Get a better work/life balance

You may find your priorities changing as you get closer to retirement. If you’re still really enjoying your job and would love to find a way to carry on using your experience and skills, there may be a way you can reduce the number of hours or change the role you do without retiring just yet.

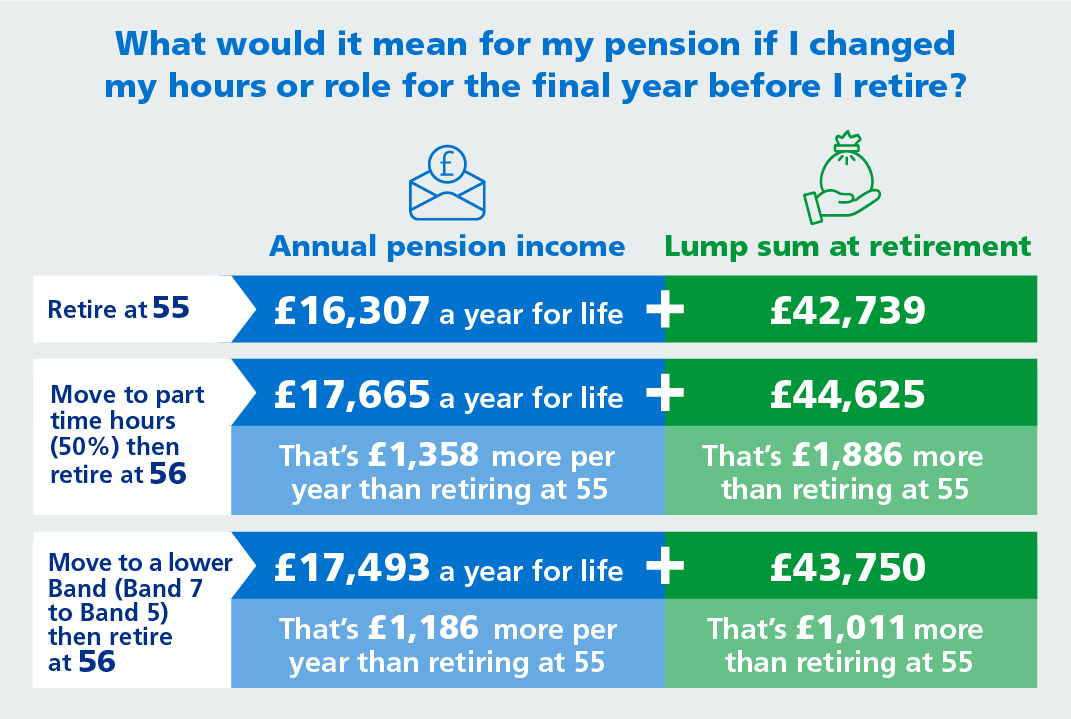

To give colleagues an idea of how changing the shape of their role could affect pension benefits, we have set out an illustration below. Details of the contributions that members have to pay to be part of the NHS Pension Scheme are available on the NHS Business Services Authority website.

For our illustration, we’ve used an example of an “officer” member of the NHS Pension Scheme who was age 55 on 1 April 2023 (and so has both 1995 Section and 2015 Scheme benefits). They are currently at Band 7 (5+ years’ experience) on the Agenda for Change pay scale. But, they consider:

- Working part time (50% of their hours); or

- Changing their role from a Band 7 to Band 5 (5+ years’ experience) role over the coming year (i.e. taking a job with a lower level of responsibility).

It is important to note that when considering a change to your role you should always discuss this with your employer first. In addition, when reducing your level of responsibility, please also ask your employer to look into “pay protections” for you, too. If eligible, this will mean that any final salary benefits you have in the 1995 Section or 2008 Section are linked to the higher salary you had before changing your role. For more information, visit the NHS BSA Member Hub: NHS Pensions (nhsbsa.nhs.uk)

For completeness, the illustrations would be similar for those not covered by Agenda for Change considering similar scenarios, too.

