissioning data will be available for these items.

-

A wider range of devices, consumables and personal equipment may be recorded in inventory management systems that track clinical non-pay items to the patient. Using this source of information for material non-pay items is a superior costing method.

-

If an inventory management system is not available, national programmes such as Scan4Safety or the National Joint Registry are useful sources of patient-level information for prostheses, devices and implants.

Feed detail

-

All prostheses, devices, implants and clinical non-pay items with a material cost provided to patients in clinical settings or at home, within the costing period.

-

The homecare clinical items, personal equipment and consumables feed is an auxiliary feed but is not expected to match to any master feed patient events.

-

Feed 15a is an organisation-wide feed to cover clinical non-pay items with a material cost, not just those used in theatres. Key areas to review are interventional radiology, cardiac devices inserted in catheter labs and assisted reproduction.

-

Feed 15b brings in items supplied to the patient’s home, so the costing system can report on the services vital to safe and effective care outside the hospital setting.

Master Feed 16: Improving Access to Psychological Therapies (IAPT)

Data source

-

This data will be available from local systems, in accordance with the submission of IAPT data.

Feed detail

-

This feed should contain the non-admitted contacts for IAPT services that are not recorded in the MHSDS dataset.

-

It is unlikely there will be any auxiliary feed matches.

-

As the fields available in IAPT are not the same as in the MHSDS we are treating this as a separate feed. The costing processes should be the same as those for CM3: Non-admitted patient care.

Feed 17: Sexual health

Data source

-

This data will be available from local systems.

Feed detail

-

Scope: all sexual health contacts within the costing period that are not recorded in the standard NAPC feeds.

-

This is a standalone feed and therefore should not be matched to any other feeds.

-

These may be pseudonymised contacts.

-

If used as a master feed, the sexual health feed patient events can have auxiliary feeds such as pathology matched to them, to show the testing part of the care. If the contacts are anonymised or pseudonymised, this may not be possible. See CM16: Sexual health services.

Master feed 18: Community dentistry

Data source

-

This data will be available from local systems.

-

There are three types of data for dental activity:

- in the main PAS as admission episodes (included in the APC feed, out of scope for this feed)

- in the main PAS as outpatient attendances (included in the NAPC feeds, out of scope for this feed)

- in a separate local system for community dentistry activity (in scope for this feed).

Feed detail

-

Scope: all community dentistry contacts are in scope of this feed. This may include personal dental services.

-

It is unlikely there will be any auxiliary feed matches.

-

The feed should show the unit of dental activity as this is used for costing and local reporting.

-

This feed should not contain hospital-based dentistry data already recorded as part of the CDS. This information should be in Feed 1a: APC and Feed 3a: NAPC.

Master Feed 19a Wheelchair contacts and auxiliary Feed 19b: Wheelchair equipment (CM19: Wheelchair services)

Data source

-

This data will be available from local systems.

-

There are two types of data for wheelchair activity for this feed:

- wheelchair service contacts either recorded in the main PAS or in the local wheelchair system. If PAS data is used, additional data items are required to show the currencies (see CM19: Wheelchair services)

- the value recorded against each item of equipment issued to a patient as recorded in the wheelchair system.

Master Feed 19a: Wheelchair contacts

Detail

-

Scope: wheelchair contacts within the costing period regardless of whether they are recorded on the main PAS or a separate clinical information system. You should ensure there is no duplication of data between NAPC feeds and the wheelchair feed.

-

The only anticipated match for Feed 19a would be auxiliary Feed 19b: Wheelchair equipment.

-

The feed should show the nationally defined level of patient need as this is a unit used for local reporting and national currencies – this information would normally only be included in the wheelchair system. An optional field has also been included in the data items in spreadsheet IR1.2 to record a locally defined level of need if this gives greater detail/specialisation.

-

The feed should have a patient identifier and date so analysis and reporting can show wheelchair equipment with the patient contact(s). The cost of equipment should not be absorbed into the wheelchair contact.

Auxiliary Feed 19b: Wheelchair equipment

Feed detail

-

Scope: all wheelchair equipment and accessories issued to a patient (including where a patient representative collects the items or they are delivered to the patient’s residence) within the costing period.

