Retire and return

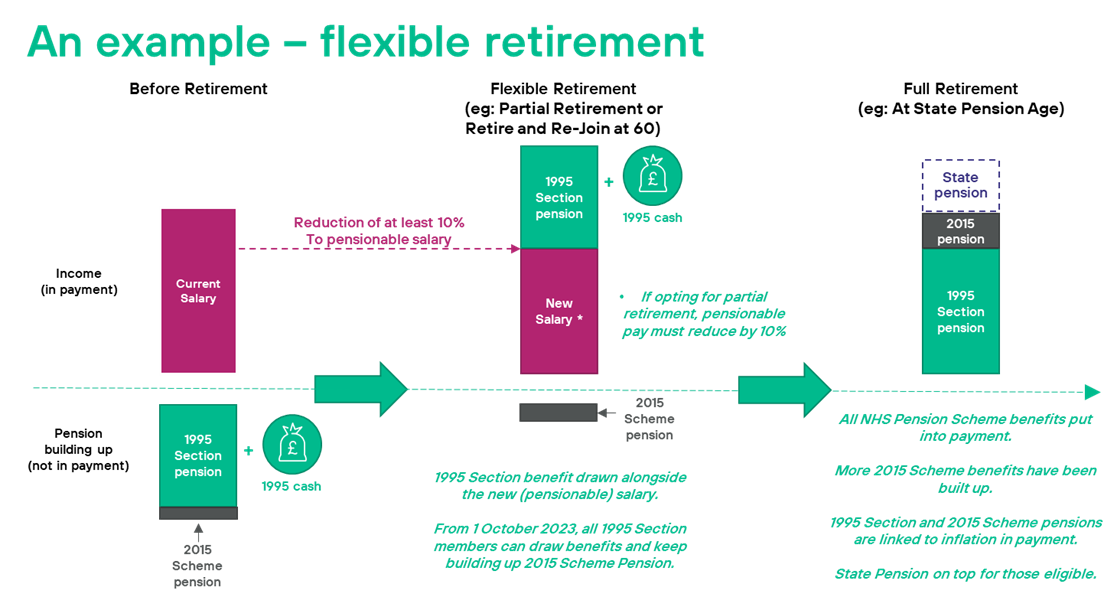

Having a salary coming in each month can give you real peace of mind. What if you could take your pension and top it up with a salary too – that could give you best of both worlds. There are a couple of options available to you.

Retire and re-join the NHS Pension Scheme (from 1 April 2023)

If you’re not ready to stop work altogether, you can retire and take your full pension, then return to work after a short break and re-join the NHS Pension Scheme to keep building your future pension benefits.

This is called retire and re-join. It’s already available to members in the 2008 Section and 2015 Scheme.

- If you decide to re-join the NHS, you can work as many hours as you choose, and your pension payments won’t be reduced or stopped (known as ‘abatement’).

- You can re-join the NHS Pension Scheme even if you have 45 years of service in the 1995 or 2008 Section, as long as you’re under the age of 75.

Individuals considering this option should discuss with their line manager the terms on which they will be able to return following retirement. Depending on the circumstances, it may not be possible to return to the same role – which may affect your decision.

Partial retirement

With partial retirement you can claim your pension, whilst continuing to work, but without having to take a break and leave your job. It’s already available to members of the 2008 Section and 2015 Scheme and from I October 2023, it is available to members of the 1995 Section, too.

- From 1 October 2023, you will be able to take between 20% and 100% of your pension benefits, without having to leave your current job.

- You can continue building your pension in the 2015 Scheme.

- You won’t need to take a break or change jobs, but you will need to work with your employer to adjust your hours or reshape your contract so your “pensionable pay” is reduced by 10% for the first year (or your pensionable commitment by 10% if you’re a Practitioner).

See how flexible retirement could work for you:

What would it mean for my pension if I took all of my 1995 Section benefits at 55 but carry on working part-time in the NHS until I reach 60?

| Partially retire at 55 taking 100% of 1995 benefits: | £13,348 a year for life | Lump sum of £44,449 |

| Reduce hours by 50% and carry on working in the NHS, without taking a break or changing contract, and continue contributing to the pension scheme until age 60 | ||

| Fully retire at 60 taking 100% of 2015 benefits: | An additional £8,239 a year for life | |

Retire and re-join would work very similarly to the example above. The difference would be that the member would need to take a short break and return to work on a new contract. The member could then continue contributing to the NHS Pension Scheme and would build up benefits in the 2015 Scheme.

All flexible working options are subject to agreement with your employer. You can read more about a flexible retirement on the NHS Business Services Authority website.

An extra note on inflation:

During each year of active service, your 2015 Scheme pension is reviewed to keep in line with the rise in the cost of living. 2015 Scheme pensions are reviewed using the Consumer Price Index (CPI). This measures how costs of a representative basket of goods and services have changed over time An additional 1.5% is added. This makes sure the value of your pension will be above inflation.

Once you start receiving your pension, your benefits will continue to be reviewed each year to keep up with living costs – it’s called the Pensions Increase.

Example assumptions

- The individual is aged 55 as at 1 April 2023.

- The individual was in the 1995 Section of the NHS Pension Scheme until 31 March 2015. They joined the 2015 Scheme from 1 April 2015. The illustrations do not make any allowance for the McCloud judgment, if applicable, for members eventually being given a choice between receiving their legacy (1995 or 2008 Section) and 2015 Scheme benefits in retirement for the period 1 April 2015 to 31 March 2022.

- The individual is an “Officer” member. The example does not reflect “Practitioner” benefits.

- The individual has a pensionable salary of £47,672 (Band 7) before they first take pension benefits at 55. They reduce their hours by 50% and return to work on a part-time salary of £24,670. Salary increases for 2023/24 are assumed to be 3.5% and then 2% p.a. thereafter.

- The illustrations are based on the current actuarial factors in force in the Scheme (August 2021) – these are used for calculating any reductions to benefits because benefits are paid prior to Normal Pension Age.

- The member does not have Special Class status or Mental Health Officer status – therefore, their 1995 Section benefits will be reduced to reflect the fact that they’re being paid before Normal Pension Age prior to age 60. Individuals with Special Class status or Mental Health Officer status may be able to draw their benefits earlier without these reductions applying. See the NHS Business Services Authority website for more information about Special Class status and Mental Health Officer status.

- The illustrations do not allow for the uptake of certain options that members may be able to exercise, for example, they do not allow for the exchange of pension for additional cash.

- The figures quoted may incorporate a small degree of rounding.

- All of the examples are illustrative only and are not designed to represent the particular circumstances of any one individual. Find out which pension scheme you are a member of on the NHS Business Services Authority website.

See below for more detail:

Partial retirement

The member wants to take 100% of their 1995 Section benefits at age 55. The benefits the member may take (accounting for any early payment reductions) are:

| Retire at 55 | 1995 Section |

| Service | 28 |

| Pension | £13,348p.a.* |

| Lump sum | £44,449*** |

The member wants to take 100% of their 2015 Scheme benefits at age 60. The benefits the member may take (accounting for any early payment reductions) are:

| Retire at 60 | 2015 Scheme |

| Service | 12 |

| Pension | £8,239p.a.** |

| Lump sum | – |

* includes early retirement adjustment of 20% at 55.

** includes early retirement adjustment of 30% at 60.

*** includes early retirement adjustment of 11.2% at 55.

Talk to your manager to find out more about your flexible working options.

See your personal pension details on your Total Reward Statement