What would it mean for my pension if I changed my hours or role for the final year before I retire?

| Retire at 55: | £17,720 a year for life | Lump sum of £44,449 | |

Moving to part-time hours (50%)

| Retire at 56: | £19,406 a year for life: That’s £1,686 more per year than retiring at 55 |

Lump sum of £47,093: That’s £2,644 more than retiring at 55 |

Moving to a lower band role (Band 7 to Band 5)

| Retire at 56: | £19,021 a year for life: That’s £1,301 more per year than retiring at 55 |

Lump sum of £45,501: That’s £1,052 more than retiring at 55 |

The member’s benefits have increased because:

- they have built up more benefits in the 2015 Scheme (albeit at a slower rate than if they had stayed in their current role),

- their past benefits have increased in line with inflation/salary increases, and

- lower earlier retirement reductions have been applied.

An extra note on inflation:

During each year of active service, your 2015 Scheme pension is reviewed to keep in line with the rise in the cost of living. 2015 Scheme pensions are reviewed using the Consumer Price Index (CPI). This measures how costs of a representative basket of goods and services have changed over time. An additional 1.5% is added. This makes sure the value of your pension will be above inflation.

Once you start receiving your pension, your benefits will continue to be reviewed each year to keep up with living costs – it’s called the Pensions Increase.

Example assumptions

- The individual is aged 55 as at 1 April 2023.

- The individual was in the 1995 Section of the NHS Pension Scheme until 31 March 2015. They joined the 2015 Scheme from 1 April 2015. The illustrations do not make any allowance for the McCloud judgment, if applicable, for members eventually being given a choice between receiving their legacy (1995 or 2008 Section) and 2015 Scheme benefits in retirement for the period 1 April 2015 to 31 March 2022.

- The individual is an “Officer” member. The example does not reflect “Practitioner” benefits.

- The individual has a pensionable salary of £47,672 (Band 7) but consider reducing their hours by 50% (keeping the same salary) or moving to Band 5 (with a pensionable salary of £34,087). Salary increases for 2023/24 are assumed to be 3.5% and then 2% p.a. thereafter.

- The illustrations are based on the current actuarial factors in force in the Scheme (August 2021) – these are used for calculating any reductions to benefits because benefits are paid prior to Normal Pension Age. In the 1995 Section, benefits paid after Normal Pension Age (60) are not subject to increases for late payment and so individuals staying beyond Normal Pension Age need to consider this when assessing their options.

- The member does not have Special Class status or Mental Health Officer status – therefore, their 1995 Section benefits will be reduced to reflect the fact that they’re being paid before Normal Pension Age prior to age 60. Individuals with Special Class status or Mental Health Officer status may be able to draw their benefits earlier without these reductions applying. See the NHS Business Services Authority website for more information about Special Class sstatus and Mental Health Officer status. Specifically, it is important to consider whether changes in roles will have an impact on Mental Health Officer or Special Class status.

- The illustrations do not allow for the uptake of certain options that members may be able to exercise, for example, they do not allow for the exchange of pension for additional cash.

- The figures quoted may incorporate a small degree of rounding.

- All of the examples are illustrative only and are not designed to represent the particular circumstances of any one individual. Find out which pension scheme you are a member of on the NHS Business Services Authority website.

See below for more detail:

The benefits the member may take at 55 (accounting for any early payment reductions) are:

| Retire at 55 | 1995 Section | 2015 Scheme | Total |

| Service | 28 | 7 | 35 |

| Pension | £13,348 p.a.* | £4,372 p.a.*8 | £17,720 p.a. |

| Lump sum | £44,449*** | – | £44,449*** |

The benefits the member may take at 56 (accounting for any early payment reductions) are with a 50% reduction of hours in their final year are:

| Retire at 56 | 1995 Section | 2015 Scheme | Total |

| Service | 28 | 7.5 | 35.5 |

| Pension | £14,420 p.a.* | £4,986 p.a.** | £19,406 p.a. |

| Lump sum | £47,093*** | – | £47,093*** |

The benefits the member may take at 56 (accounting for any early payment reductions) with a salary reduction of c.30% in their final year are:

| Retire at 56 | 1995 Section | 2015 Scheme | Total |

| Service | 28 | 8 | 36 |

| Pension | £13,932 p.a.* | £5,088p.a.** | £19,021 p.a. |

| Lump sum | £45,501*** | – | £45,501*** |

* includes early retirement adjustment of 20% at 55 and 16.5% at 56.

** includes early retirement adjustment of 43.7% at 55 and 41.3% at 56.

*** includes early retirement adjustment of 11.2% at 55 and 9.1% at 56.

Talk to your manager to find out more about your flexible working options.