-

The anticipated match for Feed 19b would be Feed 19a: Wheelchair contacts, so any other matches should be reviewed.

-

The feed should include the cost of the equipment or the cost of reconditioning equipment before reissue to a patient.

-

The feed should have a patient identifier and date so analysis can show the total cost of wheelchair services for the patient but the cost should not be absorbed into the wheelchair contact(s).

- Equipment will not be issued at all contacts, and there will not necessarily be a contact with a wheelchair professional on the date equipment is issued.

Feed 25: Specialist rehabilitation (CM36: Specialist rehabilitation)

Data source

-

This data will come from the source used at your trust for the nationally collected CDS or United Kingdom Rehabilitation Outcomes Collaborative (UKROC) submission.

Feed detail

-

Scope: patients receiving specialist rehabilitation in a discrete unit.

-

This feed provides extra information to capture the rehabilitation complexity score and associated dates.

-

The patient events created as HRGs by the grouper should be brought into the PLICS as a feed so they can be costed as patient events separately from the admission:

- the feed should contain the categorisations of rehabilitation as defined by (UKROC:

- complex specialised rehabilitation services – level 1

- specialist rehabilitation services – level 2

- non-specialist rehabilitation services – level 3

- or show a null categorisation.

-

As reporting the point of delivery for these HRGs is also a requirement, a field is included for this manual allocation based on your data:

- admitted patients with overnight stay (elective and non-elective)

- day case

- regular day/night admissions

- outpatients/contacts (non-admitted)

- other – this category has been included to understand if there are any types of activity not included above.

Feed 26: Audiology contacts (CM22: Audiology services)

Data source

-

This data will be available from local systems.

-

All audiology contacts should be included in the costing system. The contacts may be loaded via Feed 26: Audiology contacts or Feed 3a: NAPC. You should ensure there is no duplication of patient events between these two feeds. Feed 26 is available to assist the reconciliation of patient events, where audiology is not included in the main PAS and CDS submissions.

Feed detail

-

Scope: all patients receiving audiology services, where they are not contained in Feed 3a: NAPC. This should include:

- direct access audiology patients (GP direct access and ongoing audiology care): these are audiology patient events

- patients having ongoing care following discharge from an acute pathway: these are audiology patient events

- patient events where the responsible clinician is in another specialty – and the audiology contact supports that service area. These are components of the patient event in the named TFC within NAPC, APC or ED. These contacts should be used in the costing system to support allocation of audiology cost as component of the other TFC, not as an audiology TFC patient event.

Feed 27: Maternity Services identifiers: mandating year 2024/25 (CM24: Maternity)

Data source

-

This data should come from the local source used for the nationally collected Maternity Services Data Set (MSDS).

Feed detail

-

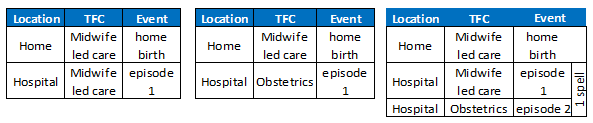

Scope: maternity patient events as recorded on the MSDS including the pregnancy identifier, the antenatal appointment booking date, the maternity discharge date to identify when patient events relate to maternity services, and the discharge from delivery event date for identifying postnatal contacts following a delivery event. This feed is used for pathway reporting.

-

This feed is used to connect mother to baby, and mother/baby to pregnancy, so the whole pathway can be reported. It can be used to link feeds 1a and 3a (which do not have a pregnancy identifier) to feeds 3d, 3e and 12b. There is no costed output to patient events from this feed.

Feed 28: Radiotherapy (CM26: Radiotherapy)

Data source

-

This data should come from the source used at your trust for the nationally collected Radiotherapy Data Set (RTDS). Extra information may be required from your main PAS or other local sources.

Feed detail

-

Scope: patient events showing all radiotherapy planning HRGs and treatment attendance HRGs. There will usually be multiple treatment events for each planning event.

Feed 29: Chemotherapy (CM25: Chemotherapy)

Data source

-

Patient NAPC information will be available from local systems. APC care will be available from PAS.

