Delayed retirement (1 and 5 years)

After working alongside dedicated and caring colleagues for many years, you may feel mixed emotions about retirement. Although the idea of spending more time doing the things you enjoy is appealing, you might feel like you’re not ready to stop working yet – you may feel like you have more to give.

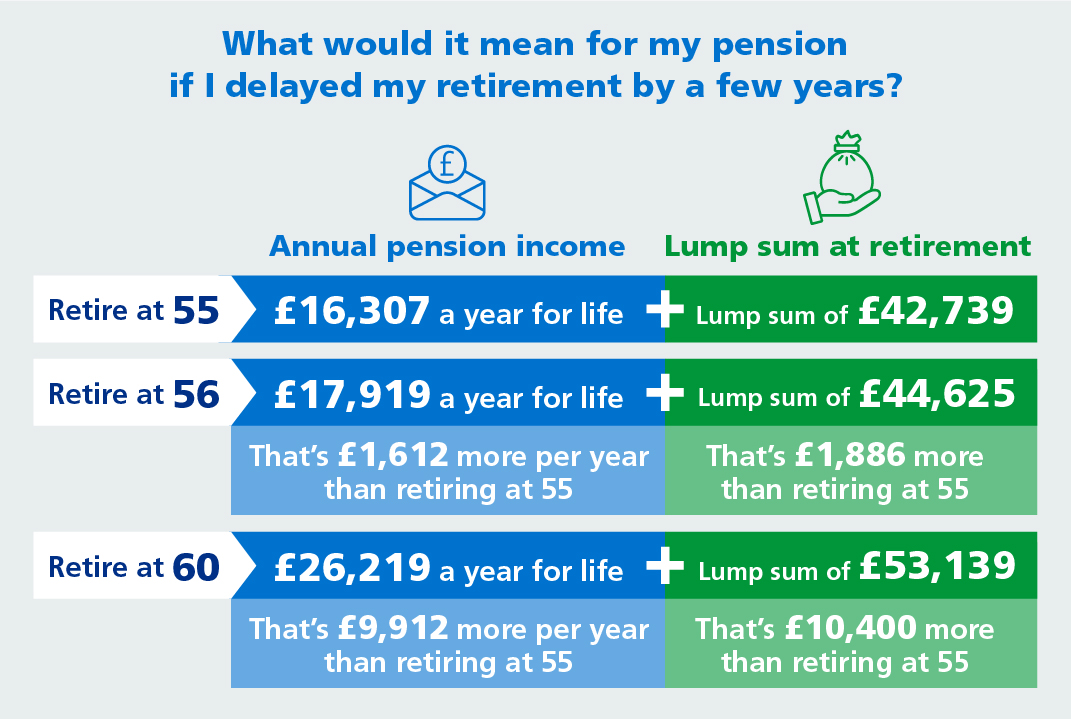

To give colleagues an idea of how staying in work for longer without drawing your benefits affects pensions, we have set out an illustration below which shows how benefits change over time. The longer you stay, the more benefits you can build up. Details of the contributions that members have to pay to be part of the NHS Pension Scheme are available on the NHS Business Services Authority website.

For our illustration, we’ve used an example of an “officer” member of the NHS Pension Scheme who was age 55 on 1 April 2023 (and so has both 1995 Section and 2015 Scheme benefits). They are currently at Band 7 (5+ years’ experience) on the Agenda for Change pay scale (but the illustrations would be similar for those not covered by Agenda for Change, too).

They do not have Special Class status or Mental Health Officer status, either of which could allow them to take their 1995 Section benefits without some of the reductions illustrated. See the NHS Business Services Authority website for more information about Special Class status and Mental Health Officer status.

The example below compares retiring at age 55, with staying on until 56 or 60.

