We are recognised and rewarded

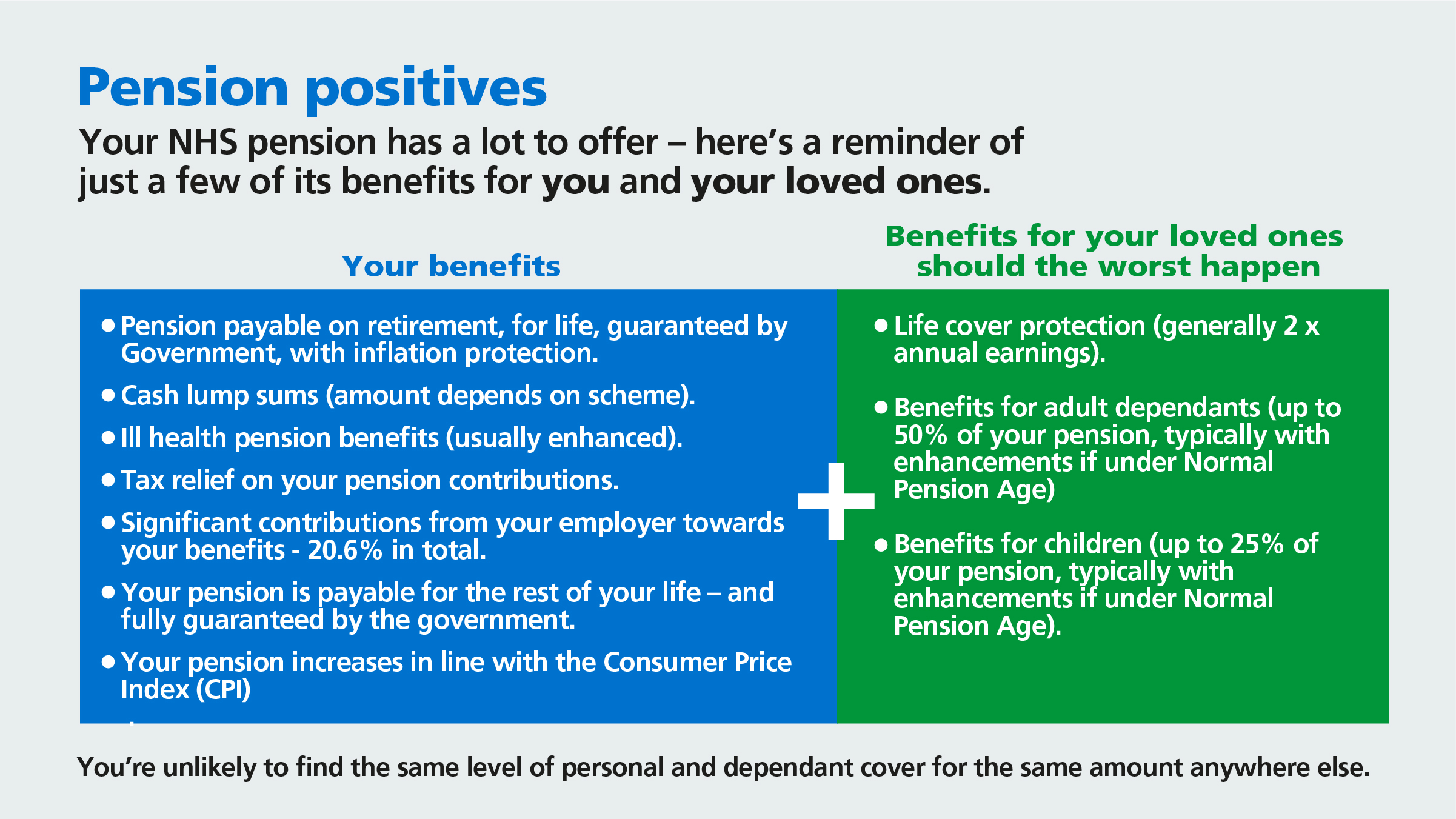

We have developed a very simple short video which provides an overview of the NHS Pension Scheme. Find out how valuable the scheme is for you and your loved ones.

Get to know your new options for flexible retirement!

Did you know that if you are a member of the 1995 Section of the NHS Pension Scheme, from October 2023 you will be able to take your pension and carry on working – this is called partial retirement. New pension reforms mean full retirement is not the only choice.

Partial retirement is already available in the 2008 Section and 2015 Scheme but now, if you are a member of the 1995 Section, in discussion with your employer you can choose to draw down between 20% and 100% of your pension. You just need to reduce your pensionable pay by 10% for the first 12 months. You can do this by discussing with your employer on those elements of pay which do not need to count towards your pension savings or reduce your working hours.

Are you already retired but want to come back to the NHS? From 1 April 2023, changes to the 1995 Section also mean that for the first time, if you retire and return to the NHS, you can join the 2015 Scheme and build up more pension savings.

Please do take a look at NHS Employers and NHS Business Services Authority websites for more information and guidance.

Pensions and flexible working in your later career

Find the balance between work and what matters most to you as you approach retirement through a variety of flexible working options.

And whatever you choose you can still make the most of your pension. In fact, flexible working means you can carry on building on what you’ve got, and still protect yo

ur loved ones with life assurance and other great benefits.

If you are a member of the 1995 Section, subject to certain conditions, you will have more flexibility in how you take your NHS pension, whilst keeping your salary:

- From 1 April 2023, as a member of the 1995 Section, you can retire fully and return to NHS employment and, if you want, continue earning 2015 Scheme pension benefits. This is called ‘retire and re-join’ and is already available to members of the 2008 Section and 2015 Scheme.

- From 1 April 2023, if you retire and return to NHS employment, you can work as many hours as you want, you pension will not be reduced. The old ‘16-hour’ rule placed a limit on the hours an employee could work in the first calendar month after retiring and returning to NHS employment.

- From 1 October 2023, you can take some or all of your pension benefits and carry-on working in the same role. This is called ‘partial retirement’ and is already available to members of the 2008 Section and 2015 Scheme.

- To lessen the impact of the annual allowance tax charges, the Department of Health and Social Care (DHSC) will change the date on which NHS Pension Scheme benefits are increased with inflation. The date will move from 1 April to 6 April from the 2022/23 tax year. This will ensure that the annual allowance calculations only measure pension growth that occurs above the rate of inflation.

NHS Employers and the NHS Business Services Authority (who are responsible for administering the NHS Pension Scheme), have further information about the new pension flexibilities.

Take a look at these examples of how different flexible working options could see you continue using your skills and experience in the way that best suits you, and the impact they could have on your pension benefits in the NHS Pension Scheme.

For our illustration, we’ve used an example of an “officer” member of the NHS Pension Scheme who was age 55 on 1 April 2023 (and so has both 1995 Section and 2015 Scheme benefits). However, the broad range of options illustrated are available to most colleagues who want to explore them (including those with “practitioner” benefits, too).

Take a look at the flexible working options below – and if you’d like to know more, please speak to your line manager or colleagues responsible for HR or the NHS Pension Scheme within your organisation.

Finally, if you need to find out more information about the pension benefits that you have please look on your Total Reward Statement or contact the administrator (the NHS Business Services Authority) using their member hub.

1.

1.  2.

2.  3.

3.  4.

4.