-

The medicines information will be available from the local e-prescribing system, as it is mandatory to record chemotherapy and supporting medicines at patient level (see Feed 10a: Medicines dispensed).

Feed detail

-

Scope: all patient events where chemotherapy was delivered.

Master feed 30: Renal dialysis (CM37: Renal dialysis)

Data source

-

The patient information will be available from local systems. All renal dialysis patients are admitted for their treatment, but this information may not be within the main PAS or the CDS. The episodes may be loaded via Feed 30: Renal dialysis or Feed 1a: APC if the additional data items for renal dialysis are included in that feed.

-

You should ensure there is no duplication of patient events between these two feeds. Feed 30 is available to assist the reconciliation of patient events, where renal dialysis is not included in the main PAS and CDS submissions.

Feed detail

-

Scope: all patients undergoing renal dialysis within the costing period, including those still in a bed at midnight on the last day of the costing period.

Identifying hidden activity

-

Take care to identify any ‘hidden’ activity in your trust. This is activity that takes place in your trust but is not recorded on any of your trust’s main information systems, including PAS.

-

For example, a department may not record telephone activity on PAS. If this is the case, you should work with your informatics department and the service to obtain a feed containing 100% of the patient events undertaken by the department. This work is part of the NHS Long Term Plan to improve digitally enabled care, benefiting staff and patients.

-

Capturing ‘hidden’ activity is important to ensure that:

- costs incurred are not incorrectly allocated to recorded activity, thus inflating its reported cost

- patient-facing and overhead costs incurred are allocated over all activity, not just activity reported on the provider’s main system such as PAS

- income received is identified against the correct service.

Other data considerations

-

The patient-level feeds do not contain income information. You may decide to include an income feed at patient level to enhance your trust’s reporting dashboard. The standards refer to income where this makes it easier to understand both the costs and income for a particular service for cost reconciliation, local reporting, business intelligence and where there is special treatment of income for the National Cost Collection.

-

The feeds do not include description fields, for example there is a ward code field but not a ward code description field. You may ask for feeds to include description fields for ease of use; otherwise, you will need to maintain code and description look-up tables for each feed, so you can understand the cost data supplied and facilitate appropriate outputs for reporting. There should be a process for mapping and a rolling programme for revalidating the codes and descriptions with each service.

-

You may use locally generated specialty codes to report patient events locally. For example, epidermolysis bullosa will be reported under the dermatology TFC but your provider may decide to assign it a local TFC code, so this specialist activity is clearly reported.

-

If local TFC codes are used, they should still be included in the patient level feeds and in the costing process, as they need to be allocated correctly. You should maintain a table mapping the local specialty codes to the national TFCs, to ensure consistency with the information submitted nationally for reconciliation purposes.

Legally restricted sensitive data

-

Some costed records should not be reported locally or submitted to the National Cost Collection at patient level, for information governance reasons. The costing system will manage these in different ways:

- Pseudonymised records are where the patient record has had patient identifiable information removed but the system keeps a key to track back to the patient.

- Anonymised records are where the patient record has the patient identifiable data removed but without a key.

- Proxy records are where no patient record is available for costing, so a ‘record’ is created to show the cost of care.

Proxy records

-

Proxy patient event records can be created to provide patient records to attach cost where there is no other record – for example:

- where there is no patient event to attach the component costs care provided, such as homecare delivered medicines or equipment

- to provide anonymous costed records for services that need to cost ‘a’ patient not ‘the’ patient: for example, LRSD patient events.

-

You will need a suitable source of local information to create the correct number of proxy records, provide sufficient detail for the costing process, and agree this within your assurance process (see the FutureNHS Assurance of cost data: learning extension). These should conform to the same criteria as the relevant national dataset but remain clearly identifiable as proxy records.

-

You should avoid generating proxy patient records within the costing system to solve data quality issues or to create an electronic record where there is only a paper record for the patient event as this can lead to double counting of activity outputs. For example, if someone later adds a missing record and it flows through to the costing system, both the proxy record and the correct record will receive costs for the same activity. It is better practice to work with your informatics department and service teams to create the correct electronic data entry in the ‘right first time’ principle.