What would it mean for my pension if I delayed my retirement by a few years?

| Retire at 55: | £17,720 a year for life | Lump sum of £44,449 |

| Retire at 56: | £19,674 a year for life: That’s £1,954 more per year than retiring at 55 | Lump sum of £47,093: That’s £2,644 more than retiring at 55 |

| Retire at 60: | £28,714 a year for life: That’s £10,994 more per year than retiring at 55 | Lump sum of £56,078: That’s £11,629 more than retiring at 55 |

This member’s benefits have increased because:

- they have built up an extra year of benefits in the 2015 Scheme,

- their past benefits have increased in line with inflation/salary increases, and

- Early retirement pension reductions are lower for every additional year worked.

Over the extra 1- and 5-year periods they have continued to earn their salary (out of which they need to pay for membership of the pension scheme). Over 5 years, their total gross salary was over £230k and the pension contributions for this person would be 11.6% (on which they would get tax relief).

An extra note on inflation:

During each year of active service, your 2015 Scheme pension is reviewed to keep in line with the rise in the cost of living. 2015 Scheme pensions are reviewed using the Consumer Price Index (CPI). This measures how costs of a representative basket of goods and services have changed over time. An additional 1.5% is added each year. This ensures the value of your pension will be above inflation.

Once you start receiving your pension, your benefits will continue to be reviewed each year to keep up with living costs – it’s called the Pensions Increase.

Example assumptions

- The individual is aged 55 as at 1 April 2023.

- The individual was in the 1995 Section of the NHS Pension Scheme until 31 March 2015. They joined the 2015 Scheme from 1 April 2015. This illustration does not make any allowance for the McCloud judgment, if applicable, for members eventually being given a choice between receiving their legacy (1995 or 2008 Section) and 2015 Scheme benefits in retirement for the period 1 April 2015 to 31 March 2022.

- The individual is an “Officer” member. The example does not reflect “Practitioner” benefits.

- The individual has a pensionable salary of £47,672 (Band 7). Salary increases for 2023/24 are assumed to be 3.5% and then 2% p.a. thereafter.

- The illustrations are based on the current actuarial factors in force in the Scheme (August 2021) – these are used for calculating any reductions to benefits because benefits are paid prior to Normal Pension Age. In the 1995 Section, benefits paid after Normal Pension Age (60) are not subject to increases for late payment and so individuals staying beyond Normal Pension Age need to consider this when assessing their options.

- The member does not have Special Class status or Mental Health Officer status – therefore, their 1995 Section benefits will be reduced to reflect the fact that they’re being paid before Normal Pension Age prior to age 60. Individuals with Special Class status or Mental Health Officer status may be able to draw their benefits earlier without these reductions applying. See the NHS Business Services Authority website for more information about Special Class status and Mental Health Officer status.

- The illustrations do not allow for the uptake of certain options that members may be able to exercise, for example, they do not allow for the exchange of pension for additional cash.

- The figures quoted may incorporate a small degree of rounding.

- All of the examples are illustrative only and are not designed to represent the particular circumstances of any one individual. Find out which pension scheme you are a member of on the NHS Business Services Authority website.

See below for more detail:

The benefits the member may take at 55, 56 and 60 (accounting for any early payment reductions) are:

| Retire at 55 | 1995 Section | 2015 Scheme | Total |

| Service | 28 | 7 | 35 |

| Pension | £13,348 p.a.* | £4,372** | £17,720 p.a. |

| Lump sum | £44,449*** | – | £44,449*** |

| Retire at 56 | 1995 Section | 2015 Scheme | Total |

| Service | 28 | 8 | 36 |

| Pension | £14,420 p.a.* | £5,254** | £19,674 p.a. |

| Lump sum | £47,093*** | – | £47,093*** |

| Retire at 60 | 1995 Section | 2015 Scheme | Total |

| Service | 28 | 12 | 40 |

| Pension | £18,693 p.a. | £10,021 p.a.** | £28,714 p.a. |

| Lump sum | £56,078 | £56,078 |

* includes early retirement adjustment of 20% at 55 and 16.5% at 56.

** includes early retirement adjustment of 43.7% at 55, 41.3% at 56 and 30% at 60.

*** includes early retirement adjustment of 11.2% at 55 and 9.1% at 56.

Talk to your manager to find out more about your flexible working options.