-

Proxy records should be noted in your ICAL worksheet 16: Proxy records. They should also appear in the activity reconciliation – as described in Standard CP5: Reconciliation – as the costed patient records will not reconcile to the in-house or national dataset.

Part cost flag

-

Where part of the patient care cost relates to different organisations, the total cost of the patient event will not show a ‘complete’ value. For example:

- where part of the care is provided by an independent sector provider, and the remaining care is provided by the NHS trust

- where two (or more) NHS trusts in an integrated care system (ICS) provide care for the same patient event, without a recharge of the cost between organisations.

-

To identify records where the cost is not complete, you should identify the patient event with a ‘part cost flag’.

Costing processes

Before you implement the costing processes (CPs), you should have access to the integrated technical document, in particular:

- spreadsheet CP3.1: Resources for patient-facing cost

- spreadsheet CP3.2: Activities for patient-facing costs

- spreadsheet CP3.3: Methods to allocate patient-facing resources, first to activities and then to patients.

CP1: Ensuring the correct cost quantum

Scope

-

This standard applies to all lines of the general ledger (GL).

Overview

-

You need the income and expenditure for costing. We refer to this as the GL output. This output needs to be at cost centre and expense code levels and is a snapshot of the general ledger at a point in time. Expense codes may also be called ‘account codes’ or ‘subjective codes’.

-

You do not require balance sheet items for costing.

-

If your charitable funds are in your general ledger, they should be identified and not included in the costing system, except where costs funded by charitable funds have been transferred to own patient care services.

-

You can bring your general ledger into your costing system, either bringing in:

- the trial balance: for audit purposes this should balance to zero, or

- only the cost and income: this should reconcile to your statement of comprehensive income.

To reduce the burden on your costing system, we recommend the second approach

-

As a minimum, you should bring the values into the costing system each quarter. This allows regular work to map the GL combinations in the costing system in a manageable way. Leaving this process to the year end will lead to more burden for both costing and wider finance teams.

-

As a superior costing method, SCM83: Loading finance data from the general ledger monthly, you can bring your financial values into the system in the cycle that is recognised by financial management teams. Loading financial values more frequently can enable swifter resolution of mapping problems and allow more accurate adjustments.

-

The general ledger is closed at the end of the period, after which it cannot be revised (although some systems may allow you to back post payroll journals and to make other changes during the external audit process). For example, if in March you discover an error in the previous January’s ledger, the correction can only be made in March’s ledger. Doing so will correct the year-to-date position, even though the January and March figures do not represent the true cost at those times: one will be overstated and the other understated. Check with other finance team colleagues to ensure only final closed periods that contain any such changes are brought into the costing system.

-

If such corrections are material, you may choose to amend the costing system GL input with a journal, ensuring an audit trail of such adjustments to ensure reconciliation.

-

The timing of reporting some costs in the general ledger may pose a challenge. For example, overtime pay for a particular month may be posted in the general ledger in the month it was paid, not the month it was worked. This highlights a limitation in the time-reporting and expense payment system. We recognise this limitation but are not currently proposing a work-around for it.

-

Discuss the GL layout and structure with the other finance team colleagues so you understand it. This will help you understand the composition of the costing output. The Financial accounting and reporting page on the NHS England website can also help you understand your GL structure.

-

Keep a record of the input of cost into your costing system for each costing period. There may be multiple loads and we recommended each load is noted in the ICAL worksheet 12: GL load record.

Approach

Obtaining the general ledger output

-

Finance team colleagues should tell you when the general ledger has been closed and give you details of any off-ledger adjustments for the period. You need to put these adjustments into your cost ledger (CL), especially if included in your trust’s financial position report, as you will need to reconcile to this.

-

Keep a record of all these adjustments in ICAL worksheet 11: Adjustments to the general ledger at each load, to reconcile back to the GL output. Take care to ensure any manual adjustments are mapped to the correct line of the cost ledger.

-

Ensure the process for extracting the GL output is documented in ICAL worksheet 8: Extracting GL output. You should extract this only after the finance team colleagues tell you they have closed the general ledger for the period.

-

You should be notified when new cost centres and expense codes have been set up in the general ledger.

-

Trusts should not rename, merge or use existing cost centres for something else without informing you, as not knowing when this has been done will cause problems for costing. Ideally, they should close a cost centre and set up a new one rather than renaming. If this is not possible, they should tell you about any changes.

-

The new GL cost centres and expense codes need to be mapped to the cost ledger. You then need to reflect these changes in the costing system.

-

‘Error suspense’ ledger codes need to be addressed so that all costs can be assigned accurately to patients. Work with your finance colleagues to determine what these codes contain so the contents are mapped to the correct lines in the cost ledger. Note: organisations may use a different name for these codes, such as ‘holding’ or ‘dump’ ledger codes.

-

You should have a rolling programme of regular meetings with your wider finance colleagues to review the general ledger and its role in costing. This can identify problems and enhance their engagement with use of the data.

-

Where income from a charitable donation appears in the general ledger it should be aligned with the cost centre and expense code where the expenditure is recorded, using the income code in spreadsheet CP2.1 to identify it. This allows compliance with both costing standards (income should be identifiable) and collections (charitable income can be netted off from the cost which it funded).

-

Where charitable cost centres are in the general ledger, the expenditure and income on the cost centre should net to zero at the end of the costing period. The income not used would normally be deferred until the next period: but you should review any negative balances on the charitable fund cost centres and ensure the costing system does not offset the income against the cost of own patient care cost group. A set of charitable fund cost centres are shown in the cost ledger as cost centre codes starting with WWW for transparency.

CP2: Clearly identifying costs

Scope

-

This standard applies to the general ledger (GL) in conjunction with the GL load described in CP1: Ensuring the correct cost quantum.

Overview

-

Costing processes should identify and consistently allocate costs to enable meaningful analysis locally and nationally.

-

A trust’s general ledger is normally set up for local requirements rather than to support the standardised cost process. This means they will vary in structure.

-

This standard aims to ensure a process is in place to take this into account when the costing process starts, ensuring costs are mapped to resources consistently. To achieve this, the Approved Costing Guidance uses a standardised cost ledger (CL).

-

The cost ledger ensures that as part of the costing process, all costs across the NHS are categorised and allocated in the same way. This process is called general ledger to cost ledger (GL to CL) mapping.

-

This standard describes a flexible approach that enables you to decide between two methods of GL mapping:

- Method 1 Essential mapping: This method will take your GL chart of accounts directly to the collection resources or overheads. In completing method 1 you should ensure you do not miss costs that need remedial action to get them in the right place to start the costing process.

- Method 2 Full mapping: This method will take your general ledger and map all the GL codes to the standardised cost ledger.

-

This standard describes the process for method 2 mapping as this is our preferred approach for most organisations. It also details how you should allocate overheads to patient-facing resources so they can be distributed to activities. See the FutureNHS Ledger mapping: learning extension on FutureNHS.

-

As part of your costing process, you may encounter elements of negative cost. The treatment of these is explained in General ledger negative costs

-

Some areas of your ledger will need specialist treatment. You should ensure you understand and implement CP5: Reconciliation and CM8: Clinical and commercial services.

Approach

The following key principles enable you to clearly identify costs and allocate them according to the prescribed methodology (see CP3: Allocating costs to activities):

- Patient-facing costs:

- relate directly to delivering patient care and are driven by patient-facing activity

- can be either pay or non-pay and should be allocated using an activity-based allocation method

- are grouped into resources for allocation and linked to costing activities in the costing process.

- Overheads do not directly relate to delivering patient care; many relate to running the organisation. For example, they may be a corporate service, such as finance, or at a service level, such as ward clerk.

- Corporate overheads such as finance and HR are allocated to all services that used them, using a code starting T1S, each with a prescribed allocation method. These costs should not be directly mapped to resources and activities in the costing process.

- Income can be clearly and transparently identified.

-

You should work with your financial management team to ensure costs are aligned to the correct location in the cost ledger, starting with the most material items.

Mapping methods

-

You may choose to implement either method 1 or method 2 change mapping to meet the needs of your trust; combine mapping methods if that better represents your trust.

-

Whichever method you choose:

- you must understand the general ledger, especially larger items, and make sure costs are mapped appropriately to resources

- ensure the costing system reconciles at resource level; otherwise, further steps will not reconcile and may prove more complex to unravel. Refer to CP5: Reconciliation and the FutureNHS Assurance of Cost data: learning extension.

-

Over time, all trusts should aim to use method 2 mapping where method 1 does not ensure consistency for national level analysis. For example, where different allocation methods are prescribed by costing resource and costing activity level but only one allocation method is possible at collection resource and collection activity level.

-

You may wish to retain some elements of method 1 mapping if that is more suitable for your environment.

-

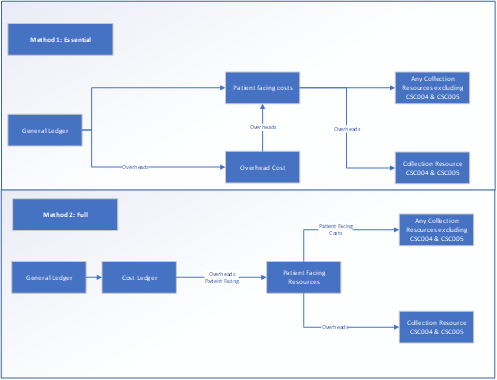

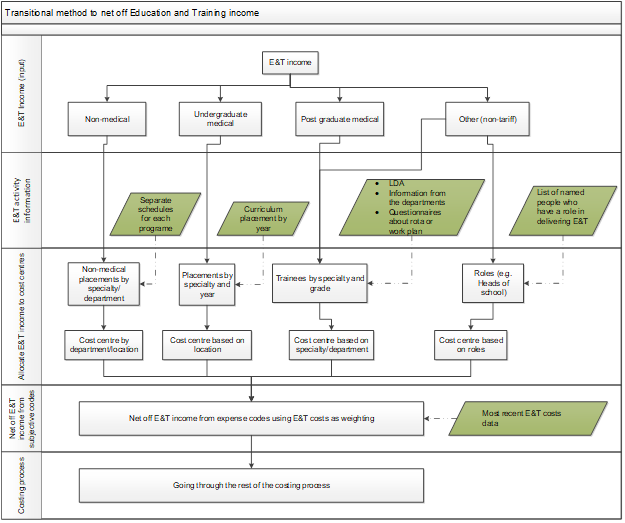

Figure CP2.1 shows the application of the cost ledger to the trust’s general ledger in the two mapping methods.

Figure CP 2.1: Mapping methods

This figure outlines the two mapping methods. Essential method 1 maps costs flowing from the general ledger to overhead costs and patient facing costs and then from patient facing costs to a) any collection resources excluding CSC004 and CSC005 and b) collection resources CSC004 and CSC005. Full method 2 maps costs flowing from the general ledger via the cost ledger to patient facing resources and from there to patient facing costs (any collection resources excluding CSC004 and CSC005) and overheads (collection resources CSC004 and CSC005).

-

Complying with method 2 involves an in-depth investigation of the general ledger to understand the costs it contains.

-

You should ensure it does not become too time consuming: focus on material areas initially and plan to review other areas periodically.

-

Method 2 provides a way to get the costs into the right starting position with the appropriate label – that is, from your GL to the CL costing account codes, and then to the correct resource codes.

-

Method 1 is more straightforward and aggregates costs to collection resources. Benefits include the ability to establish a holistic view of your GL costs.

-

If you use method 1, you should retain evidence of your mapping exercise if this cannot be completed in your costing software. It should evidence that all material costs have been considered.

-

Regardless of mapping method, you should still comply with the prescribed resource and overhead allocation methods in spreadsheets CP2.2 (for overheads) and CP3.3 (for patient-facing resources). See CP3: Allocating costs to activities. You should not use locally defined allocation methods to allocate costs.

-

There is additional risk of inaccuracy if adopting method 1. Trusts should be aware of these risks and plan appropriate mitigations.

-

If as an organisation, you choose not to complete the full GL to CL exercise, it is still important to understand method 2. The FutureNHS Ledger mapping: learning extension outlines the main premises of the two mapping methods in more detail.

Implementing method 2

-

The cost ledger outlines a chart of accounts that will cover most costs in many trusts but is not exhaustive. Where it does not have a combination of cost centre and expense code required for your trust, you should refer to the resource application hierarchy (RAH) tool on FutureNHS and customise your cost ledger.

-

Although the initial GL to CL mapping is a one-off exercise when setting up your PLICS; you should review it at least once a year, in line with the refresh of the integrated technical document. This is to ensure your cost ledger remains representative of how the costs in each part of your general ledger are used for costing.

-

The process of GL to CL mapping may run incrementally or simultaneously. For ease of understanding, we describe the process in linear steps.

-

The transformation of the general ledger into the resources should occur within your costing system to ensure mappings can be traced and reconciled to your general ledger.

-

If, in your costing system, the costing process takes place at a more granular level than the prescribed costing resources, you may continue using this method. The use of local resources or cost items will require the implementation of an additional mapping process. You should log the method you use in ICAL worksheet 15: Superior costing methods.

-

Your actions should include:

- Disaggregation: Some costs may be reported in the general ledger at a level not detailed enough for patient-level costing; for example, where multiple costs are combined in a single GL code. These costs need to be disaggregated when creating the cost ledger, using an appropriate method.

- Aggregation: Some costs may be reported separately in the general ledger but can be aggregated for patient-level costing when creating the cost ledger to simplify areas with the same treatment.

- Remedial actions: If a material cost has been incorrectly recorded in the general ledger, it should be corrected at this point.

-

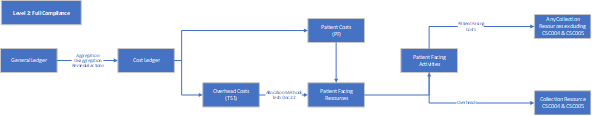

At the same time or following the system process to put the costs into the right starting place following the GL to CL mapping, the costing software will undertake a process called reciprocal costing. Figure CP2.2 describes the costing process from general ledger to collection resources.

Figure CP2.2 Simplified costing process

Figure CP2.2 is a flow diagram outlining a simplified costing process from general ledger to cost ledger then overhead costs and patient costs feeding into patient facing resources and from there to patient facing activities.

Treatment of overheads (including reciprocal costing)

-

Certain costs in your general ledger are not patient facing but provide support services for clinical and non-clinical areas. These are called overheads and refer to expenses associated with running a trust that cannot be directly linked to the treatment of a patient. They are incurred regardless of activity level.

-

Overheads should be allocated to the cost centre(s) which used the service using prescribed allocation methods. Once the overhead has been allocated to the cost centre(s), it should be apportioned to the expense codes within the cost centre(s).

-

Overheads are grouped into overhead titles and assigned a T1S code in spreadsheet CP2.2. Each T1S code, and its allocation method, is shown in spreadsheet CP2.2.

-

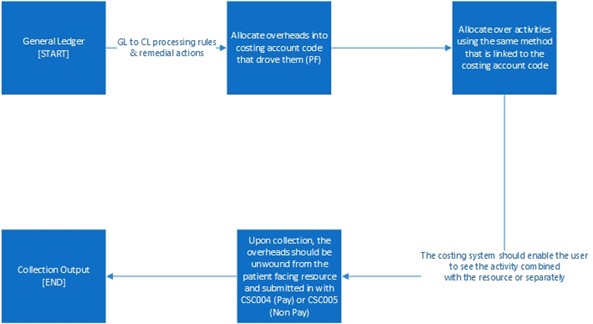

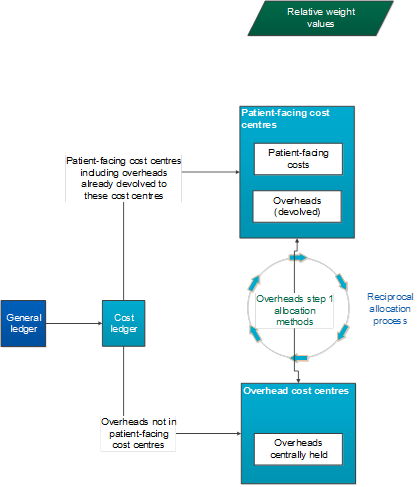

As a superior costing method, SCM84: Overhead costs (patient level), you may use an appropriate two-step allocation method which incorporates a patient event-based allocation method. See Figure CP2.3.

Figure CP2.3 Simplified GL to collection output

Figure CP2.3 describes the treatment of overheads from the general ledger to cost ledger to collection. Overheads that have been absorbed into patient-facing resources need to be separated for the cost collection and grouped into the two support collection resources: CSC004 (Pay) and CSC005 (Non-Pay).

-

Using an expenditure-based allocation method, some ledger areas may get a larger proportion of allocated overheads because of specific high-cost items.

-

Costs that may affect the allocation calculation include Clinical Negligence Scheme for Trusts (CNST), high cost medicines, interventional radiology/nuclear medicine consumables or prostheses. If so, investigate and correct the overheads allocation and adjust the allocation to allow for this. Any amendment to overheads should be recorded in your ICAL worksheet 13: Percentage split of allocation bases. See the FutureNHS CNST briefing paper.

Devolved and centrally held costs

-

During your GL review, it is important to identify whether a cost is centrally held or has already been devolved to the relevant cost centres in the cost ledger – for example, as part of service line reporting. You should discuss the allocation method used for devolving costs with your financial management department, so you can understand whether the devolved general ledger represents costs allocated using a method prescribed for costing.

-

Once understood, you can identify any steps needed to put the costs in the correct starting place for the costing process as follows:

- Held centrally: use the prescribed allocation method.

- Already been devolved to the cost centre that used it, using the prescribed method or a superior costing method: no action – costs are already in the correct place and you do not need to aggregate the costs.

- Already been devolved to the cost centre that used it but not using the prescribed method or a superior costing method: aggregate to a central code, so the process will use the prescribed allocation method.

Reciprocal costing

-

This standard prescribes reciprocal costing enabling allocation of overheads across patient facing and other overhead cost centres, as all those services have ‘used’ the cost of the overhead.

-

You should do this using a reciprocal allocation method, which allows all corporate support service costs to be allocated to, and received from, other corporate support services. For example, HR costs should be allocated across all cost centres that have staff, as all staff benefit from HR services.

-

Reciprocal costing must take place within the costing system.

-

A reciprocal allocation method reflects the interactions between supporting departments and therefore provides more accurate results than a hierarchical approach.

-

Overheads should not be allocated using a hierarchical method as this will only allow cost to be allocated in one direction between corporate support services. See Figure CP2.4.

Figure CP2.4 Reciprocal costing

Figure CP2.4 describes reciprocal costing and the allocation of overheads across patient facing and centrally held cost centres.

-

Following this process, patient-facing costs with their allocated portion of overheads are mapped to resources.

General ledger negative costs

-

A negative cost is a balance less than zero on a costing account code that is for expenditure. This code would normally have a positive balance to show the expenditure.

-

Negative costs flowing into the costing system can cause problems in calculating an appropriate cost for a patient event, as it reduces the true cost of the care. Where a negative cost is significant, the impact may even show as patient events that have a negative cost. These are not accepted in the National Cost Collection, as this situation should not be possible.

-

When doing the final, full-year costing process for the National Cost Collection, many negative balances that show in the monthly or quarterly reporting will disappear, as the expenditure in that costing account code will be sufficient to offset them. However, you should monitor negative balances throughout the year, to ensure major issues do not occur. See the FutureNHS Negative costs: briefing paper.

Cost classification

-

Classifying costs as fixed, semi-fixed or variable is not part of the costing calculations but rather a classification showing how costs behave based on level of activity. It is therefore used for reporting purposes, based on national classification rules given here and in spreadsheet CP2.1 The standardised cost ledger.

-

This classification is important for a trust’s internal financial management and discussions about service change and developing local payment mechanisms.

-

When activity levels change, costs do not all change in the same way. Variable costs will usually change in relation to the activity change but fixed costs will remain the same over the given period.

-

You should classify each line in your cost ledger as fixed, semi-fixed or variable, based on a timeframe of 12 months. Where trusts are applying method 1 mapping and do not use the cost ledger, they should still ensure they have an appreciation of which costs are fixed, semi-fixed and variable.

Fixed costs

-

Fixed costs remain the same regardless of the level of activity.

-